UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-04632

The European

Equity Fund, Inc.

(Exact Name of Registrant

as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal

Executive Offices) (Zip Code)

Registrant’s

Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of

Agent for Service)

| Date of fiscal year end: |

12/31 |

| |

|

| Date of reporting period: |

6/30/2023 |

| ITEM 1. |

REPORT TO STOCKHOLDERS |

| |

|

| |

(a) |

| |

|

June 30, 2023

Semiannual Report

to Shareholders

The European Equity Fund, Inc.

Ticker Symbol:

EEA

Contents

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment

Management Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK

GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

|

|

|

|

|

|

|

| 2 |

|

| |

|

The European Equity Fund, Inc. |

|

|

The Fund seeks long-term capital appreciation through investment primarily in

equity and equity-linked securities of issuers domiciled in Europe.

Investments in funds involve risks, including the loss

of principal.

The shares of most closed-end funds, including the Fund, are not continuously offered. Once issued, shares of

closed-end funds are bought and sold in the open market. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s

shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

This Fund is diversified and primarily focuses its investments in equity securities of issuers domiciled in Europe, thereby increasing its vulnerability to developments

in that region. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Any fund that concentrates in a particular segment of

the market or in a particular geographical region will generally be more volatile than a fund that invests more broadly.

The United States, the European Union

(EU), the United Kingdom, and other countries have imposed sanctions in response to the Russian military and other actions in recent years. These sanctions have adversely affected Russian individuals, Russian issuers and the Russian economy. Russia,

in turn, has imposed sanctions targeting Western individuals, businesses and products. The various sanctions have adversely affected, and may continue to adversely affect, not only the Russian economy but also the economies of many countries in

Europe. The continuation of current sanctions or the imposition of additional sanctions may materially adversely affect the value of the Fund’s portfolio.

As

of January 1, 2021 the United Kingdom is no longer part of the EU customs union and single market, nor is it subject to EU policies and international agreements. The long-term impact of the United Kingdom’s withdrawal from the EU is still

unknown and could have adverse economic and political effects on the United Kingdom, the EU and its member countries, and the global economy, including financial markets and asset valuations.

War, terrorism, sanctions, economic uncertainty, trade disputes, public health crises, natural disasters, climate change and related geopolitical events have led and,

in the future, may lead to significant disruptions in U.S. and world economies and markets, which may lead to increased market volatility and may have significant adverse effects on the Fund and its investments.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

3 |

|

|

|

|

| Letter to the Shareholders |

|

(Unaudited) |

Dear Shareholder,

For the six-month period ended June 30, 2023, the total return of The European Equity Fund, Inc. (the “Fund”) in U.S. dollars (USD) was 14.52% based on net asset value and 15.24% based on market price. During

the same period, the return of the Fund’s benchmark, the MSCI Europe Index, was 13.59%.1 The Fund’s discount to net asset value averaged 13.66% for the period from January 1, 2023

to June 30, 2023, compared with 14.66% for the same period a year earlier.

After the decline seen in 2022, the first half of 2023 saw European equities move

higher while experiencing reduced volatility. The first quarter started on a positive note as falling European natural gas prices helped allay fears about a potential recession. This was reflected across various sentiment indicators, with consumer

confidence rising. In addition, the continued reopening of China’s economy as restrictions were eased boosted hopes for global growth broadly. As a result of the brighter macroeconomic outlook, European equities posted their strongest January

return since 2015.

However, the tone in markets became more negative in February, as core eurozone inflation for January was gauged at a record high of 5.3%. By

March, persistently high inflation led to a ratcheting upward of investor expectations with respect to the level at which central bank policy rates would ultimately peak. This dynamic was reversed in the wake of the collapse of Silicon Valley Bank

in the U.S. on March 10, 2023, which raised fears of a broader financial system contagion. Soon after, Credit Suisse came under investor scrutiny and saw large deposit outflows, which culminated in a purchase by UBS that included guarantees

from the Swiss government. These developments led to significant market volatility as investors speculated as to whether central banks globally might pause their current rate hiking cycles given heightened recession risks.

Entering the second quarter, investors continued to speculate as to the likelihood of further bank failures. Indeed, early May saw First Republic Bank become the third

U.S. bank to fail. However, the resulting financial turmoil proved relatively isolated, and by June equity volatility measures had fallen to their lowest levels since the beginning of the pandemic in March of 2020.

|

|

|

|

|

| 4 |

|

| |

|

The European Equity Fund, Inc. |

Core euro zone inflation for June came in at 5.4%, only slightly beneath the 5.7% peak seen in March. With the financial

system appearing to be on relatively stable footing, central banks maintained their focus on moving policy rates higher to rein in inflation. The European Central Bank hiked its overnight lending rate by twenty-five basis points in both May and

June, taking the deposit facility rate to 3.5%.

With respect to the Fund’s performance relative to the benchmark, positive contributions were led by

positioning in information technology based on both an overweight to and selection within the sector. In terms of individual holdings, overweights to semiconductor companies Infineon Technologies AG and STMicroelectronics NV explain the bulk of the

outperformance, with gains driven by strong fundamentals based on robust demand in the first quarter of 2023.

Positioning in materials was the next most significant

contributor to relative performance. Most notably, shares of building materials companies CRH PLC and Sika AG enjoyed a recovery helped by lower energy and raw materials costs.

The Fund continued to be meaningfully overweight in the industrials sector. In this vein, shares of French building products company Cie de Saint Gobain and

transportation and logistics companies Deutsche Post AG (Germany) and DSV A/S (Denmark) rebounded after a difficult 2022.

