0000763744FALSE00007637442023-12-222023-12-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2023

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 22, 2023, LCI Industries (the “Company”) and certain of its subsidiaries entered into an Amendment No. 6 (the “Amendment”) which amends the Company’s existing Fourth Amended and Restated Credit Agreement (the “Amended Credit Agreement”) with JPMorgan Chase Bank, N.A., as administrative agent, and the other bank lenders party thereto to provide for adjustment to the maximum total net leverage ratio for the fiscal quarter ending December 31, 2023 applicable under the Amended Credit Agreement. Specifically, the Company shall not permit the total net leverage ratio to exceed 3.50:1.00 as of the last day of the fiscal quarter ending December 31, 2023 and 3.00:1.00 as of the last day of each fiscal quarter ending on or after March 31, 2024.

The foregoing description of the Amendment is a summary of the material terms, does not purport to be complete, and is qualified in its entirety by reference to the Amendment, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01 is incorporated into this Item 2.03 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index:

10.1 Amendment No. 6 to Fourth Amended and Restated Credit Agreement, dated as of December 22, 2023, by and among LCI Industries, Lippert Components, Inc., LCI Industries B.V., LCI Industries Pte. Ltd., each other Subsidiary of the Company listed on the signature pages thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | December 22, 2023 |

AMENDMENT NO. 6

THIS AMENDMENT NO. 6 (this “Amendment”), dated as of December 22, 2023, is among Lippert Components, Inc., a Delaware corporation (“Lippert”), LCI INDUSTRIES B.V., a Netherlands limited liability company (besloten vennootschap met beperkte aansprakelijkheid) having its statutory seat (statutaire zetel) in Amsterdam, the Netherlands and registered with the Dutch Trade Register (Kamer van Koophandel) under number 70655421 (“LCI BV”), LCI Industries Pte. Ltd., a company incorporated under the laws of Singapore with company registration number 201932119H (the “Singapore Borrower”; together with LCI BV, the “Foreign Borrowers”; and the Foreign Borrowers together with Lippert, the “Borrowers”), LCI Industries, a Delaware corporation (the “Company”), each other Subsidiary of the Company listed on the signature pages hereto (together with the Borrowers and the Company, the “Loan Parties”), the Lenders party hereto and JPMorgan Chase Bank, N.A., as administrative agent (in such capacity, the “Administrative Agent”).

PRELIMINARY STATEMENTS:

(1) The Borrowers, the Company, the Lenders party thereto and the Administrative Agent are parties to the Fourth Amended and Restated Credit Agreement dated as of December 14, 2018 (as previously amended, the “Existing Credit Agreement” and the Existing Credit Agreement, as amended by this Amendment, the “Credit Agreement”). Capitalized terms not otherwise defined in this Amendment have the same meanings as specified in the Credit Agreement.

(2) The Company and the other Borrowers desire to amend the Existing Credit Agreement as set forth herein, the Lenders party hereto and the Administrative Agent have so agreed on the terms and conditions set forth herein.

(3) In consideration of the premises set forth above, the terms and conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Borrowers, the Lenders party hereto and the Administrative Agent hereby agree to enter into this Amendment.

Section 1. Amendment. Effective as of the Amendment Effective Date, Section 6.10(a) of the Existing Credit Agreement is hereby amended and restated in its entirety as follows:

“(a) The Borrowers shall not permit the Total Net Leverage Ratio to exceed (i) 3.00:1.00 as of the last day of each fiscal quarter ending on or after December 31, 2018 but prior to June 30, 2023, (ii) 4.00:1.00 as of the last day of the fiscal quarter ending June 30, 2023, (iii) 4.25:1.00 as of the last day of the fiscal quarter ending September 30, 2023, (iv) 3.50:1.00 as of the last day of the fiscal quarter ending December 31, 2023 and (v) 3.00:1.00 as of the last day of each fiscal quarter ending on or after March 31, 2024; provided that after the consummation or making of any Material Acquisition, such maximum Total Net Leverage Ratio shall be increased to 3.50:1.00 solely for the last day of the fiscal quarter in which such Material Acquisition is consummated or made and for the last day of the next three succeeding fiscal quarters, provided that (i) such election shall not be made more than two times after the Fourth Amendment Effective Date and prior to the Maturity Date and (ii) after the last fiscal quarter for which such 3.50:1.00 ratio level shall apply following such election, there shall be at least two fiscal quarters during which the ratio level is 3.00:1.00 prior to any further such election.”

