First Trust Advisors L.P. Announces Portfolio Manager Conference Call for First Trust Mortgage Income Fund

September 27 2016 - 4:19PM

Business Wire

First Trust Advisors L.P. (“FTA”) announced today that First

Trust Mortgage Income Fund (NYSE: FMY) (the “Fund”) intends to host

a conference call with The Mortgage Securities Team of First Trust,

the Fund’s portfolio manager, on Tuesday,

October 11, 2016 at 4:15 P.M. Eastern Time. The purpose

of the call is to hear the portfolio management team provide an

update for the Fund and the Market.

- Dial-in Number: (800) 319-9003;

International (719) 325-2137; and Passcode # 835234. Please call 10

to 15 minutes before the scheduled start of the

teleconference.

- Telephone Replay: (888) 203-1112;

International (719) 457-0820; and Passcode # 7552246. The replay

will be available after the call until 11:59 P.M. Eastern Time on

Friday, November 11, 2016.

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $99 billion

as of August 31, 2016 through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

If you have questions about the Fund that you would like

answered on the call, please email your questions to

cefquestions@ftadvisors.com in advance of the call and refer to

FMY, by Friday, October 7, 2016, 4:15 P.M. Eastern Time.

Principal Risk Factors: Investment return and market value of an

investment in the Fund will fluctuate. Shares, when sold, may be

worth more or less than their original cost.

The debt securities in which the Fund invests are subject to

certain risks, including issuer risk, reinvestment risk, prepayment

risk, credit risk, and interest rate risk. Issuer risk is the risk

that the value of fixed-income securities may decline for a number

of reasons which directly relate to the issuer. Reinvestment risk

is the risk that income from the Fund's portfolio will decline if

the Fund invests the proceeds from matured, traded or called bonds

at market interest rates that are below the Fund portfolio's

current earnings rate. Prepayment risk is the risk that, upon a

prepayment, the actual outstanding debt on which the Fund derives

interest income will be reduced. Credit risk is the risk that an

issuer of a security will be unable or unwilling to make dividend,

interest and/or principal payments when due and that the value of a

security may decline as a result. Interest rate risk is the risk

that fixed-income securities will decline in value because of

changes in market interest rates.

A portion of the Fund's managed assets may be invested in

subordinated classes of mortgage-backed securities. Such

subordinated classes are subject to a greater degree of non-payment

risk than are senior classes of the same issuer or agency.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

prospectus, shareholder reports, and other regulatory filings.

The Fund’s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160927006677/en/

First Trust Advisors L.P.Jeff Margolin, (630) 915-6784

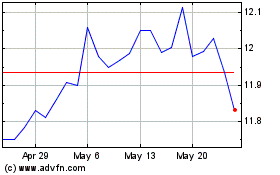

First Trust Mortgage Inc... (NYSE:FMY)

Historical Stock Chart

From May 2024 to Jun 2024

First Trust Mortgage Inc... (NYSE:FMY)

Historical Stock Chart

From Jun 2023 to Jun 2024