On the negative side, the Fund’s

underweight allocation to the consumer discretionary sector and security selection within utilities weighed on relative performance.

|

|

|

|

|

|

|

|

|

| Sector Diversification (As a % of Equity Securities) |

|

6/30/23 |

|

|

12/31/22 |

|

| Financials |

|

|

21% |

|

|

|

18% |

|

| Industrials |

|

|

16% |

|

|

|

16% |

|

| Health Care |

|

|

15% |

|

|

|

16% |

|

| Information Technology |

|

|

9% |

|

|

|

10% |

|

| Consumer Discretionary |

|

|

9% |

|

|

|

9% |

|

| Materials |

|

|

8% |

|

|

|

10% |

|

| Consumer Staples |

|

|

8% |

|

|

|

6% |

|

| Communication Services |

|

|

7% |

|

|

|

7% |

|

| Energy |

|

|

4% |

|

|

|

6% |

|

| Utilities |

|

|

3% |

|

|

|

2% |

|

| |

|

|

100% |

|

|

|

100% |

|

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

5 |

|

Market Outlook

We are

entering the second half of the year in a somewhat cautious stance, given stubbornly high core inflation even as both the U.S. and E.U. economies seem likely to be entering a soft patch. Moreover, China’s post-pandemic recovery is proving

slower than hoped. While the emergence of applications for artificial intelligence may continue to boost the market’s aggregate performance, this is unlikely in our view to compensate over the near term for the current range of cyclical

headwinds.

In this context, we have become more constructive on the consumer staples sector, most notably the beverages segment where we expect gross margins for

brewers to be supported by a lower cost of goods sold. Brewers have recently underperformed and their relative valuation versus spirits has become more attractive.

The communication services sector remains among our favorites as well, as a more consolidated competitive environment in most European countries has resulted in improved

pricing power and reduced need for capital expenditures.

Within the financials sector, we maintain a positive view of European banks. Net interest income for

lenders has enjoyed robust growth

|

|

|

|

|

|

|

|

|

|

|

| Ten Largest Equity Holdings at June 30, 2023

(30.5% of Net Assets) |

|

Country |

|

Percent |

|

| |

1. |

|

|

Novo Nordisk A/S |

|

Denmark |

|

|

4.3 |

% |

| |

2. |

|

|

HSBC Holdings PLC |

|

United Kingdom |

|

|

3.4 |

% |

| |

3. |

|

|

Nestle SA |

|

Switzerland |

|

|

3.3 |

% |

| |

4. |

|

|

ASML Holding NV |

|

Netherlands |

|

|

3.1 |

% |

| |

5. |

|

|

Allianz SE |

|

Germany |

|

|

3.0 |

% |

| |

6. |

|

|

ING Groep NV |

|

Netherlands |

|

|

3.0 |

% |

| |

7. |

|

|

Compass Group PLC |

|

United Kingdom |

|

|

2.7 |

% |

| |

8. |

|

|

TotalEnergies SE |

|

France |

|

|

2.7 |

% |

| |

9. |

|

|

AXA SA |

|

France |

|

|

2.5 |

% |

| |

10. |

|

|

Roche Holding AG |

|

Switzerland |

|

|

2.5 |

% |

Portfolio holdings and characteristics are subject to change and not

indicative of future portfolio composition.

For more details about the Fund’s investments, see the Schedule of Investments commencing on page 10. For additional

information about the Fund, including performance, dividends, presentations, press releases, market updates, daily NAV and shareholder reports, please visit dws.com.

|

|

|

|

|

| 6 |

|

| |

|

The European Equity Fund, Inc. |

resulting from the combination of a higher interest rate regime and deposit rates that are only gradually moving higher to reflect the hiking of short-term interest rates by central banks. At the

same time, credit quality has shown no significant signs of deterioration.

Within consumer discretionary, we are positioned for a recovery of the global auto

industry after an extraordinary three-year period during which vehicle deliveries have fallen well short of meeting consumer demand. As supply constraints continue to gradually ease, we expect release of this

pent-up demand to benefit auto manufacturers.

As for the industrials sector, the deterioration in leading indicators

including the U.S. purchasing managers’ index has led us to avoid capital goods companies while favoring the more stable commercial & professional services sub-sector. Finally, within materials,

we remain cautious with respect to metals & mining companies pending signs of a more robust Chinese economy.

Sincerely,

|

|

|

|

|

|

|

|

|

|

| Christian Strenger |

|

Juan Barriobero de la Pisa |

|

Hepsen Uzcan |

| Chairman |

|

Portfolio Manager |

|

Director, President and Chief Executive Officer |

The views expressed in the preceding discussion reflect those of the portfolio management team generally through the end of the

period of the report as stated on the cover. The management team’s views are subject to change at any time based on market and other conditions and should not be construed as recommendations. Past performance is no guarantee of future

results. Current and future portfolio holdings are subject to risk.

| 1 |

The MSCI Europe Index tracks the performance of 15 developed markets in Europe. MSCI indices are calculated using closing

local market prices and translate into U.S. dollars using the London close foreign exchange rates. Index returns do not reflect any fees or expenses and it is not possible to invest directly in the MSCI Europe Index. |

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

7 |

|

|

|

|

| Performance Summary |

|

June 30, 2023 (Unaudited) |

All performance shown is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee

future results. Investment return and net asset value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data

quoted. Please visit dws.com for the most recent performance of the Fund.

Fund specific data and performance are provided for informational purposes only

and are not intended for trading purposes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Annual Total Returns as of 6/30/23 |

|

|

|

|

|

|

|

|

|

| |

|

6-Month‡ |

|

|

1-Year |

|

|

5-Year |

|

|

10-Year |

|

| Net Asset Value(a) |

|

|

14.52 |

|

|

|

22.60 |

|

|

|

5.84 |

|

|

|

6.47 |

|

| Market Price(a) |

|

|

15.24 |

|

|

|

23.13 |

|

|

|

5.25 |

|

|

|

5.98 |

|

| MSCI Europe Index(b) |

|

|

13.59 |

|

|

|

21.81 |

|

|

|

5.19 |

|

|

|

5.70 |

|

|

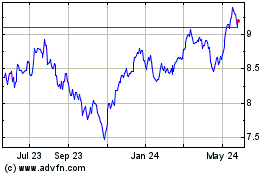

| Growth of an Assumed $10,000 Investment |

The growth of $10,000 is

cumulative.

| a |

Total return based on net asset value reflects changes in the Fund’s net asset value during each period. Total return

based on market value reflects changes in market value during each period. Each figure includes reinvestments of income and capital gain distributions, if any, at market prices pursuant to the dividend reinvestment plan. Total returns based on net

asset value and market price will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares trade during the period. Expenses of the Fund include investment advisory and administration fees

and other fund expenses. Total returns shown take into account these fees and expenses. The annualized expense ratio of the Fund for the six months ended June 30, 2023 was 1.42%. |

|

|

|

|

|

| 8 |

|

| |

|

The European Equity Fund, Inc. |

| b |

The MSCI Europe Index tracks the performance of 15 developed markets in Europe. MSCI indices are calculated using closing

local market prices and translate into U.S. dollars using the London close foreign exchange rates. |

| |

Index returns do not reflect any fees or expenses and it is not possible to invest directly in the MSCI Europe Index.

