ADJUSTED EBITDA IN LINE WITH FOURTH QUARTER RESULTS; AVAILABLE

LIQUIDITY OF $1.1 BILLION THE WOODLANDS, Texas, May 8

/PRNewswire-FirstCall/ -- First Quarter 2009 Highlights -- Revenues

for the first quarter of 2009 were $1,693 million, a decrease of

33% compared to $2,540 million for the first quarter of 2008 and a

decrease of 17% compared to $2,048 million for the fourth quarter

of 2008. -- As of March 31, 2009, we had $1,115 million of combined

cash and unused borrowing capacity consisting of $473 million cash

and $642 million available borrowings under our credit facilities.

We generated positive cash flow through aggressive management of

our primary working capital. This available liquidity uniquely

positions our business during these challenging economic times. --

Net loss attributable to Huntsman Corporation for the first quarter

of 2009 was $290 million or $1.24 loss per diluted share compared

to net income attributable to Huntsman Corporation of $7 million or

$0.03 per diluted share for the same period in 2008 and net income

attributable to Huntsman Corporation of $598 million or $2.53 per

diluted share for the fourth quarter of 2008. Adjusted net loss

from continuing operations attributable to Huntsman Corporation for

the first quarter of 2009 was $274 million or $1.17 loss per

diluted share including tax expense of $146 million or $0.62 per

diluted share due to the establishment of a tax valuation allowance

in the U.K. Excluding the tax valuation allowance the first quarter

2009 loss from continuing operations attributable to Huntsman

Corporation was $128 million or $0.55 loss per diluted share. This

adjusted net loss reflects a decrease compared to adjusted net

income from continuing operations attributable to Huntsman

Corporation of $17 million or $0.07 per diluted share for the same

period in 2008 and adjusted net loss from continuing operations

attributable to Huntsman Corporation of $91 million or $0.38 loss

per diluted share for the fourth quarter of 2008. -- On April 16,

2009, we announced that as a matter of precautionary planning our

wholly owned subsidiary Huntsman International LLC entered into a

credit agreement waiver with lenders of its $650 million revolving

credit facility. Among other things the waiver relaxed the senior

secured leverage ratio covenant from 3.75 to 1.00 to 5.00 to 1.00

for the measurement periods between June 30, 2009 and June 30,

2010. -- On January 22, 2009, we announced a company-wide

initiative to reduce costs across all divisions and functions.

Including steps begun in the fourth quarter of 2008, we intend to

reduce our full-time employment by approximately 1,250 positions -

nearly 10% of all employees. In addition, full-time contractor

positions will be reduced by 490. Annualized operating cost savings

from all elements of the initiative are estimated to be $150

million. -- Adjusted EBITDA from continuing operations for the

first quarter of 2009 was $50 million compared to $188 million for

the same period in 2008 and $51 million for the fourth quarter of

2008. -- We continue to pursue our multi-billion dollar fraud and

tortious interference claims against Credit Suisse and Deutsche

Bank. The court in Montgomery County, Texas has ordered mediation

to begin on May 13, 2009 and trial to commence on June 8, 2009.

Summarized earnings are as follows: Three months ended Three months

March 31, ended --------- ----- December In millions, except per

share amounts 2009 2008 31, 2008

------------------------------------- ---- ---- --------- Net

(loss) income attributable to Huntsman Corporation $(290) $7 $598

Adjusted net (loss) income from continuing operations $(274) $17

$(91) Diluted (loss) income per share $(1.24) $0.03 $2.53 Adjusted

diluted (loss) income per share from continuing operations $(1.17)

$0.07 $(0.38) EBITDA $30 $170 $984 Adjusted EBITDA from $50 $188

$51 continuing operations See end of press release for important

explanations Peter R. Huntsman, our President and CEO, stated: "Our

results for the first quarter of 2009 reflect decreased demand in

all our businesses resulting from the worldwide economic slowdown.

