0001836176false00018361762023-08-042023-08-040001836176fath:ClassACommonUnitsMember2023-08-042023-08-040001836176us-gaap:CommonClassAMember2023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 4, 2023

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39994 |

|

40-0023833 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

NYSE |

Warrants to purchase Class A common stock |

|

FATH.WS |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

er next two years Expanded mid-volume production of existing program $1.7 million in 2021; expect $4-$8 million in 2022 orders Prototype with mid-volume production follow-on $4.5 million over three-month period New cross-sell of sheet metal low-volume production $450k in 2021; expect over $1.5 million in 2022 orders Prototype & low-volume production Global healthcare company Global semiconductor company Disruptive electric vehicle manufacturer Global leader in mobile robotics 1 2 3 4 5 6 Global leader in gas measurement instruments and technologies Leading subsea technology company $550K production order Expansion to higher volume production of existing program New Strategic Accounts Existing Strategic Accounts

Statement (preliminary unaudited) Repor

|

|

Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 4, 2023 (the “Effective Date”), Fathom Digital Manufacturing Corporation (the “Company”) entered into a consulting agreement (the “Consulting Agreement”) with Richard Stump, the former Chief Commercial Officer of the Company and a named executive officer for the fiscal year ended December 31, 2022. Under the Consulting Agreement, Mr. Stump will serve as a Technical Consultant providing additive & advanced technology and digital strategy advising services, from the Effective Date until February 28, 2024 (the “Separation Date”). The Consulting Agreement supersedes Mr. Stump’s previously disclosed Separation Date of September 30, 2023.

In exchange for the consulting services, Mr. Stump will receive an hourly fee equal to $168 per hour, continued vesting of incentive equity awards, and eligibility to participate in the same employee benefits generally available to other peer employees.

Pursuant to the Consulting Agreement, Mr. Stump will be an at-will employee and either the Company or Mr. Stump may terminate the Consulting Agreement prior to the Separation Date by providing 10 days’ prior notice. The Consulting Agreement does not provide for any severance or other termination rights. Mr. Stump will continue to be subject to the restrictive covenants contained within the Company’s Executive Restrictive Covenant Agreement.

The foregoing description of the Consulting Agreement is a summary only and is qualified in its entirety by reference to its full text, a copy of which is attached to this Current Report as Exhibit 10.1 and incorporated herein by reference.

|

|

Item 9.01. |

Financial Statement and Exhibits |

(d) Exhibits.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

FATHOM DIGITAL MANUFACTURING CORPORATION |

|

|

By: |

|

/s/ Mark Frost |

Name: |

|

Mark Frost |

Title: |

|

Chief Financial Officer |

Date: August 10, 2023

Exhibit 10.1

Execution Version

CONSULTING Agreement

THIS CONSULTING AGREEMENT (this “Agreement”), is made as of August 4, 2023 (the “Effective Date”), by and between Fathom Digital Manufacturing Corporation (the “Company”) and Richard Stump (“Consultant”).

WHEREAS, the Company and Consultant are parties to that certain Offer Letter, dated as of December 23, 2021 (the “Offer Letter”);

WHEREAS, Consultant and the Company intend that Consultant’s employment with the Company shall transfer from that of a salaried, exempt employee to an hourly, nonexempt employee as of the Effective Date; and

WHEREAS, the Company desires to engage the services of Consultant to provide certain services to the Company and its respective subsidiaries (the “Company Group”) as a part-time employee and Consultant desires to be engaged by the Company upon the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the premises and the mutual promises contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Consultant hereby agree as follows:

1.Term. This Agreement will commence on the Effective Date and will continue until February 28, 2024 (the “Initial Term”). The Company shall have the option, but not the obligation, to renew the Agreement following the Initial Term for a mutually agreed upon service period (the “Renewal Term”). The Agreement may be terminated by the Company by providing ten (10) days’ prior notice to the Consultant during the Initial Term or Renewal Term (the “Term”).

2.Position; Services. During the Term, Consultant shall be engaged as a nonexempt, hourly employee in the position of Technical Consultant and shall provide additive & advanced technology and digital strategy advising services to the Company, and such other duties as reasonably requested by the Company (collectively, the “Services”). During the Initial Term, Consultant generally will be expected to provide the Services for ten (10) hours per week.