|

| ‡ |

Total returns shown for periods less than one year are not annualized. |

|

|

|

|

|

|

|

|

|

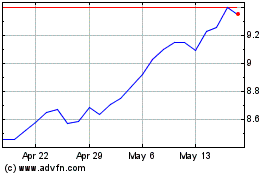

| Net Asset Value and Market Price |

|

|

|

|

|

|

|

|

|

| |

|

As of 6/30/23 |

|

|

As of 12/31/22 |

|

| Net Asset Value |

|

$ |

10.05 |

|

|

$ |

8.81 |

|

| Market Price |

|

$ |

8.61 |

|

|

$ |

7.50 |

|

Prices and Net Asset Value fluctuate and are not guaranteed.

|

|

|

|

|

| Distribution Information |

|

Per Share |

|

| Six Months as of 6/30/23: |

|

|

|

|

| Income Distribution |

|

$ |

0.03 |

|

Distributions are historical, not guaranteed and will fluctuate. Distributions do not include return of capital or other non-income sources.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

9 |

|

|

|

|

| Schedule of Investments |

|

as of June 30, 2023 (Unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value ($) |

|

| Common Stocks 94.8% |

|

|

|

|

|

|

|

|

| France 21.9% |

|

|

|

|

|

|

|

|

|

|

|

| Banks 1.1% |

|

|

|

|

|

|

|

|

| BNP Paribas SA |

|

|

12,269 |

|

|

|

772,539 |

|

|

|

|

| Beverages 1.4% |

|

|

|

|

|

|

|

|

| Pernod Ricard SA |

|

|

4,349 |

|

|

|

960,251 |

|

|

|

|

| Building Products 1.8% |

|

|

|

|

|

|

|

|

| Cie de Saint-Gobain |

|

|

20,284 |

|

|

|

1,233,183 |

|

|

|

|

| Construction & Engineering 1.9% |

|

|

|

|

|

|

|

|

| Vinci SA |

|

|

11,305 |

|

|

|

1,311,945 |

|

|

|

|

| Financial Services 0.8% |

|

|

|

|

|

|

|

|

| Worldline SA 144A* |

|

|

16,049 |

|

|

|

586,513 |

|

|

|

|

| Insurance 2.5% |

|

|

|

|

|

|

|

|

| AXA SA |

|

|

59,773 |

|

|

|

1,762,202 |

|

|

|

|

| IT Services 1.4% |

|

|

|

|

|

|

|

|

| Capgemini SE |

|

|

5,015 |

|

|

|

949,469 |

|

|

|

|

| Media 1.1% |

|

|

|

|

|

|

|

|

| Vivendi SE |

|

|

85,716 |

|

|

|

786,025 |

|

|

|

|

| Oil, Gas & Consumable Fuels 2.7% |

|

|

|

|

|

|

|

|

| TotalEnergies SE |

|

|

32,509 |

|

|

|

1,863,637 |

|

|

|

|

| Personal Care Products 1.3% |

|

|

|

|

|

|

|

|

| L’Oreal SA |

|

|

1,926 |

|

|

|

897,368 |

|

|

|

|

| Pharmaceuticals 2.1% |

|

|

|

|

|

|

|

|

| Sanofi |

|

|

13,278 |

|

|

|

1,422,424 |

|

|

|

|

| Professional Services 1.7% |

|

|

|

|

|

|

|

|

| Bureau Veritas SA |

|

|

24,231 |

|

|

|

664,012 |

|

| Teleperformance |

|

|

3,059 |

|

|

|

512,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,176,084 |

|

|

|

|

| Textiles, Apparel & Luxury Goods 2.1% |

|

|

|

|

|

|

|

|

| LVMH Moet Hennessy Louis Vuitton SE |

|

|

1,510 |

|

|

|

1,421,584 |

|

| Total France (Cost $14,960,864) |

|

|

|

|

|

|

15,143,224 |

|

|

|

|

| Germany 17.0% |

|

|

|

|

|

|

|

|

|

|

|

| Air Freight & Logistics 2.0% |

|

|

|

|

|

|

|

|

| Deutsche Post AG (Registered) |

|

|

28,471 |

|

|

|

1,389,270 |

|

|

|

|

| Diversified Telecommunication Services 2.1% |

|

|

|

|

|

|

|

|

| Deutsche Telekom AG (Registered) |

|

|

67,282 |

|

|

|

1,466,197 |

|

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

| 10 |

|

| |

|

The European Equity Fund, Inc. |

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value ($) |

|

|

|

| Independent Power & Renewable Electricity Producers 1.7% |

|

|

|

|

|

| RWE AG |

|

|

26,621 |

|

|

|

1,157,859 |

|

|

|

|

| Insurance 3.0% |

|

|

|

|

|

|

|

|

| Allianz SE (Registered) |

|

|

8,894 |

|

|

|

2,068,565 |

|

|

|

|

| Interactive Media & Services 1.2% |

|

|

|

|

|

|

|

|

| Scout24 SE 144A |

|

|

12,841 |

|

|

|

813,599 |

|

|

|

|

| Pharmaceuticals 1.7% |

|

|

|

|

|

|

|

|

| Merck KGaA |

|

|

7,201 |

|

|

|

1,190,512 |

|

|

|

|

| Semiconductors & Semiconductor Equipment 1.5% |

|

|

|

|

|

|

|

|

| Infineon Technologies AG |

|

|

25,144 |

|

|

|

1,036,427 |

|

|

|

|

| Software 1.4% |

|

|

|

|

|

|

|

|

| SAP SE |

|

|

7,220 |

|

|

|

985,640 |

|

|

|

|

| Textiles, Apparel & Luxury Goods 0.8% |

|

|

|

|

|

|

|

|

| adidas AG |

|

|

3,033 |

|

|

|

588,221 |

|

|

|

|

| Trading Companies & Distributors 1.6% |

|

|

|

|

|

|

|

|

| Brenntag SE |

|

|

13,880 |

|

|

|

1,081,117 |

|

| Total Germany (Cost $10,656,580) |

|

|

|

|

|

|

11,777,407 |

|

|

|

|

| United Kingdom 14.6% |

|

|

|

|

|

|

|

|

|

|

|

| Banks 3.4% |

