Kirby Corporation (“Kirby”) (NYSE: KEX) today announced net

earnings attributable to Kirby for the fourth quarter ended

December 31, 2020 of $22.2 million or $0.37 per share, compared

with $2.8 million or $0.05 per share for the 2019 fourth quarter.

Excluding one-time charges in the 2019 fourth quarter, net earnings

attributable to Kirby were $34.5 million or $0.58 per share.

Consolidated revenues for the 2020 fourth quarter were $489.8

million compared with $655.9 million reported for the 2019 fourth

quarter.

For the 2020 full year, Kirby reported a net

loss attributable to Kirby of ($272.5) million or ($4.55) per

share, compared with net earnings attributable to Kirby of $142.3

million or $2.37 per share for 2019. Excluding one-time items in

both years, 2020 net earnings attributable to Kirby were $110.0

million or $1.84 per share, compared with $174.0 million or $2.90

per share for 2019. Consolidated revenues for 2020 were $2.17

billion compared with $2.84 billion for 2019.

David Grzebinski, Kirby’s President and Chief

Executive Officer, commented, “During the fourth quarter, the

impact of the pandemic on the economy continued to constrain demand

in Kirby’s businesses. Although overall demand modestly increased

in some areas of distribution and services, there was no

improvement in inland and coastal barge utilization in the

quarter.

“In marine transportation, our inland and

coastal businesses faced continued market weakness and low demand

for liquid cargoes including refined products, crude, and black

oil. With hurricanes impacting the Gulf Coast in October and a

second wave of COVID-19 cases escalating during the quarter,

average refinery utilization only began to improve in mid-November

and remained well below historical norms for the fourth quarter.

These challenging market conditions contributed to continued low

barge utilization throughout the quarter, limited spot market

activity, and increased pricing pressure.

“In distribution and services, overall activity

levels continued to slowly recover during the fourth quarter. In

commercial and industrial, we benefited from modest improvements in

economic activity, higher Thermo King product revenues, and sales

of new marine engines. These improvements were partially offset by

seasonality including lower utilization in the power generation

rental fleet and reduced major overhauls in marine repair. In the

oilfield, improved U.S. frac activity contributed to higher demand

for new transmissions, parts, and service; however, total oil and

gas revenues declined due to the timing of new pressure pumping

equipment deliveries in manufacturing,” Mr. Grzebinski

concluded.

Segment Results – Marine

Transportation Marine transportation revenues for the 2020

fourth quarter were $299.4 million compared with $402.0 million for

the 2019 fourth quarter. Operating income for the 2020 fourth

quarter was $29.2 million compared with $54.5 million for the 2019

fourth quarter. Segment operating margin for the 2020 fourth

quarter was 9.7% compared with 13.6% for the 2019 fourth

quarter.

In the inland market, average barge utilization

was in the high 60% range during the 2020 fourth quarter compared

to the low 90% range in the 2019 fourth quarter. Barge volumes were

heavily impacted by lower refinery and chemical plant utilization

and reduced demand for refined products and petrochemicals.

Significant hurricane activity in October also contributed to

operational disruptions and lower volumes along the Gulf Coast. As

a result of lower barge utilization, average spot market pricing

for the quarter declined approximately 10% sequentially and 25%

year-on-year. Average term contract pricing on expiring contracts

was down in the low double digits. Revenues in the inland market

declined 28% compared to the 2019 fourth quarter due to the impact

of reduced barge utilization and lower fuel rebills, partially

offset by the Savage Inland Marine asset acquisition which closed

on April 1, 2020. During the fourth quarter, the inland market

represented 75% of segment revenues and had an operating margin in

the low to mid-teens.