Section 2. Conditions to Effectiveness. This Amendment shall be effective on and as of the date (the “Amendment Effective Date”) on which the following conditions shall have been satisfied:

(a)The Administrative Agent shall have received from each Loan Party and each Lender party hereto (including the Administrative Agent) either (i) an original counterpart of this Amendment signed on behalf of such party or (ii) written evidence satisfactory to the Administrative Agent (which may include telecopy or .pdf transmission of a signed signature page of this Amendment) that such party has signed a counterpart of this Amendment (followed promptly by original counterparts to be delivered to the Administrative Agent).

(b)The Administrative Agent shall have received all fees and other amounts due and payable on or prior to the Amendment Effective Date, including, those certain fees due and payable under that certain Amendment No. 6 to Fourth Amended and Restated Credit Agreement Fee Letter, dated as of the date hereof, among the Administrative Agent, Lippert and the Company, and to the extent invoiced, reimbursement or payment of all out of pocket expenses required to be reimbursed or paid by the Borrowers hereunder or under the Credit Agreement.

Section 3. Confirmation. Each Loan Party agrees that each Loan Document to which it is a party, is hereby reaffirmed, ratified, approved and confirmed in each and every respect on and after the Amendment Effective Date, except that each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words of like import referring to the Credit Agreement, and each reference in the other Loan Documents to the “Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement shall mean and be a reference to the Credit Agreement, as modified by this Amendment. In all other respects, the terms of the Credit Agreement and the other Loan Documents are hereby confirmed. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of the Lenders or the Administrative Agent under the Existing Credit Agreement or any of the other Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents or any other documents, instruments and agreements executed and/or delivered in connection therewith.

Section 4. Representations and Warranties. After giving effect to this Amendment, the following statements by the Loan Parties shall be true and correct (and the Loan Parties, by their execution of this Amendment, hereby represent and warrant to the Administrative Agent and the Lenders that such statements shall be true and correct as at such times):

(a)The representations and warranties of the Loan Parties set forth in the Credit Agreement and each other Loan Document shall be true and correct in all material respects on and as of the date hereof, except to the extent such representations and warranties specifically relate to an earlier date, in which case such representations and warranties shall have been true and correct in all material respects on and as of such earlier date; provided that any such representations and warranties that are qualified by materiality or as to Material Adverse Effect shall be true and correct in all respects on and as of such date.

(b)No Default has occurred or is continuing.

(c)The transactions contemplated hereby are within the Borrowers’ and the other Loan Parties’ corporate or other organizational powers and have been duly authorized by all necessary corporate or other organizational and, if required, stockholder

action. This Amendment, the Credit Agreement and each other Loan Document has been duly executed and delivered by each Loan Party and constitutes a legal, valid and binding obligation of such Loan Party, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(d)The execution, delivery and performance by the Loan Parties of this Amendment and the Credit Agreement (i) do not require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except such as have been obtained or made and are in full force and effect, (ii) will not violate any applicable law or regulation or the charter, by-laws or other organizational documents of any Loan Party or any of its Subsidiaries or any order of any Governmental Authority, (iii) will not violate or result in a default under any indenture, agreement or other instrument binding upon any Loan Party or any of its Subsidiaries or its assets, or give rise to a right thereunder to require any payment to be made by any Loan Party or any of its Subsidiaries which could reasonably be expected to result in a Material Adverse Effect, and (iv) will not result in the creation or imposition of, or the requirement to create, any Lien on any asset of any Loan Party or any of its Subsidiaries.

Section 5. Governing Law. This Amendment shall be governed by, and construed in accordance with, the laws of the State of New York.

Section 6. Counterparts. This Amendment may be executed in any number of counterparts (and by different parties hereto on different counterparts), each of which shall be deemed an original as against any party whose signature appears thereon, and all of which shall together constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment by telecopy, facsimile or other electronic transmission (including .PDF) shall be effective as delivery of a manually executed counterpart of this Amendment.

Section 7. Submission to Jurisdiction. Each of the parties hereto hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of the United States District Court for the Southern District of New York sitting in the Borough of Manhattan (or if such court lacks subject matter jurisdiction, the Supreme Court of the State of New York sitting in the Borough of Manhattan), and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Amendment the transactions relating hereto or thereto, or for recognition or enforcement of any judgment, and each of the parties hereto hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding may (and any such claims, cross-claims or third party claims brought against the Administrative Agent or any of its Related Parties may only) be heard and determined in such Federal (to the extent permitted by law) or New York State court. Each of the parties hereto agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by law. Nothing in this Amendment shall affect any right that the Administrative Agent, any Issuing Bank or any Lender may otherwise have to bring any action or proceeding relating to this Amendment against any Borrower, any Loan Party or its properties in the courts of any jurisdiction.

