- Written communication relating to an issuer or third party (SC TO-C)

January 07 2011 - 4:54PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on January 7, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934.

THE EUROPEAN EQUITY FUND, INC.

(Name of Subject Company (Issuer))

THE EUROPEAN EQUITY FUND, INC.

(Name of Filing Person (Offeror))

COMMON STOCK,

$0.01 PAR VALUE PER SHARE

(Title of Class of Securities)

298768102

(CUSIP Number of Class of Securities)

John Millette

Secretary

The European Equity Fund, Inc.

c/o Deutsche Investment Management Americas, Inc.

One Beacon Street

Boston, MA 02108

(Name, address and telephone numbers of person authorized to receive notices

and communications on behalf of filing persons)

Copy to:

Donald R. Crawshaw, Esq.

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation

|

|

Amount of Filing Fee

|

|

N/A*

|

|

N/A*

|

|

|

|

|

|

*

|

|

A filing fee is not required in connection with this filing as it relates solely to preliminary

communications made before the commencement of a tender offer.

|

|

|

o

|

|

Check box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee

was previously paid. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

|

Amount Previously Paid: N/A

Form or Registration No.: N/A

Filing Party: N/A

Date Filed: N/A

|

|

þ

|

|

Check box if the filing relates solely to preliminary

communications made before the commencement of a tender offer.

|

Check the appropriate boxes to designate any transactions to which this statement relates:

|

|

o

|

|

third party tender offer subject to Rule 14d-1

|

|

|

|

|

þ

|

|

issuer tender offer subject to Rule 13e-4

|

|

|

|

|

o

|

|

going-private transaction subject to Rule 13e-3

|

|

|

|

|

o

|

|

amendment to Schedule 13D under Rule 13d-2

|

Check the following box if the filing is a final amendment reporting the results of the tender offer.

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

o

|

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

|

|

o

|

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

Press Release

FOR IMMEDIATE RELEASE

For additional information:

Deutsche Bank Press Office (212) 454-2085

Shareholder Account Information (800) 294-4366

DWS Closed-End Funds (800) 349-4281

The European Equity Fund, Inc. Announces Commencement of Tender Offer

NEW YORK, NY January 7, 2011 — The European Equity Fund, Inc. (NYSE: EEA)

(the “Fund”)

announced the commencement of a self tender offer on the terms and subject to the conditions

set forth in the Fund’s Offer to Repurchase and the related Letter of Transmittal, which are being

mailed to stockholders commencing today.

The Fund is offering to purchase up to 5% of its issued and outstanding shares of common stock at a

price equal to 98% of the Fund’s net asset value (“NAV”) per share as determined by the Fund on the

next business day after the date on which the offer expires. The Fund normally calculates its NAV

per share at 11:30 a.m. New York time on each day during which the New York Stock Exchange is open

for trading. The tender offer will terminate at 5:00 p.m. Eastern Time on February 8, 2011, unless

extended. If more than 5% of the Fund’s outstanding shares are tendered in the offer and the Fund

purchases shares in accordance with the terms of the offer, it will purchase shares from tendering

shareholders on a pro rata basis.

The offer is being made in accordance with the Discount Management Program (the “Program”) approved

by the Fund’s Board of Directors in July 2010. The Program provides for up to four, consecutive,

semi-annual tender offers, each of which will be conducted by the Fund if its shares trade at an

average discount to NAV of more than 10% during the applicable twelve-week measurement period, as

they did in the initial measurement period, which commenced on September 1, 2010.

The tender offer referred to in this announcement will be made only by the Offer to Repurchase and

the related Letter of Transmittal. Shareholders should read these

documents carefully when they become available to investors free of charge at the website of the Securities and Exchange

Commission (www.sec.gov). Neither the Offer to Repurchase will be made to, nor will tenders

pursuant to the Offer to Repurchase be accepted from or on behalf of, holders of shares in any

jurisdiction in which making or accepting the Offer to Repurchase would violate that jurisdiction’s

laws.

For more information on the tender offer, please contact the Fund’s information agent, The Altman

Group, Inc. at 1-800-884-5101.

For more information on the Fund, including the most recent month-end performance, visit

www.dws-investments.com

or call (800) 349-4281.

The European Equity Fund, Inc. is a diversified, closed-end investment company seeking

long-term capital appreciation through investment primarily (normally at least 80% of its assets)

in equity and equity-linked securities of companies domiciled in European countries utilizing the

Euro currency. Investing in foreign securities, particularly those of emerging markets, presents

certain risks, such as currency fluctuations, political and economic changes, and market risks. Any

fund that concentrates in a particular segment of the market will generally be more volatile than a

fund that invests more broadly.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public

offering and, once issued, shares of closed-end funds are sold in the open market through a stock

exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price

of a fund’s shares is determined by a number of factors, several of which are beyond the control of

the fund. Therefore, a fund cannot predict whether its shares will trade at, below or above net

asset value. There can be no assurance that the Program will be effective in reducing the Fund’s

market discounts.

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there

be any sale of these securities in any state or jurisdiction in which such offer or solicitation or

sale would be unlawful prior to registration or qualification under the laws of such state or

jurisdiction.

This announcement is not a recommendation, an offer to purchase or a solicitation of an offer to

sell shares of the Fund. The Fund is filing today with the Securities and Exchange Commission a

tender offer statement on Schedule TO and related exhibits, including an offer to purchase, letter

of transmittal, and other related documents. Stockholders of the Fund should read the offer to

purchase and the tender offer statement on Schedule TO, the letter of transmittal and related

exhibits, as they contain important information about the Fund’s tender offer. Stockholders can

obtain these documents free of charge from the Securities and

Exchange Commission’s website at www.sec.gov. or from the Fund’s information agent, The Altman

Group, Inc. at 1-800-884-5101.

Certain statements contained in this release may be forward-looking in nature. These include all

statements relating to plans, expectations, and other statements that are not historical facts and

typically use words like “expect,” “anticipate,” “believe,” “intend,” and similar expressions. Such

statements represent management’s current beliefs, based upon information available at the time the

statements are made, with regard to the matters addressed. All forward-looking statements are

subject to risks and uncertainties that could cause actual results to differ materially from those

expressed in, or implied by, such statements. Management does not undertake any obligation to

update or revise any forward-looking statements, whether as a result of new information, future

events, or otherwise.

NOT FDIC/ NCUA INSURED

•

MAY LOSE VALUE

•

NO BANK GUARANTEE

NOT A DEPOSIT

•

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

DWS Investments is part of Deutsche Bank’s Asset Management division and, within the US,

represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company

Americas, Deutsche Investment Management Americas Inc. and DWS Trust Company. R-20423-1 (1/11)

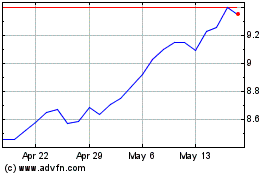

European Equity (NYSE:EEA)

Historical Stock Chart

From May 2024 to Jun 2024

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2023 to Jun 2024