In the coastal market, reduced demand for

refined products and black oil resulted in limited spot market

activity, the return of some chartered equipment as term contracts

expired, and barge utilization in the mid-70% range. Pricing in the

spot market was generally stable; however, average term contract

pricing declined in the mid-single digits year-on-year. Revenues in

the coastal market declined 18% compared to the 2019 fourth quarter

as a result of reduced barge utilization, lower fuel rebills,

retirements of three large capacity vessels, and delays associated

with hurricanes in the Gulf of Mexico during October. The coastal

market represented 25% of segment revenues and had a negative

operating margin in the low to mid-single digits during the

quarter.

Segment Results –

Distribution and Services Distribution and

services revenues for the 2020 fourth quarter were $190.3 million

compared with $253.9 million for the 2019 fourth quarter. The

segment had an operating loss in the 2020 fourth quarter of ($2.9)

million compared to an operating loss of ($2.7) million in the 2019

fourth quarter which included $3.3 million of severance expense.

Operating margin was (1.5)% for the 2020 fourth quarter compared

with (1.1)% for the 2019 fourth quarter.

In the commercial and industrial market,

revenues increased compared to the 2019 fourth quarter primarily

due to the contribution from Convoy Servicing Company, a Thermo

King distributor which was acquired in January 2020. This increase

was partially offset by reduced economic activity which resulted in

lower business levels in the on-highway and power generation

businesses. The marine repair business was also down year-on-year

due to reduced major engine overhaul activity. During the quarter,

the commercial and industrial market represented approximately 78%

of segment revenues and had an operating margin in the low single

digits.

In the oil and gas market, revenues and

operating income declined compared to the 2019 fourth quarter due

to low oil prices and reduced oilfield activity which resulted in

limited customer demand for new and overhauled engines and

transmissions, parts and service. The manufacturing business

experienced a sharp reduction in orders year-on-year with minimal

deliveries of new and remanufactured pressure pumping equipment.

During the quarter, the oil and gas market represented

approximately 22% of segment revenues and had a negative operating

margin in the mid-teens.

Cash Generation For the 2020

fourth quarter, Adjusted EBITDA was $81.3 million compared with

$72.0 million for the 2019 fourth quarter which included $35.5

million of non-cash one-time inventory write-downs. During the

quarter, net cash provided by operating activities was $85.1

million, some of which was used to fund capital expenditures of

$18.8 million, resulting in free cash flow of $66.3 million. A

significant U.S. tax refund in excess of $100 million previously

contemplated in Kirby’s cash flow guidance was not received during

the 2020 fourth quarter as anticipated and is now expected in the

2021 first quarter. As of December 31, 2020, the Company had $80.3

million of cash and cash equivalents on the balance sheet and

$684.1 million of cash and liquidity available. Total debt was

$1,468.6 million, reflecting a $109.8 million reduction compared to

September 30, 2020, and the debt-to-capitalization ratio was

32.2%.

2021 Outlook Commenting on the

2021 full year outlook, Mr. Grzebinski said, “Although Kirby’s

businesses continue to be challenged by the COVID-19 pandemic and

the associated unprecedented declines in demand, we believe that

improved business activity and utilization levels will occur in the

second half of the year. With the vaccine distribution now

underway, it is likely that material improvements in economic

activity and increased energy consumption are ahead. We do believe,

however, the first half of the year will likely remain challenging

until the pandemic eases and refinery utilization materially

recovers. In the first quarter, we expect weak market conditions in

marine transportation to continue with further pricing pressure on

contract renewals. As well, surging cases of COVID-19 across the

U.S. have impacted our ability to crew our vessels, resulting in

delays and in some cases lost revenue. As a result, we anticipate a

sequential reduction in earnings during the first quarter with

improving results thereafter as the effects of the pandemic

moderate and demand for our products and services steadily

increases.”

