KB Home Announces Agreement with Nationstar Mortgage

March 12 2012 - 8:00AM

Business Wire

KB Home (NYSE: KBH), one of the nation's premier homebuilders,

today announced that it has entered into an agreement with

Nationstar Mortgage, under which Nationstar will become KB Home’s

preferred mortgage lender. Under the agreement, Nationstar will

offer a wide array of financing options and mortgage loan products

to the Company’s homebuyers at all KB Home communities

nationwide.

“We look forward to working with Nationstar and its group of

professionals who are dedicated to providing exceptional customer

service to our homebuyers,” said Jeffrey Mezger, president and

chief executive officer of KB Home. “Nationstar is a national

lender that is capable of serving KB Home’s homebuyers as we

continue to help them fulfill the American dream of

homeownership.”

Nationstar Mortgage, headquartered in Lewisville, Texas, is one

of the nation’s leading mortgage services providers, and a lender

offering FHA, VA, USDA, conventional conforming and nonconforming

products directly to consumers. It is currently one of the largest

non-bank mortgage servicers in the country with a portfolio of

approximately $107 billion and 645,000 customers.

KB Home builds quality homes in 32 markets across the United

States with a focus on providing choice and value to its customers.

The agreement with Nationstar is intended to offer KB Home

customers a seamless home buying experience, from purchase and

mortgage application to picking up the keys to their new home.

About KB Home

KB Home is one of the largest and most recognized homebuilding

companies in the United States. Since its founding in 1957, the

company has built more than half a million quality homes. KB Home's

signature Built to Order™ approach lets each buyer customize their

new home from lot location to floor plan and design features. In

addition to meeting strict ENERGY STAR® guidelines, all KB homes

are highly energy efficient to help lower monthly utility costs for

homeowners, which the company demonstrates with its proprietary KB

Home Energy Performance Guide® (EPG). A leader in utilizing

state-of-the-art sustainable building practices, KB Home was named

the #1 Green Homebuilder in a 2010 study by Calvert Investments and

the #1 Homebuilder on FORTUNE magazine's 2011 World's Most Admired

Companies list. Los Angeles-based KB Home was the first homebuilder

listed on the New York Stock Exchange, and trades under the ticker

symbol "KBH." For more information about KB Home's new home

communities, call 888-KB-HOMES or visit www.kbhome.com.

Forward-Looking and Cautionary Statements

Certain matters discussed in this press

release, including any statements that are predictive in nature or

concern future market and economic conditions, business and

prospects, our future financial and operational performance, or our

future actions and their expected results are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are based on current

expectations and projections about future events and are not

guarantees of future performance. We do not have a specific policy

or intent of updating or revising forward-looking statements.

Actual events and results may differ materially from those

expressed or forecasted in forward-looking statements due to a

number of factors. The most important risk factors that could cause

our actual performance and future events and actions to differ

materially from such forward-looking statements include, but are

not limited to: general economic, employment and business

conditions; adverse market conditions that could result in

additional impairments or abandonment charges and operating losses,

including an oversupply of unsold homes, declining home prices and

increased foreclosure and short sale activity, among other things;

conditions in the capital and credit markets (including residential

consumer mortgage lending standards, the availability of

residential consumer mortgage financing and mortgage foreclosure

rates); material prices and availability; labor costs and

availability; changes in interest rates; inflation; our debt level,

including our ratio of debt to total capital, and our ability to

adjust our debt level and structure and to access the credit,

capital or other financial markets or other external financing

sources; weak or declining consumer confidence, either generally or

specifically with respect to purchasing homes; competition for home

sales from other sellers of new and existing homes, including

sellers of homes obtained through foreclosures or short sales;

weather conditions, significant natural disasters and other

environmental factors; government actions, policies, programs and

regulations directed at or affecting the housing market (including,

but not limited to, the Dodd-Frank Act, tax credits, tax incentives

and/or subsidies for home purchases, tax deductions for residential

consumer mortgage interest payments and property taxes, tax

exemptions for profits on home sales, and programs intended to

modify existing mortgage loans and to prevent mortgage

foreclosures), the homebuilding industry, or construction

activities; the availability and cost of land in desirable areas;

our warranty claims experience with respect to homes previously

delivered and actual warranty costs incurred; legal or regulatory

proceedings or claims; our ability to access capital; our ability

to use/realize the net deferred tax assets we have generated; our

ability to successfully implement our current and planned product,

geographic and market positioning (including, but not limited to,

our efforts to expand our inventory base/pipeline with desirable

land positions or interests at reasonable cost and to expand our

community count and open new communities, and our increasing

operational and investment concentration in markets

in California and Texas), revenue growth, and overhead

and other cost reduction strategies; consumer traffic to our new

home communities and consumer interest in our product designs,

including The Open Series™; the impact of our former unconsolidated

mortgage banking joint venture ceasing to offer mortgage banking

services after June 30, 2011; the manner in which our

homebuyers are offered and obtain residential consumer mortgage

loans and mortgage banking services; information technology

failures and data security breaches; and other events outside of

our control. Please see our periodic reports and other filings with

the Securities and Exchange Commission, including our Annual

Report on Form 10-K for the year ended November 30, 2011, for

a further discussion of these and other risks and uncertainties

applicable to our business.

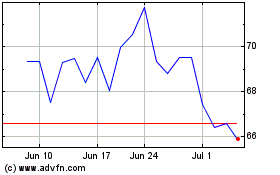

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

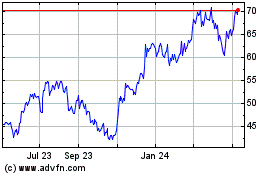

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024