Northrop Grumman, General Dynamics Bolster Full-Year Profit Forecasts -- 3rd Update

July 24 2019 - 7:55PM

Dow Jones News

By Dave Sebastian

Northrop Grumman Corp. and General Dynamics Corp., two of the

largest aerospace-and-defense companies, raised their profit

outlooks for the year as they posted second-quarter results that

beat expectations.

Northrop Grumman logged a profit of $861 million, a 9.1% rise

from the same quarter last year. Per-share earnings were $5.06.

Analysts polled by FactSet had expected $4.68 a share.

Shares in Northrop Grumman rose 5.9% on Wednesday.

Overall sales at Northrop Grumman increased 19% from a year

earlier to $8.46 billion, beating analysts' estimates of $8.41

billion.

Its aerospace-systems business booked $3.39 billion in sales, up

1.6%, partly driven by increased production of the F-35 jet

fighter, for which Northrop Grumman provides center-fuselage and

other components. Sales in innovation systems more than tripled

from last year to $1.5 billion, as the company sold more

military-aerospace structures, launch vehicles and tactical

missiles.

The company said its order backlog rose 10% to $63 billion.

For the full year, Northrop Grumman expects adjusted earnings

per share of $19.30 to $19.55, up from the company's previous

outlook of $18.90 to $19.30.

General Dynamics reported a profit of $806 million, up 2.5% from

a year earlier. Earnings were $2.77 a share, above the $2.68 a

share that analysts had expected. Shares rose less than 1% on

Wednesday.

Revenue at General Dynamic rose 4% to $9.56 billion. Its

aerospace segment recorded $2.14 billion in revenue, up 13%. Sales

for its combat-, mission- and marine-systems segments also rose,

though information-technology sales declined.

General Dynamics said its order backlog totaled $67.65 billion,

up 2.1% from the same quarter last year.

The company boosted its profit guidance to a range of $11.85 to

$11.90 a share, compared with the previous midpoint of $11.65 and a

consensus of $11.76.

Hunter Keay, managing director and senior analyst at Wolfe

Research, said aerospace-and-defense companies are relieved that

lawmakers on Monday reached a deal to increase federal spending to

$2.7 trillion over two years.

"The spending environment globally has always been driven by

threats, and state-level threats are clearly on the forefront," Mr.

Keay said. "It's a bipartisan issue -- that is, national security.

Booking momentum is robust, cash flow is very solid, and we've seen

pretty solid commentary across the board on margins."

(END) Dow Jones Newswires

July 24, 2019 19:40 ET (23:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

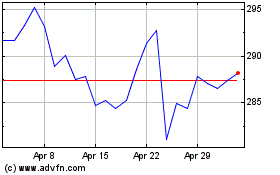

General Dynamics (NYSE:GD)

Historical Stock Chart

From Mar 2024 to Apr 2024

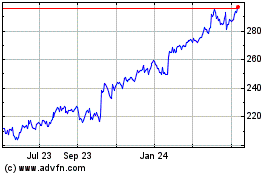

General Dynamics (NYSE:GD)

Historical Stock Chart

From Apr 2023 to Apr 2024