In inland marine, market conditions are expected

to remain challenging in the coming months, with gradual

improvement in the second quarter, and a more meaningful recovery

in the second half of 2021. Barge utilization is projected to start

the year in the low to mid-70% range and improve into the high 80%

to low 90% range by the end of the year. Pricing, which typically

improves with barge utilization, is expected to remain under

pressure in the near-term. Financially, first quarter revenues and

operating margin are expected to be the lowest of the year, and

sequentially down as compared to the 2020 fourth quarter due to the

impact of lower pricing on term contract renewals and increased

delays from seasonal winter weather. Anticipated improvements in

the spot market later in 2021 should contribute to increased barge

utilization and better operating margins as the year progresses.

However, the full year impact of lower term contract pricing is

expected to result in full year operating margins lower than the

mid-teens margins realized in 2020.

In coastal, COVID-19 and the associated impact

on market conditions are expected to have a meaningful impact on

2021 results. Throughout 2020, much of coastal’s business was under

term contracts established in more favorable market conditions

during 2019 and early 2020. With current headwinds including

limited spot demand, the return of some chartered equipment, lower

term contract pricing, and crewing difficulties due to COVID-19,

coastal’s financial results are expected to be lower in 2021. As

well, the retirement of three older large capacity coastal vessels

during the second and third quarters of 2020, and the retirement of

an additional vessel in mid-2021, will have a negative impact on

full year results when compared to 2020. In the first quarter,

Kirby expects coastal revenues and operating margin to decline

compared to the 2020 fourth quarter, primarily due to the impact of

lower term contract pricing and challenges crewing vessels. For the

full year, Kirby expects coastal revenues will decline year-on-year

with negative operating margins, the magnitude of which will be

dependent on the timing of a material improvement in refined

products and black oil demand later in 2021.

In distribution and services, improving economic

activity and growth in the oilfield are expected to boost activity

levels and contribute to meaningful year-over-year improvement in

revenue and operating income. In commercial and industrial,

revenues are expected to benefit from improving economic

conditions, as well as from growth in the on-highway market, in

part due to Kirby’s new online parts sales platform which was

launched last year. However, these gains are expected to be

partially offset by lower sales of new marine engines which had

remained strong throughout 2020. In the oil and gas market, higher

commodity prices and increasing well completions activity are

expected to contribute to improved demand for new transmissions,

service and parts, as well as higher pressure pumping

remanufacturing activity. Additionally, a heightened focus on

sustainability across the energy sector and industrial complex is

expected to result in continued growth in new orders for Kirby’s

portfolio of environmentally friendly equipment during the year.

Overall, operating margins in distribution and services are

expected to be positive in the low to mid-single digits for the

full year, with the first quarter being the lowest, and the third

quarter being the highest prior to normal seasonal declines in the

fourth quarter.

Kirby expects 2021 capital spending to range

between $125 to $145 million, with the midpoint representing a

year-on-year reduction near 10%. Approximately $15 million is

associated with the construction of new inland towboats, and

approximately $95 to $110 million is associated with capital

upgrades and improvements to existing inland and coastal marine

equipment and facility improvements. The balance of approximately

$15 to $20 million largely relates to new machinery and equipment,

facility improvements, and information technology projects in

distribution and services and corporate. Overall, Kirby expects to

generate net cash provided by operating activities of $375 million

to $455 million, with free cash flow of $230 million to $330

million in 2021.

Mr. Grzebinski concluded, “Undoubtedly, 2020

will be remembered as an extremely challenging year. Kirby faced

unprecedented reductions in demand across the Company, a record

setting hurricane season, and the need to protect the health and

safety of our employees and customers. Despite the many challenges,

I am proud that our dedicated employees rose to the occasion.

Throughout 2020, we safely crewed our vessels, kept our branches

and facilities operating, ensured reliable and consistent customer

service, and successfully integrated newly acquired companies and

assets. Although our overall financial performance materially

declined year-on-year, I’m pleased with our efforts to reduce

costs, control capital expenditures, and focus on cash flow. With

these actions, Kirby enters 2021 in a strong financial position.

The new year brings continued uncertainty with respect to the

timing of a material recovery and likely further reductions in

earnings during the first quarter. Regardless, we believe better

days are ahead with improved demand and activity levels for all of

Kirby’s businesses as 2021 progresses and the impacts from the

pandemic moderate.”