|

|

|

|

|

|

|

|

| HSBC Holdings PLC |

|

|

293,810 |

|

|

|

2,321,813 |

|

|

|

|

| Commercial Services & Supplies 1.3% |

|

|

|

|

|

|

|

|

| Rentokil Initial PLC |

|

|

115,540 |

|

|

|

903,207 |

|

|

|

|

| Hotels, Restaurants & Leisure 2.7% |

|

|

|

|

|

|

|

|

| Compass Group PLC |

|

|

67,024 |

|

|

|

1,875,976 |

|

|

|

|

| Media 1.2% |

|

|

|

|

|

|

|

|

| Informa PLC |

|

|

91,341 |

|

|

|

842,912 |

|

|

|

|

| Oil, Gas & Consumable Fuels 1.6% |

|

|

|

|

|

|

|

|

| Shell PLC |

|

|

36,870 |

|

|

|

1,097,823 |

|

|

|

|

| Pharmaceuticals 1.8% |

|

|

|

|

|

|

|

|

| AstraZeneca PLC |

|

|

8,552 |

|

|

|

1,225,752 |

|

|

|

|

| Professional Services 1.6% |

|

|

|

|

|

|

|

|

| RELX PLC |

|

|

33,069 |

|

|

|

1,101,711 |

|

|

|

|

| Trading Companies & Distributors 1.0% |

|

|

|

|

|

|

|

|

| Ashtead Group PLC |

|

|

10,049 |

|

|

|

695,377 |

|

| Total United Kingdom (Cost $7,601,032) |

|

|

|

|

|

|

10,064,571 |

|

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value ($) |

|

| Switzerland 12.8% |

|

|

|

|

|

|

|

|

|

|

|

| Chemicals 3.0% |

|

|

|

|

|

|

|

|

| DSM-Firmenich AG* |

|

|

9,121 |

|

|

|

981,279 |

|

| Sika AG (Registered) |

|

|

3,834 |

|

|

|

1,095,612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,076,891 |

|

|

|

|

| Food Products 3.3% |

|

|

|

|

|

|

|

|

| Nestle SA (Registered) |

|

|

18,952 |

|

|

|

2,278,984 |

|

|

|

|

| Health Care Equipment & Supplies 1.3% |

|

|

|

|

|

|

|

|

| Straumann Holding AG (Registered) |

|

|

5,467 |

|

|

|

886,830 |

|

|

|

|

| Life Sciences Tools & Services 1.4% |

|

|

|

|

|

|

|

|

| Lonza Group AG (Registered) |

|

|

1,597 |

|

|

|

951,989 |

|

|

|

|

| Pharmaceuticals 2.5% |

|

|

|

|

|

|

|

|

| Roche Holding AG |

|

|

5,563 |

|

|

|

1,700,358 |

|

|

|

|

| Semiconductors & Semiconductor Equipment 1.3% |

|

|

|

|

|

|

|

|

| STMicroelectronics NV |

|

|

18,529 |

|

|

|

921,018 |

|

| Total Switzerland (Cost $9,110,305) |

|

|

|

|

|

|

8,816,070 |

|

|

|

|

| Netherlands 11.1% |

|

|

|

|

|

|

|

|

|

|

|

| Automobiles 1.1% |

|

|

|

|

|

|

|

|

| Stellantis NV |

|

|

43,160 |

|

|

|

757,569 |

|

|

|

|

| Banks 4.0% |

|

|

|

|

|

|

|

|

| ABN AMRO Bank NV (CVA) 144A |

|

|

45,433 |

|

|

|

705,280 |

|

| ING Groep NV |

|

|

153,605 |

|

|

|

2,067,450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,772,730 |

|

|

|

|

| Beverages 1.8% |

|

|

|

|

|

|

|

|

| Heineken NV |

|

|

11,801 |

|

|

|

1,212,446 |

|

|

|

|

| Entertainment 1.1% |

|

|

|

|

|

|

|

|

| Universal Music Group NV |

|

|

35,928 |

|

|

|

797,595 |

|

|

|

|

| Semiconductors & Semiconductor Equipment 3.1% |

|

|

|

|

|

|

|

|

| ASML Holding NV |

|

|

2,940 |

|

|

|

2,126,404 |

|

| Total Netherlands (Cost $5,240,488) |

|

|

|

|

|

|

7,666,744 |

|

|

|

|

| Denmark 6.4% |

|

|

|

|

|

|

|

|

|

|

|

| Air Freight & Logistics 1.2% |

|

|

|

|

|

|

|

|

| DSV A/S |

|

|

3,785 |

|

|

|

794,641 |

|

|

|

|

| Electric Utilities 0.9% |

|

|

|

|

|

|

|

|

| Orsted A/S 144A |

|

|

6,567 |

|

|

|

620,371 |

|

|

|

|

| Pharmaceuticals 4.3% |

|

|

|

|

|

|

|

|

| Novo Nordisk A/S ‘‘B’’ |

|

|

18,535 |

|

|

|

2,985,434 |

|

| Total Denmark (Cost $2,447,838) |

|

|

|

|

|

|

4,400,446 |

|

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

| 12 |

|

| |

|

The European Equity Fund, Inc. |

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Value ($) |

|

| Sweden 4.6% |

|

|

|

|

|

|

|

|

|

|

|

| Banks 3.2% |

|

|

|

|

|

|

|

|

| Svenska Handelsbanken AB ‘‘A’’ |

|

|

90,776 |

|

|

|

758,833 |

|

| Swedbank AB ‘‘A’’ |

|

|

85,000 |

|

|

|

1,430,300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,189,133 |

|

|

|

|

| Machinery 1.4% |

|

|

|

|

|

|

|

|

| Atlas Copco AB ‘‘A’’ |

|

|

68,091 |

|

|

|

979,119 |

|

| Total Sweden (Cost $2,857,283) |

|

|

|

|

|

|

3,168,252 |

|

|

|

|

| Ireland 3.7% |

|

|

|

|

|

|

|

|

|

|

|

| Construction Materials 2.4% |

|

|

|

|

|

|

|

|

| CRH PLC |

|

|

30,037 |

|

|

|

1,654,752 |

|

|

|

|

| Containers & Packaging 1.3% |

|

|

|

|

|

|

|

|

| Smurfit Kappa Group PLC |

|

|

26,343 |

|

|

|

877,358 |

