false00018361760001836176us-gaap:CommonClassAMember2023-08-142023-08-1400018361762023-08-142023-08-140001836176fath:ClassACommonUnitsMember2023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 14, 2023

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39994 |

|

40-0023833 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

NYSE |

Warrants to purchase Class A common stock |

|

FATH.WS |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

er next two years Expanded mid-volume production of existing program $1.7 million in 2021; expect $4-$8 million in 2022 orders Prototype with mid-volume production follow-on $4.5 million over three-month period New cross-sell of sheet metal low-volume production $450k in 2021; expect over $1.5 million in 2022 orders Prototype & low-volume production Global healthcare company Global semiconductor company Disruptive electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Global leader in gas measurement instruments and technologies Leading subsea technology company $550K production order Expansion to higher volume production of existing program New Strategic Accounts Existing Strategic Accounts

Statement (preliminary unaudited) Repor

|

|

Item 2.02. |

Results of Operations and Financial Condition. |

On August 14, 2023, Fathom Digital Manufacturing Corporation (“Fathom”) issued a press release announcing its financial results for the quarter ended June 30, 2023. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 2.02 of this Current Report and in Exhibit 99.1 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Exhibit 99.1 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.1 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

|

|

Item 7.01. |

Regulation FD Disclosure. |

Fathom is posting an earnings presentation for the quarter ended June 30, 2023 to its website at https://investors.fathommfg.com. A copy of the presentation is being furnished herewith as Exhibit 99.2. Fathom will use the presentation during its conference call on August 14, 2023 and also may use the presentation from time to time in conversations with analysts, investors and others.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 7.01 of this Current Report and in Exhibit 99.2 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

The information contained in Exhibit 99.2 is summary information that is intended to be considered in the context of Fathom’s filings with the SEC. Fathom undertakes no duty or obligation to publicly update or revise the information contained in this Current Report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Exhibit 99.2 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.2 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s preliminary unaudited results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

FATHOM DIGITAL MANUFACTURING CORPORATION |

|

|

By: |

|

/s/ Mark Frost |

Name: |

|

Mark Frost |

Title: |

|

Chief Financial Officer |

Date: August 14, 2023

Exhibit 99.1

Fathom Digital Manufacturing Reports Second Quarter 2023 Financial Results

Second Quarter 2023 Highlights

•Revenue totaled $34.5 million

•Total orders were $38.0 million

•Net loss totaled $(7.3) million; Adjusted net loss1 was $(5.7) million

•Adjusted EBITDA1 totaled $4.8 million, representing an Adjusted EBITDA margin1 of 14.0%

First Half 2023 Highlights

•Revenue totaled $69.5 million

•Total orders were $72.6 million

•Net loss totaled $(8.6) million; adjusted net loss1 totaled $(11.2) million

•Adjusted EBITDA1 was $8.9 million, representing an Adjusted EBITDA margin1 of 12.8%

HARTLAND, Wis., August 14, 2023 -- Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced financial results for the second quarter and six months ended June 30, 2023.

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

($ in thousands) |

6/30/2023 |

6/30/2022 |

|

6/30/2023 |

6/30/2022 |

Revenue |

$34,474 |

$41,985 |

|

$69,481 |

$82,526 |

Net income (loss) |

$(7,264) |

$34,284 |

|

$(8,595) |

$53,278 |

Adjusted net income (loss)1 |

$(5,669) |

$1,497 |

|

$(11,171) |

$696 |

Adjusted EBITDA1 |

$4,819 |

$8,973 |

|

$8,920 |

$14,846 |

Adjusted EBITDA margin1 |

14.0% |

21.4% |

|

12.8% |

18.0% |

1 See “Non-GAAP Financial Information.” Reconciliations of non-GAAP financial measures are included in the appendix.

“Fathom’s results for the second quarter were consistent with our expectations as we continue to realize cost savings from our previously announced optimization plan, partially offsetting the impact of a challenging macro environment,” said Ryan Martin, Fathom Chief Executive Officer. “During the quarter, we grew order volumes approximately 10% on a sequential basis, increasing our backlog, and improved sequentially our Adjusted EBITDA and Adjusted EBITDA margin by 17.5% and 230 basis points, respectively. Our focus remains on fully leveraging our comprehensive capabilities to meet the high-mix, low-to-mid volume production needs of enterprise-level customers and driving profitable, long-term growth.”

