Kirby Corporation (“Kirby”) (NYSE: KEX) today announced net

earnings attributable to Kirby for the fourth quarter ended

December 31, 2023, of $61.9 million or $1.04 per share, compared

with earnings of $37.3 million, or $0.62 per share for the 2022

fourth quarter. Excluding one-time charges in the 2022 fourth

quarter, net earnings attributable to Kirby were $40.3 million or

$0.67 per share. Consolidated revenues for the 2023 fourth quarter

were $799.2 million compared with $730.2 million in the 2022 fourth

quarter.

For the 2023 full year, Kirby reported net

earnings attributable to Kirby of $222.9 million or $3.72 per

share, compared with earnings of $122.3 million or $2.03 per share

for 2022. Excluding one-time items in both years, 2023 net earnings

attributable to Kirby were $223.1 million or $3.72 per share,

compared with $126.6 million or $2.10 per share in 2022.

Consolidated revenues for 2023 were $3.1 billion compared with $2.8

billion for 2022.

David Grzebinski, Kirby’s President, and Chief

Executive Officer, commented, “During the fourth quarter, continued

strong fundamentals in both our businesses resulted in significant

year-over-year growth in our revenues and earnings. In marine

transportation, pricing on spot and term contracts benefited from

strong demand and limited availability of barges while the onset of

winter weather conditions proved to be a headwind to efficiency in

the quarter. Distribution and services delivered higher revenues

sequentially, but margins were down slightly from the third quarter

due to lower demand in our power rental business and typical

seasonal slowness. We ended the year on a good note, and we

anticipate strong growth in 2024.

“In inland marine, we continued to experience

strong demand and high barge utilization with our barge utilization

rates in the low 90% range. Spot market prices continued to push

higher and were up in the low to mid-single digits sequentially and

in the mid-teens range year-over-year. Pricing increases on term

contract renewals were up year-over-year on average in the

high-single digits during the quarter. While the efficiency of our

operations was challenged during the quarter, with delay days up

86% sequentially, strong pricing and utilization mostly offset this

allowing for inland marine margins to remain flat sequentially with

operating margins in the high-teens on average.”

Mr. Grzebinski continued, “In our coastal marine

business, we saw consistent customer demand during the fourth

quarter that helped maintain barge utilization in the low to

mid-90’s. Overall, coastal marine revenues were up 4% sequentially

as improved spot and term contract pricing more than offset planned

maintenance and ballast water treatment installations which reduced

equipment availability. As a result, the coastal business was able

to finish the year with operating margins in the low single digits

for the quarter.”

“In distribution and services, demand in the

fourth quarter remained steady throughout much of the segment

marked by a sequential increase in revenues, increases in new

orders and steady backlog. In oil and gas, operating income was up

sequentially and year-over-year as solid execution on our backlog

and deliveries were partially offset by lower activity levels in

remanufactured equipment. In commercial and industrial, while

revenues were up sequentially, the seasonal falloff in our power

rentals business led to a sequential decline in operating income.

Despite supply chain issues and seasonal weakness, the business

segment overall was strong for the year end” Mr. Grzebinski

said.

Segment Results – Marine

Transportation

Marine transportation revenues for the 2023

fourth quarter were $452.6 million compared with $422.7 million for

the 2022 fourth quarter. Operating income for the 2023 fourth

quarter was $68.2 million compared with $46.7 million for the 2022

fourth quarter. Segment operating margin for the 2023 fourth

quarter was 15.1% compared with 11.1% for the 2022 fourth

quarter.

In inland, average 2023 fourth quarter barge

utilization was in the low 90% range due to strong customer demand

and the re-opening of the Illinois River locks. Operating

conditions were mostly unfavorable in the quarter with several

other lock delays and the onset of seasonal winter weather. During

the quarter, average spot market rates increased in the low to

mid-single digits sequentially and in the mid-teens range compared

to the 2022 fourth quarter. Term contracts that renewed in the

fourth quarter increased on average in the high single-digit range.