|

| Total Ireland (Cost $2,932,789) |

|

|

|

|

|

|

2,532,110 |

|

|

|

|

| Spain 1.9% |

|

|

|

|

|

|

|

|

|

|

|

| Banks 1.9% |

|

|

|

|

|

|

|

|

| Banco Santander SA (Cost $1,404,728) |

|

|

361,862 |

|

|

|

1,336,247 |

|

|

|

|

| Australia 0.8% |

|

|

|

|

|

|

|

|

|

|

|

| Metals & Mining 0.8% |

|

|

|

|

|

|

|

|

| BHP Group Ltd. (Cost $205,682) (a) |

|

|

19,816 |

|

|

|

589,402 |

|

| Total Common Stocks (Cost $57,417,589) |

|

|

|

|

|

|

65,494,473 |

|

|

|

|

| Preferred Stocks 2.2% |

|

|

|

|

|

|

|

|

| Germany 2.2% |

|

|

|

|

|

|

|

|

|

|

|

| Automobiles 2.2% |

|

|

|

|

|

|

|

|

| Porsche Automobil Holding SE* |

|

|

12,572 |

|

|

|

756,508 |

|

| Volkswagen AG |

|

|

5,686 |

|

|

|

762,579 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

1,519,087 |

|

| Total Germany (Cost $2,520,052) |

|

|

|

|

|

|

1,519,087 |

|

| Total Preferred Stocks (Cost $2,520,052) |

|

|

|

|

|

|

1,519,087 |

|

|

|

|

| Cash Equivalents 2.3% |

|

|

|

|

|

|

|

|

| DWS Central Cash Management Government Fund,

5.13% (Cost $1,593,223) (b) |

|

|

1,593,223 |

|

|

|

1,593,223 |

|

|

|

|

| |

|

% of Net

Assets |

|

|

Value ($) |

|

| Total Investment Portfolio (Cost $61,530,864) |

|

|

99.3 |

|

|

|

68,606,783 |

|

| Other Assets and Liabilities, Net |

|

|

0.7 |

|

|

|

464,071 |

|

| |

|

| Net Assets |

|

|

100.0 |

|

|

|

69,070,854 |

|

The accompanying notes are an integral part of the

financial statements.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

13 |

|

A summary of the Fund’s transactions with affiliated investments during the period ended June 30, 2023 are as

follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value ($)

at

12/31/2022 |

|

|

Pur-

chases

Cost

($) |

|

|

Sales

Proceeds

($) |

|

|

Net

Real-

ized

Gain/

(Loss)

($) |

|

|

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($) |

|

|

Income

($) |

|

|

Capital

Gain

Distri-

butions

($) |

|

|

Number of

Shares at

6/30/2023 |

|

|

Value ($)

at

6/30/2023 |

|

| |

Securities Lending Collateral 0.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DWS Government & Agency Securities Portfolio ‘‘DWS Government Cash Institutional Shares’’,

5.03% (b) (c) |

|

| |

— |

|

|

|

0 (d) |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,313 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

Cash Equivalents 2.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

DWS Central Cash Management Government Fund, 5.13% (b) |

|

| |

1,312,005 |

|

|

|

4,498,116 |

|

|

|

4,216,898 |

|

|

|

— |

|

|

|

— |

|

|

|

35,741 |

|

|

|

— |

|

|

|

1,593,223 |

|

|

|

1,593,223 |

|

| |

1,312,005 |

|

|

|

4,498,116 |

|

|

|

4,216,898 |

|

|

|

— |

|

|

|

— |

|

|

|

42,054 |

|

|

|

— |

|

|

|

1,593,223 |

|

|

|

1,593,223 |

|

| * |

Non-income producing security. |

| (a) |

BHP Group PLC is domiciled in Australia and is listed on the London Stock Exchange. |

| (b) |

Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| (c) |

Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower

rebates. |

| (d) |

Represents the net increase (purchases cost) or decrease (sales proceeds) in the amount invested in cash collateral for

the period ended June 30, 2023. |

144A: Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may

be resold in transactions exempt from registration, normally to qualified institutional buyers.

For purposes of its industry concentration policy, the Fund

classifies issuers of portfolio securities at the industry sub-group level. Certain of the categories in the above Schedule of Investments consist of multiple industry

sub-groups or industries.

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in

active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable

inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk associated with investing in those securities.

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

| 14 |

|

| |

|

The European Equity Fund, Inc. |

The following is a summary of the inputs used as of June 30, 2023 in valuing the Fund’s investments. For

information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note 1 in the accompanying Notes to Financial Statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Common Stocks and/or Other Equity Investments (e) |