Conference Call A conference

call is scheduled for 7:30 a.m. Central Standard Time today,

Thursday, January 28, 2021, to discuss the 2020 fourth quarter

performance as well as the outlook for 2021. To listen to the

webcast, please visit the Investor Relations section of Kirby’s

website at https://kirbycorp.com. A slide presentation for this

conference call will be posted on Kirby’s website approximately 15

minutes before the start of the webcast. For listeners who wish to

participate in the question and answer session of the conference

call webcast, you may access the call by dialing (866) 691-5839

within the U.S. and Canada or +1 (409) 216-0840 internationally.

The conference ID for the call is 5269699. A replay of the webcast

will be available for a period of one year by visiting the News

& Events page in the Investor Relations section of Kirby’s

website.

GAAP to Non-GAAP Financial

Measures The financial and other information to be

discussed in the conference call is available in this press release

and in a Form 8-K filed with the Securities and Exchange

Commission. This press release and the Form 8-K includes a non-GAAP

financial measure, Adjusted EBITDA, which Kirby defines as net

earnings (loss) attributable to Kirby before interest expense,

taxes on income, depreciation and amortization, impairment of

long-lived assets, and impairment of goodwill. A reconciliation of

Adjusted EBITDA with GAAP net earnings (loss) attributable to Kirby

is included in this press release. This press release also includes

non-GAAP financial measures which exclude certain one-time items,

including earnings before taxes on income (excluding one-time

items), net earnings attributable to Kirby (excluding one-time

items), and diluted earnings per share (excluding one-time items).

A reconciliation of these measures with GAAP is included in this

press release. Management believes the exclusion of certain

one-time items from these financial measures enables it and

investors to assess and understand operating performance,

especially when comparing those results with previous and

subsequent periods or forecasting performance for future periods,

primarily because management views the excluded items to be outside

of Kirby’s normal operating results. This press release also

includes a non-GAAP financial measure, free cash flow, which Kirby

defines as net cash provided by operating activities less capital

expenditures. A reconciliation of free cash flow with GAAP is

included in this press release. Kirby uses free cash flow to assess

and forecast cash flow and to provide additional disclosures on the

Company’s liquidity as a result of uncertainty surrounding the

impact of the COVID-19 pandemic on global and regional market

conditions. Free cash flow does not imply the amount of residual

cash flow available for discretionary expenditures as it excludes

mandatory debt service requirements and other non-discretionary

expenditures. This press release also includes marine

transportation performance measures, consisting of ton miles,

revenue per ton mile, towboats operated and delay days. Comparable

marine transportation performance measures for the 2019 year and

quarters are available in the Investor Relations section of Kirby’s

website, https://kirbycorp.com, under Financials.

Forward-Looking Statements

Statements contained in this press release with respect to the

future are forward-looking statements. These statements reflect

management’s reasonable judgment with respect to future events.

Forward-looking statements involve risks and uncertainties. Actual

results could differ materially from those anticipated as a result

of various factors, including cyclical or other downturns in

demand, significant pricing competition, unanticipated additions to

industry capacity, changes in the Jones Act or in U.S. maritime

policy and practice, fuel costs, interest rates, weather conditions

and timing, magnitude and number of acquisitions made by Kirby, and

the impact of the COVID-19 pandemic and the related response of

governments on global and regional market conditions.

Forward-looking statements are based on currently available

information and Kirby assumes no obligation to update any such

statements. A list of additional risk factors can be found in

Kirby’s annual report on Form 10-K for the year ended December 31,

2019 and in subsequent quarterly filings on Form 10-Q.

