Current Report Filing (8-k)

May 18 2020 - 4:26PM

Edgar (US Regulatory)

LEGGETT & PLATT INC false 0000058492 0000058492 2020-05-15 2020-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 15, 2020

LEGGETT & PLATT, INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Missouri

|

|

001-07845

|

|

44-0324630

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

No. 1 Leggett Road,

Carthage, MO

|

|

64836

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code 417-358-8131

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $.01 par value

|

|

LEG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

The amendment and restatement of the Company’s Flexible Stock Plan (the “Plan”) was approved by shareholders at the Annual Meeting of Shareholders held May 15, 2020. The Plan provides for the award of stock-based benefits (including stock options, stock appreciation rights, restricted stock, stock units, performance awards, and other stock-based awards) to attract and retain valuable employees, directors and other key individuals; align the interests of participants with the interests of shareholders; and reward outstanding performance. The Plan has a term of 10 years.

Our named executive officers, Karl G. Glassman (Chairman & CEO), J. Mitchell Dolloff (President & COO), Jeffrey L. Tate (Executive Vice President & CFO), Scott S. Douglas (Senior Vice President - General Counsel & Secretary), along with our non-employee directors and other key employees are eligible to participate in the Plan. The material terms and conditions of the Plan and the amendments adopted by the shareholders at the Annual Meeting have been previously reported under Proposal Three: Approval of the Amendment and Restatement of the Flexible Stock Plan in the Company’s Proxy Statement (beginning on page 20), filed March 31, 2020 (the “Proxy Statement”), and in the Plan document attached as an Appendix to that Proxy Statement. The amendments to the Plan included:

|

|

(i)

|

an increase in the number of shares available for future grants under the Plan by 10 million. Under the Plan, each option or stock appreciation right counts as one share against the shares available under the Plan, but each share granted for any other award, such as restricted stock, stock units and performance awards, counts as three shares against the Plan. The Company has largely discontinued granting options (although options remain available through our Deferred Compensation Program);

|

|

|

(ii)

|

the expansion of the cancellation and “clawback” provisions such that the Compensation Committee of the Board (the “Committee”) has the right to require the participant to forfeit and repay to the Company all or a part of an award issued to the participant, including income or other benefit received upon vesting, exercise or payment: (a) in the preceding two years, if in its discretion, the Committee determines that the participant violated any confidentiality, non-solicitation or non-competition obligations applicable to the participant, engaged in improper conduct contributing to the need to restate external Company financial statements, committed an act of fraud or significant dishonesty, or committed a significant violation of the Company’s written policies or applicable laws, and any such activity resulted in significant financial or reputational loss to the Company; (b) to the extent required under applicable law or securities exchange listing standards; or (c) to the extent required or permitted under any written policy of the Company dealing with the recoupment of compensation, subject to the limits of applicable law. For the purposes of the “clawback,” improper conduct contributing to the need to restate any external Company financial statements will always be deemed to result in a significant loss.

|

Prior to the amendment, the Committee had the right to require the participant to forfeit any or all of the income or other benefit received upon vesting, exercise or payment of an award: (a) if, in its sole discretion, the Committee determined that the participant violated any confidentiality, non-solicitation or non-compete obligations applicable to the participant, or, during the period of employment of service, established a relationship with a competitor of the Company or engaged in activity that was in conflict with or adverse to the interests of the Company, including fraud or conduct contributing to any financial restatement; or (b) to the extent required or permitted under any written policy of the Company dealing with recoupment of compensation, and to the extent permitted by applicable law; and

|

|

(iii)

|

various updates to the Plan for certain tax law changes and for other administrative matters.

|

Perry E. Davis (former EVP, President - Residential Products and Industrial Products) and Matthew C. Flanigan (former EVP & CFO) have retired and therefore no longer receive new awards under the Plan, other than receiving dividend equivalents applicable to certain undistributed account balances.

The above disclosure is only a brief description of the Plan, as amended and restated, and is qualified in its entirety by the description in Proposal Three: Approval of the Amendment and Restatement of the Flexible Stock Plan, in the Company’s Proxy Statement filed March 31, 2020, and the Flexible Stock Plan, attached as an Appendix to that Proxy Statement, each of which is incorporated herein by reference. The Plan, as amended and restated, is included as Exhibit 10.1.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Company held its Annual Meeting of Shareholders on May 15, 2020. In connection with this meeting, proxies were solicited pursuant to Section 14(a) of the Securities Exchange Act of 1934, as amended. Matters voted upon were (i) the election of eleven directors; (ii) the ratification of the Audit Committee’s selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; (iii) the approval of the amendment and restatement of the Company’s Flexible Stock Plan to, among other things, increase the number of shares available for future grants by 10 million, and to expand the cancellation and “clawback” provisions; and (iv) an advisory vote to approve named executive officer compensation as described in the Proxy Statement. The number of votes cast for and against, as well as abstentions and broker non-votes, with respect to each matter, as applicable, are set forth below.

