- Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (N-Q)

November 29 2010 - 2:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

_______________________________

Investment Company Act file number 811-04632

The European Equity Fund, Inc.

(Exact name of registrant as specified in charter)

345 Park Avenue

New York, NY 10154

(Address of principal executive offices) (Zip code)

Paul Schubert

100 Plaza One

Jersey City, NJ 07311

(Name and address of agent for service)

Registrant's telephone number, including area code:

(201) 593-6408

Date of fiscal year end:

12/31

Date of reporting period:

9/30/10

|

ITEM 1.

|

SCHEDULE OF INVESTMENTS

|

|

THE EUROPEAN EQUITY FUND, INC.

|

SEPTEMBER 30, 2010 (unaudited)

|

SCHEDULE OF INVESTMENTS

|

Shares

|

|

Description

|

|

Value(a)

|

|

|

INVESTMENTS IN GERMAN

SECURITIES – 43.8%

|

|

|

|

|

|

|

COMMON STOCKS – 40.5%

|

|

|

|

|

AIRLINES – 3.8%

|

|

|

|

187,000

|

|

|

Deutsche Lufthansa*

|

|

$

|

3,441,862

|

|

|

|

|

|

AUTOMOBILES – 4.2%

|

|

|

|

60,000

|

|

|

Daimler*

|

|

|

3,804,795

|

|

|

|

|

|

CHEMICALS – 6.2%

|

|

|

|

21,000

|

|

|

Lanxess

|

|

|

1,151,962

|

|

|

|

|

11,000

|

|

|

Linde

|

|

|

1,433,527

|

|

|

|

|

16,000

|

|

|

Wacker Chemie

|

|

|

2,955,828

|

|

|

|

|

|

|

5,541,317

|

|

|

|

|

|

CONSTRUCTION

MATERIALS – 1.0%

|

|

|

|

18,000

|

|

|

HeidelbergCement

|

|

|

868,486

|

|

|

|

|

|

DIVERSIFIED

TELECOMMUNICATION

SERVICES – 3.6%

|

|

|

|

240,000

|

|

|

Deutsche Telekom

|

|

|

3,287,225

|

|

|

|

|

|

ELECTRIC UTILITIES – 1.9%

|

|

|

|

57,000

|

|

|

E.ON

|

|

|

1,682,799

|

|

|

|

|

|

ELECTRICAL

EQUIPMENT – 2.0%

|

|

|

|

80,000

|

|

|

Tognum

|

|

|

1,773,824

|

|

|

|

|

|

INDUSTRIAL

CONGLOMERATES – 4.5%

|

|

|

|

22,000

|

|

|

Rheinmetall

|

|

|

1,456,348

|

|

|

|

|

25,000

|

|

|

Siemens

|

|

|

2,642,105

|

|

|

|

|

|

|

4,098,453

|

|

|

|

|

|

INSURANCE – 2.0%

|

|

|

|

16,000

|

|

|

Allianz

|

|

|

1,810,403

|

|

|

|

|

|

INTERNET SOFTWARE &

SERVICES – 2.0%

|

|

|

|

110,000

|

|

|

United Internet

|

|

|

1,780,649

|

|

|

|

|

|

PERSONAL PRODUCTS – 1.0%

|

|

|

|

15,000

|

|

|

Beiersdorf

|

|

|

919,260

|

|

|

|

|

|

PHARMACEUTICALS – 1.9%

|

|

|

|

24,000

|

|

|

Bayer

|

|

|

1,675,551

|

|

|

|

|

|

SOFTWARE – 4.2%

|

|

|

|

25,000

|

|

|

SAP

|

|

|

1,238,135

|

|

|

|

|

21,000

|

|

|

Software

|

|

|

2,539,533

|

|

|

|

|

|

|

3,777,668

|

|

|

|

Shares

|

|

Description

|

|

Value(a)