Revenues in the inland market increased 11% compared to the 2022

fourth quarter primarily due higher pricing and barge utilization.

Operating margins improved year-over-year to the high-teens. The

inland market represented 82% of segment revenues in the fourth

quarter of 2023.

In coastal, market conditions improved modestly

during the quarter, with Kirby’s barge utilization remaining in the

low to mid-90% range. Pricing in the spot market increased in the

mid-single digits sequentially and term contract renewals increased

low 20% range year-over-year. Revenues in the coastal market were

7% lower compared to the 2022 fourth quarter and represented 18% of

segment revenues. The coastal business had a positive operating

margin in the low-single digits during the quarter.

Segment Results –

Distribution and Services

Distribution and services revenues for the 2023

fourth quarter were $346.6 million compared with $307.4 million for

the 2022 fourth quarter. Operating income for the 2023 fourth

quarter was $28.7 million compared with $17.1 million for the 2022

fourth quarter. Operating margin was 8.3% for the 2023 fourth

quarter compared with 5.5% for the 2022 fourth quarter.

In the commercial and industrial market,

revenues and operating income increased compared to the 2022 fourth

quarter, primarily due to higher business levels in marine repair,

on-highway and power generation. Thermo King also contributed

favorably with sequential and year-on-year growth due to increased

sales despite negative headwinds from supply chain constraints.

Overall, commercial and industrial revenues increased 24% compared

to the 2022 fourth quarter and represented approximately 64% of

segment revenues. Commercial and industrial operating margins were

in the mid to high-single digits.

In the oil and gas market, revenues and

operating income results were mixed when compared to the 2022

fourth quarter. The manufacturing business achieved significant

year-over-year growth with orders and deliveries of pressure

pumping equipment and power generation equipment for electric

fracturing which was offset by lower activity in conventional

remanufacturing. Overall, oil and gas revenues decreased 3%

compared to the 2022 fourth quarter while operating income

increased 289% with operating margins in the low double digits. Oil

& gas represented approximately 36% of segment revenues.

Cash Generation

For the 2023 fourth quarter, EBITDA was $149.4

million compared with $113.5 million for the 2022 fourth quarter.

Net cash provided by operating activities was $216.0 million, and

capital expenditures were $126.7 million. During the quarter, the

Company had net proceeds from asset sales totaling $4.2 million. As

of December 31, 2023, the Company had $32.6 million of cash and

cash equivalents on the balance sheet and $491.2 million of

available liquidity. Total debt was $1,016.6 million, reflecting a

$63.0 million reduction compared to December 31, 2022, and the

debt-to-capitalization ratio improved to 24.2%.

2024 Outlook

Commenting on the 2024 full year outlook, Mr.

Grzebinski said, “We ended 2023 in a position of strength in both

of our segments. In marine transportation, barge utilization and

customer demand remain strong, and rates continue to increase. In

distribution and services, demand for our products and services

remains strong, and we continue to receive new orders in

manufacturing. Overall, we anticipate our businesses to deliver 30%

to 40% earnings growth in 2024. Key risks putting us at the lower

end of this range or below would be the impact from a recession or

lingering inflation. Achieving the higher end of this range would

be driven by stronger than expected chemical markets for marine and

stronger than expected oil and gas markets for distribution and

services.”

In inland marine, our 2024 outlook anticipates

positive market dynamics with steady customer demand and tight

conditions due to limited new barge construction in the industry.

In addition to this, many industry units are scheduled for

maintenance. With these tight market conditions, we expect our

barge utilization rates to be in the low to mid-90% range

throughout the year. Overall, inland revenues are expected to grow

in the mid to high single digit range on a full year basis.

However, a potential recession along with a drop in demand could

impact expected growth. The Company expects operating margins to

gradually improve during the year with the first quarter being the

lowest and averaging around 20% for the full year.