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in thousands, except per share amounts) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine transportation |

|

$ |

299,419 |

|

$ |

402,010 |

|

$ |

1,404,265 |

|

$ |

1,587,082 |

|

|

Distribution and services |

|

|

190,337 |

|

|

253,917 |

|

|

767,143 |

|

|

1,251,317 |

|

|

Total revenues |

|

|

489,756 |

|

|

655,927 |

|

|

2,171,408 |

|

|

2,838,399 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

342,947 |

|

|

471,382 |

|

|

1,510,818 |

|

|

2,030,046 |

|

|

Selling, general and administrative |

|

|

58,860 |

|

|

70,786 |

|

|

258,272 |

|

|

277,388 |

|

|

Taxes, other than on income |

|

|

8,452 |

|

|

10,447 |

|

|

42,000 |

|

|

41,933 |

|

|

Depreciation and amortization |

|

|

54,854 |

|

|

54,861 |

|

|

219,921 |

|

|

219,632 |

|

|

Impairments and other charges |

|

|

— |

|

|

35,525 |

|

|

561,274 |

|

|

35,525 |

|

|

Gain on disposition of assets |

|

|

(131 |

) |

|

(3,251 |

) |

|

(118 |

) |

|

(8,152 |

) |

|

Total costs and expenses |

|

|

464,982 |

|

|

639,750 |

|

|

2,592,167 |

|

|

2,596,372 |

|

|

Operating income (loss) |

|

|

24,774 |

|

|

16,177 |

|

|

(420,759 |

) |

|

242,027 |

|

| Other

income |

|

|

1,962 |

|

|

1,110 |

|

|

8,147 |

|

|

3,787 |

|

| Interest

expense |

|

|

(11,423 |

) |

|

(12,968 |

) |

|

(48,739 |

) |

|

(55,994 |

) |

|

Earnings (loss) before taxes on income |

|

|

15,313 |

|

|

4,319 |

|

|

(461,351 |

) |

|

189,820 |

|

| (Provision)

benefit for taxes on income |

|

|

7,102 |

|

|

(1,347 |

) |

|

189,759 |

|

|

(46,801 |

) |

|

Net earnings (loss) |

|

|

22,415 |

|

|

2,972 |

|

|

(271,592 |

) |

|

143,019 |

|

| Less: Net

earnings attributable to noncontrolling interests |

|

|

(211 |

) |

|

(195 |

) |

|

(954 |

) |

|

(672 |

) |

|

Net earnings (loss) attributable to Kirby |

|

$ |

22,204 |

|

$ |

2,777 |

|

$ |

(272,546 |

) |

$ |

142,347 |

|

| Net earnings

(loss) per share attributable to Kirby common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.37 |

|

$ |

0.05 |

|

$ |

(4.55 |

) |

$ |

2.38 |

|

|

Diluted |

|

$ |

0.37 |

|

$ |

0.05 |

|

$ |

(4.55 |

) |

$ |

2.37 |

|

| Common stock

outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

59,937 |

|

|

59,799 |

|

|

59,912 |

|

|

59,750 |

|

|

Diluted |

|

|

59,975 |

|

|

59,998 |

|

|

59,912 |

|

|

59,909 |

|

CONDENSED CONSOLIDATED FINANCIAL

INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in thousands) |

|

| Adjusted

EBITDA: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) attributable to Kirby |

