WASATCH FUNDS TRUST

Supplement dated August 30, 2013 to the

Prospectus dated January 31, 2013

Investor Class

Equity Funds

Wasatch Core Growth Fund® (WGROX)

Wasatch Emerging India Fund® (WAINX)

Wasatch Emerging Markets Select Fund™ (WAESX)

Wasatch Emerging Markets Small Cap Fund® (WAEMX)

Wasatch Frontier Emerging Small Countries Fund™ (WAFMX)

Wasatch Global Opportunities Fund® (WAGOX)

Wasatch Heritage Growth Fund® (WAHGX)

Wasatch International Growth Fund® (WAIGX)

Wasatch International Opportunities Fund® (WAIOX)

Wasatch Large Cap Value Fund® (FMIEX)

Wasatch Long/Short Fund® (FMLSX)

Wasatch

Micro Cap Fund® (WMICX)

Wasatch Micro Cap Value Fund® (WAMVX)

Wasatch Small Cap Growth Fund® (WAAEX)

Wasatch Small Cap Value Fund® (WMCVX)

Wasatch Strategic Income Fund® (WASIX)

Wasatch Ultra Growth Fund® (WAMCX)

Wasatch World Innovators Fund® (WAGTX)

Bond Funds

Wasatch–1st Source Income

Fund™ (FMEQX)

Wasatch-Hoisington U.S. Treasury Fund® (WHOSX)

This Supplement updates certain information contained in the Wasatch Funds Prospectus for Investor Class shares dated January 31, 2013. You should

retain this Supplement and the Prospectus for future reference. Additional copies of the Prospectus may be obtained free of charge by visiting our web site at www.WasatchFunds.com or calling us at 800.551.1700.

Wasatch Emerging Markets Small Cap Fund (the “Fund”)

Footnote 1 to the the Annual Fund Operating Expenses table under the heading “Fees and Expenses of the Fund” in the Summary section of

the Prospectus for the Fund on page 14 is hereby deleted in its entirety and replaced with the following:

1

The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.95% until at least January 31, 2015 (excluding

interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that may terminate the contractual limitation prior to the

contract’s expiration. The Advisor may rescind the contractual limitation on expenses at any time after its expiration date.

The fourth

sentence under the heading “Example” in the Summary section of the Prospectus for the Fund on page 14 is hereby deleted in its entirety and replaced with the following:

The example reflects contractual fee waivers and reimbursements through January 31, 2015.

The heading “Historical Performance” in the Summary section of the Prospectus for the Fund on page 16 is hereby supplemented with the

following:

Year-to-date return through 6/30/13 was -2.49%.

The second paragraph under the Average Annual Total Returns table under the heading “Historical Performance” in the Summary section of

the Prospectus for the Fund on page 16 is hereby deleted.

1

Wasatch Small Cap Growth Fund (the “Fund”)

Footnote 1 to the the Annual Fund Operating Expenses table under the heading “Fees and Expenses of the Fund” in the Summary section of

the Prospectus for the Fund on page 57 is hereby deleted in its entirety and replaced with the following:

1

The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% until at least January 31, 2015 (excluding

interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). Acquired Fund Fees and Expenses are not included in the expense limitation. The Board of Trustees

is the only party that may terminate the contractual limitation prior to the contract’s expiration. The Advisor may rescind the contractual limitation on expenses at any time after its expiration date. There were no reimbursements for the

Investor Class shares of the Fund during 2012. The Total Annual Fund Operating Expenses may not equal the expense ratio stated in the Fund’s most recent Annual Report and Financial Highlights, which reflects the operating expenses of the Fund

and does not include Acquired Fund Fees and Expenses.

The fourth sentence under the heading “Example” in the Summary section of the

Prospectus for the Fund on page 57 is hereby deleted in its entirety and replaced with the following:

The example reflects contractual fee waivers and

reimbursements through January 31, 2015.