Although average demand for the quarter was soft, in fact it was

softer than the fourth quarter, we did see positive order patterns

within the first quarter and left the quarter with stronger demand

than we entered. We have taken aggressive action to manage those

business elements within our control. We are ahead of target and

schedule to eliminate in excess of $150 million from our cost

structure. We are actively managing our working capital for

improvements to provide additional liquidity and we have obtained a

waiver to our credit agreement that relaxes certain covenants and

preserves our ability to access our $650 million revolver." He

added, "With our strong liquidity and lower cost structure we are

well positioned for the current recession and to prosper as we see

a return to normal market conditions." Huntsman Corporation

Operating Results Three months ended March 31, In millions, except

per share amounts 2009 2008 -------------------------------------

---- ---- Revenues $1,693 $2,540 Cost of goods sold 1,548 2,173

----- ----- Gross profit 145 367 Operating expenses 225 276

Restructuring, impairment and plant closing costs 14 4 --- ---

Operating (loss) income (94) 87 Interest expense, net (55) (65)

Loss on accounts receivable securitization program (4) (4) Equity

in income of investment in unconsolidated affiliates 1 3 Expenses

associated with the Merger and related litigation (7) (5) --- ---

(Loss) income from continuing operations before income taxes (159)

16 Income tax expense (138) (4) ---- --- (Loss) income from

continuing operations (297) 12 Income (loss) from discontinued

operations, net of tax(1) 3 (1) --- --- Net (loss) income (294) 11

Less net loss (income) attributable to noncontrolling interests 4

(4) --- --- Net (loss) income attributable to Huntsman Corporation

$(290) $7 ===== === Net (loss) income attributable to Huntsman

Corporation $(290) $7 Interest expense, net 55 65 Income tax

expense 138 4 Depreciation and amortization 126 94 Income taxes

included in discontinued operations(1,3) 1 - --- --- EBITDA(3) $30

$170 Adjusted EBITDA - continuing operations(3) $50 $188 Basic

(loss) income per share $(1.24) $0.03 Diluted (loss) income per

share $(1.24) $0.03 Adjusted diluted (loss) income per share from

continuing operations(3) $(1.17) $0.07 Common share information:

Basic shares outstanding 234 227 Diluted shares 234 234 See end of

press release for footnote explanations Huntsman Corporation

Segment Results Three months ended March 31, In millions 2009 2008

---- ---- Segment Revenues: Polyurethanes $600 $1,002 Advanced

Materials 257 379 Textile Effects 152 243 Performance Products 500

631 Pigments 196 285 Eliminations and other (12) - --- --- Total

$1,693 $2,540 ====== ====== Segment EBITDA(3): Polyurethanes $26

$132 Advanced Materials 10 40 Textile Effects (11) (1) Performance

Products 81 53 Pigments (29) 10 Corporate and other (51) (63)

Discontinued operations(1) 4 (1) --- --- Total $30 $170 === ====

Segment Adjusted EBITDA(3) : Polyurethanes $27 $132 Advanced

Materials 10 40 Textile Effects (11) - Performance Products 81 53

Pigments (16) 11 Corporate and other (41) (48) --- --- Total $50

$188 === ==== Three months ended March 31, 2009 vs. 2008

------------- Average Sales Period-Over-Period Decrease Selling

Price Volume ------------- ------ Polyurethanes (27)% (18)%

Advanced Materials (8)% (27)% Textile Effects (4)% (34)%

Performance Products (a) (13)% (10)% Pigments (2)% (30)% (a)

Excludes revenues and sales volumes from tolling arrangements. See

end of press release for footnote explanations Three Months Ended

March 31, 2009 Compared to Three Months Ended March 31, 2008

Revenues for the three months ended March 31, 2009 decreased to

$1,693 million from $2,540 million during the same period in 2008.

Revenues decreased due to lower sales volumes and lower average

selling prices in all of our segments. For the three months ended

March 31, 2009, EBITDA was $30 million compared to $170 million in

the same period in 2008. Adjusted EBITDA from continuing operations

for the three months ended March 31, 2009 was $50 million compared

to $188 million for the same period in 2008. Polyurethanes The

decrease in revenues in the Polyurethanes segment for the three

months ended March 31, 2009 compared to the same period in 2008 was

primarily due to lower MDI sales volumes and overall lower average

selling prices. MDI sales volumes decreased primarily due to lower

demand in all regions and across all major markets as a result of

the worldwide economic slowdown. MDI average selling prices

decreased primarily due to competitive pressures, lower raw

material costs and the strength of the U.S. dollar against major

European currencies. PO and MTBE sales volumes increased due to

stronger demand while average selling prices decreased with lower

raw material costs. The decrease in EBITDA in the Polyurethanes

segment was primarily the result of lower MDI sales volumes and

margins partially offset by lower general and administrative costs.