1. Proposal One: Election of Directors. All eleven nominees for director listed in the Proxy Statement were elected to hold office until the 2021 Annual Meeting of Shareholders, or until their successors are elected and qualified, with the following vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTOR NOMINEE

|

|

FOR

|

|

|

AGAINST

|

|

|

ABSTAIN

|

|

|

BROKER

NON-VOTE

|

|

|

Mark A. Blinn

|

|

|

96,499,572

|

|

|

|

797,413

|

|

|

|

395,732

|

|

|

|

15,969,224

|

|

|

Robert E. Brunner

|

|

|

93,831,757

|

|

|

|

3,369,995

|

|

|

|

490,965

|

|

|

|

15,969,224

|

|

|

Mary Campbell

|

|

|

96,807,021

|

|

|

|

494,879

|

|

|

|

390,817

|

|

|

|

15,969,224

|

|

|

J. Mitchell Dolloff

|

|

|

92,889,379

|

|

|

|

4,416,373

|

|

|

|

386,965

|

|

|

|

15,969,224

|

|

|

Manuel A. Fernandez

|

|

|

94,937,602

|

|

|

|

2,362,309

|

|

|

|

392,806

|

|

|

|

15,969,224

|

|

|

Karl G. Glassman

|

|

|

92,527,687

|

|

|

|

4,759,822

|

|

|

|

405,208

|

|

|

|

15,969,224

|

|

|

Joseph W. McClanathan

|

|

|

92,740,702

|

|

|

|

4,528,304

|

|

|

|

423,711

|

|

|

|

15,969,224

|

|

|

Judy C. Odom

|

|

|

93,728,263

|

|

|

|

3,542,851

|

|

|

|

421,603

|

|

|

|

15,969,224

|

|

|

Srikanth Padmanabhan

|

|

|

96,906,916

|

|

|

|

383,577

|

|

|

|

402,224

|

|

|

|

15,969,224

|

|

|

Jai Shah

|

|

|

96,527,406

|

|

|

|

762,098

|

|

|

|

403,213

|

|

|

|

15,969,224

|

|

|

Phoebe A. Wood

|

|

|

92,509,130

|

|

|

|

4,747,051

|

|

|

|

436,536

|

|

|

|

15,969,224

|

|

2. Proposal Two: Ratification of Independent Registered Public Accounting Firm. The ratification of the Audit Committee’s selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020 was approved with the following vote:

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON-VOTE

|

|

110,452,711

|

|

2,779,694

|

|

429,536

|

|

N/A

|

3. Proposal Three: Approval of the Amendment and Restatement of the Flexible Stock Plan. The amendment and restatement of the Company’s Flexible Stock Plan to, among other things, increase the number of shares available for future grants by 10 million, and expand the cancellation and “clawback” provisions, was approved with the following vote:

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON-VOTE

|

|

89,139,279

|

|

8,087,928

|

|

465,510

|

|

15,969,224

|

4. Proposal Four: Advisory Vote to Approve Named Executive Officer Compensation. The advisory vote to approve the Company’s named executive officer compensation package as described in the “Executive Compensation and Related Matters” section of the Company’s Proxy Statement (commonly known as “Say-on-Pay”) consisted of the following:

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER

NON-VOTE

|

|

92,785,021

|

|

4,265,337

|

|

642,359

|

|

15,969,224

|

On May 15, 2020, the Board appointed Karl G. Glassman as Chairman and Judy C. Odom as Lead Director.

Also, on May 15, each non-management member of the Board of Directors was granted an equity award (either Company restricted stock or restricted stock units (“RSUs”)) as part of the normal director compensation package. Each non-management director, other than the Lead Director, received $150,000 of equity, while the Lead Director received $275,000 of equity.

Historically, the number of shares or units awarded was calculated by dividing the dollar value of the award by the closing price of the Company’s stock on the grant date, which was $26.61. Under this methodology, the Lead Director would have received 10,334 units, and all other directors would have received 5,637 shares or units. However, the Board changed the methodology in light of the recent stock price volatility and economic conditions related to the COVID-19 pandemic. For the 2020 grant, the number of shares or units awarded was calculated by dividing the dollar value of the award by the average closing stock price of the Company stock for the 10 trading days following the 2019 fourth quarter earnings release ($45.85 per share), which was also used for the 2020 long-term equity incentive awards granted to the Company’s named executive officers and other managers as approved by the Committee in February 2020. Under this calculation, the Lead Director received 5,998 units and all other directors received 3,272 shares or units.

The awards generally have a 12-month vesting period, ending on the day preceding the next annual meeting of shareholders. Vesting accelerates in the event of death, disability or, if the director’s service is terminated upon a change in control of the Company. RSUs are settled in shares of Company stock and earn dividend equivalents at a 20% discount to the market price of Company stock on the dividend payment date. Directors may elect to defer settlement of the RSU award for 2 to 10 years after the grant date.

The updated Summary Sheet of Director Compensation is attached and incorporated herein by reference as Exhibit 10.2.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

EXHIBIT INDEX

|

*

|

Denotes filed herewith.

|

|

**

|

Denotes management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGGETT & PLATT, INCORPORATED

|

|

|

|

|

|

|

|

|

|

Date: May 18, 2020

|

|

|

|

By:

|

|

/s/ SCOTT S. DOUGLAS

|

|

|

|

|

|

|

|

Scott S. Douglas

|

|

|

|

|

|

|

|

Senior Vice President –

|

|

|

|

|

|

|

|

General Counsel & Secretary

|

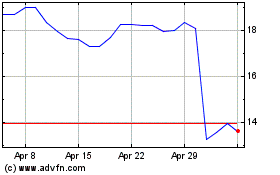

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

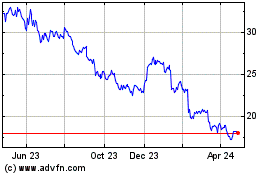

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Apr 2023 to Apr 2024