Filed by Frank’s International N.V.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Frank’s International N.V.

Commission File No.: 001-36053

From: Message from Mike Jardon

To: All Frank’s and Expro Employees

Subject: New Expro update

Ladies and gentlemen,

I am pleased to inform you that we have reached another important milestone as we draw closer to becoming new Expro. Frank’s has now posted a “proxy statement” to its shareholders following receipt of approval from the U.S. Securities and Exchange Commission (SEC).

The proxy statement provides details of the merger to Frank’s shareholders and sets out the date for a meeting (10th September) at which Frank’s shareholders will be asked to approve the merger. In addition to approval from the SEC, all the required regulatory approvals have also been received.

For those that have FI shares, I would encourage you to put your vote in via Merrill’s website at benefitsonline.com. Once signed in, select your IIA profile, login to your brokerage account and navigate to Shareholder Documents (bottom of the page) where you can select the AGM materials and proceed to vote.

The combination is a strategic and beneficial move and positions Frank’s and Expro for growth and scale that builds upon both companies’ legacy.

It is still anticipated that the transaction will close by the end of Q3. Following the close, the company stock will trade on the New York Stock Exchange with the ticker “XPRO”.

We are working hard to develop a new Expro that is well positioned for success. Capitalizing on the strengths of both companies, we are creating a brand that allows us to advance, while leveraging our rich heritage.

I will update you as we make further progress. Thank you to everyone for their continued hard work and commitment.

Mike Jardon

CEO, Expro

No Offer or Solicitation

This communication relates to a proposed merger and related transactions (the “Transactions”) between Frank’s International N.V. (“Frank’s”) and Expro Group Holdings International Limited (“Expro”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transactions or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information

In connection with the Transactions, Frank’s has filed a registration statement on Form S-4 (the “Registration Statement”) and a definitive proxy statement/prospectus with the U.S. Securities and Exchange Commission (the “SEC”). In addition, Frank’s intends to file other relevant materials with the SEC regarding the Transactions. SHAREHOLDERS OF FRANK’S AND EXPRO ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS. Such shareholders are able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Frank’s and Expro filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Additional information is available on the Frank’s website, www.franksinternational.com.

Participants in the Solicitation

Frank’s and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Frank’s in connection with the Transactions. Expro and its officers and directors may also be deemed participants in such solicitation. Information regarding Frank’s directors and executive officers is contained in the proxy statement/prospectus, Frank’s Annual Report on Form 10-K for the year ended December 31, 2020, which was filed with the SEC on March 1, 2021, and certain of its Current Reports on Form 8-K. You can obtain free copies of these documents at the SEC’s website at http://www.sec.gov or by accessing Frank’s website at http://www.franksinternational.com. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the Registration Statement and the proxy statement/prospectus and will be contained in other relevant materials to be filed with the SEC when they become available.

Forward-Looking Statements and Cautionary Statements

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Expro or Frank’s expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance that convey the uncertainty of future events or outcomes identify the forward-looking statements, although not all forward-looking statements contain such identifying words. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include, but are not limited to, statements, estimates and projections regarding the Transactions, pro forma descriptions of the combined company, anticipated or expected revenues, EBITDA, synergies or cost-savings, operations, integration and transition plans, opportunities and anticipated future performance. These statements are based on certain assumptions made by Frank’s and Expro based on management’s experience, expectations and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Forward-looking statements are not guarantees of performance.

Although Frank’s and Expro believe the expectations reflected in these forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Frank’s, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Such risks and uncertainties include the risk of the failure to obtain the required votes of Frank’s and Expro’s shareholders; the timing to consummate the Transactions; the risk that the conditions to closing of the Transactions may not be satisfied or that the closing of the Transactions otherwise does not occur; the failure to close the Transactions on the anticipated terms, including the anticipated tax treatment; the risk that a regulatory approval, consent or authorization that may be required for the Transactions is not obtained in a timely manner or at all, or is obtained subject to conditions that are not anticipated; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement relating to the Transactions; unanticipated difficulties or expenditures relating to the Transactions; the diversion of management time on Transactions-related matters; the ultimate timing, outcome and results of integrating the operations of Frank’s and Expro; the effects of the business combination of Frank’s and Expro following the consummation of the Transactions, including the combined company’s future financial condition, results of operations, strategy and plans; the risk that any announcements relating to the Transactions could have adverse effects on the market price of Frank’s common stock; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Transactions; expected synergies and other benefits from the Transactions; the potential for litigation related to the Transactions; results of litigation, settlements and investigations; actions by third parties, including governmental agencies; volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for Frank’s and Expro’s services and their associated effect on rates, utilization, margins and planned capital expenditures; unique risks associated with offshore operations; global economic conditions; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation, including legislative and regulatory initiatives addressing global climate change or other environmental concerns; investment in and development of competing or alternative energy sources; ability to retain and hire key personnel, including management and field personnel; the length of time it will take for the United States and the rest of the world to slow the spread of the COVID-19 virus to the point where applicable authorities ease current restrictions on various commercial and economic activities; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Expro’s or Frank’s control, including those detailed in Frank’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Frank’s website at http://www.franksinternational.com and on the SEC’s website at http://www.sec.gov. Any forward-looking statement speaks only as of the date on which such statement is made, and Expro and Frank’s undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

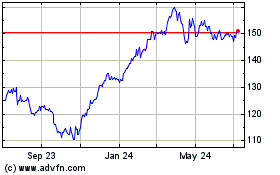

Fiserv (NYSE:FI)

Historical Stock Chart

From Aug 2024 to Sep 2024

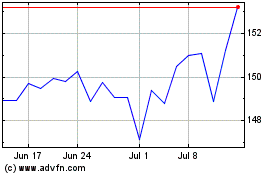

Fiserv (NYSE:FI)

Historical Stock Chart

From Sep 2023 to Sep 2024