For Immediate Release

Chicago, IL – March 9, 2012 – Zacks Equity Research highlights

Cabela's, Inc. (CAB) as the Bull of the Day and

KB Home (KBH) as the Bear of the Day. In addition,

Zacks Equity Research provides analysis on

Williams-Sonoma (WSM), Navistar

(NAV) and Stein Mart ( SMRT).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

Cabela's, Inc. (CAB) fourth-quarter 2011

earnings of $1.06 per share beat the Zacks Consensus Estimate of

$0.99, and surged 23.3% from the prior-year quarter. The quarter

witnessed healthy revenue growth and profitability at its retail

segment, improved performance at Cabela's CLUB Visa program,

increased merchandise gross margin and boost in market share.

Merchandise gross margin expanded 40 basis points to 36.4%

during the quarter. Management reiterated its long-term goal of

increasing the margin by 200-300 basis points. Driven by improving

trends, the company now expects earnings to increase at a

double-digit rate in fiscal 2012.

The company is looking to enhance its retail square footage

growth and focusing on next-generation store and new Outpost store

formats. Moreover, the company remains committed on alleviating bad

debt risk in its credit card business. The gradual improvement in

the economy has lowered delinquencies and charge-offs.

Bear of the Day:

KB Home (KBH) faces a fragile housing market.

Increased availability of housing alternatives may keep the

company's earnings under pressure. Furthermore, the company's

housing market is highly concentrated, which poses threats to its

earnings performance.

The company did post a profit of $0.18 per share during the

fourth quarter of fiscal 2011, which was much higher than the Zacks

Consensus Estimate of $0.03. Nevertheless, the negative factors

have led us to downgrade the recommendation on shares of KB Home

from Neutral to Underperform with a target price of $10.00.

Our long-term Underperform recommendation on the stock indicates

that it will perform lower than the overall market. Our $10 target

price, 25.0X our 2013 EPS estimate, reflects this view.

Latest Posts on the Zacks Analyst Blog:

Optimism on Greek Bonds, U.S. Jobs

Greece’s private sector bond swap, whose uncertain fate had

gripped the markets in recent days, appears to be attracting enough

participation to make the deal binding on all bondholders.

The details of the swap will come out Friday morning, but

growing optimism about the deal is helping bring down the yields on

Italian and Spanish government bonds, which had started creeping

back up in recent days.

Friday morning not only clears up the air on the Greek

situation, but will also likely confirm the recent improving trend

in the U.S. labor market though the February non-farm payroll

report. This morning’s modestly weaker-than-expected Initial

Jobless Claims report nevertheless confirms the improving jobs

picture, helping build expectations of a strong labor reading

tomorrow. The expectation is that a favorable labor market read on

Friday will serve as the key catalyst to push stocks above

resistance levels.

Initial Jobless Claims came in a tad weaker than expected last

week – up 8K to 362K vs. expectations of a lower rise. The prior

week’s tally was modestly revised upwards to 354K from the

originally reported 353K. The four-week average, which smoothes out

the week-to-week fluctuation, moved up by a mere 250 to 355K.

This week’s modest ‘miss’ notwithstanding, the overall trend in

the labor market has consistently been in favorable direction

lately. It will be interesting to see if Friday’s jobs report will

further confirm this trend.

On the earnings front, Williams-Sonoma (WSM),

the home furnishings retailer, beat earnings and revenue

expectations and guided higher. Results at truck maker

Navistar (NAV) and retailer Stein

Mart ( SMRT) came short of expectations.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

CABELAS INC (CAB): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

NAVISTAR INTL (NAV): Free Stock Analysis Report

STEIN MART INC (SMRT): Free Stock Analysis Report

WILLIAMS-SONOMA (WSM): Free Stock Analysis Report

To read this article on Zacks.com click here.

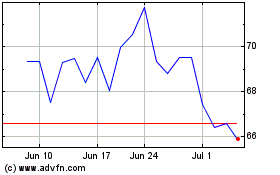

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

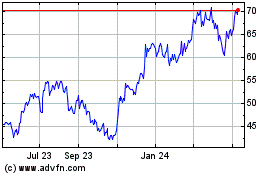

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024