|

$ |

22,204 |

|

$ |

2,777 |

|

$ |

(272,546 |

) |

$ |

142,347 |

|

|

Interest expense |

|

|

11,423 |

|

|

12,968 |

|

|

48,739 |

|

|

55,994 |

|

|

Provision (benefit) for taxes on income |

|

|

(7,102 |

) |

|

1,347 |

|

|

(189,759 |

) |

|

46,801 |

|

|

Impairment of long-lived assets |

|

|

— |

|

|

— |

|

|

165,304 |

|

|

— |

|

|

Impairment of goodwill |

|

|

— |

|

|

— |

|

|

387,970 |

|

|

— |

|

|

Depreciation and amortization |

|

|

54,854 |

|

|

54,861 |

|

|

219,921 |

|

|

219,632 |

|

|

|

|

$ |

81,379 |

|

$ |

71,953 |

|

$ |

359,629 |

|

$ |

464,774 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

|

$ |

18,814 |

|

$ |

64,096 |

|

$ |

148,185 |

|

$ |

248,164 |

|

| Acquisitions

of businesses and marine equipment |

|

$ |

6,200 |

|

$ |

4,951 |

|

$ |

354,972 |

|

$ |

262,491 |

|

| |

|

December 31, |

|

| |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

| |

|

|

(unaudited,

$ in thousands) |

|

|

Cash and cash equivalents |

|

$ |

80,338 |

|

$ |

24,737 |

|

| Long-term

debt, including current portion |

|

$ |

1,468,586 |

|

$ |

1,369,767 |

|

| Total

equity |

|

$ |

3,087,553 |

|

$ |

3,371,592 |

|

| Debt to

capitalization ratio |

|

|

32.2 |

% |

|

28.9 |

% |

MARINE TRANSPORTATION STATEMENTS OF

EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marine

transportation revenues |

|

$ |

299,419 |

|

$ |

402,010 |

|

$ |

1,404,265 |

|

$ |

1,587,082 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

189,196 |

|

|

263,162 |

|

|

907,119 |

|

|

1,034,758 |

|

|

Selling, general and administrative |

|

|

25,888 |

|

|

31,306 |

|

|

111,182 |

|

|

122,202 |

|

|

Taxes, other than on income |

|

|

7,676 |

|

|

8,183 |

|

|

35,528 |

|

|

34,538 |

|

|

Depreciation and amortization |

|

|

47,503 |

|

|

44,881 |

|

|

186,798 |

|

|

179,742 |

|

|

Total costs and expenses |

|

|

270,263 |

|

|

347,532 |

|

|

1,240,627 |

|

|

1,371,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

29,156 |

|

$ |

54,478 |

|

$ |

163,638 |

|

$ |

215,842 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating margin |

|

|

9.7 |

% |

|

13.6 |

% |

|

11.7 |

% |

|

13.6 |

% |

DISTRIBUTION AND SERVICES STATEMENTS OF

EARNINGS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distribution

and services revenues |

|

$ |

190,337 |

|

$ |

253,917 |

|

$ |

767,143 |

|

$ |

1,251,317 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of sales and operating expenses |

|

|

154,290 |

|

|

208,220 |

|

|

604,238 |

|

|

995,288 |

|

|

Selling, general and administrative |

|

|

32,154 |

|

|

37,279 |

|

|

140,449 |

|

|

145,473 |

|

|

Taxes, other than on income |

|

|

756 |

|

|

2,255 |

|

|

6,392 |

|

|

7,357 |

|

|

Depreciation and amortization |

|

|

6,003 |

|

|

8,831 |

|

|

28,255 |

|

|

35,998 |

|

|

Total costs and expenses |

|

|

193,203 |

|

|

256,585 |

|

|

779,334 |

|

|

1,184,116 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

(2,866 |

) |

$ |

(2,668 |

) |

$ |

(12,191 |

) |

$ |

67,201 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating margin |

|

|

(1.5 |

)% |

|

(1.1 |

)% |

|

(1.6 |

)% |

|

5.4 |

% |

OTHER COSTS AND EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General

corporate expenses |

|

$ |

1,647 |

|

$ |

3,359 |

|

$ |

11,050 |

|

$ |

13,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment

of long-lived assets |

|

$ |

— |

|

$ |

— |

|

$ |

165,304 |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment

of goodwill |

|

$ |

— |

|

$ |

— |

|

$ |

387,970 |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Inventory

write-downs |

|

$ |

— |

|

$ |

35,525 |

|

$ |

8,000 |

|

$ |

35,525 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Gain) on

disposition of assets |

|

$ |

(131 |

) |

$ |

(3,251 |

) |

$ |

(118 |

) |

$ |

(8,152 |

) |

ONE-TIME CHARGES AND

BENEFITS

The 2020 and 2019 GAAP results include certain

one-time charges (all 2020 one-time items occurred in the first

quarter, and all 2019 one-time items occurred in the fourth

quarter). The following is a reconciliation of GAAP earnings to

non-GAAP earnings, excluding the one-time items for earnings before

tax (pre-tax), net earnings attributable to Kirby (after-tax), and

diluted earnings per share (per share):