The fourth paragraph under the heading “Principal Strategies” in the Summary section

of the Prospectus for the Fund on page 58 is hereby supplemented with the following:

The secondary objective of income is achieved when

fast growing portfolio companies pay dividends, generated by cash flow, typically after achieving growth targets.

The heading “Principal

Risks” in the Summary section of the Prospectus for the Fund on page 58 is hereby supplemented with the following:

Consumer

discretionary sector risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market

fluctuation, than a fund without the same focus. Industries in the consumer discretionary segment, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall

economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Energy Sector Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same

focus. The value of energy companies is particularly vulnerable to developments in the energy sector, fluctuations in price and supply of energy fuels, energy conservation, supply of and demand for specific energy-related products or services, and

tax policy and other government regulation.

Financials sector risk.

To the extent the Fund emphasizes, from time to time,

investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Industries in the financial segment, such as

banks, insurance companies, broker-dealers and real estate investment trusts, may be sensitive to changes in interest rates and general economic activity and are generally subject to extensive government regulation.

Health Care Stock Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a

greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Health care companies are strongly affected by worldwide scientific or technological developments. Their

products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials sector risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a

greater degree to the risks particular to that segment, and may experience greater market

2

fluctuation, than a fund without the same focus. Industries in the industrial segment, such as companies engaged in the production, distribution or service of products or equipment for

manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and

government regulation and spending, import controls, commodity prices, and worldwide competition.

Information Technology Risk.

To the extent

the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Stocks

of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions.

Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

The

heading “Historical Performance” in the Summary section of the Prospectus for the Fund on page 59 is hereby supplemented with the following:

Year-to-date return through 6/30/13 was 13.39%.

The second paragraph under the Average Annual Total Returns table under the heading “Historical Performance” in the Summary section of

the Prospectus for the Fund on page 59 is hereby deleted.

Wasatch Small Cap Value (the “Fund”)

Footnote 2 to the the Annual Fund Operating Expenses table under the heading “Fees and Expenses of the Fund” in the Summary section of

the Prospectus for the Fund on page 61 is hereby deleted in its entirety and replaced with the following:

2

The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% until at least January 31, 2015 (excluding

interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that may terminate the contractual limitation prior to the

contract’s expiration. The Advisor may rescind the contractual limitation on expenses at any time after its expiration date. There were no reimbursements for the Investor Class shares of the Fund during 2012.

The fourth sentence under the heading “Example” in the Summary section of the Prospectus for the Fund on page 61 is hereby deleted in

its entirety and replaced with the following:

The example reflects contractual fee waivers and reimbursements through January 31, 2015.

The fourth paragraph under the heading “Principal Strategies” in the Summary section of the Prospectus for the Fund on page 62 is hereby

supplemented with the following:

The secondary objective of income is achieved when fast growing portfolio companies pay dividends,

generated by cash flow, typically after achieving growth targets.

The heading “Principal Risks” in the Summary section of the

Prospectus for the Fund on page 62 is hereby supplemented with the following:

Consumer discretionary sector risk.

To the extent the

Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Industries

in the consumer discretionary segment, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and

spending, and changes in demographics and consumer tastes.

Energy Sector Risk.

To the extent the Fund emphasizes, from time to time,

investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. The value of energy companies is particularly

vulnerable to developments in the

3

energy sector, fluctuations in price and supply of energy fuels, energy conservation, supply of and demand for specific energy-related products or services, and tax policy and other government

regulation.

Health Care Stock Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be

subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Health care companies are strongly affected by worldwide scientific or technological

developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in government policies.

Industrials sector risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a

greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Industries in the industrial segment, such as companies engaged in the production, distribution or service of

products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer

spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Information

Technology Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a

fund without the same focus. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market

entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market.

The heading “Historical Performance” in the Summary section of the Prospectus for the Fund on page 63 is hereby supplemented with the

following:

Year-to-date return through 6/30/13 was 17.41%.

The second paragraph under the Average Annual Total Returns table under the heading “Historical Performance” in the Summary section of

the Prospectus for the Fund on page 63 is hereby deleted.