|

|

|

|

|

| France |

|

$ |

15,143,224 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

15,143,224 |

|

| Germany |

|

|

13,296,494 |

|

|

|

— |

|

|

|

— |

|

|

|

13,296,494 |

|

| United Kingdom |

|

|

10,064,571 |

|

|

|

— |

|

|

|

— |

|

|

|

10,064,571 |

|

| Switzerland |

|

|

8,816,070 |

|

|

|

— |

|

|

|

— |

|

|

|

8,816,070 |

|

| Netherlands |

|

|

7,666,744 |

|

|

|

— |

|

|

|

— |

|

|

|

7,666,744 |

|

| Denmark |

|

|

4,400,446 |

|

|

|

— |

|

|

|

— |

|

|

|

4,400,446 |

|

| Sweden |

|

|

3,168,252 |

|

|

|

— |

|

|

|

— |

|

|

|

3,168,252 |

|

| Ireland |

|

|

2,532,110 |

|

|

|

— |

|

|

|

— |

|

|

|

2,532,110 |

|

| Spain |

|

|

1,336,247 |

|

|

|

— |

|

|

|

— |

|

|

|

1,336,247 |

|

| Australia |

|

|

589,402 |

|

|

|

— |

|

|

|

— |

|

|

|

589,402 |

|

| Short-Term Instruments (e) |

|

|

1,593,223 |

|

|

|

— |

|

|

|

— |

|

|

|

1,593,223 |

|

| Total |

|

$ |

68,606,783 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

68,606,783 |

|

| (e) |

See Schedule of Investments for additional detailed categorizations. |

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

15 |

|

Statement of Assets and Liabilities

|

|

|

|

|

| as of June 30, 2023 (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

| Investments in non-affiliated securities, at value (cost $59,937,641) |

|

$ |

67,013,560 |

|

Investment in DWS Central Cash Management Government Fund

(cost $1,593,223) |

|

|

1,593,223 |

|

| Foreign currency, at value (cost $209,896) |

|

|

205,889 |

|

| Receivable for investments sold |

|

|

394,703 |

|

| Dividends receivable |

|

|

42,981 |

|

| Foreign taxes recoverable |

|

|

292,160 |

|

| Interest receivable |

|

|

7,018 |

|

| Other assets |

|

|

33,374 |

|

| Total assets |

|

|

69,582,908 |

|

|

|

| Liabilities |

|

|

|

|

| Payable for investments purchased |

|

|

349,518 |

|

| Investment advisory fee payable |

|

|

30,622 |

|

| Payable for Directors’ fees and expenses |

|

|

29,645 |

|

| Administration fee payable |

|

|

11,135 |

|

| Accrued expenses and other liabilities |

|

|

91,134 |

|

| Total liabilities |

|

|

512,054 |

|

| Net assets |

|

$ |

69,070,854 |

|

|

|

| Net Assets Consist of |

|

|

|

|

| Distributable earnings (gain) |

|

|

6,722,408 |

|

| Paid-in capital |

|

|

62,348,446 |

|

| Net assets |

|

$ |

69,070,854 |

|

|

|

| Net Asset Value |

|

|

|

|

|

|

| Net assets value per share ($69,070,854 ÷ 6,872,132 shares of common stock issued and outstanding, $.001 par value, 80,000,000 shares authorized) |

|

$ |

10.05 |

|

The accompanying notes are an integral part of the

financial statements.

|

|

|

|

|

| 16 |

|

| |

|

The European Equity Fund, Inc. |

Statement of Operations

|

|

|

|

|

| for the six months ended June 30, 2023 (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| Net Investment Income |

|

|

|

|

| Income: |

|

|

|

|

|

|

| Dividends (net of foreign withholding taxes of $199,272) |

|

$ |

1,456,862 |

|

| Income distributions — DWS Central Cash Management Government Fund |

|

|

35,741 |

|

| Securities lending income, net of borrower rebates |

|

|

6,313 |

|

| Total investment income |

|

|

1,498,916 |

|

| Expenses: |

|

|

|

|

|

|

| Investment advisory fee |

|

|

216,081 |

|

| Administration fee |

|

|

66,487 |

|

| Custody and accounting fee |

|

|

23,164 |

|

| Services to shareholders |

|

|

8,559 |

|

| Reports to shareholders and shareholder meeting expenses |

|

|

26,967 |

|

| Directors’ fees and expenses |

|

|

46,255 |

|

| Legal fees |

|

|

59,035 |

|

| Audit and tax fees |

|

|

27,512 |

|

| NYSE listing fee |

|

|

11,771 |

|

| Insurance |

|

|

3,728 |

|

| Miscellaneous |

|

|

16,840 |

|

| Total expenses before expense reductions |

|

|

506,399 |

|

| Expense reductions |

|

|

(33,244 |

) |

| Total expenses after expense reductions |

|

|

473,155 |

|

| Net investment income |

|

|

1,025,761 |

|

|

|

| Realized and Unrealized Gain (Loss) |

|

|

|

|

| Net realized gain (loss) from: |

|

|

|

|

|

|

| Investments |

|

|

887,040 |

|

| Foreign currency |

|

|

27,676 |

|

| Net realized gain (loss) |

|

|

914,716 |

|

| Change in net unrealized appreciation (depreciation) on: |

|

|

|

|

|

|

| Investments |

|

|

6,797,665 |

|

| Foreign currency |

|

|

(5,636 |

) |

| Change in net unrealized appreciation (depreciation) |

|

|

6,792,029 |

|

| Net gain (loss) |

|

|

7,706,745 |

|

| Net increase (decrease) in net assets resulting from operations |

|

$ |

8,732,506 |

|

The accompanying notes are an integral part of the

financial statements.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

17 |

|

Statement of Changes in Net Assets

|

|

|

|

|

|

|

|

|

| Increase (Decrease) in Net Assets |

|

Six Months

Ended

June 30, 2023

(Unaudited) |

|

|

Year Ended

December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

| Operations: |

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

$ |

1,025,761 |

|

|

$ |

1,083,807 |

|

| Net realized gain (loss) |

|

|

914,716 |

|

|

|

(1,474,152 |

) |

| Change in net unrealized appreciation (depreciation) |

|

|

6,792,029 |

|

|

|

(15,164,750 |

) |

| Net increase (decrease) in net assets resulting from operations |

|

|

8,732,506 |

|

|

|

(15,555,095 |

) |

| Distributions to shareholders |

|

|

(224,231 |

) |

|

|

(6,066,503 |

) |

| Fund share transactions: |

|

|

|

|

|

|

|

|

|

|

|

| Net proceeds from reinvestment of distributions |

|

|

272,836 |

|

|

|

4,085,740 |

|

| Shares repurchased |

|

|

(527,925 |

) |

|

|

(2,755,470 |

) |

| Net increase (decrease) in net assets from Fund share transactions |

|

|

(255,089 |

) |

|

|

1,330,270 |

|

| Total increase (decrease) in net assets |

|

|

8,253,186 |

|

|

|

(20,291,328 |

) |

| Net assets at beginning of period |

|

|

60,817,668 |

|

|

|

81,108,996 |

|

|

|

|

| Net assets at end of period |

|

$ |

69,070,854 |

|

|

$ |

60,817,668 |

|

|

|

|

| Other Information |

|

|

|

|

|

|

|

|

| Shares outstanding at beginning of period |

|

|

6,902,996 |

|

|

|

6,788,192 |

|

| Shares issued from reinvestment of distributions |

|

|

32,196 |

|

|

|

464,944 |

|

| Shares repurchased |

|

|

(63,060 |

) |

|

|

(350,140 |

) |

|

|

|

| Shares outstanding at end of period |

|

|

6,872,132 |

|

|

|

6,902,996 |

|

The accompanying notes are an integral part of the

financial statements.