Summary of Financial Results

Revenue for the second quarter of 2023 was $34.5 million compared to $42.0 million in the second quarter of 2022, a decrease of 17.9% primarily due to lower production volumes driven by the softer macroeconomic environment, primarily impacting Fathom’s production precision sheet metal product line. For the six months ended June 30, 2023, revenue totaled $69.5 million versus $82.5 million for the six months ended June 30, 2022.

Gross profit for the second quarter of 2023 totaled $10.5 million, or 30.6% of revenue, compared to $15.5 million, or 37.0% of revenue, in the second quarter of 2022. Gross profit for the six months ended June 30, 2023 was $22.5 million, or 32.4% of revenue, compared to $27.5 million, or 33.4% of revenue, which includes approximately $3.2 million in non-cash purchase accounting adjustments, for the same period in 2022.

Net loss for the second quarter of 2023 was $(7.3) million compared to net income of $34.3 million in the second quarter of 2022. Excluding the revaluation of Fathom warrants and earnout shares, stock compensation expense, optimization plan expenses, and other costs, Fathom reported an adjusted net loss in the second quarter of 2023 totaling $(5.7) million compared to adjusted net income of $1.5 million for the same period in 2022.

Net loss for the six months ended June 30, 2023 was $(8.6) million compared to net income of $53.3 million for the same period in 2022. For the six months ended June 30, 2023, the adjusted net loss was $(11.2) million compared to adjusted net income of $0.7 million for the same period in 2022.

Adjusted EBITDA for the second quarter of 2023 totaled $4.8 million versus $9.0 million for the same period in 2022 primarily due to lower volume leverage, partially offset by cost savings from the execution of Fathom’s optimization plan. The Adjusted EBITDA margin in the quarter was 14.0% compared to 21.4% in the second quarter of 2022.

For the six months ended June 30, 2023, Adjusted EBITDA and Adjusted EBITDA margin were $8.9 million and 12.8%, respectively, compared to $14.8 million and 18.0%, respectively, for the same period in 2022.

Conference Call

Fathom will host a conference call on Monday, August 14, 2023 at 8:30 am Eastern Time to discuss the results for the second quarter 2023 and provide the company’s outlook for the third quarter 2023. The dial-in number for callers in the U.S. is +1-833-470-1428 and the dial-in number for international callers is +1-404-975-4839. The access code for all callers is 900561. The conference call will be broadcast live over the Internet and include a slide presentation. To access the webcast and supporting materials, please visit the investor relations section of Fathom’s website at https://investors.fathommfg.com.

A replay of the conference call can be accessed through August 21, 2023, by dialing +1-866-813-9403 (US) or +1-929-458-6194 (international), and then entering the access code 173691. The webcast will also be archived on Fathom’s website.

About Fathom Digital Manufacturing

Fathom is one of the largest on-demand digital manufacturing platforms in North America, serving the comprehensive product development and low- to mid-volume manufacturing needs of some of the largest and most innovative companies in the world. With more than 25 quick turn manufacturing processes combined with an extensive national footprint, Fathom seamlessly blends in-house capabilities across plastic and metal additive technologies, CNC machining, injection molding and tooling, sheet metal fabrication, design and engineering, and more. Fathom has more than 35 years of industry experience and is at the forefront of the Industry 4.0 digital manufacturing revolution, serving clients in the technology, defense, aerospace, medical, automotive, IOT sectors, and others. Fathom's certifications include: ITAR Registered, ISO 9001:2015 Design Certified, ISO 9001:2015, ISO 13485:2016, AS9100:2016, and NIST 800-171. To learn more, visit https://fathommfg.com/.