The following is hereby added after the table under the heading

“Wasatch Funds-Management-Management Fees and Expense Limitations” of the Prospectus for the Fund on page 90:

Effective January 31, 2012,

the management fee was reduced from 1.50% to 1.00% for the Small Cap Value Fund.

All Funds

The first paragraph under the heading “Wasatch Funds-Management-Portfolio Managers” of the Prospectus for the Funds on page 91 is hereby

supplemented with the following:

The lead portfolio managers are ultimately responsible for managing their respective Funds in accordance

with the Fund’s investment objectives and strategies.

The third bullet under the heading “Wasatch Funds-Account Policies-How

Investor Class Shares are Priced” of the Prospectus for the Funds on page 99 is hereby deleted in its entirety and replaced with the following:

|

|

•

|

|

The Funds’ share prices are calculated as of the close of trading on the New York Stock Exchange (NYSE) (normally 4:00 p.m. Eastern Time) every day the

NYSE is open.

|

4

The following is hereby added under the heading “Wasatch Funds-Financial Highlights” of the

Prospectus for the Emerging Market Small Cap, Small Cap Growth and Small Cap Value Funds which begins on page 107:

The Financial

Highlights for the six months ended March 31, 2013 are not audited and are available in the semi-annual report which is available upon request.

W

ASATCH

F

UNDS

— Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from

Investment Operations

|

|

|

|

|

|

|

|

|

Less Distributions

|

|

|

|

|

|

|

|

Net Asset

Value

Beginning

of Period

|

|

|

Net

Investment

Income (Loss)

|

|

|

Net Realized

and Unrealized

Gains (Losses)

on Investments

|

|

|

Total from

Investment

Operations

|

|

|

Redemption

Fees

|

|

|

Dividends

from Net

Investment

Income

|

|

|

Distributions

from Net

Realized

Gains

|

|

|

Total

Distributions

|

|

|

Emerging Markets Small Cap Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period ended 3/31/13 (unaudited)

|

|

$

|

2.66

|

|

|

|

—

|

4

|

|

|

0.29

|

|

|

|

0.29

|

|

|

|

—

|

4

|

|

|

(0.01

|

)

|

|

|

—

|

|

|

|

(0.01

|

)

|

|

Small Cap Growth Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period ended 3/31/13 (unaudited)

|

|

$

|

43.82

|

|

|

|

0.01

|

|

|

|

4.11

|

|

|

|

4.12

|

|

|

|

—

|

4

|

|

|

—

|

|

|

|

(2.89

|

)

|

|

|

(2.89

|

)

|

|

Small Cap Value Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period ended 3/31/13 (unaudited)

|

|

$

|

3.81

|

|

|

|

—

|

4

|

|

|

0.62

|

|

|

|

0.62

|

|

|

|

—

|

4

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

See Notes to Financial Highlights.

5

(for a share outstanding throughout each period)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios to Average Net Assets

|

|

|

Supplemental Data

|

|

|

Net Asset

Value

End of

Period

|

|

Total Return

(%)

1

|

|

|

Expenses

Net of

Waivers

and

Reimbursements (%)

2

|

|

|

Expenses

Before

Waivers

and

Reimbursements (%)

2

|

|

|

Net Investment

Income Net of

Waivers and

Reimbursements (%)

2

|

|

|

Net Investment

Income Before

Waivers and

Reimbursements (%)

2

|

|

|

Net Assets

End of

Period

(000’s)

|

|

|

Portfolio

Turnover

Rate

1 3

|

|

|

$ 2.94

|

|

|

11.05

|

|

|

|

1.95

|

5

|

|

|

2.07

|

5

|

|

|

(0.38

|

)

|

|

|

(0.50

|

)

|

|

$

|

1,872,462

|

|

|

|

17

|

%

|

|

$ 45.05

|

|

|

10.05

|

|

|

|

1.24

|

5

|

|

|

1.24

|

5

|

|

|

(0.06

|

)

|

|

|

(0.06

|

)

|

|

$

|

2,087,887

|

|

|

|

6

|

%

|

|

$ 4.43

|

|

|

16.27

|

|

|

|

1.30

|

5

|

|

|

1.30

|

5

|

|

|

0.25

|

|

|

|

0.25

|

|

|

$

|

178,405

|

|

|

|

16

|

%

|

Notes to Financial Highlights

|

1

|

Not annualized for periods less than one year.