|

|

|

|

|

THRIFTS & MORTGAGE

FINANCE – 2.2%

|

|

|

|

88,000

|

|

|

Aareal Bank*

|

|

$

|

1,959,614

|

|

|

|

|

|

|

|

Total Common Stocks

(cost $31,006,173)

|

|

|

36,421,906

|

|

|

|

|

|

PREFERRED STOCKS – 3.3%

|

|

|

|

|

AUTOMOBILES – 1.3%

|

|

|

|

10,000

|

|

|

Volkswagen

(cost $951,062)

|

|

|

1,208,346

|

|

|

|

|

|

HOUSEHOLD PRODUCTS – 2.0%

|

|

|

|

34,000

|

|

|

Henkel & Co.

(cost $1,288,680)

|

|

|

1,828,420

|

|

|

|

|

|

|

|

Total Preferred Stocks

(cost $2,239,742)

|

|

|

3,036,766

|

|

|

|

|

|

|

|

Total Investments in German

Securities

(cost $33,245,915)

|

|

|

39,458,672

|

|

|

|

INVESTMENTS IN FRENCH

COMMON STOCKS – 17.5%

|

|

|

|

|

|

|

COMMERCIAL BANKS – 3.9%

|

|

|

|

60,000

|

|

|

Societe Generale

|

|

|

3,460,022

|

|

|

|

|

|

HEALTH CARE EQUIPMENT &

SUPPLIES – 2.3%

|

|

|

|

30,000

|

|

|

Essilor International

|

|

|

2,066,595

|

|

|

|

|

|

HOTELS, RESTAURANTS &

LEISURE – 2.0%

|

|

|

|

50,000

|

|

|

Accor

|

|

|

1,827,942

|

|

|

|

|

|

MULTI-UTILITIES – 2.4%

|

|

|

|

60,000

|

|

|

GDF Suez

|

|

|

2,150,537

|

|

|

|

|

|

OIL, GAS &

CONSUMABLE FUELS – 1.8%

|

|

|

|

32,000

|

|

|

Total

|

|

|

1,651,201

|

|

|

|

|

|

TEXTILES, APPAREL &

LUXURY GOODS – 5.1%

|

|

|

|

31,000

|

|

|

LVMH Moet Hennessy

Louis Vuitton

|

|

|

4,552,760

|

|

|

|

|

|

|

|

Total Investments in French

Common Stocks

(cost $15,378,700)

|

|

|

15,709,057

|

|

|

|

Shares

|

|

Description

|

|

Value(a)

|

|

|

INVESTMENTS IN SPANISH

COMMON STOCKS – 9.1%

|

|

|

|

|

|

|

COMMERCIAL BANKS – 4.3%

|

|

|

|

300,000

|

|

|

Banco Santander

|

|

$

|

3,815,032

|

|

|

|

|

|

DIVERSIFIED

TELECOMMUNICATION

SERVICES – 4.1%

|

|

|

|

150,000

|

|

|

Telefonica

|

|

|

3,719,012

|

|

|

|

|

|

INDEPENDENT POWER

PRODUCERS & ENERGY

TRADERS – 0.7%

|

|

|

|

200,000

|

|

|

Iberdrola Renovables

|

|

|

665,525

|

|

|

|

|

|

|

|

Total Investments in Spanish

Common Stocks

(cost $5,782,232)

|

|

|

8,199,569

|

|

|

|

INVESTMENTS IN DUTCH

COMMON STOCKS – 7.9%

|

|

|

|

|

|

|

CHEMICALS – 2.1%

|

|

|

|

36,000

|

|

|

Koninklijke DSM

|

|

|

1,846,546

|

|

|

|

|

|

DIVERSIFIED FINANCIAL

SERVICES – 2.2%

|

|

|

|

195,000

|

|

|

ING Groep*

|

|

|

2,025,444

|

|

|

|

|

|

ENERGY EQUIPMENT &

SERVICES – 2.3%

|

|

|

|

110,000

|

|

|

SBM Offshore

|

|

|

2,086,932

|

|

|

|

|

|

FOOD PRODUCTS – 1.3%

|

|

|

|

40,000

|

|

|

Unilever

|

|

|

1,197,017

|

|

|

|

|

|

|

|

Total Investments in Dutch

Common Stocks

(cost $6,689,177)