Forward-Looking Statements

Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II; changes in general economic conditions, including as a result of the COVID-19 pandemic or any future outbreaks of other highly infectious or contagious disease; the implementation of our optimization plan could result in greater costs

and fewer benefits than we anticipate; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Fathom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on April 7, 2023, as amended on May 1, 2023, as well as Fathom’s other filings with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Fathom undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law.

Non-GAAP Financial Information

This press release includes Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

We define and calculate Adjusted Net Income as net income (loss) before the impact of any change in the estimated fair value of the company’s warrants or earnout shares, tax receivable agreement liability, optimization plan expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. We define and calculate Adjusted EBITDA as net income (loss) before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: change in the estimated fair value of the company’s warrants or earnout shares, tax receivable agreement liability, optimization plan expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of optimization plan expenses), non-cash (for example, in the case of depreciation, amortization, goodwill impairment, and stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense). Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments.

Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom's control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company's results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be

considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity.

Contact:

Michael Cimini

Director, Investor Relations

Fathom Digital Manufacturing

(262) 563-5575

michael.cimini@fathommfg.com

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

|

|

|

June 30, 2023

(Unaudited) |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash |

|

$ |

10,733 |

|

|

$ |

10,713 |

|

Accounts receivable, net |

|

|

24,496 |

|

|

|

28,641 |

|

Inventory |

|

|

17,177 |

|

|

|

15,718 |

|

Prepaid expenses and other current assets |

|

|

2,618 |

|

|

|

3,588 |

|

Total current assets |

|

|

55,024 |

|

|

|

58,660 |

|

Property and equipment, net |

|

|

48,384 |

|

|

|

47,703 |

|

Right-of-use lease assets, net |

|

|

12,034 |

|

|

|

12,565 |

|

Intangible assets, net |

|

|

242,342 |

|

|

|

251,412 |

|

Other non-current assets |

|

|

144 |

|

|

|

175 |

|

Total assets |

|

$ |

357,928 |

|

|

$ |

370,515 |

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

10,311 |

|

|

$ |

7,982 |

|

Accrued expenses |

|

|

8,155 |

|

|

|

8,176 |

|

Current lease liability |

|

|

2,233 |

|

|

|

2,374 |

|

Other current liabilities |

|

|

3,478 |

|

|

|

4,828 |

|

Current portion of debt, net |

|

|

49,167 |

|

|

|

42,744 |

|

Total current liabilities |

|

|

73,344 |

|

|

|

66,104 |

|

Long-term debt, net |

|

|

109,551 |

|

|

|

114,327 |

|

Fathom earnout shares liability |

|

|

808 |

|

|

|

5,960 |

|

Sponsor earnout shares liability |

|

|

137 |

|

|

|

930 |

|

Warrant liability |

|

|

600 |

|

|

|

2,780 |

|

Payable to related parties pursuant to the tax receivable agreement (includes $4,050 and $4,000 at fair value, respectively) |

|

|

28,263 |

|

|

|

25,360 |

|

Noncurrent lease liability |

|

|

10,285 |

|

|

|

11,083 |

|

Total liabilities |

|

|

222,988 |

|

|

|

226,544 |

|

Commitments and Contingencies: |

|

|

|

|

|

|

Contingently Redeemable Preferred Equity: |

|

|

|

|

|

|

Redeemable non-controlling interest in Fathom OpCo |

|

|

80,059 |

|

|

|

92,207 |

|

Shareholders' Equity: |

|

|

|

|

|

|

Class A common stock, $0.0001 par value; 300,000,000 shares authorized; issued and outstanding 70,085,417 and 65,808,764 shares as of June 30, 2023 and December 31, 2022, respectively |

|

|

7 |

|

|

|

7 |

|

Class B common stock, $0.0001 par value; 180,000,000 shares authorized; issued and outstanding 66,547,589 and 70,153,051 shares as of June 30, 2023 and December 31, 2022, respectively |