|

|

|

Full Year 2020 |

|

Full Year 2019 |

|

|

|

|

Pre-Tax |

|

After-Tax |

|

Per Share |

|

Pre-Tax |

|

After-Tax |

|

Per Share |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited,

$ in millions except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP earnings |

$ |

(461.4 |

) |

$ |

(272.5 |

) |

$ |

(4.55 |

) |

$ |

189.8 |

|

$ |

142.3 |

|

$ |

2.37 |

|

| Impairments

and other charges |

|

561.3 |

|

433.3 |

|

7.24 |

|

35.5 |

|

28.0 |

|

0.47 |

|

| Income tax

benefit on 2018 and 2019 net operating loss carrybacks |

|

— |

|

(50.8 |

) |

(0.85 |

) |

— |

|

— |

|

— |

|

| Severance

and early retirement expense |

|

— |

|

— |

|

— |

|

4.8 |

|

3.7 |

|

0.06 |

|

| Earnings,

excluding one-time items(2) |

$ |

99.9 |

$ |

110.0 |

$ |

1.84 |

$ |

230.1 |

$ |

174.0 |

$ |

2.90 |

|

RECONCILIATION OF FREE CASH

FLOW

The following is a reconciliation of GAAP net

cash provided by operating activities to non-GAAP free cash

flow(2):

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019(3) |

|

2020 |

|

2019(3) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(unaudited,

$ in millions) |

|

|

Net cash provided by operating activities |

|

$ |

85.1 |

|

$ |

124.2 |

|

$ |

444.9 |

|

$ |

511.8 |

|

| Less:

Capital expenditures |

|

|

(18.8 |

) |

|

(64.1 |

) |

|

(148.2 |

) |

|

(248.2 |

) |

| Free cash

flow(2) |

|

$ |

66.3 |

|

$ |

60.1 |

|

$ |

296.7 |

|

$ |

263.6 |

|

| |

|

FY 2021 Projection |

|

| |

|

Low |

|

High |

|

| |

|

|

|

|

|

| |

|

|

(unaudited,

$ in millions) |

|

|

Net cash provided by operating activities |

|

$ |

375 |

|

$ |

455 |

|

| Less:

Capital expenditures |

|

$ |

(145 |

) |

$ |

(125 |

) |

| Free cash

flow(2) |

|

$ |

230 |

|

$ |

330 |

|

MARINE TRANSPORTATION PERFORMANCE

MEASUREMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

Year |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

| Inland

Performance Measurements: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ton Miles (in millions) (4) |