3.Compensation; Benefits; Company Policies.

a.Hourly Compensation. In consideration for the Services to be provided by Consultant, the Company shall pay Consultant an hourly fee equal to $168 per hour, less applicable taxes and withholdings, and such compensation shall be payable on the Company’s regular payroll schedule during the Term (the “Hourly Fee”). Upon termination of the Term, the Company shall pay to Consultant any earned but unpaid Hourly Fees for Services rendered prior to such termination, and neither the Company nor any other member of the Company Group shall have any further obligation to Consultant in respect of the Services thereafter.

b.Consultant’s Incentive Equity Awards. For the avoidance of doubt, the Consultant shall continue to vest in any unvested equity awards while providing Services to the Company Group during the Initial Term, subject in all respects to the terms and conditions of the Company’s 2021 Omnibus Incentive Plan (the “Plan”) and each equity award’s award agreement (including with respect to vesting and forfeiture). For the avoidance of doubt, the parties acknowledge and agree that as of the Effective Date, Consultant has 46,084 unvested stock options, 61,292 unvested restricted stock units (“RSUs”) and 465,519

unvested performance-vested restricted stock units (“PSUs”), subject to that certain option award agreement, dated February 25, 2022, RSU award agreement, dated February 25, 2022, and RSU and PSU award agreement, dated December 23, 2021, respectively.

i.Settlement of Awards. All equity awards vesting during the Initial Term will settle, if at all, no later than March 15, 2024, unless the terms of the respective award agreement and the Plan require otherwise.

ii.No Other Interests. Consultant acknowledges and agrees that, other than (i) the options and RSUs described in Section 3(b) and (ii) any indirect ownership interest of Consultant in shares held by Kemeera Holdings, Inc., Consultant holds no other units, shares, stock options, equity awards or any other equity under any other agreement or arrangement with any Company Group member.

c.Employee Benefit Plans. Consultant shall be eligible to participate in the Company’s benefit plans generally offered to other part-time, hourly employees in similar positions and with similar responsibilities (subject to any applicable restrictions). Eligibility and/or change in status information for purposes of the Company’s benefit plans will be shared with Consultant in connection with entering into this Agreement.

d.Company Policies. Consultant shall be responsible for tracking his working time in accordance with the Company’s approved policies and practices, as such policies may be amended from time to time. Consultant and the compensation and benefits offered hereunder will also be subject to all other Company policies, including with respect to the reimbursement of business expenses, insider trading and compensation recovery and/or recoupment, that are currently in place or that may be adopted by the Company to comply with applicable law or to comport with good corporate governance practices, as such policies may be amended from time to time.

4.At-Will Employment. Your employment is at-will, meaning that you or the Company can terminate your employment without cause or reason at any time.

5.Restrictive Covenants. Consultant remains subject to the restrictive covenants contained within the Company’s Executive Restrictive Covenant Agreement in Appendix A of Consultant’s Offer Letter and attached hereto as Exhibit A.

a.No Assignment; Termination. This Agreement may not be assigned by either party without the prior written consent of the other party, except that the Company may assign any of its rights or delegate any of its duties hereunder to one or more of its affiliates. After any expiration or termination of the Term, this Agreement will be of no further force or effect, provided that the provisions of this Section and Exhibit A shall survive such expiration or termination.

b.Governing Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of California without giving effect to principles regarding the conflict of laws. For the purposes of any suit, action, or other proceeding arising out of this Agreement or with respect to Consultant’s engagement hereunder, the parties hereto agree to submit to the exclusive jurisdiction of the federal or state courts located in California. Notwithstanding anything herein to the contrary, the parties may seek injunctive relieve with respect to Exhibit A in any court of competent jurisdiction.

2

c.Amendment; Entire Agreement. No provision of this Agreement may be amended, modified, waived, or discharged unless such amendment, waiver, modification, or discharge is agreed to in writing and such writing is signed by the Company and Consultant. This Agreement shall supersede any other agreement between the parties hereto with respect to the subject matter hereof.

d.Notice. All notices and other communications hereunder shall be in writing and shall be given by hand delivery to the other party hereto or by registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

if to Consultant, to Consultant’s most recent address on file with the Company; and

if to the Company:

Fathom Digital Manufacturing Corporation

1050 Walnut Ridge Drive

Hartland, WI 53029

Attention: Chief Human Resources Officer

or to such other address as either party hereto shall have furnished to the other in writing in accordance herewith. Notice and communications shall be effective when actually received by the addressee.

e.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument.

[Signature page follows]

3

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered as of the date first above written.

COMPANY:

Fathom Digital Manufacturing Corporation

By: /s/ Caprice Perez

Name: Caprice Perez

Title: Chief Human Resources Officer

CONSULTANT:

Richard Stump

By: /s/ Richard Stump

Name: Richard Stump

Title: Co-Founder

[Signature Page to Consulting Agreement]

Exhibit A

Executive Restrictive Covenant Agreement

5

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fath_ClassACommonUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

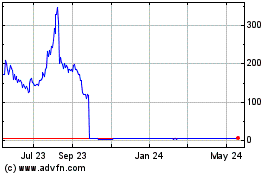

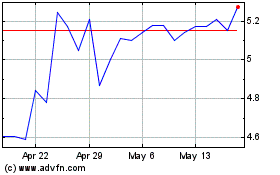

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Apr 2023 to Apr 2024