|

|

7 |

|

|

|

7 |

|

Additional paid-in-capital |

|

|

592,068 |

|

|

|

587,941 |

|

Accumulated other comprehensive loss |

|

|

(107 |

) |

|

|

(107 |

) |

Accumulated deficit |

|

|

(537,094 |

) |

|

|

(536,084 |

) |

Shareholders’ equity attributable to Fathom Digital Manufacturing Corporation |

|

|

54,881 |

|

|

|

51,764 |

|

Total Liabilities, Shareholders’ Equity, and Redeemable Non-Controlling Interest |

|

$ |

357,928 |

|

|

$ |

370,515 |

|

Consolidated Statements of Comprehensive Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ 34,474 |

|

|

$ 41,985 |

|

$ 69,481 |

|

|

$ 82,526 |

Cost of revenue |

|

23,940 |

|

|

26,437 |

|

47,002 |

|

|

54,981 |

Gross profit |

|

10,534 |

|

|

15,548 |

|

22,479 |

|

|

27,545 |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative |

|

9,445 |

|

|

11,617 |

|

20,217 |

|

|

26,381 |

Depreciation and amortization |

|

4,643 |

|

|

4,452 |

|

9,218 |

|

|

8,968 |

Restructuring |

|

1,406 |

|

|

- |

|

2,056 |

|

|

- |

Total operating expenses |

|

15,494 |

|

|

16,069 |

|

31,491 |

|

|

35,349 |

Operating loss |

|

(4,960) |

|

|

(521) |

|

(9,012) |

|

|

(7,804) |

Interest expense and other (income) expense |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

3,959 |

|

|

1,858 |

|

7,429 |

|

|

3,332 |

Other expense |

|

65 |

|

|

129 |

|

138 |

|

|

195 |

Other income |

|

(1,784) |

|

|

(36,108) |

|

(8,103) |

|

|

(63,223) |

Total interest expense and other (income) expense, net |

|

2,240 |

|

|

(34,121) |

|

(536) |

|

|

(59,696) |

Net income (loss) before income tax |

|

$ (7,200) |

|

|

$ 33,601 |

|

$ (8,476) |

|

|

$ 51,892 |

Income tax (benefit) expense |

|

64 |

|

|

(683) |

|

119 |

|

|

(1,386) |

Net income (loss) |

|

$ (7,264) |

|

|

$ 34,284 |

|

$ (8,595) |

|

|

$ 53,278 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average Class A common shares outstanding |

|

|

|

|

|

|

|

|

|

|

Basic |

|

69,703,407 |

|

|

52,259,885 |

|

68,382,896 |

|

|

51,530,961 |

Diluted |

|

136,302,053 |

|

|

135,524,773 |

|

136,213,635 |

|

|

135,305,168 |

Q2 2023 Revenue by Product Line

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

($ in thousands) |

6/30/2023 |

% Revenue |

6/30/2022 |

% Revenue |

% Change |

Revenue By Product Line |

|

|

|

|

|

Additive manufacturing |

$3,287 |

9.5% |

$4,410 |

10.5% |

-25.5% |

Injection molding |

$6,064 |

17.6% |

$7,093 |

16.9% |

-14.5% |

CNC machining |

$13,240 |

38.4% |

$14,584 |

34.7% |

-9.2% |

Precision sheet metal |

$10,164 |

29.5% |

$14,751 |

35.1% |

-31.1% |

Other revenue |

$1,719 |

5.0% |

$1,147 |

2.7% |

49.9% |

Total |

$34,474 |

100.0% |

$41,985 |

100.0% |

-17.9% |

|

|

|

|

|

|

Six Months 2023 Revenue by Product Line

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

($ in thousands) |

6/30/2023 |

% Revenue |

6/30/2022 |

% Revenue |

% Change |

Revenue By Product Line |

|

|

|

|

|

Additive manufacturing |

$6,875 |

9.9% |

$8,559 |

10.4% |

-19.7% |

Injection molding |

$10,743 |

15.5% |

$13,908 |

16.9% |

-22.8% |

CNC machining |

$27,470 |

39.5% |

$27,910 |

33.8% |

-1.6% |

Precision sheet metal |

$20,547 |

29.6% |

$29,434 |

35.7% |

-30.2% |

Other revenue |

$3,846 |

5.5% |

$2,715 |

3.3% |

41.7% |

Total |

$69,481 |

100.0% |

$82,526 |

100.0% |

-15.8% |

|

|

|

|

|

|

1 Represents the impacts from the change in fair value related to the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 2 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for acquisitions and severance.

Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

Net (loss) income |

|

$ (7,264) |

|

$ 34,284 |

|

$ (8,595) |

|

$ 53,278 |

Stock compensation |

|

1,239 |

|

1,796 |

|

2,332 |

|

3,926 |

Inventory step-up amortization |

|

- |

|

- |

|

- |

|

3,241 |

Restructuring expense |

|

1,406 |

|

- |

|

2,056 |

|

- |

Change in fair value of warrant liability(1) |

|

(400) |

|

(12,500) |

|

(2,180) |

|

(20,600) |

Change in fair value of earnout share liabilities(1) |

|

(1,115) |

|

(22,930) |

|

(5,945) |

|

(41,900) |

Change in fair value of tax receivable agreement(1) |

|

(250) |

|

(200) |

|

50 |

|

(200) |

Integration, non-recurring, non-operating, cash, and non-cash costs(2) |

|

715 |

|

1,047 |

|

1,111 |

|

2,951 |

Adjusted net loss |

|

$ (5,669) |

|

$ 1,497 |

|

$ (11,171) |

|

$ 696 |

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

Net income (loss) |

|

$ (7,264) |

|

$ 34,284 |

|

$ (8,595) |

|

$ 53,278 |

Depreciation and amortization |

|

6,465 |

|

5,996 |

|

12,543 |

|

12,204 |

Interest expense, net |

|

3,959 |

|

1,858 |

|

7,429 |

|

3,332 |

Income tax expense (benefit) |

|

64 |

|

(378) |

|

119 |

|

(1,386) |

Stock compensation |

|

1,239 |

|

1,796 |

|

2,332 |

|

3,926 |

Inventory step-up amortization |

|

- |

|

- |

|

- |

|

3,241 |

Restructuring expense |

|

1,406 |

|

- |

|

2,056 |

|

- |

Change in fair value of warrant liability(1) |

|

(400) |

|

(12,500) |

|

(2,180) |

|

(20,600) |

Change in fair value of earnout shares liability(1) |

|

(1,115) |

|

(22,930) |

|

(5,945) |

|

(41,900) |

Change in fair value of tax receivable agreement(1) |

|

(250) |

|

(200) |

|

50 |

|

(200) |

|

|

|

|

|

|

|

|

|

Integration, non-recurring, non-operating, cash, and non-cash costs(2) |

|

715 |

|

1,047 |

|

1,111 |

|

2,951 |

Adjusted EBITDA |

|

$ 4,819 |

|

$ 8,973 |

|

$ 8,920 |

|

$ 14,846 |

|

|

|

|

|

|

|

|

|

1 Represents the impacts from the change in fair value related to the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 2 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for acquisitions and severance.

Q2 2023 Financial Results�August 14, 2023

Forward-Looking Statements�Certain statements made in this presentation are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II; changes in general economic conditions, including as a result of the COVID-19 pandemic or any future outbreaks of other highly infectious or contagious disease; the implementation of our optimization plan could result in greater costs and fewer benefits than we anticipate; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Fathom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on April 7, 2023, as amended on May 1, 2023, as well as Fathom’s other filings with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this presentation. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Fathom undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law. Non-GAAP Information �This presentation includes Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. We define and calculate Adjusted Net Income as net income (loss) before the impact of any change in the estimated fair value of the company’s warrants or earnout shares, tax receivable agreement liability, optimization plan expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this presentation. We define and calculate Adjusted EBITDA as net income (loss) before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: change in the estimated fair value of the company’s warrants or earnout shares, tax receivable agreement liability, optimization plan expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this presentation. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of optimization plan expenses), non-cash (for example, in the case of depreciation, amortization, goodwill impairment, and stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense). Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom's control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company's results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity. Disclaimers