|

|

2,905 |

|

|

3,800 |

|

|

13,006 |

|

|

14,611 |

|

|

Revenue/Ton Mile (cents/tm) (5) |

|

|

7.8 |

|

|

8.2 |

|

|

8.4 |

|

|

8.4 |

|

|

Towboats operated (average) (6) |

|

|

248 |

|

|

299 |

|

|

287 |

|

|

299 |

|

|

Delay Days (7) |

|

|

1,768 |

|

|

3,031 |

|

|

10,408 |

|

|

13,259 |

|

|

Average cost per gallon of fuel consumed |

|

$ |

1.20 |

|

$ |

2.05 |

|

$ |

1.41 |

|

$ |

2.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barges (active): |

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

1,066 |

|

|

1,053 |

|

|

Coastal tank barges |

|

|

44 |

|

|

49 |

|

|

Offshore dry-cargo barges |

|

|

4 |

|

|

4 |

|

|

Barrel capacities (in millions): |

|

|

|

|

|

|

|

|

Inland tank barges |

|

|

24.1 |

|

|

23.4 |

|

|

Coastal tank barges |

|

|

4.2 |

|

|

4.7 |

|

|

(1) |

|

Kirby has historically evaluated its operating performance using

numerous measures, one of which is Adjusted EBITDA, a non-GAAP

financial measure. Kirby defines Adjusted EBITDA as net earnings

attributable to Kirby before interest expense, taxes on income,

depreciation and amortization, impairment of long-lived assets, and

impairment of goodwill. Adjusted EBITDA is presented because of its

wide acceptance as a financial indicator. Adjusted EBITDA is one of

the performance measures used in Kirby’s incentive bonus plan.

Adjusted EBITDA is also used by rating agencies in determining

Kirby’s credit rating and by analysts publishing research reports

on Kirby, as well as by investors and investment bankers generally

in valuing companies. Adjusted EBITDA is not a calculation based on

generally accepted accounting principles and should not be

considered as an alternative to, but should only be considered in

conjunction with, Kirby’s GAAP financial information. |

| |

|

|

| (2) |

|

Kirby

uses certain non-GAAP financial measures to review performance

excluding certain one-time items including: earnings before taxes

on income, excluding one-time items; net earnings attributable to

Kirby, excluding one-time items; and diluted earnings per share,

excluding one-time items. Management believes that the exclusion of

certain one-time items from these financial measures enables it and

investors to assess and understand operating performance,

especially when comparing those results with previous and

subsequent periods or forecasting performance for future periods,

primarily because management views the excluded items to be outside

of the company's normal operating results. Kirby also uses free

cash flow, which is defined as net cash provided by operating

activities less capital expenditures, to assess and forecast cash

flow and to provide additional disclosures on the Company’s

liquidity as a result of uncertainty surrounding the impact of the

COVID-19 pandemic on global and regional market conditions. Free

cash flow does not imply the amount of residual cash flow available

for discretionary expenditures as it excludes mandatory debt

service requirements and other non-discretionary expenditures.

These non-GAAP financial measures are not calculations based on

generally accepted accounting principles and should not be

considered as an alternative to, but should only be considered in

conjunction with Kirby’s GAAP financial information. |

| |

|

|

| (3) |

|

See

Kirby’s 2019 10-K for amounts provided by (used in) investing and

financing activities. |

| |

|

|

| (4) |

|

Ton miles

indicate fleet productivity by measuring the distance (in miles) a

loaded tank barge is moved. Example: A typical 30,000 barrel tank

barge loaded with 3,300 tons of liquid cargo is moved 100 miles,

thus generating 330,000 ton miles. |

| |

|

|

| (5) |

|

Inland

marine transportation revenues divided by ton miles. Example:

Fourth quarter 2020 inland marine transportation revenues of

$225,406,000 divided by 2,905,000,000 inland marine transportation

ton miles = 7.8 cents. |

| |

|

|

| (6) |

|

Towboats

operated are the average number of owned and chartered towboats

operated during the period. |

| |

|

|

| (7) |

|

Delay

days measures the lost time incurred by a tow (towboat and one or

more tank barges) during transit. The measure includes transit

delays caused by weather, lock congestion and other navigational

factors. |

Contact: Eric Holcomb

713-435-1545

Kirby (NYSE:KEX)

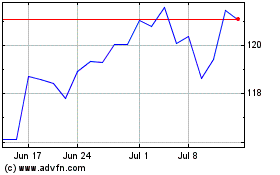

Historical Stock Chart

From Oct 2024 to Nov 2024

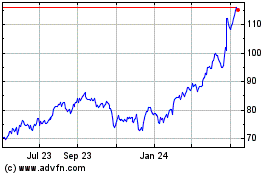

Kirby (NYSE:KEX)

Historical Stock Chart

From Nov 2023 to Nov 2024