|

|

2

|

Annualized for periods less than one year.

|

|

3

|

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

|

|

4

|

Represents amounts less than $.005 per share.

|

|

5

|

Includes interest expense of less than 0.01%.

|

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

6

WASATCH FUNDS TRUST

Supplement dated August 30, 2013 to the

Prospectus dated January 31, 2013

Institutional Class

Equity Funds

Wasatch Core Growth Fund

®

-Institutional Class shares (WIGRX)

Wasatch Emerging Markets Select Fund™-Institutional Class shares (WIESX)

Wasatch Large Cap Value Fund

®

-Institutional Class shares (WILCX)

Wasatch Small Cap Value Fund

®

-Institutional Class shares (WICVX)

This Supplement updates certain information contained in the Wasatch Funds Prospectus for Institutional Class shares dated January 31, 2013. You

should retain this Supplement and the Prospectus for future reference. Additional copies of the Prospectus may be obtained free of charge by visiting our web site at www.WasatchFunds.com or calling us at 800.551.1700.

Wasatch Small Cap Value (the “Fund”)

Footnote 2 to the the Annual Fund Operating Expenses table under the heading “Fees and Expenses of the Fund” in the Summary section of

the Prospectus for the Fund on page 12 is hereby deleted in its entirety and replaced with the following:

2

The Advisor has contractually agreed to reimburse the Investor Class shares of the Fund for Total Annual Fund Operating Expenses in excess of 1.50% until at least January 31, 2015 (excluding

interest, dividend expense on short sales/interest expense, taxes, brokerage commissions, other investment related costs and extraordinary expenses). The Board of Trustees is the only party that may terminate the contractual limitation prior to the

contract’s expiration. The Advisor may rescind the contractual limitation on expenses at any time after its expiration date. There were no reimbursements for the Investor Class shares of the Fund during 2012.

The fourth sentence under the heading “Example” in the Summary section of the Prospectus for the Fund on page 12 is hereby deleted in

its entirety and replaced with the following:

The example reflects contractual fee waivers and reimbursements through January 31, 2015.

The fourth paragraph under the heading “Principal Strategies” in the Summary section of the Prospectus for the Fund on page 13 is hereby

supplemented with the following:

The secondary objective of income is achieved when fast growing portfolio companies pay dividends,

generated by cash flow, typically after achieving growth targets.

The heading “Principal Risks” in the Summary section of the

Prospectus for the Fund on page 62 is hereby supplemented with the following:

Consumer discretionary sector risk.

To the extent the

Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Industries

in the consumer discretionary segment, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly impacted by the performance of the overall economy, interest rates, competition, consumer confidence and

spending, and changes in demographics and consumer tastes.

Energy Sector Risk.

To the extent the Fund emphasizes, from time to time,

investments in a market segment, the Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. The value of energy companies is particularly

vulnerable to developments in the energy sector, fluctuations in price and supply of energy fuels, energy conservation, supply of and demand for specific energy-related products or services, and tax policy and other government regulation.

Health Care Stock Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject

to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Health care companies are strongly affected by worldwide scientific or

1

technological developments. Their products may rapidly become obsolete. Many health care companies are also subject to significant government regulation and may be affected by changes in

government policies.

Industrials sector risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the

Fund will be subject to a greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Industries in the industrial segment, such as companies engaged in the production,

distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate

changes, changes in consumer spending, legislative and government regulation and spending, import controls, commodity prices, and worldwide competition.

Information Technology Risk.

To the extent the Fund emphasizes, from time to time, investments in a market segment, the Fund will be subject to a

greater degree to the risks particular to that segment, and may experience greater market fluctuation, than a fund without the same focus. Stocks of information technology companies may be volatile because issuers are sensitive to rapid obsolescence

of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. Information technology stocks, especially those of smaller, less-seasoned companies, tend to be more

volatile than the overall market.