Advanced Materials The decrease in revenues in the Advanced

Materials segment for the three months ended March 31, 2009

compared to the same period in 2008 was due to lower sales volumes

and lower average selling prices. Sales volumes decreased due to

lower demand in all regions and across all major markets as a

result of the worldwide economic slowdown. Average selling prices

decreased primarily as a result of increased competition in our

base resins market and the strength of the U.S. dollar against

major European currencies. The decrease in EBITDA was primarily due

to lower sales volumes, partially offset by lower raw material and

fixed costs. Textile Effects The decrease in revenues in the

Textile Effects segment for the three months ended March 31, 2009

compared to the same period in 2008 was due to lower sales volumes

and lower average selling prices. Sales volumes decreased primarily

due to lower demand for Apparel and Home Textile products, as well

as for Specialty Textiles products in all regions as a result of

the worldwide economic slowdown. Average selling prices decreased

primarily as a result of the strength of the U.S. dollar against

major European currencies, the Indian Rupee and Brazilian Real

while selling prices in local currency were higher in Asia and the

Americas. The decrease in EBITDA was primarily due to lower sales

volumes, partially offset by lower raw material and fixed costs.

Performance Products The decrease in revenues in the Performance

Products segment for the three months ended March 31, 2009 compared

to the same period in 2008 was due to a decrease in both average

selling prices and sales volumes. Average selling prices decreased

in response to lower raw material costs. Sales volumes decreased

across most product lines primarily due to the worldwide economic

slowdown. The increase in EBITDA in the Performance Products

segment was mainly due to higher contribution margins resulting

from lower raw material costs. Also, in the prior year period our

Port Neches, Texas facility underwent an extended turnaround and

inspection, the financial impact of which we estimate was

approximately $14 million. Pigments The decrease in revenues in the

Pigments segment for the three months ended March 31, 2009 compared

to the same period in 2008 was due to lower sales volumes and lower

average selling prices. Sales volumes decreased primarily due to

lower demand in all regions as a result of the worldwide economic

slowdown. Average selling prices decreased primarily as a result of

the strength of the U.S. dollar against major European currencies

while selling prices in local currency were higher. The decrease in

EBITDA in the Pigments segment was primarily due to lower sales

volumes and higher restructuring and plant closing costs. During

the three months ended March 31, 2009 the Pigments segment recorded

restructuring, impairment and plant closing costs of $13 million

compared to $1 million for the same period in 2008. Discontinued

Operations On November 5, 2007, we completed the sale of the assets

that comprised our U.S. base chemicals business to Flint Hills

Resources. On August 1, 2007, we completed the sale of the majority

of the assets that comprised our Polymers segment to Flint Hills

Resources. Results from these businesses have been classified as

discontinued operations. Corporate and Other Corporate and other

items include the results of our Australia styrenics business,

unallocated foreign exchange gains and losses, unallocated

corporate overhead, loss on the sale of accounts receivable, merger

and related litigation associated income and expense, income and

expense attributable to noncontrolling interests, unallocated

restructuring costs, gain and loss on the disposition of assets and

other non-operating income and expense. In the first quarter of

2009, the total of these items was a loss of $51 million compared

to a loss of $63 million in the comparable period of 2008. The

increase in EBITDA from these items was primarily the result of an

$8 million increase in income attributable to noncontrolling

interests and a $6 million increase in unallocated foreign exchange

gains ($2 million in gains in the 2009 period compared to $4

million in losses in the 2008 period). Income Taxes During the

three months ended March 31, 2009, we recorded $138 million of

income tax expense compared to $4 million of income tax expense in

the comparable period of 2008. During the first quarter of 2009, we

established a valuation allowance of $146 million on our U.K. net

deferred tax assets, primarily as a result of cumulative losses

through the current period. Liquidity, Capital Resources and

Outstanding Debt As of March 31, 2009 we had $1,115 million of

combined cash and unused borrowing capacity compared to $1,291

million at December 31, 2008. During the three months ended March

31, 2009, net debt plus outstandings under our off-balance sheet

accounts receivable securitization program decreased $37 million.

On April 16, 2009, we announced that our wholly owned subsidiary,

Huntsman International LLC, entered into a credit agreement waiver

with the lenders under its $650 million revolving credit facility.

