UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

(Name of Issuer)

Common Stock, par value $0.20 per share

(Title of Class of Securities)

(CUSIP Number)

|

Brian L. Schorr, Esq.

Trian Fund Management, L.P.

280 Park Avenue, 41st Floor

New York, New York 10017

Tel. No.: (212) 451-3000

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ◻.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The Information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the

liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Nelson Peltz

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [ _]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90*

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 (the “Form 10-Q”).

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Peter W. May

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90%*

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Form 10-Q.

|

1

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Edward P. Garden

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90%*

|

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Form 10-Q.

|

1

|

NAME OF REPORTING PERSON

Trian Fund Management, L.P.

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

20-3454182

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90%*

|

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Form 10-Q.

|

1

|

NAME OF REPORTING PERSON

Trian Fund Management GP, LLC

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

20-3454087

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

AF

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90%*

|

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Form 10-Q.

|

1

|

NAME OF REPORTING PERSON

Trian Partners AM Holdco, Ltd.

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

85-0622810

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) [ ]

(b) [_]

|

|

3

|

SEC USE ONLY

|

|

|

4

|

SOURCE OF FUNDS

WC

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

|

8

|

SHARED VOTING POWER

45,457,427

|

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

SHARED DISPOSITIVE POWER

45,457,427

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,457,427

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

[X]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.90%*

|

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

_______

*Calculated based on 459,335,113 shares of Common Stock outstanding as of September 30, 2020, as reported in the Issuer’s Form 10-Q.

This Amendment No. 1 amends and supplements the Schedule 13D filed with the Securities and Exchange Commission on October 2, 2020 (the “Original Schedule 13D”) relating to the Common Stock, par value $0.20 per share

(the “Shares”), of Invesco Ltd., a Bermuda exempted company (the “Issuer”). The address of the principal executive office of the Issuer is 1555 Peachtree Street, NE., Suite 1800, Atlanta, Georgia 30309.

Capitalized terms not defined herein shall have the meaning ascribed to them in the Original Schedule 13D. Except as set forth herein, the Original Schedule 13D is unmodified

Items 4, 5, 6 and 7 of the Original Schedule 13D are hereby amended and supplemented as follows:

Item 4. Purpose of Transaction

Item 4 of the Original Schedule 13D is hereby amended and supplemented by adding the following information:

On November 4, 2020, the Issuer increased the size of its Board from nine to twelve directors and appointed each of Nelson Peltz, Chief Executive Officer and a Founding Partner of Trian Management, and Ed Garden, Chief

Investment Officer and a Founding Partner of Trian Management, as a director effective immediately. The Issuer has agreed to include Mr. Peltz and Mr. Garden on its slate of director nominees in its proxy statement for its Annual Meeting of

Shareholders in May 2021. Also on November 4, 2020, the Issuer appointed a third independent director to fill the remaining vacancy on the Board as of December 1, 2020.

The Board has appointed Mr. Peltz to the Nomination & Corporate Governance Committee, and it has appointed Mr. Garden to the Nomination & Corporate Governance Committee and the Compensation Committee.

Item 5. Interest in Securities of the Issuer

Item 5 of the Schedule 13D is hereby amended and supplemented by adding the following information:

(a) As of 4:00 pm, New York City time, on November 4, 2020, the Reporting Persons beneficially owned, in the aggregate, 45,457,427 Shares, representing approximately 9.90% of the Issuer’s outstanding Shares (calculated

based on 459,335,113 Shares outstanding as of September 30, 2020, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020).

(b) There have been no new transactions by the Reporting Persons since the filing of the Original Schedule 13D.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Item 6 of the Schedule 13D is hereby amended and supplanted by adding the following information:

Pursuant to an agreement entered into on November 4, 2020 between Nelson Peltz and Trian Management, and an agreement dated November 4, 2020 between Mr. Garden and Trian Management (collectively, the “Director Fee

Agreements”), each of Mr. Peltz and Mr. Garden agreed, among other things, that as long as he is a partner or officer of Trian Management and for a period of ninety days thereafter, Trian Management shall be entitled to direct the disposition and

voting of any Shares or other securities that he receives from the Issuer as compensation for his service as a director of the Issuer. Trian Management is also entitled to receive the consideration received as a result of any disposition of such

Shares or other securities. The foregoing description of the Director Fee Agreements is a summary only and is qualified in its entirety by reference to the Director Fee Agreements, which are filed as Exhibit 3 and Exhibit 4 hereto and incorporated

herein by reference.

