Kadant Acquires Leading U.S. Baler Manufacturer

August 23 2021 - 4:53PM

Kadant Inc. (NYSE:KAI) today announced it has completed its

acquisition of Balemaster for $54 million in cash, subject to

certain customary adjustments.

Balemaster is a leading U.S. manufacturer of horizontal balers

and related equipment used primarily for recycling packaging waste

at corrugated box plants and large retail and distribution centers.

The company’s revenue for the trailing twelve months ended June 30,

2021 was approximately $22 million. Balemaster will become part of

Kadant’s Material Handling reporting segment.

“Our acquisition of Balemaster expands our presence in the

secondary material processing sector and creates new opportunities

for leveraging our high-performance balers produced in Europe,”

said Jeffrey L. Powell, president and chief executive officer of

Kadant Inc. “The company is a market leader in North America and

its strong aftermarket business fits well with Kadant. We are

excited to welcome the employees of Balemaster to the Kadant

family.”

“We are proud of the strong brand and market presence Balemaster

has built over the past 75 years,” said Cornel Raab, president of

Balemaster. “Kadant is a world-class company with a similar culture

and values as our family-built business, and we believe it is a

great home for our company and employees.”

Conference CallKadant will hold a conference

call and webcast on Tuesday, August 24, 2021 at 9:30 a.m. eastern

time to discuss the acquisition. To listen to the call and view the

webcast, go to the “Investors” section of the Company’s website at

www.kadant.com. To participate in the question and answer session,

dial 888-326-8410 within the U.S., or +1-704-385-4884 outside the

U.S., and reference participant passcode 2987001. A replay of the

webcast will be available on the Company’s website through

September 24, 2021.

About Kadant Kadant Inc. is a global supplier

of high-value, critical components and engineered systems used in

process industries worldwide. The Company’s products, technologies,

and services play an integral role in enhancing process efficiency,

optimizing energy utilization, and maximizing productivity in

resource-intensive industries. Kadant is based in Westford,

Massachusetts, with approximately 2,900 employees in 21 countries

worldwide. For more information, visit www.kadant.com.

Safe Harbor StatementThe following constitutes

a “Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that involve a number of risks and uncertainties,

including forward-looking statements about the financial and

operating performance of Balemaster, the benefits of the

acquisition, and the expected future business and financial

performance of Balemaster. These forward-looking statements

represent our expectations as of the date of this press release. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events,

or otherwise. These forward-looking statements are subject to known

and unknown risks and uncertainties that may cause our actual

results to differ materially from these forward-looking statements

as a result of various important factors, including those set forth

under the heading "Risk Factors" in Kadant’s annual report on Form

10-K for the fiscal year ended January 2, 2021 and subsequent

filings with the Securities and Exchange Commission. These include

risks and uncertainties relating to Kadant's ability to

successfully integrate Balemaster and its operations and employees

and realize anticipated benefits from the acquisition;

unanticipated disruptions to the business, general and regional

economic conditions, and the future performance of Balemaster;

potential adverse reactions or changes to business or employee

relationships, including those resulting from the announcement of

the acquisition; competitive and/or investor responses to the

acquisition; uncertainty of the expected financial performance of

the combined operations; the ability to realize anticipated

synergies and cost savings; unexpected costs, charges or expenses

resulting from the acquisition; the impact of the COVID-19 pandemic

on our operating and financial results; adverse changes in global

and local economic conditions; the variability and difficulty in

accurately predicting revenues from large capital equipment and

systems projects; health epidemics; our acquisition strategy;

levels of residential construction activity; reductions by our wood

processing customers of their capital spending or production of

oriented strand board; changes to the global timber supply;

development and use of digital media; cyclical economic conditions

affecting the global mining industry; demand for coal, including

economic and environmental risks associated with coal; failure of

our information systems or breaches of data security and

cybertheft; implementation of our internal growth strategy; price

increases or shortages of raw materials; competition; changes in

our tax provision or exposure to additional tax liabilities; our

ability to successfully manage our manufacturing operations;

disruption in production; future restructurings; loss of key

personnel and effective succession planning; protection of

intellectual property; climate change; adequacy of our insurance

coverage; global operations; policies of the Chinese government;

the variability and uncertainties in sales of capital equipment in

China; currency fluctuations; economic conditions and regulatory

changes caused by the United Kingdom’s exit from the European

Union; changes to government regulations and policies around the

world; compliance with government regulations and policies and

compliance with laws; environmental laws and regulations;

environmental, health and safety laws and regulations impacting the

mining industry; our debt obligations; restrictions in our credit

agreement and note purchase agreement; substitution of an

alternative index for LIBOR; soundness of financial institutions;

fluctuations in our share price; and anti-takeover provisions.

ContactsInvestor Contact Information:Michael

McKenney, 978-776-2000IR@kadant.com orMedia Contact

Information:Wes Martz, 269-278-1715media@kadant.com

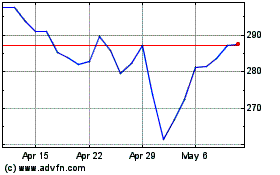

Kadant (NYSE:KAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

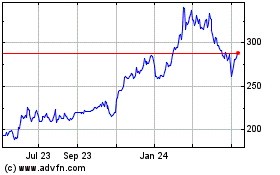

Kadant (NYSE:KAI)

Historical Stock Chart

From Apr 2023 to Apr 2024