In coastal marine, strong customer demand is

expected throughout the year with barge utilization in the low to

mid-90% range. With major shipyards and ballast water treatment

installations concluding in the first half of the year, revenues

for the full year are expected to increase in the high single to

low double digits range compared to 2023. Coastal operating margins

are expected to be in the mid to high single digit range on a full

year basis.

In the distribution and services segment,

despite the uncertainty from volatile commodity prices, we expect

to yield incremental demand for OEM products, parts, and services

in the segment. In commercial and industrial, strong demand for

power generation and stable marine repair is expected to help drive

full year revenue growth in the high single-digit to low

double-digit percentage range. In oil and gas, our manufacturing

backlog is expected to provide stable levels of activity through

most of 2024 which will be offset by lower activity levels in the

oilfield market. We anticipate extended lead times in the near-term

to continue contributing to a volatile delivery schedule of new

products in 2024. Overall, the Company expects segment revenues to

be flat to slightly down on a full year basis with operating

margins in the mid to high-single digits but slightly lower

year-over-year due to mix.

Kirby expects to generate net cash provided from

operating activities of $600 million to $700 million in 2024 and

capital spending is expected to range between $290 million to $330

million. Approximately $190 million to $240 million is associated

with marine maintenance capital and improvements to existing inland

and coastal marine equipment, including the remaining ballast water

treatment systems on some coastal vessels, and facility

improvements. Up to approximately $90 million is associated with

growth capital spending in both our businesses.

Leadership Update

Today we announce the retirement of Joseph H.

Pyne, Kirby’s Chairman of the Board who will not stand for

reelection upon the expiration of his current term, which expires

at the conclusion of Kirby’s 2024 Annual Stockholders meeting on

April 26, 2024. Mr. Pyne has served as Chairman of Kirby since

April 2010 and has been a board member for 35 years. Succeeding Mr.

Pyne is Richard J. “Dick” Alario who has been elected as Chairman

of the Board, effective April 26, 2024. Mr. Alario has been a board

member since 2011 and brings a tremendous skill set to this role.

He has been involved with the Company and its strategy since

joining the board and most recently served as Kirby’s Lead

Independent director since 2021. Also, Rocky B. Dewbre, will not

stand for election as a director at the conclusion of his term

which expires on April 26, 2024. Mr. Dewbre was added to Kirby’s

board last year in conjunction with the Cooperation Agreement

between Kirby and shareholder JCP Investment Management.

Commenting on Mr. Dewbre’s departure and his

retirement from Kirby, Mr. Pyne stated, “I want to thank Rocky for

his contributions to the Board and to wish him well. With respect

to my retirement from the Board, I have been with Kirby 46 years,

and it has been a terrific journey. Kirby has grown tremendously

during my time with the company, and it has done so from the

strength of the excellent men and women who dedicate their careers

to this great company. The outlook for Kirby is as good as I have

ever seen and I am certain Mr. Alario as chairman, the Board, the

management team, and all the employees will deliver a very bright

future.”

Commenting on Mr. Dewbre’s departure and Mr.

Pyne’s retirement, Mr. Grzebinski stated, “I wish Rocky well and

thank him for his thoughtful input to Kirby. With respect to Joe, I

have enjoyed working with Joe over the past 14 years. Joe’s wisdom

and commitment to Kirby are unparalleled and he will very much be

missed. On behalf of the Board and all Kirby employees we thank him

for all he has done and wish Joe a happy and healthy

retirement.”

Conference Call

A conference call is scheduled for 7:30 a.m.

Central Standard Time today, Thursday, February 1, 2024, to discuss

the 2023 fourth quarter performance as well as the outlook for

2024. To listen to the webcast, please visit the Investor Relations

section of Kirby’s website at www.kirbycorp.com. For

listeners who wish to participate in the question and answer

session via telephone, please pre-register at

Kirby Earnings Call Registration.

All registrants will receive dial-in information and a PIN allowing

them to access the live call. A slide presentation for this

conference call will be posted on Kirby’s website approximately 15

minutes before the start of the webcast. A replay of the webcast

will be available for a period of one year by visiting the News

& Events page in the Investor Relations section of Kirby’s

website.