Item 7. Materials to be Filed as Exhibits

Item 7 of the Schedule 13D is hereby amended and supplemented by adding the following information:

3. Agreement entered into on November 4, 2020 between Nelson Peltz and Trian Management

4. Agreement entered into on November 4, 2020 between Edward P. Garden and Trian Management

[INTENTIONALLY LEFT BLANK]

SIGNATURE

After reasonable inquiry and to the best of each of the undersigned knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: November 5, 2020

|

|

TRIAN FUND MANAGEMENT, L.P.

|

|

By:

|

Trian Fund Management GP, LLC, its general partner

|

|

|

|

|

By:

|

/s/ EDWARD P. GARDEN

|

|

|

Name:

|

Edward P. Garden

|

|

|

Title:

|

Member

|

|

|

|

|

|

TRIAN FUND MANAGEMENT GP, LLC

|

|

|

|

|

By:

|

/s/ EDWARD P. GARDEN

|

|

|

Name:

|

Edward P. Garden

|

|

|

Title:

|

Member

|

|

|

|

|

|

TRIAN PARTNERS AM HOLDCO, LTD.

|

|

|

|

|

By:

|

/s/ EDWARD P. GARDEN

|

|

|

Name:

|

Edward P. Garden

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

/s/ NELSON PELTZ

Nelson Peltz

|

|

|

|

|

|

|

|

|

/s/ PETER W. MAY

Peter W. May

|

|

|

|

|

|

/s/ EDWARD P. GARDEN

Edward P. Garden

|

Exhibit 3

November 4, 2020

Mr. Nelson Peltz

223 Sunset Avenue, Ste. 223

Palm Beach, Florida 33480

Dear Nelson:

In connection with the investment in Invesco Ltd. (“Invesco”) by a fund managed by Trian Fund Management, L.P. (“Trian”),

you have been appointed to serve as a director of Invesco by its Board of Directors (the “Board”).

We understand that, consistent with its practices, Invesco may be awarding to you, as a director of Invesco, equity compensation

in the form of shares of common stock (such equity compensation, “Shares”), and may be paying to you, fees in cash, in addition to the grant of Shares referred to above (collectively, “Fees”). This is to confirm our prior understanding

that you are authorized to accept such Shares and Fees in your individual capacity on behalf of Trian upon the terms and conditions of this letter, including your agreement that, as long as you are an officer or partner of Trian and for a period of 90

days thereafter, you will follow the direction of Trian with respect to (x) the Transfer (as defined below) of such Shares and (y) the Transfer of any other securities (including, without limitation, any stock options, restricted stock units or shares

of common stock issuable in exchange for, or upon exercise of, such other securities) of Invesco that you may receive as a director of Invesco (“Other Securities”). You further agree that (i) you will request that Invesco deliver all Fees

directly to an account designated by Trian, (ii) you will not dispose of, transfer, sell, assign, pledge, hypothecate or encumber (collectively, “Transfer”) any Shares or Other Securities, without Trian’s prior written consent, which may be

withheld in Trian’s sole discretion, (iii) you shall vote all Shares or Other Securities that you hold at any meeting of shareholders of Invesco in the manner that you are directed to do so by Trian in its sole discretion and (iv) you shall execute any

written consent of the shareholders of Invesco as Trian may, in its sole discretion, request that you execute. Upon any Transfer of all or a portion of any Shares or Other Securities, Trian shall be entitled to receive the consideration received as a

result of such Transfer (the “Equity Consideration”).

Trian agrees to indemnify you against any tax imposed on income to you, net of any corresponding deduction to which you are

entitled as a result of the transfer to Trian of the Fees, the Transfer of any Shares and/or Other Securities to Trian, and/or proceeds from any Transfer of any Equity Consideration to Trian. Such indemnification shall include all taxes imposed on a

tax indemnification payment and shall apply to income reported by either Invesco or Trian. For purposes of this letter agreement, taxes shall include any penalties, interest or additions to tax imposed upon you with respect to taxes.

This letter agreement shall be governed by, and construed in accordance with, the laws of the State of New York, applicable to

agreements made and to be performed entirely within such State.

This letter shall be binding upon the parties hereto and their respective successors, assigns, heirs and estates.