|

|

|

7,155,939

|

|

|

|

INVESTMENTS IN SWISS

COMMON STOCKS – 6.6%

|

|

|

|

|

|

|

ELECTRICAL EQUIPMENT – 1.6%

|

|

|

|

70,000

|

|

|

ABB*

|

|

|

1,483,980

|

|

|

|

|

|

INSURANCE – 2.4%

|

|

|

|

9,000

|

|

|

Zurich Financial Services

|

|

|

2,121,711

|

|

|

|

|

|

METALS & MINING – 2.6%

|

|

|

|

120,000

|

|

|

Xstrata

|

|

|

2,302,751

|

|

|

|

|

|

|

|

Total Investments in Swiss

Common Stocks

(cost $5,114,254)

|

|

|

5,908,442

|

|

|

|

Shares

|

|

Description

|

|

Value(a)

|

|

|

INVESTMENTS IN BRITISH

COMMON STOCKS – 4.5%

|

|

|

|

|

COMMERCIAL BANKS – 3.5%

|

|

|

|

2,000,000

|

|

|

Lloyds Banking Group*

|

|

$

|

2,335,521

|

|

|

|

|

1,100,000

|

|

|

Royal Bank of Scotland*

|

|

|

818,173

|

|

|

|

|

|

|

3,153,694

|

|

|

|

|

|

COMMERCIAL SERVICES &

SUPPLIES – 1.0%

|

|

|

|

35,000

|

|

|

Aggreko

|

|

|

865,737

|

|

|

|

|

|

Total Investments in British

Common Stocks

(cost $3,417,161)

|

|

|

4,019,431

|

|

|

|

INVESTMENTS IN FINNISH

COMMON STOCKS – 3.8%

|

|

|

|

|

AUTO COMPONENTS – 1.7%

|

|

|

|

45,000

|

|

|

Nokian Renkaat

|

|

|

1,547,182

|

|

|

|

|

|

CONSTRUCTION &

ENGINEERING – 1.0%

|

|

|

|

38,000

|

|

|

Yit

|

|

|

901,953

|

|

|

|

|

|

MACHINERY – 1.1%

|

|

|

|

22,000

|

|

|

Metso

|

|

|

1,009,535

|

|

|

|

|

|

Total Investments in Finnish

Common Stocks

(cost $2,880,250)

|

|

|

3,458,670

|

|

|

|

INVESTMENTS IN DANISH

COMMON STOCKS – 2.4%

|

|

|

|

|

CHEMICALS – 1.1%

|

|

|

|

50,000

|

|

|

Christian Hansen Holding*

|

|

|

1,011,137

|

|

|

|

|

|

ELECTRICAL EQUIPMENT – 1.3%

|

|

|

|

30,000

|

|

|

Vestas Wind Systems*

|

|

|

1,132,034

|

|

|

|

|

|

Total Investments in Danish

Common Stocks

(cost $2,784,322)

|

|

|

2,143,171

|

|

|

|

INVESTMENTS IN ITALIAN

COMMON STOCKS – 2.0%

|

|

|

|

|

COMMERCIAL BANKS – 2.0%

|

|

|

700,000

|

|

UniCredit

(cost $1,422,533)

|

|

|

1,789,521

|

|

|

|

Shares

|

|

Description

|

|

Value(a)

|

|

|

INVESTMENTS IN NORWEGIAN

COMMON STOCKS – 1.0%

|

|

|

|

|

FOOD PRODUCTS – 1.0%

|

|

|

|

1,000,000

|

|

|

Marine Harvest

(cost $817,928)

|

|

$

|

881,481

|

|

|

|

INVESTMENTS IN BELGIAN

COMMON STOCKS – 0.9%

|

|

|

|

|

DIVERSIFIED FINANCIAL

SERVICES – 0.9%

|

|

|

|

37,000

|

|

|

KBC Ancora*

(cost $917,201)

|

|

|

811,556

|

|

|

|

|

|

Total Investments in Common and

Preferred Stocks – 99.5%

(cost $78,449,673)**

|

|

|

89,535,509

|

|

|

|

|

|

Other Assets and Liabilities,

Net – 0.5%

|

|

|

444,463

|

|

|

|

|

|

NET ASSETS – 100.0%

|

|

$

|

89,979,972

|

|

|

For information on the Fund's policies regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent semi-annual or annual financial statements.