GAAP to Non-GAAP Financial

Measures The financial and other information to be

discussed in the conference call is available in this press release

and in a Form 8-K filed with the Securities and Exchange

Commission. This press release and the Form 8-K includes a non-GAAP

financial measure, EBITDA, which Kirby defines as net earnings

attributable to Kirby before interest expense, taxes on income, and

depreciation and amortization. A reconciliation of EBITDA with GAAP

net earnings attributable to Kirby is included in this press

release. This press release also includes non-GAAP financial

measures which exclude certain one-time items, including earnings

before taxes on income (excluding one-time items), net earnings

attributable to Kirby (excluding one-time items), and diluted

earnings per share (excluding one-time items). A reconciliation of

these measures with GAAP is included in this press release.

Management believes the exclusion of certain one-time items from

these financial measures enables it and investors to assess and

understand operating performance, especially when comparing those

results with previous and subsequent periods or forecasting

performance for future periods, primarily because management views

the excluded items to be outside of Kirby’s normal operating

results. This press release additionally includes a non-GAAP

financial measure, free cash flow, which Kirby defines as net cash

provided by operating activities less capital expenditures. A

reconciliation of free cash flow with GAAP is included in this

press release. Kirby uses free cash flow to assess and forecast

cash flow and to provide additional disclosures on the Company’s

liquidity. Free cash flow does not imply the amount of residual

cash flow available for discretionary expenditures as it excludes

mandatory debt service requirements and other non-discretionary

expenditures. This press release also includes marine

transportation performance measures, consisting of ton miles,

revenue per ton mile, towboats operated and delay days. Comparable

marine transportation performance measures for the 2022 year and

quarters are available in the Investor Relations section of Kirby’s

website, www.kirbycorp.com, under Financials.

Forward-Looking Statements

Statements contained in this press release with respect to the

future are forward-looking statements. These statements reflect

management’s reasonable judgment with respect to future events.

Forward-looking statements involve risks and uncertainties. Actual

results could differ materially from those anticipated as a result

of various factors, including adverse economic conditions, industry

competition and other competitive factors, adverse weather

conditions such as high water, low water, tropical storms,

hurricanes, tsunamis, fog and ice, tornados, COVID-19 or other

pandemics, marine accidents, lock delays or closures, fuel costs,

interest rates, construction of new equipment by competitors,

government and environmental laws and regulations, and the timing,

magnitude and number of acquisitions made by the Company.

Forward-looking statements are based on currently available

information and Kirby assumes no obligation to update any such

statements. A list of additional risk factors can be found in

Kirby’s annual report on Form 10-K for the year ended December 31,

2022.

About Kirby Corporation Kirby

Corporation, based in Houston, Texas, is the nation’s largest

domestic tank barge operator transporting bulk liquid products

throughout the Mississippi River System, on the Gulf Intracoastal

Waterway, and coastwise along all three United States coasts. Kirby

transports petrochemicals, black oil, refined petroleum products

and agricultural chemicals by tank barge. In addition, Kirby

participates in the transportation of dry-bulk commodities in

United States coastwise trade. Through the distribution and

services segment, Kirby provides after-market service and genuine

replacement parts for engines, transmissions, reduction gears,

electric motors, drives, and controls, specialized electrical

distribution and control systems, energy storage battery systems,

and related equipment used in oilfield services, marine, power

generation, on-highway, and other industrial applications. Kirby

also rents equipment including generators, industrial compressors,

high capacity lift trucks, and refrigeration trailers for use in a

variety of industrial markets. For the oil and gas market, Kirby

manufactures and remanufactures oilfield service equipment,

including pressure pumping units, and manufactures electric power

generation equipment, specialized electrical distribution and

control equipment, and high capacity energy storage/battery systems

for oilfield customers.

