KB Home Announces Final Results of Its Tender Offers

February 16 2012 - 12:29PM

Business Wire

KB Home (NYSE: KBH), one of the nation’s premier homebuilders,

today announced the expiration and final results of its tender

offers to purchase up to $100 million in aggregate principal amount

(the “Maximum 2014 Amount”) of its 5¾% Senior Notes due 2014 (the

“2014 Note Tender Offer”) and up to $340 million, less any amount

accepted in the 2014 Note Tender Offer, in aggregate principal

amount (the “Maximum 2015 Amount”) of its 5⅞% Senior Notes due 2015

and 6¼% Senior Notes due 2015 on an equal-priority basis. The

tender offers were made pursuant to an Offer to Purchase dated

January 19, 2012 and a related Letter of Transmittal, each as

amended by a press release issued on February 1, 2012, which set

forth a more detailed description of the terms of the tender

offers.

As of 11:59 p.m., New York City time, on February 15, 2012, the

aggregate principal amount of 5¾% Senior Notes due 2014 (the “2014

Notes”) tendered was $56,304,000, and the aggregate principal

amount of 5⅞% Senior Notes due 2015 and 6¼% Senior Notes due 2015

(together, the “2015 Notes”) tendered was $170,038,000 and

$201,050,000, respectively. Because the aggregate principal amount

of 2015 Notes tendered exceeded the Maximum 2015 Amount, tendered

2015 Notes will be purchased on a pro rata basis. As a result, KB

Home accepted for purchase $56,304,000 in aggregate principal

amount of 2014 Notes, $129,993,000 in aggregate principal amount of

5⅞% Senior Notes due 2015, and $153,703,000 in aggregate principal

amount of 6¼% Senior Notes due 2015, with settlement expected

today. As previously announced, KB Home intends to apply the

net proceeds from its public offering of $350 million in aggregate

principal amount of 8.00% Senior Notes due 2020, which closed on

February 7, 2012, toward the payment of accepted 2014 Notes and

2015 Notes.

Holders whose 2014 Notes have been accepted for purchase will

receive $1,010 per $1,000 principal amount of notes. Holders whose

2015 Notes have been accepted for purchase and who tendered at or

prior to the “Early Tender Date” of 5:00 p.m., New York City time,

on January 31, 2012, will receive $1,000 per $1,000 principal

amount of notes, which includes the Early Tender Premium of $30 per

$1,000 principal amount. Holders whose 2015 Notes have been

accepted for purchase and who tendered after the Early Tender Date

will receive $970 per $1,000 principal amount of notes.

Citigroup Global Markets Inc. and Credit Suisse Securities (USA)

LLC served as dealer managers for the tender offers. Global

Bondholder Services Corporation served as the depositary and

information agent.

For additional information regarding the terms of the tender

offers, please contact Citigroup Global Markets Inc. at (800)

558-3745 (toll free) or (212) 723-6106 (collect), or Credit Suisse

Securities (USA) LLC at (800) 820-1653 (toll free) or (212)

538-2147 (collect). Requests for documents and questions regarding

the tender of securities may be directed to Global Bondholder

Services Corporation at (866) 540-1500 (toll free) or (212)

430-3774 (collect).

About KB Home

KB Home (NYSE: KBH), one of the nation’s premier homebuilders,

has delivered over half a million quality homes for families since

its founding in 1957. The Los Angeles-based company is

distinguished by its Built to Order™ homebuilding approach that

puts a custom home experience within reach of its customers at an

affordable price. KB Home has been named the #1 Green Homebuilder

in a study by Calvert Investments and the #1 Homebuilder on FORTUNE

magazine’s 2011 World’s Most Admired Companies list. The Company

trades under the ticker symbol “KBH” and was the first homebuilder

listed on the New York Stock Exchange. For more information about

any of KB Home's new home communities, call 888-KB-HOMES or visit

www.kbhome.com.

Forward-Looking and Cautionary Statements

Certain matters discussed in this press release, including any

statements that are predictive in nature or concern future market

and economic conditions, business and prospects, our future

financial and operational performance, or our future actions and

their expected results are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on current expectations and

projections about future events and are not guarantees of future

performance. We do not have a specific policy or intent of updating

or revising forward-looking statements. Actual events and results

may differ materially from those expressed or forecasted in

forward-looking statements due to a number of factors. The most

important risk factors that could cause our actual performance and

future events and actions to differ materially from such

forward-looking statements include, but are not limited to: general

economic, employment and business conditions; adverse market

conditions that could result in additional impairments or

abandonment charges and operating losses, including an oversupply

of unsold homes, declining home prices and increased foreclosure

and short sale activity, among other things; conditions in the

capital and credit markets (including residential consumer mortgage

lending standards, the availability of residential consumer

mortgage financing and mortgage foreclosure rates); material prices

and availability; labor costs and availability; changes in interest

rates; inflation; our debt level, including our ratio of debt to

total capital, and our ability to adjust our debt level and

structure and to access the credit, capital or other financial

markets or other external financing sources; weak or declining

consumer confidence, either generally or specifically with respect

to purchasing homes; competition for home sales from other sellers

of new and existing homes, including sellers of homes obtained

through foreclosures or short sales; weather conditions,

significant natural disasters and other environmental factors;

government actions, policies, programs and regulations directed at

or affecting the housing market (including, but not limited to, the

Dodd-Frank Act, tax credits, tax incentives and/or subsidies for

home purchases, tax deductions for residential consumer mortgage

interest payments and property taxes, tax exemptions for profits on

home sales, and programs intended to modify existing mortgage loans

and to prevent mortgage foreclosures), the homebuilding industry,

or construction activities; the availability and cost of land in

desirable areas; our warranty claims experience with respect to

homes previously delivered and actual warranty costs incurred;

legal or regulatory proceedings or claims; our ability to access

capital; our ability to use/realize the net deferred tax assets we

have generated; our ability to successfully implement our current

and planned product, geographic and market positioning (including,

but not limited to, our efforts to expand our inventory

base/pipeline with desirable land positions or interests at

reasonable cost and to expand our community count and open new

communities, and our increasing operational and investment

concentration in markets in California and Texas), revenue growth,

and overhead and other cost reduction strategies; consumer traffic

to our new home communities and consumer interest in our product

designs, including The Open Series™; the impact of our former

unconsolidated mortgage banking joint venture ceasing to offer

mortgage banking services after June 30, 2011; the manner in which

our homebuyers are offered and obtain residential consumer mortgage

loans and mortgage banking services; information technology

failures and data security breaches; and other events outside of

our control. Please see our periodic reports and other filings with

the Securities and Exchange Commission, including our Annual Report

on Form 10-K for the year ended November 30, 2011, for a further

discussion of these and other risks and uncertainties applicable to

our business.

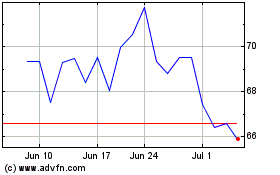

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

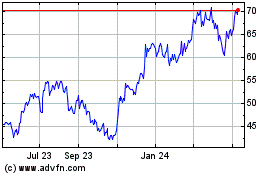

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024