Q2 2022 Highlights 1 Adjusted EBITDA is a non-GAAP financial measure. Reconciliations of non-GAAP financial measures are included in the Appendix. Total Orders: $38.0 million Revenue: $34.5 million Adjusted EBITDA1: $4.8 million Fathom’s Q2 results were consistent with expectations driven by increasing momentum for new orders and continued execution of the company’s optimization plan

Key Recent Business Wins Customer / Industry Order Size Technologies $1.2 million CNC machining $1.8 million Injection molding and cast urethane $1.8 million Injection molding and additive manufacturing $1.7 million Sheet metal and CNC machining $760K Additive manufacturing Medical technology provider Global semiconductor company Electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Market leader in nanotechnology Global technology company $2.5 million Managed services agreement

Q2 2023 Revenue Q2 2023 revenue declined 17.9%, reflecting ongoing softness in macro environment Focus remains on growing strategic accounts by leveraging Fathom’s comprehensive capabilities and deep technical expertise, providing a differentiated customer experience Fathom’s strategic accounts have demonstrated continued growth since going public

Q2 2023 Adjusted EBITDA1 1 Adjusted EBITDA is a non-GAAP financial measure. Reconciliation of GAAP net income (loss) to Adjusted EBITDA is included in the Appendix. 2 Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. Q2 performance reflects lower volume leverage, partially offset by reduced cost structure Realized Q2 cost savings of ~$4.3 million, bringing the cumulative amount to ~$9.5 million SG&A as percentage of sales declined to 27.4% in Q2 2023 due to restructuring efforts Q2 2023 Adjusted EBITDA margin2 of 14.0% improved 230 basis points sequentially

Liquidity and Cash Flow Availability Liquidity ($ in millions) 6/30/2023 Term debt $118.8 Secured revolving credit facility $42.0 Gross debt $160.8 Cash and cash equivalents $10.7 Net debt $150.1 Undrawn revolver commitments $8.0 Available liquidity $18.7 Cash Flow Summary ($ in millions) Q2 2023 Net cash provided by operations $1.7 Capital expenditures $1.1 Free operating cash flow $0.6 Available liquidity totaled $18.7 million as of 6/30/2023 Net debt was $150.1 million as of 6/30/2023 Net cash provided by operations totaled $1.7 million in Q2 2023 Capital expenditures lowered to $1.1 million in Q2 2023 Free operating cash flow totaled $0.6 million in Q2 2023

Financial Guidance 1 Source: Fathom’s third quarter 2023 forecast, as of August 14, 2023, reflects management projections and macroeconomic outlook. 2 Adjusted EBITDA is a non-GAAP financial measures. See Appendix for historical reconciliation of GAAP net income (loss) to Adjusted EBITDA. ($ in millions) Current Outlook1 Revenue $31.5 - $33.5 Adjusted EBITDA2 $3.5 - $4.5 Third Quarter 2023 Forecast

Summary Q2 results reflect positive momentum for new orders, up ~10% on a sequential basis 1 2 4 5 3 Ongoing execution of optimization plan led to sequential improvement in profitability Fathom is poised to capitalize on increased scalability as market conditions improve Maintain focus on increasing financial flexibility and improving capital structure Positive long-term fundamentals remain intact despite near-term macro headwinds