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands, except per share

amounts) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine transportation |

|

$ |

452,595 |

|

|

$ |

422,736 |

|

|

$ |

1,721,937 |

|

|

$ |

1,616,967 |

|

|

Distribution and services |

|

|

346,581 |

|

|

|

307,429 |

|

|

|

1,369,703 |

|

|

|

1,167,787 |

|

|

Total revenues |

|

|

799,176 |

|

|

|

730,165 |

|

|

|

3,091,640 |

|

|

|

2,784,754 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

561,732 |

|

|

|

534,069 |

|

|

|

2,180,422 |

|

|

|

2,060,941 |

|

|

Selling, general and administrative |

|

|

84,343 |

|

|

|

80,971 |

|

|

|

335,213 |

|

|

|

302,692 |

|

|

Taxes, other than on income |

|

|

6,156 |

|

|

|

6,739 |

|

|

|

34,766 |

|

|

|

35,071 |

|

|

Depreciation and amortization |

|

|

54,905 |

|

|

|

50,945 |

|

|

|

211,156 |

|

|

|

201,443 |

|

|

Gain on disposition of assets |

|

|

(779 |

) |

|

|

(308 |

) |

|

|

(5,009 |

) |

|

|

(8,279 |

) |

|

Total costs and expenses |

|

|

706,357 |

|

|

|

672,416 |

|

|

|

2,756,548 |

|

|

|

2,591,868 |

|

|

Operating income |

|

|

92,819 |

|

|

|

57,749 |

|

|

|

335,092 |

|

|

|

192,886 |

|

|

Other income |

|

|

1,745 |

|

|

|

4,824 |

|

|

|

11,041 |

|

|

|

16,677 |

|

|

Interest expense |

|

|

(13,115 |

) |

|

|

(11,990 |

) |

|

|

(52,008 |

) |

|

|

(44,588 |

) |

|

Earnings before taxes on income |

|

|

81,449 |

|

|

|

50,583 |

|

|

|

294,125 |

|

|

|

164,975 |

|

|

Provision for taxes on income |

|

|

(19,487 |

) |

|

|

(13,258 |

) |

|

|

(71,220 |

) |

|

|

(42,214 |

) |

|

Net earnings |

|

|

61,962 |

|

|

|

37,325 |

|

|

|

222,905 |

|

|

|

122,761 |

|

|

Net (earnings) loss attributable to noncontrolling interests |

|

|

(56 |

) |

|

|

(16 |

) |

|

|

30 |

|

|

|

(470 |

) |

|

Net earnings attributable to Kirby |

|

$ |

61,906 |

|

|

$ |

37,309 |

|

|

$ |

222,935 |

|

|

$ |

122,291 |

|

|

Net earnings per share attributable to Kirby common

stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.05 |

|

|

$ |

0.62 |

|

|

$ |

3.74 |

|

|

$ |

2.04 |

|

|

Diluted |

|

$ |

1.04 |

|

|

$ |

0.62 |

|

|

$ |

3.72 |

|

|

$ |

2.03 |

|

|

Common stock outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

58,970 |

|

|

|

59,890 |

|

|

|

59,531 |

|

|

|

60,038 |

|

|

Diluted |

|

|

59,335 |

|

|

|

60,211 |

|

|

|

59,857 |

|

|

|

60,329 |

|

CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands) |

|

|

EBITDA:(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Kirby |

|

$ |

61,906 |

|

|

$ |

37,309 |

|

|

$ |

222,935 |

|

|

$ |

122,291 |

|

|

Interest expense |

|

|

13,115 |

|

|

|

11,990 |

|

|

|

52,008 |

|

|

|

44,588 |

|

|

Provision for taxes on income |

|

|

19,487 |

|

|

|

13,258 |

|

|

|

71,220 |

|

|

|

42,214 |

|

|

Depreciation and amortization |

|

|

54,905 |

|

|

|

50,945 |

|

|

|

211,156 |

|

|

|

201,443 |

|

|

|

|

$ |

149,413 |

|

|

$ |

113,502 |

|

|

$ |

557,319 |

|

|

$ |

410,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

126,767 |

|

|

$ |

52,343 |

|

|

$ |

401,730 |

|

|

$ |

172,606 |

|

|

Acquisitions of businesses and marine equipment |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