* Non-income producing security.

** The cost for federal income tax purposes was $79,031,380. At September 30, 2010, net unrealized appreciation for all securities based on tax cost was $10,504,129. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $16,486,438 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $5,982,309.

(a) Value stated in US dollars.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of September 30, 2010 in valuing the Fund's investments.

|

Category

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

Common Stocks and/or Other Equity Investments

(b)

|

|

|

Germany

|

|

$

|

39,458,672

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

39,458,672

|

|

|

|

France

|

|

|

15,709,057

|

|

|

|

—

|

|

|

|

—

|

|

|

|

15,709,057

|

|

|

|

Spain

|

|

|

8,199,569

|

|

|

|

—

|

|

|

|

—

|

|

|

|

8,199,569

|

|

|

|

Netherlands

|

|

|

7,155,939

|

|

|

|

—

|

|

|

|

—

|

|

|

|

7,155,939

|

|

|

|

Switzerland

|

|

|

5,908,442

|

|

|

|

—

|

|

|

|

—

|

|

|

|

5,908,442

|

|

|

|

United Kingdom

|

|

|

4,019,431

|

|

|

|

—

|

|

|

|

—

|

|

|

|

4,019,431

|

|

|

|

Finland

|

|

|

3,458,670

|

|

|

|

—

|

|

|

|

—

|

|

|

|

3,458,670

|

|

|

|

Denmark

|

|

|

2,143,171

|

|

|

|

—

|

|

|

|

—

|

|

|

|

2,143,171

|

|

|

|

Italy

|

|

|

1,789,521

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,789,521

|

|

|

|

Norway

|

|

|

881,481

|

|

|

|

—

|

|

|

|

—

|

|

|

|

881,481

|

|

|

|

Belgium

|

|

|

811,556

|

|

|

|

—

|

|

|

|

—

|

|

|

|

811,556

|

|

|

|

Total

|

|

$

|

89,535,509

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

89,535,509

|

|

|

There have been no transfers in and out of Level 1 and Level 2 fair value measurements during the period ended September 30, 2010.

(b) See Schedule of Investments for additional detailed categorizations.

|

ITEM 2.

|

CONTROLS AND PROCEDURES

|

|

|

|

|

|

(a)The Chief Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on the evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report.

|

|

|

|

|

|

(b)There have been no changes in the registrant’s internal control over financial reporting that occurred during the registrant’s last fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal controls over financial reporting.

|

|

|

|

|

ITEM 3.

|

EXHIBITS

|

|

|

|

|

|

Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Registrant:

|

The European Equity Fund, Inc.

|

|

|

|

|

By:

|

/s/Michael G. Clark

Michael G. Clark

President

|

|

|

|

|

Date:

|

November 23, 2010

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By:

|

/s/Michael G. Clark

Michael G. Clark

President

|

|

|

|

|

Date:

|

November 23, 2010

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/Paul Schubert

Paul Schubert

Chief Financial Officer and Treasurer

|

|

|

|

|

Date:

|

November 23, 2010

|

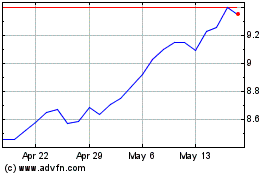

European Equity (NYSE:EEA)

Historical Stock Chart

From May 2024 to Jun 2024

European Equity (NYSE:EEA)

Historical Stock Chart

From Jun 2023 to Jun 2024