The heading “Historical Performance” in the Summary section of the Prospectus for the Fund on

page 14 is hereby supplemented with the following:

Year-to-date return through 6/30/13 was 17.62%.

The second paragraph under the Average Annual Total Returns table under the heading “Historical Performance” in the Summary section of

the Prospectus for the Fund on page 14 is hereby deleted.

The following is hereby added after the table under the heading

“Wasatch Funds-Management-Management Fees and Expense Limitations” of the Prospectus for the Fund on page 19:

Effective January 31, 2012,

the management fee was reduced from 1.50% to 1.00% for the Small Cap Value Fund.

All Funds

The first paragraph under the heading “Wasatch Funds-Management-Portfolio Managers” of the Prospectus for the Funds on page 19 is hereby

supplemented with the following:

The lead portfolio managers are ultimately responsible for managing their respective Funds in accordance

with the Fund’s investment objectives and strategies.

The third bullet under the heading “Wasatch Funds-Account Policies-How Fund

Shares are Priced” of the Prospectus for the Funds on page 25 is hereby deleted in its entirety and replaced with the following:

|

|

•

|

|

The Funds’ share prices are calculated as of the close of trading on the New York Stock Exchange (NYSE) (normally 4:00 p.m. Eastern Time) every day the

NYSE is open.

|

2

The following is hereby added under the heading “Wasatch Funds-Financial Highlights” of the

Prospectus for the Small Cap Value Fund beginning on page 33:

The Financial Highlights for the six months ended

March 31, 2013 are not audited and are available in the semi-annual report which is available upon request.

WASATCH FUNDS —

Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from

Investment Operations

|

|

|

|

|

|

|

|

|

Less Distributions

|

|

|

|

|

|

|

|

Net Asset

Value

Beginning

of Period

|

|

|

Net

Investment

Income (Loss)

|

|

|

Net Realized

and Unrealized

Gains (Losses)

on Investments

|

|

|

Total from

Investment

Operations

|

|

|

Redemption

Fees

|

|

|

Dividends

from Net

Investment

Income

|

|

|

Distributions

from Net

Realized

Gains

|

|

|

Total

Distributions

|

|

|

Small Cap Value Fund —Institutional Class

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months ended 3/31/13 (unaudited)

|

|

$

|

3.82

|

|

|

|

0.01

|

|

|

|

0.61

|

|

|

|

0.62

|

|

|

|

—

|

4

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

3

(for a share outstanding throughout each period)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios to Average Net Assets

|

|

|

Supplemental Data

|

|

|

Net Asset

Value

End of

Period

|

|

Total Return (%)

1 7

|

|

|

Expenses

Net of

Waivers and

Reimbursements (%)

2

|

|

|

Expenses

Before

Waivers and

Reimbursements (%)

2

|

|

|

Net Investment

Income Net of

Waivers

and

Reimbursements (%)

2

|

|

|

Net Investment

Income Before

Waivers and

Reimbursements (%)

2

|

|

|

Net Assets

End of

Period

(000’s)

|

|

|

Portfolio

Turnover

Rate

1 3

|

|

|

$ 4.44

|

|

|

16.23

|

|

|

|

1.15

|

5

|

|

|

1.57

|

5

|

|

|

0.39

|

|

|

|

(0.03

|

)

|

|

$

|

8,275

|

|

|

|

16

|

%

|

Notes to Financial Highlights

|

1

|

Not annualized for periods less than one year.

|

|

2

|

Annualized for periods less than one year.

|

|

3

|

Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

|

|

4

|

Represents amounts less than $.005 per share.

|

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

4

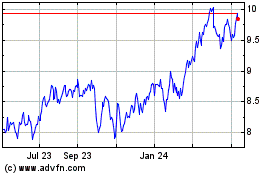

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Jul 2024 to Aug 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Aug 2023 to Aug 2024