Form 497 - Definitive materials

September 28 2023 - 4:02PM

Edgar (US Regulatory)

Prospectus Supplement

John Hancock Investment Trust

John Hancock International Dynamic Growth

Fund (the fund)

Supplement dated September 28, 2023 to the current Prospectus, as may be

supplemented (the Prospectus)

At a meeting held on September 26–28, 2023, the fund’s Board of

Trustees approved a management fee reduction. As a result effective October 1, 2023, the table related to the fund’s management fee schedule and the paragraph preceding the

table in the “Fund details” section, under the heading “Who’s who — Management fee,” are amended and restated as follows:

Management fee

The fund pays the advisor a management fee for its services to the fund. The advisor in turn pays the fees of the subadvisor. The management fee is stated as an annual percentage of the aggregate net assets of the fund (together with the assets of any other applicable fund identified in the advisory agreement) determined in accordance with the following schedule, and that rate is applied to the average daily net assets of the fund. The fee schedule that follows became effective October 1, 2023.

Average daily net assets ($) |

|

| |

|

| |

|

| |

|

| |

|

| |

|

*

When Aggregate Net Assets exceed $1 billion on any day, the annual rate of Advisory fee is

0.750% on the first $1 billion of Aggregate Net Assets.

You should read this supplement in conjunction with the Prospectus and retain it for your future

reference.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of

The Manufacturers Life Insurance Company and are used by its affiliates under license.

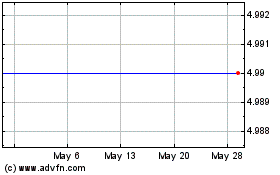

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

From Apr 2024 to May 2024

John Hancock Tax Advanta... (NYSE:HTY)

Historical Stock Chart

From May 2023 to May 2024