|

|

|

|

|

| 18 |

|

| |

|

The European Equity Fund, Inc. |

Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months

Ended 6/30/23 |

|

|

Years Ended December 31, |

|

| |

|

(Unaudited) |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

|

|

| Per Share Operating Performance |

|

|

|

|

|

| Net asset value, beginning of period |

|

|

$8.81 |

|

|

|

$11.95 |

|

|

|

$12.09 |

|

|

|

$10.73 |

|

|

|

$9.04 |

|

|

|

$10.97 |

|

| Income (loss) from investment operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income

(loss)a |

|

|

.15 |

|

|

|

.16 |

|

|

|

.15 |

|

|

|

.10 |

|

|

|

.15 |

|

|

|

.08 |

|

| Net realized and unrealized gain (loss) on investments and foreign

currency |

|

|

1.12 |

|

|

|

(2.40 |

) |

|

|

1.11 |

|

|

|

1.38 |

|

|

|

2.03 |

|

|

|

(1.98 |

) |

| Total from investment operations |

|

|

1.27 |

|

|

|

(2.24 |

) |

|

|

1.26 |

|

|

|

1.48 |

|

|

|

2.18 |

|

|

|

(1.90 |

) |

| Less distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income |

|

|

(.03 |

) |

|

|

(.29 |

) |

|

|

(.11 |

) |

|

|

(.13 |

) |

|

|

(.13 |

) |

|

|

(.07 |

) |

| Net realized gains |

|

|

— |

|

|

|

(.58 |

) |

|

|

(1.39 |

) |

|

|

(.07 |

) |

|

|

(.39 |

) |

|

|

— |

|

| Total distributions |

|

|

(.03 |

) |

|

|

(.87 |

) |

|

|

(1.50 |

) |

|

|

(.20 |

) |

|

|

(.52 |

) |

|

|

(.07 |

) |

| Dilution in net asset value from dividend reinvestment |

|

|

(.01 |

) |

|

|

(.10 |

) |

|

|

— |

|

|

|

(.01 |

) |

|

|

(.01 |

) |

|

|

— |

|

| Increase resulting from share repurchases |

|

|

.01 |

|

|

|

.07 |

|

|

|

.10 |

|

|

|

.09 |

|

|

|

.04 |

|

|

|

.04 |

|

| Net asset value, end of period |

|

|

$10.05 |

|

|

|

$8.81 |

|

|

|

$11.95 |

|

|

|

$12.09 |

|

|

|

$10.73 |

|

|

|

$9.04 |

|

| Market value, end of period |

|

|

$8.61 |

|

|

|

$7.50 |

|

|

|

$10.37 |

|

|

|

$10.40 |

|

|

|

$9.38 |

|

|

|

$7.73 |

|

|

|

|

|

|

|

|

| Total Investment Return for the Periodb |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Based upon market value (%) |

|

|

15.24 |

** |

|

|

(19.12 |

) |

|

|

15.23 |

|

|

|

13.28 |

|

|

|

28.29 |

|

|

|

(21.02 |

) |

| Based upon net asset value (%) |

|

|

14.52 |

c** |

|

|

(17.55 |

)c |

|

|

14.22 |

|

|

|

15.12 |

|

|

|

25.48 |

|

|

|

(16.90 |

)c |

|

| Ratios to Average Net Assets |

|

| Total expenses before expense reductions (%) |

|

|

1.52 |

* |

|

|

1.57 |

|

|

|

1.28 |

|

|

|

1.30 |

|

|

|

1.33 |

|

|

|

1.38 |

|

| Total expenses after expense reductions (%) |

|

|

1.42 |

* |

|

|

1.47 |

|

|

|

1.28 |

|

|

|

1.30 |

|

|

|

1.33 |

|

|

|

1.28 |

|

| Net investment income (%) |

|

|

1.53 |

** |

|

|

1.66 |

|

|

|

1.16 |

|

|

|

.93 |

|

|

|

1.51 |

|

|

|

.75 |

|

| Portfolio turnover (%) |

|

|

7 |

** |

|

|

25 |

|

|

|

57 |

|

|

|

25 |

|

|

|

60 |

|

|

|

58 |

|

| Net assets at end of period ($ thousands) |

|

|

69,071 |

|

|

|

60,818 |

|

|

|

81,109 |

|

|

|

87,186 |

|

|

|

81,254 |

|

|

|

70,177 |

|

| a |

Based on average shares outstanding during the period. |

| b |

Total investment return based on net asset value reflects changes in the Fund’s net asset value during each period.

Total return based on market value reflects changes in market value during each period. Each figure includes reinvestments of dividend and capital gain distributions, if any. These figures will differ depending upon the level of any discount from or

premium to net asset value at which the Fund’s shares trade during the period. |

| c |

Total return would have been lower had certain expenses not been reduced. |

The accompanying notes are an integral part of the financial statements.

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

19 |

|

|

|

|

| Notes to Financial Statements |

|

(Unaudited) |

A. Accounting Policies

The European Equity

Fund, Inc. (the “Fund”) was incorporated in Delaware on April 8, 1986 as a diversified, closed-end management investment company. Investment operations commenced on July 23, 1986. The Fund

reincorporated in Maryland on August 29, 1990 and, on October 16, 1996, the Fund changed from a diversified to a non-diversified company. The Fund became a diversified fund on October 31, 2008.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires

management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Fund qualifies as an investment company under Topic 946 of Accounting

Standards Codification of U.S. GAAP. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation. The Fund calculates its net asset

value (“NAV”) per share for publication at the close of regular trading on Deutsche Börse XETRA, normally at 11:30 a.m., New York time.

The

Fund’s Board has designated DWS International GmbH (the “Advisor”) as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Advisor’s Pricing Committee (the “Pricing Committee”) typically

values securities using readily available market quotations or prices supplied by independent pricing services (which are considered fair values under Rule 2a-5). The Advisor has adopted fair valuation procedures that provide methodologies for fair

valuing securities.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1

includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes

significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in

those securities.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade prior to the time of valuation. Securities for

|

|

|

|

|

| 20 |

|

| |

|

The European Equity Fund, Inc. |

which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid

quotation. Equity securities are generally categorized as Level 1.