The waiver relaxes the senior secured leverage ratio covenant from

3.75 to 1.00 to 5.00 to 1.00 for the measurement periods between

June 30, 2009 and June 30, 2010. The waiver, among other things,

also modifies the definition of Consolidated EBITDA and permits

Huntsman International LLC to add back any lost profits

attributable to Hurricanes Gustav and Ike that occurred in 2008.

Additionally, the amount of permitted cash charges that can be

added back to Consolidated EBITDA was increased from $100 million

to $200 million. As consideration for the waiver, Huntsman

International offered a one-time payment of 50 basis points to

consenting lenders. In addition the LIBOR spread on borrowed funds

under the revolving credit facility increased to 400 basis points.

Among other things, Huntsman also agreed not to make aggregate

restricted payments greater than $100 million plus Available Equity

Proceeds during the waiver period. During the first quarter 2009,

we achieved a favorable cash benefit from changes in accounts

receivable, inventory and accounts payable of $58 million. For the

three months ended March 31, 2009, total capital expenditures were

$61 million compared to $109 million for the same period in 2008.

We expect to spend approximately $230 million on capital

expenditures in 2009 compared to approximately $418 million in

2008. We continue to pursue our multi-billion dollar fraud and

tortious interference claims against Credit Suisse and Deutsche

Bank in the Montgomery County, Texas court. Any potential recovery

resulting from this litigation may impact our liquidity. In

connection with our ongoing insurance claim related to the April

29, 2006 Port Arthur, Texas fire, we have received partial

insurance proceeds to date of $365 million. We have claimed an

additional $243 million as presently due and owing and unpaid under

our insurance policies as of March 31, 2009. The settlement of

insurance claims will continue during 2009. Any anticipated

recoveries are expected to be used to repay secured debt. Below is

our outstanding debt: March 31, December 31, In millions 2009 2008

---- ---- Debt: Senior Credit Facilities $1,524 $1,540 Secured

Notes 295 295 Senior Notes 198 198 Subordinated Notes 1,238 1,285

Other Debt 284 329 Convertible Notes 235 235 --- --- Total Debt

3,774 3,882 ----- ----- Total Cash 473 662 --- --- Net Debt $3,301

$3,220 ====== ====== Off-balance sheet accounts receivable

securitization program $328 $446 Huntsman Corporation

Reconciliation of Adjustments Net Income (Loss) Attributable

Diluted to Huntsman Income (Loss) EBITDA Corporation Per Share

------ ------------- --------- Three months Three months Three

months ended ended ended In millions, except March 31, March 31,

March 31, per share amounts 2009 2008 2009 2008 2009 2008

-------------------- ---- ---- ---- ---- ---- ---- GAAP $30 $170

$(290) $7 $(1.24) $0.03 Adjustments: Loss on accounts receivable

securitization program 4 4 - - - - Unallocated foreign currency

(gain) loss (2) 4 - 1 - - Other restructuring, impairment and plant

closing costs 14 4 14 3 0.06 0.01 Expenses associated with the

Merger 7 5 4 5 0.02 0.02 Acquisition related expenses 1 - 1 - - -

(Income) loss from discontinued operations, net of tax(1) (4) 1 (3)