37,500 |

|

|

$ |

3,900 |

|

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands) |

|

|

Cash and cash equivalents |

|

$ |

32,577 |

|

|

$ |

80,577 |

|

|

Long-term debt, including current portion |

|

$ |

1,016,595 |

|

|

$ |

1,079,618 |

|

|

Total equity |

|

$ |

3,186,677 |

|

|

$ |

3,045,168 |

|

|

Debt to capitalization ratio |

|

|

24.2 |

% |

|

|

26.2 |

% |

MARINE TRANSPORTATION STATEMENTS OF

EARNINGS

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands) |

|

|

Marine transportation revenues |

|

$ |

452,595 |

|

|

$ |

422,736 |

|

|

$ |

1,721,937 |

|

|

$ |

1,616,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

299,906 |

|

|

|

291,138 |

|

|

|

1,136,526 |

|

|

|

1,146,657 |

|

|

Selling, general and administrative |

|

|

33,049 |

|

|

|

34,916 |

|

|

|

134,641 |

|

|

|

128,340 |

|

|

Taxes, other than on income |

|

|

4,550 |

|

|

|

5,079 |

|

|

|

27,602 |

|

|

|

28,235 |

|

|

Depreciation and amortization |

|

|

46,901 |

|

|

|

44,884 |

|

|

|

184,225 |

|

|

|

177,551 |

|

|

Total costs and expenses |

|

|

384,406 |

|

|

|

376,017 |

|

|

|

1,482,994 |

|

|

|

1,480,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

68,189 |

|

|

$ |

46,719 |

|

|

$ |

238,943 |

|

|

$ |

136,184 |

|

|

Operating margin |

|

|

15.1 |

% |

|

|

11.1 |

% |

|

|

13.9 |

% |

|

|

8.4 |

% |

DISTRIBUTION AND SERVICES STATEMENTS OF

EARNINGS

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands) |

|

|

Distribution and services revenues |

|

$ |

346,581 |

|

|

$ |

307,429 |

|

|

$ |

1,369,703 |

|

|

$ |

1,167,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

261,221 |

|

|

|

242,686 |

|

|

|

1,040,905 |

|

|

|

913,624 |

|

|

Selling, general and administrative |

|

|

48,840 |

|

|

|

41,778 |

|

|

|

187,424 |

|

|

|

163,642 |

|

|

Taxes, other than on income |

|

|

1,681 |

|

|

|

1,641 |

|

|

|

7,051 |

|

|

|

6,708 |

|

|

Depreciation and amortization |

|

|

6,186 |

|

|

|

4,263 |

|

|

|

19,842 |

|

|

|

16,776 |

|

|

Total costs and expenses |

|

|

317,928 |

|

|

|

290,368 |

|

|

|

1,255,222 |

|

|

|

1,100,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

28,653 |

|

|

$ |

17,061 |

|

|

$ |

114,481 |

|

|

$ |

67,037 |

|

|

Operating margin |

|

|

8.3 |

% |

|

|

5.5 |

% |

|

|

8.4 |

% |

|

|

5.7 |

% |

OTHER COSTS AND EXPENSES

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(unaudited, $ in thousands) |

|

|

General corporate expenses |

|

$ |

4,802 |

|

|

$ |

6,339 |

|

|

$ |

23,341 |

|

|

$ |

18,614 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposition of assets |

|

$ |

(779 |

) |

|

$ |

(308 |

) |

|

$ |

(5,009 |

) |

|

$ |

(8,279 |

) |

ONE-TIME CHARGES

The 2022 fourth quarter and 2023 and 2022 full

year GAAP results include certain one-time charges. The following

is a reconciliation of GAAP earnings to non-GAAP earnings,

excluding the one-time items, for earnings before tax (pre-tax),

net earnings attributable to Kirby (after-tax), and diluted

earnings per share (per share):