Investments in open-end investment companies are

valued and traded at their NAV each business day and are categorized as Level 1.

Purchased options are generally valued at the settlement prices established

each day on the exchange on which they are traded and are categorized as Level 1.

Securities and other assets for which market quotations are not readily

available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally

categorized as Level 3. In accordance with the Fund’s valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security;

the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company’s or issuer’s financial statements; an evaluation

of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and, with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which the

security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the

classification of the fair value measurements is included in a table following the Fund’s Schedule of Investments.

Securities Transactions and Investment Income. Investment transactions are accounted for on a trade date plus one basis for daily NAV

calculation. However, for financial reporting purposes, investment security transactions are reported on trade date. Interest income is recorded on the accrual basis. Dividend income is recorded on the

ex-dividend date net of foreign withholding taxes. Certain dividends from foreign securities may be recorded subsequent to the ex-dividend date as soon as the Fund is

informed of such dividends. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) for investments.

Securities Lending. Prior to May 1, 2023, Brown Brothers

Harriman & Co. served as securities lending agent for the Fund. Effective May 1, 2023, National Financial Services LLC (Fidelity Agency Lending), as lending

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

21 |

|

agent, lends securities of the Fund to certain financial institutions under the terms of its securities lending agreement. During the term of the loans, the Fund continues to receive dividends

generated by the securities and to participate in any changes in their market value. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at

least equal to the value of the securities loaned. When the collateral falls below specified amounts, the securities lending agent will use its best effort to obtain additional collateral on the next business day to meet required amounts under the

securities lending agreement. During the six months ended June 30, 2023, the Fund invested the cash collateral into a joint trading account in affiliated money market funds, including DWS Government & Agency Securities Portfolio, managed by

DWS Investment Management Americas, Inc. DWS Investment Management Americas, Inc. receives a management/administration fee (0.07% annualized effective rate as of June 30, 2023) on the cash collateral invested in DWS Government & Agency

Securities Portfolio. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a securities lending agent. Either the Fund or the

borrower may terminate the loan at any time and the borrower, after notice, is required to return borrowed securities within a standard time period. There may be risks of delay and costs in recovery of securities or even loss of rights in the

collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the

replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity

risk associated with such investments.

The Fund had no securities on loan at June 30, 2023.

Foreign Currency Translation. The books and records of the

Fund are maintained in United States dollars.

Assets and liabilities denominated in foreign currency are translated into United States dollars at the

prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. Net realized and unrealized gains and losses

on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income

accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on

|

|

|

|

|

| 22 |

|

| |

|

The European Equity Fund, Inc. |

investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation

on investments.

At June 30, 2023, the exchange rate was EUR €1.00 to USD $1.09.

Contingencies. In the normal course of business, the Fund

may enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not

yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Taxes. The Fund’s policy is to comply with the

requirements of the Internal Revenue Code of 1986, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests. Such taxes are generally based on income and/or capital gains

earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a

result of security sales are reflected as a component of net realized gain/loss on investments.

At December 31, 2022, the Fund had a net tax basis capital loss

carryforward of approximately $1,612,000, which may be applied against realized net taxable capital gains indefinitely.

At June 30, 2023, the aggregate cost of

investments for federal income tax purposes was $61,530,864. The net unrealized appreciation for all investments based on tax cost was $7,075,919. This consisted of aggregate gross unrealized appreciation for all investments for which there was an

excess of value over tax cost of $14,917,664 and aggregate gross unrealized depreciation for all investments for which there was an excess of tax cost over value of $7,841,745.

The Fund has reviewed the tax positions for the open tax years as of December 31, 2022 and has determined that no provision for income tax and/or uncertain tax

positions is required in the Fund’s financial statements. The Fund’s federal tax returns for the prior three fiscal years remain open subject to examinations by the Internal Revenue Service.

Dividends and Distributions to Shareholders. The Fund

records dividends and distributions to its shareholders on the ex-dividend date. The timing and character of certain income and capital gain distributions are determined annually in accordance with United

States federal income tax regulations, which may differ from accounting principles generally

|

|

|

|

|

|

|

| The European Equity Fund, Inc. |

|

| |

|

|

23 |

|

accepted in the United States of America. These differences primarily relate to restructuring of certain securities. The Fund may utilize a portion of the proceeds from capital share repurchases

as a distribution from net investment income and realized capital gains. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such

period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the NAV of the Fund.

The tax character

of current year distributions will be determined at the end of the current fiscal year.

B. Investment Advisory and Administration Agreements

The Fund is party to an Investment Advisory Agreement with DWS International GmbH (“DWSI”). The Fund also has an Administration Agreement with DWS

Investment Management Americas, Inc. (“DIMA”). DWSI and DIMA are affiliated companies.

Under the Investment Advisory Agreement with DWSI, DWSI directs the

investments of the Fund in accordance with its investment objectives, policies and restrictions. DWSI determines the securities, instruments and other contracts relating to investments to be purchased, sold or entered into by the Fund.

The Investment Advisory Agreement provides DWSI with a fee, computed weekly and payable monthly, at the annual rate of 0.65% of the Fund’s average weekly net assets

up to and including $100 million, and 0.60% of such assets in excess of $100 million. In addition, DWSI has agreed to implement a temporary partial fee waiver. Effective January 1, 2022, the fee payable by the Fund to DWSI was reduced

by 10 basis points for a one year period and this temporary partial fee waiver was subsequently extended through December 31, 2023.

Accordingly, for the six months

ended June 30, 2023, the fee pursuant to the Investment Advisory Agreement aggregated $216,081, of which $33,244 was waived resulting in an annualized rate of 0.55% of the Fund’s average weekly net assets.

Under the Administration Agreement with DIMA, DIMA provides certain fund administration services to the Fund. The Administration Agreement provides DIMA with an annual

fee, computed weekly and payable monthly, of 0.20% of the Fund’s average weekly net assets.

C. Transactions with Affiliates

DWS Service Company (“DSC”), an affiliate of DIMA, is the transfer agent, dividend-paying agent and shareholder service