Appendix

Income Statement Three Months Ended Six Months Ended June 30, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Revenue $ 34,474 $ 41,985 $ 69,481 $ 82,526 Cost of revenue 23,940 26,437 47,002 54,981 Gross profit 10,534 15,548 22,479 27,545 Operating expenses Selling, general, and administrative 9,445 11,617 20,217 26,381 Depreciation and amortization 4,643 4,452 9,218 8,968 Restructuring 1,406 - 2,056 - Total operating expenses 15,494 16,069 31,491 35,349 Operating loss (4,960) (521) (9,012) (7,804) Interest expense and other (income) expense Interest expense 3,959 1,858 7,429 3,332 Other expense 65 129 138 195 Other income (1,784) (36,108) (8,103) (63,223) Total interest expense and other (income) expense, net 2,240 (34,121) (536) (59,696) Net income (loss) before income tax $ (7,200) $ 33,601 $ (8,476) $ 51,892 Income tax (benefit) expense 64 (683) 119 (1,386) Net income (loss) $ (7,264) $ 34,284 $ (8,595) $ 53,278 Weighted average Class A common shares outstanding Basic 69,703,407 52,259,885 68,382,896 51,530,961 Diluted 136,302,053 135,524,773 136,213,635 135,305,168

Revenue By Product Line Three Months Ended Six Months Ended ($ in thousands) 6/30/2023 % Revenue 6/30/2022 % Revenue % Change 6/30/2023 % Revenue 6/30/2022 % Revenue % Change Revenue By Product Line Additive manufacturing $3,287 9.5% $4,410 10.5% -25.5% $6,875 9.9% $8,559 10.4% -19.7% Injection molding $6,064 17.6% $7,093 16.9% -14.5% $10,743 15.5% $13,908 16.9% -22.8% CNC machining $13,240 38.4% $14,584 34.7% -9.2% $27,470 39.5% $27,910 33.8% -1.6% Precision sheet metal $10,164 29.5% $14,751 35.1% -31.1% $20,547 29.6% $29,434 35.7% -30.2% Other revenue $1,719 5.0% $1,147 2.7% 49.9% $3,846 5.5% $2,715 3.3% 41.7% Total $34,474 100.0% $41,985 100.0% -17.9% $69,481 100.0% $82,526 100.0% -15.8%

Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss) 1 Represents the impacts from the change in fair value related to the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 2 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for acquisitions and severance. Three Months Ended Six Months Ended June 30, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Net (loss) income $ (7,264) $ 34,284 $ (8,595) $ 53,278 Stock compensation 1,239 1,796 2,332 3,926 Inventory step-up amortization - - - 3,241 Restructuring expense 1,406 - 2,056 - Change in fair value of warrant liability(1) (400) (12,500) (2,180) (20,600) Change in fair value of earnout share liabilities(1) (1,115) (22,930) (5,945) (41,900) Change in fair value of tax receivable agreement(1) (250) (200) 50 (200) Integration, non-recurring, non-operating, cash, and non-cash costs(2) 715 1,047 1,111 2,951 Adjusted net loss $ (5,669) $ 1,497 $ (11,171) $ 696

Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA 1 Represents the impacts from the change in fair value related to the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 2 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for acquisitions and severance. Three Months Ended Six Months Ended June 30, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Net income (loss) $ (7,264) $ 34,284 $ (8,595) $ 53,278 Depreciation and amortization 6,465 5,996 12,543 12,204 Interest expense, net 3,959 1,858 7,429 3,332 Income tax expense (benefit) 64 (378) 119 (1,386) Stock compensation 1,239 1,796 2,332 3,926 Inventory step-up amortization - - - 3,241 Restructuring expense 1,406 - 2,056 - Change in fair value of warrant liability(1) (400) (12,500) (2,180) (20,600) Change in fair value of earnout shares liability(1) (1,115) (22,930) (5,945) (41,900) Change in fair value of tax receivable agreement(1) (250) (200) 50 (200) Integration, non-recurring, non-operating, cash, and non-cash costs(2) 715 1,047 1,111 2,951 Adjusted EBITDA $ 4,819 $ 8,973 $ 8,920 $ 14,846

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fath_ClassACommonUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

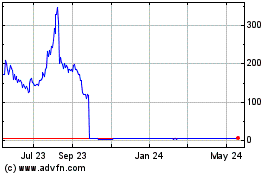

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Mar 2024 to Apr 2024

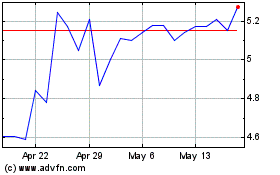

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Apr 2023 to Apr 2024