|

|

|

Fourth Quarter 2023 |

|

|

Full Year 2023 |

|

|

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Per Share |

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Per Share |

|

|

|

|

(unaudited, $ in millions except per share

amounts) |

|

|

GAAP earnings |

|

$ |

81.4 |

|

|

$ |

61.9 |

|

|

$ |

1.04 |

|

|

$ |

294.1 |

|

|

$ |

222.9 |

|

|

$ |

3.72 |

|

|

Costs related to strategic review and shareholder engagement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.0 |

|

|

|

2.4 |

|

|

|

0.04 |

|

|

IRS refund interest income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2.7 |

) |

|

|

(2.2 |

) |

|

|

(0.04 |

) |

|

Earnings, excluding one-time items(2) |

|

$ |

81.4 |

|

|

$ |

61.9 |

|

|

$ |

1.04 |

|

|

$ |

294.4 |

|

|

$ |

223.1 |

|

|

$ |

3.72 |

|

|

|

|

Fourth Quarter 2022 |

|

|

Full Year 2022 |

|

|

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Per Share |

|

|

Pre-Tax |

|

|

After-Tax |

|

|

Per Share |

|

|

|

|

(unaudited, $ in millions except per share

amounts) |

|

|

GAAP earnings |

|

$ |

50.6 |

|

|

$ |

37.3 |

|

|

$ |

0.62 |

|

|

$ |

165.0 |

|

|

$ |

122.3 |

|

|

$ |

2.03 |

|

|

Severance expense |

|

|

3.3 |

|

|

|

2.4 |

|

|

|

0.04 |

|

|

|

4.8 |

|

|

|

3.7 |

|

|

|

0.06 |

|

|

Strategic alternatives review |

|

|

0.9 |

|

|

|

0.6 |

|

|

|

0.01 |

|

|

|

0.9 |

|

|

|

0.6 |

|

|

|

0.01 |

|

|

Earnings, excluding one-time items(2) |

|

$ |

54.8 |

|

|

$ |

40.3 |

|

|

$ |

0.67 |

|

|

$ |

170.7 |

|

|

$ |

126.6 |

|

|

$ |

2.10 |

|

RECONCILIATION OF FREE CASH

FLOW

The following is a reconciliation of GAAP net

cash provided by operating activities to non-GAAP free cash

flow(2):

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022(3) |

|

|

2023 |

|

|

2022(3) |

|

|

|

|

(unaudited, $ in millions) |

|

|

Net cash provided by operating activities |

|

$ |

216.0 |

|

|

$ |

132.9 |

|

|

$ |

540.2 |

|

|

$ |

294.1 |

|

|

Less: Capital expenditures |

|

|

(126.7 |

) |

|

|

(52.3 |

) |

|

|

(401.7 |

) |

|

|

(172.6 |

) |

|

Free cash flow(2) |

|

$ |

89.3 |

|

|

$ |

80.6 |

|

|

$ |

138.5 |

|

|

$ |

121.5 |

|

MARINE TRANSPORTATION PERFORMANCE

MEASUREMENTS

|

|

|

Fourth Quarter |

|

|

Year |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Inland Performance Measurements: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ton Miles (in millions)(4) |

|

|

3,340 |

|

|

|

3,365 |

|

|

|

13,571 |

|

|

|

13,775 |

|

|

Revenue/Ton Mile (cents/tm)(5) |

|

|

11.2 |

|

|

|

10.0 |

|

|

|

10.4 |

|

|

|

9.3 |

|

|

Towboats operated (average)(6) |

|

|

281 |

|

|

|

277 |

|

|

|

280 |

|

|

|

271 |

|

|

Delay Days(7) |

|

|

2,873 |

|

|

|

3,092 |

|

|

|

10,863 |

|

|

|

10,244 |

|

|

Average cost per gallon of fuel consumed |

|

$ |

3.41 |

|

|

$ |

4.00 |

|

|

$ |

3.08 |

|

|

$ |

3.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barges (active): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