If the above is acceptable to you, please indicate your agreement by signing the enclosed duplicate copy of this letter

agreement in the space indicated below.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

|

|

TRIAN FUND MANAGEMENT, L.P.

|

|

|

|

|

|

|

|

|

|

|

By:

|

Trian Fund Management GP, LLC,

|

|

|

|

|

|

its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Peter W. May

|

|

|

|

|

|

Name:

|

Peter W. May

|

|

|

|

|

|

Title:

|

Member

|

|

|

Agreed to and Accepted:

/s/ Nelson Peltz

Nelson Peltz

Exhibit 4

November 4, 2020

Mr. Edward P. Garden

223 Sunset Avenue, Ste. 223

Palm Beach, Florida 33480

Dear Ed:

In connection with the investment in Invesco Ltd. (“Invesco”) by a fund managed by Trian Fund Management, L.P. (“Trian”), you have been appointed to serve as a director of Invesco by its

Board of Directors (the “Board”).

We understand that, consistent with its practices, Invesco may be awarding to you, as a director of Invesco, equity compensation in the form of shares of common stock (such equity compensation, “Shares”),

and may be paying to you, fees in cash, in addition to the grant of Shares referred to above (collectively, “Fees”). This is to confirm our prior understanding that you are authorized to accept such Shares and Fees in your individual capacity

on behalf of Trian upon the terms and conditions of this letter, including your agreement that, as long as you are an officer or partner of Trian and for a period of 90 days thereafter, you will follow the direction of Trian with respect to (x) the

Transfer (as defined below) of such Shares and (y) the Transfer of any other securities (including, without limitation, any stock options, restricted stock units or shares of common stock issuable in exchange for, or upon exercise of, such other

securities) of Invesco that you may receive as a director of Invesco (“Other Securities”). You further agree that (i) you will request that Invesco deliver all Fees directly to an account designated by Trian, (ii) you will not dispose of,

transfer, sell, assign, pledge, hypothecate or encumber (collectively, “Transfer”) any Shares or Other Securities, without Trian’s prior written consent, which may be withheld in Trian’s sole discretion, (iii) you shall vote all Shares or Other

Securities that you hold at any meeting of shareholders of Invesco in the manner that you are directed to do so by Trian in its sole discretion and (iv) you shall execute any written consent of the shareholders of Invesco as Trian may, in its sole

discretion, request that you execute. Upon any Transfer of all or a portion of any Shares or Other Securities, Trian shall be entitled to receive the consideration received as a result of such Transfer (the “Equity Consideration”).

Trian agrees to indemnify you against any tax imposed on income to you, net of any corresponding deduction to which you are entitled as a result of the transfer to Trian of the Fees, the Transfer of

any Shares and/or Other Securities to Trian, and/or proceeds from any Transfer of any Equity Consideration to Trian. Such indemnification shall include all taxes imposed on a tax indemnification payment and shall apply to income reported by either

Invesco or Trian. For purposes of this letter agreement, taxes shall include any penalties, interest or additions to tax imposed upon you with respect to taxes.

This letter agreement shall be governed by, and construed in accordance with, the laws of the State of New York, applicable to agreements made and to be performed entirely within such State.

This letter shall be binding upon the parties hereto and their respective successors, assigns, heirs and estates.

If the above is acceptable to you, please indicate your agreement by signing the enclosed duplicate copy of this letter agreement in the space indicated below.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

|

|

TRIAN FUND MANAGEMENT, L.P.

|

|

|

|

|

|

|

|

|

|

|

By:

|

Trian Fund Management GP, LLC,

|

|

|

|

|

|

its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Peter W. May

|

|

|

|

|

|

Name:

|

Peter W. May

|

|

|

|

|

|

Title:

|

Member

|

|

|

Agreed to and Accepted:

/s/ Edward P. Garden

Edward P. Garden

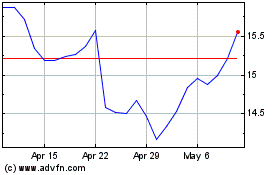

Invesco (NYSE:IVZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

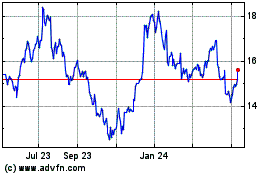

Invesco (NYSE:IVZ)

Historical Stock Chart

From Apr 2023 to Apr 2024