1 (0.01) - --- ---- ----- --- ------ ----- Adjusted continuing

operations $50 $188 $(274) $17 $(1.17) $0.07 ------ ----- UK tax

valuation allowance - - 146 - 0.62 - --- --- --- --- --- ---

Adjusted continuing operations (excluding UK tax valuation

allowance) $50 $188 $(128) $17 $(0.55) $0.07 ------ -----

Discontinued operations $4 $(1) $3 $(1) $0.01 $- (Gain) loss on

disposition of assets (4) 1 (3) 1 (0.01) - --- --- --- --- -----

--- Adjusted discontinued operations(1) $- $- $- $- $- $- Three

months ended December 31, In millions 2008 ----------- ---- Net

income attributable to Huntsman Corporation 598 Interest expense,

net 64 Income tax expense 148 Depreciation and amortization 108

Income taxes, depreciation and amortization included in

discontinued operations(1,3) 66 --- EBITDA(3) $984 Net Income

(Loss) Diluted Attributable Income to Huntsman (Loss) EBITDA

Corporation Per Share Three months Three months Three months ended

ended ended In millions, except per December 31, December 31,

December 31, share amounts 2008 2008 2008 -----------------------

---- ---- ---- GAAP $984 $598 2.53 Adjustments: Loss on accounts

receivable securitization program 11 - - Unallocated foreign

currency loss 25 12 0.05 Loss on early extinguishment of debt 1 - -

Other restructuring, impairment and plant closing costs 28 25 0.11

Income associated with the Merger (815) (610) (2.58) Gain on

dispositions of assets (1) - - Gain from discontinued operations,

net of tax(1) (178) (112) (0.47) Extraordinary gain on the

acquisition of a business, net of tax(2) (4) (4) (0.02) --- ----

------ Adjusted continuing operations $51 $(91) $(0.38) ------ See

end of press release for footnote explanations Conference Call

Information We will hold a conference call to discuss our first

quarter 2009 financial results on Friday, May 8, 2009 at 11:00 a.m.

ET. Call-in number for U.S. participants: (888) 680 - 0892 Call-in

number for international participants: (617) 213 - 4858 Participant

access code: 42481081 In order to facilitate the registration

process, you may use the following link to pre-register for the

conference call. Callers who pre-register will be given a unique

PIN to gain immediate access to the call and bypass the live

operator. You may pre-register at any time, including up to and

after the call start time. To pre-register, please go to:

https://www.theconferencingservice.com/prereg/key.process?key=PM4FPJMTR

The conference call will be available via webcast and can be

accessed from the investor relations portion of the company's

website at http://www.huntsman.com/. The conference call will be

available for replay beginning May 8, 2009 and ending May 15, 2009.

Call-in numbers for the replay: Within the U.S.: (888) 286 - 8010

International: (617) 801 - 6888 Access code for replay: 16299215

About Huntsman: Huntsman (NYSE:HUN) is a global manufacturer and

marketer of differentiated chemicals. Its operating companies

manufacture products for a variety of global industries, including

chemicals, plastics, automotive, aviation, textiles, footwear,

paints and coatings, construction, technology, agriculture, health

care, detergent, personal care, furniture, appliances and

packaging. Originally known for pioneering innovations in packaging

and, later, for rapid and integrated growth in petrochemicals,

Huntsman has more than 12,000 employees and operates from multiple

locations worldwide. The Company had 2008 revenues exceeding $10

billion. For more information about Huntsman, please visit the

company's website at http://www.huntsman.com/. Forward-Looking

Statements: Statements in this release that are not historical are

forward-looking statements. These statements are based on

management's current beliefs and expectations. The forward-looking

statements in this release are subject to uncertainty and changes

in circumstances and involve risks and uncertainties that may

affect the company's operations, markets, products, services,

prices and other factors as discussed in the Huntsman companies'

filings with the U.S. Securities and Exchange Commission.

Significant risks and uncertainties may relate to, but are not

limited to, financial, economic, competitive, environmental,

political, legal, regulatory and technological factors. In

addition, the completion of any transactions described in this

release is subject to a number of uncertainties and closing will be

subject to approvals and other customary conditions. Accordingly,

there can be no assurance that such transactions will be completed

or that the company's expectations will be realized. The company

assumes no obligation to provide revisions to any forward-looking

statements should circumstances change, except as otherwise

required by applicable laws. (1) On November 5, 2007, we completed

the sale of our U.S. base chemicals business to Flint Hills

Resources. On August 1, 2007, we completed the sale of our U.S.

polymers business to Flint Hills Resources. On December 29, 2006,

we completed the sale of our European petrochemicals business to

SABIC. Results from these businesses are treated as discontinued

operations. Segment EBITDA discontinued operations only includes

the results of our U.S. base chemicals, U.S. polymers and European

petrochemical businesses. (2) On June 30, 2006, we acquired the

global textile effects business of Ciba Specialty Chemicals Inc.