|

|

|

|

|

|

1,076 |

|

|

|

1,037 |

|

|

Coastal tank barges |

|

|

|

|

|

|

|

|

28 |

|

|

|

29 |

|

|

Offshore dry-cargo barges |

|

|

|

|

|

|

|

|

4 |

|

|

|

4 |

|

|

Barrel capacities (in millions): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

|

|

|

|

|

|

23.7 |

|

|

|

23.1 |

|

|

Coastal tank barges |

|

|

|

|

|

|

|

|

2.9 |

|

|

|

3.0 |

|

- Kirby has historically evaluated its operating performance

using numerous measures, one of which is EBITDA, a non-GAAP

financial measure. Kirby defines EBITDA as net earnings

attributable to Kirby before interest expense, taxes on income,

depreciation and amortization, impairment of long-lived assets, and

impairment of goodwill. EBITDA is presented because of its wide

acceptance as a financial indicator. EBITDA is one of the

performance measures used in Kirby’s incentive bonus plan. EBITDA

is also used by rating agencies in determining Kirby’s credit

rating and by analysts publishing research reports on Kirby, as

well as by investors and investment bankers generally in valuing

companies. EBITDA is not a calculation based on generally accepted

accounting principles and should not be considered as an

alternative to, but should only be considered in conjunction with,

Kirby’s GAAP financial information.

- Kirby uses certain non-GAAP financial measures to review

performance excluding certain one-time items including: earnings

before taxes on income, excluding one-time items; net earnings

attributable to Kirby, excluding one-time items; and diluted

earnings per share, excluding one-time items. Management believes

the exclusion of certain one-time items from these financial

measures enables it and investors to assess and understand

operating performance, especially when comparing those results with

previous and subsequent periods or forecasting performance for

future periods, primarily because management views the excluded

items to be outside of the company's normal operating results.

Kirby also uses free cash flow, which is defined as net cash

provided by operating activities less capital expenditures, to

assess and forecast cash flow and to provide additional disclosures

on the Company’s liquidity as a result of uncertainty surrounding

the impact of the COVID-19 pandemic on global and regional market

conditions. Free cash flow does not imply the amount of residual

cash flow available for discretionary expenditures as it excludes

mandatory debt service requirements and other non-discretionary

expenditures. These non-GAAP financial measures are not

calculations based on generally accepted accounting principles and

should not be considered as an alternative to, but should only be

considered in conjunction with Kirby’s GAAP financial

information.

- See Kirby’s 2022 10-K for amounts provided by (used in)

investing and financing activities.

- Ton miles indicate fleet productivity by measuring the distance

(in miles) a loaded tank barge is moved. Example: A typical 30,000

barrel tank barge loaded with 3,300 tons of liquid cargo is moved

100 miles, thus generating 330,000 ton miles.

- Inland marine transportation revenues divided by ton miles.

Example: Fourth quarter 2023 inland marine transportation revenues

of $373.2 million divided by 3,340 million inland marine

transportation ton miles = 11.2 cents.

- Towboats operated are the average number of owned and chartered

towboats operated during the period.

- Delay days measures the lost time incurred by a tow (towboat

and one or more tank barges) during transit. The measure includes

transit delays caused by weather, lock delays or closures, and

other navigational factors.

| Contact: |

Kurt

Niemietz |

| |

713-435-1077 |

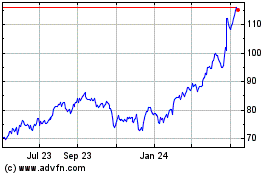

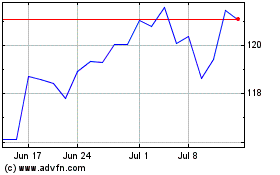

Kirby (NYSE:KEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kirby (NYSE:KEX)

Historical Stock Chart

From Nov 2023 to Nov 2024