Earnings Scorecard: ITT Corporation - Analyst Blog

March 12 2012 - 1:24PM

Zacks

ITT Corporation (ITT) reported fairly good

results for the fourth quarter and fiscal 2011. The company

achieved top-line growth of 10% year over year in the fourth

quarter 2011. The company’s sales increased across all of its four

business segments.

Fourth Quarter Highlights

Total revenue in the quarter increased 10% to $518 million

compared to $470 million in the prior-year period.

For fiscal 2011, the company reported revenues of $2.1 billion

which was 11% above the prior year with an organic growth of 9%

compared to the prior year. The primary driver of revenue growth

was a robust 19% growth in emerging markets and strong growth in

core markets of the company such as oil and gas, transportation and

aerospace.

ITT Corporation released its fourth quarter and full year 2011

earnings results and reported quarterly earnings per share from

continuing operations of $0.36, which was a penny above the Zacks

Consensus Estimate.

For the full year the company reported earnings of $1.60

reflecting a 23% increase compared to the prior year period, driven

by strong revenue growth and operating performance.

Agreement of Analysts

Among the analysts covering the stock in the last 7 days, none

revised their estimates upward for the first quarter of 2012.

However, for the last 30 days 2 analysts lowered the estimates for

the current year. Similarly, for the first quarter of 2013, none

increased their estimates but one analyst lowered the estimate in

the past 7 days.

We believe analysts expect margins to be under pressure due to

high incremental costs involved after the transformation to be a

stand-alone company. Further, some of the company’s long cycle

projects are also expected to be a drag on margins.

However, the company is positive about its performance in fiscal

2012 with an EPS growth of 13% after adjusting for the incremental

stand alone costs worth $20 million.

Magnitude of Estimate Revisions

During the last 7 days, for the first quarter of 2012, the

current estimate was stagnant at 31 cents a share. However, for the

current year 2012, the estimate was lowered 2 cents from $1.71 to

$1.69 a share.

Again for second quarter of 2012, in the last 7 days, the Zacks

Consensus estimate was lowered by a penny to 43 cents a share. For

fiscal 2013 as well, the Zacks Consensus Estimate decreased 1 cent

from $1.93 to $1.92.

Earnings Surprises

The fourth quarter earnings surprise for ITT was a penny or

2.86%. The upcoming quarter as well as fiscal 2012 it is expected

to remain at break-even, while fiscal for 2013 is expected to

report a negative earnings surprise of (0.52)%.

Summary

The company continues to make investments in attractive growth

areas such as air traffic management, emerging market expansion,

product innovation, defense adjacency, diversity strategy and

analytical instrumentation.

We are particularly bullish about two segments: a) water

equipment (primarily pumps), which should benefit from the

replacement and upgrading of aging networks in developed markets

and the build out of infrastructure in the emerging markets, and b)

ITT’s defense business, with the bulk of sales derived from

electronic and network-centric warfare.

ITT Corporation continues to expand its product portfolio and

geographical presence while making a number of strategic

acquisitions. The acquisition of Godwin Pumps broadened the

company’s global position in water, wastewater and industrial

processes, and compliments ITT’s existing Fluid Technology

portfolio.

The company is particularly focused on its presence in the

emerging markets. The acquisition of Canberra Pumps increased its

footprint in Latin America, enabling it to provide more products to

the growing oil and gas and mining markets there.

The company currently holds a Zacks Rank #3 which implies a

short term Hold rating on the stock.

About Zacks Earnings Scorecard

As a PhD from MIT, Len Zacks proved over 30 years ago that

earnings estimate revisions are the most powerful force impacting

stock prices. He turned this ground breaking discovery into two of

the most celebrating stock rating systems in use today. The Zacks

Rank for stock trading in a 1 to 3 month time horizon and the Zacks

Recommendation for long-term investing (6+ months). These “Earnings

Estimate Scorecard” articles help analyze the important aspects of

estimate revisions for each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at http://www.zacks.com/education

ITT CORP (ITT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

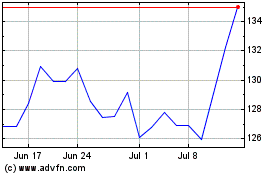

ITT (NYSE:ITT)

Historical Stock Chart

From May 2024 to Jun 2024

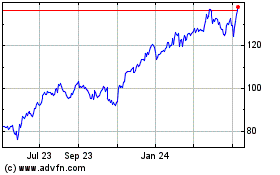

ITT (NYSE:ITT)

Historical Stock Chart

From Jun 2023 to Jun 2024