Section 8. Miscellaneous. The provisions of Section 9.07, Section 9.09(b), (d) and (e) and Section 9.10 of the Credit Agreement are incorporated herein mutatis mutandis, and the parties hereto hereby agree that such provisions shall apply to this Amendment with the same force and effect as if set forth herein in their entirety.

Section 9. Loan Document. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. This Amendment shall for all purposes constitute a Loan Document.

[remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first above written.

| | | | | |

| LCI INDUSTRIES |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| | | | | |

LIPPERT COMPONENTS, INC., |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| | | | | |

LCI SERVICE CORP., |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| | | | | |

LIPPERT COMPONENTS MANUFACTURING, INC., |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| | | | | |

INNOVATIVE DESIGN SOLUTIONS, INC., |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

Signature Page to Amendment No. 6

| | | | | |

| TAYLOR MADE GROUP, LLC |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| | | | | | | | |

| CURT MANUFACTURING, LLC |

| |

| By: | /s/ Lillian D. Etzkorn | |

| Name: Lillian D. Etzkorn Title: EVP & CFO | |

| | | | | |

| LCI INDUSTRIES B.V. |

|

| |

| By: | /s/ Christiaan Koreman |

| Name: Christiaan Koreman Title: Director A |

| |

| By: | /s/ Joerg Reithmeier |

| Name: Joerg Reithmeier Title: Director B |

| |

| | | | | |

| LCI INDUSTRIES PTE. LTD. |

|

| By: | /s/ Christiaan Koreman |

| Name: Christiaan Koreman Title: Director |

| | | | | |

| VEADA INDUSTRIES, INC. |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

Signature Page to Amendment No. 6

| | | | | |

| KASPAR RANCH HAND EQUIPMENT, LLC |

|

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| |

| FURRION LLC |

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

| |

| KINRO TEXAS, INC. |

| By: | /s/ Lillian D. Etzkorn |

| Name: Lillian D. Etzkorn Title: EVP & CFO |

Signature Page to Amendment No. 6

| | | | | |

JPMORGAN CHASE BANK, N.A., individually as a Lender and as Administrative Agent |

|

| By: | /s/ Richard Barritt |

| Name: Richard Barritt Title: Executive Director |

Signature Page to Amendment No. 6

| | | | | |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender |

|

| By: | /s/ Heather Hoopingarner |

| Name: Heather Hoopingarner Title: Director |

Signature Page to Amendment No. 6

| | | | | |

BANK OF AMERICA, N.A., as a Lender |

|

| By: | /s/ Matthew R. Doye |

| Name: Matthew R. Doye Title: Senior Vice President |

Signature Page to Amendment No. 6

| | | | | |

TRUIST BANK, as a Lender |

|

| By: | /s/ Alysa Trakas |

| Name: Alysa Trakas Title: Director |

Signature Page to Amendment No. 6

| | | | | |

BMO BANK N.A., as a Lender |

|

| By: | /s/ Joshua Hovermale |

| Name: Joshua Hovermale Title: Managing Director |

Signature Page to Amendment No. 6

| | | | | |

BMO BANK N.A., SUCCESSOR IN INTEREST TO BANK OF THE WEST, as a Lender |

|

| By: | /s/ Joshua Hovermale |

| Name: Joshua Hovermale Title: Managing Director |

Signature Page to Amendment No. 6

| | | | | |

U.S. BANK NATIONAL ASSOCIATION, as a Lender |

|

| By: | /s/ Jerrod Clements |

| Name: Jerrod Clements Title: Vice President |

Signature Page to Amendment No. 6

| | | | | |

FIFTH THIRD BANK, as a Lender |

|

| By: | /s/ Craig Ellis |

| Name: Craig Ellis Title: SVP |

Signature Page to Amendment No. 6

| | | | | |

HSBC BANK USA, NATIONAL ASSOCIATION, as a Lender |

|

| By: | /s/ Matthew Brannon |

| Name: Matthew Brannon Title: Senior Vice President |

Signature Page to Amendment No. 6

Cover

|

Dec. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 22, 2023

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

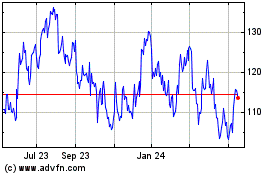

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Mar 2024 to Apr 2024

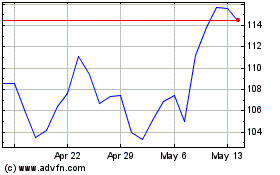

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Apr 2023 to Apr 2024