for approximately $172 million. Because the fair value of acquired

current assets less liabilities assumed exceeded the acquisition

price and planned restructuring costs, the excess was recorded as

an extraordinary gain on the acquisition of a business. The

extraordinary gain recorded during the three months ended December

31, 2008 was $4 million of which taxes were not applicable. (3) We

use EBITDA, Adjusted EBITDA from continuing operations, Adjusted

EBITDA from discontinued operations, Adjusted net income from

continuing operations and Adjusted net income from discontinued

operations. We believe that net income (loss) attributable to

Huntsman Corporation is the performance measure calculated and

presented in accordance with generally accepted accounting

principles in the U.S. ("GAAP") that is most directly comparable to

EBITDA, Adjusted EBITDA from continuing operations and Adjusted net

income from continuing operations. We believe that income (loss)

from discontinued operations is the performance measure calculated

and presented in accordance with GAAP that is most directly

comparable to Adjusted EBITDA from discontinued operations and

Adjusted net income from discontinued operations. Additional

information with respect to our use of each of these financial

measures follows: EBITDA is defined as net income (loss)

attributable to Huntsman Corporation before interest, income taxes,

and depreciation and amortization. EBITDA as used herein is not

necessarily comparable to other similarly titled measures of other

companies. The reconciliation of EBITDA to net income (loss)

available to common stockholders is set forth in the operating

results table above. Adjusted EBITDA from continuing operations is

computed by eliminating the following from EBITDA: gains and losses

from discontinued operations; restructuring, impairment and plant

closing (credits) costs; merger associated income and expense;

losses on the sale of accounts receivable to our securitization

program; unallocated foreign currency (gain) loss; certain legal

and contract settlements; losses from early extinguishment of debt;

extraordinary loss (gain) on the acquisition of a business; and

loss (gain) on dispositions of assets. The reconciliation of

Adjusted EBITDA from continuing operations to EBITDA is set forth

in the Reconciliation of Adjustments table above. Adjusted EBITDA

from discontinued operations is computed by eliminating the

following from income (loss) from discontinued operations: income

taxes; depreciation and amortization; restructuring, impairment and

plant closing (credits) costs; losses on the sale of accounts

receivable to our securitization program; unallocated foreign

currency (gain) loss; gain on partial fire insurance settlement;

and (gain) loss on disposition of assets. The following table

provides a reconciliation of Adjusted EBITDA from discontinued

operations to income (loss) from discontinued operations: Three

months ended March 31, 2009 2008 ---- ---- Net Income (loss) from

discontinued operations, net of tax $3 $(1) Income tax expense 1 -

--- --- EBITDA from discontinued operations 4 (1) (Gain) loss on

disposition of assets (4) 1 --- --- Adjusted EBITDA from

discontinued operations $- $- === === Adjusted net income (loss)

from continuing operations is computed by eliminating the after tax

impact of the following items from net income (loss) attributable

to Huntsman Corporation: loss (income) from discontinued

operations; restructuring, impairment and plant closing (credits)

costs; merger associated income and expense; unallocated foreign

currency (gain) loss; certain legal and contract settlements;

losses on the early extinguishment of debt; extraordinary loss

(gain) on the acquisition of a business; and loss (gain) on

dispositions of assets. The reconciliation of Adjusted net income

(loss) from continuing operations to net income (loss) attributable

to Huntsman Corporation common stockholders is set forth in the

Reconciliation of Adjustments table above. Adjusted net income

(loss) from discontinued operations is computed by eliminating the

after tax impact of the following items from income (loss) from

discontinued operations: restructuring, impairment and plant

closing (credits) costs; gain on partial fire insurance settlement;

and (gain) loss on the disposition of assets. The reconciliation of

Adjusted net income (loss) from discontinued operations to net

income (loss) available to common stockholders is set forth in the

Reconciliation of Adjustments table above. DATASOURCE: Huntsman

Corporation CONTACT: Media, Russ Stolle, +1-281-719-6624, or

Investor Relations, Kurt Ogden, +1-801-584-5959, both of Huntsman

Corporation Web Site: http://www.huntsman.com/

Copyright

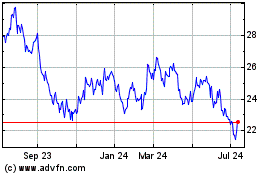

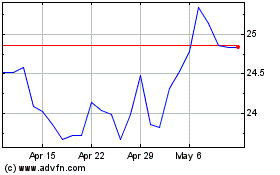

Huntsman (NYSE:HUN)

Historical Stock Chart

From May 2024 to Jun 2024

Huntsman (NYSE:HUN)

Historical Stock Chart

From Jun 2023 to Jun 2024