Kimberly-Clark Raises Full-Year Outlook as Organic Sales Grow

July 23 2019 - 8:58AM

Dow Jones News

By Aisha Al-Muslim

Kimberly-Clark Corp. raised its top- and bottom-line outlook for

the full year to reflect strong profit and organic sales results in

the latest quarter and an improving commodity environment.

The maker of Huggies diapers and Kleenex tissues now expects

organic sales growth of 3%, up from its previous guidance of 2%

growth. Per-share adjusted earnings are expected to be $6.65 to

$6.80 for the year, up from the prior estimate of $6.50 to

$6.70.

For the second quarter, ended June 30, Kimberly-Clark said

Tuesday it had strong organic-sales growth, gross margin

improvement and higher earnings per share.

The Dallas-based company said net sales for the quarter fell

0.2% to $4.59 billion, within range of the consensus forecast of

$4.58 billion from analysts polled by FactSet.

Organic sales rose 5%, while net selling prices rose 5% and

volumes fell slightly.

The company recorded a profit of $485 million, or $1.40 a share,

up from $455 million, or $1.30 a share, a year earlier. Adjusted

earnings were $1.67 a share, beating the $1.61 a share analysts

were looking for.

Shares of Kimberly-Clark, up 27% in the last 12 months, rose 2%

to $137 in premarket trading.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

July 23, 2019 08:43 ET (12:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

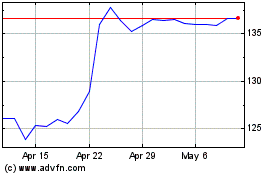

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Aug 2024 to Sep 2024

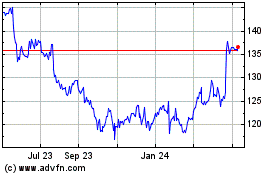

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Sep 2023 to Sep 2024