Current Report Filing (8-k)

May 04 2020 - 6:32AM

Edgar (US Regulatory)

0000033213

false

--12-31

0000033213

2020-04-30

2020-05-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): May 4, 2020 (May 1, 2020)

EQT CORPORATION

(Exact name of registrant as specified in

its charter)

|

Pennsylvania

|

|

001-3551

|

|

25-0464690

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

625 Liberty Avenue, Suite 1700,

Pittsburgh, Pennsylvania 15222

(Address of principal executive offices,

including zip code)

(412) 553-5700

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

EQT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

EQT Corporation 2020 Long-Term Incentive Plan

At

the Annual Meeting of Shareholders of EQT Corporation (the “Company”) held on May 1, 2020 (the “Annual

Meeting”), shareholders of the Company approved the EQT Corporation 2020 Long-Term Incentive Plan (the “2020

LTIP”). The 2020 LTIP is a long-term incentive plan pursuant to which awards may be granted to employees, including

executive officers, consultants, and non-employee directors of the Company and its affiliates, including options, stock

appreciation rights, restricted stock, restricted stock units, performance awards, and other awards. The 2020 LTIP was

adopted principally to serve as a successor plan to the EQT Corporation 2019 Long-Term Incentive Plan (the “2019

LTIP”), and to increase the number of shares of Company common stock reserved for equity-based awards by 7,200,000

shares (in addition to the share reserve amount that remained available under the 2019 LTIP immediately prior to the adoption

of the 2020 LTIP). No awards may be granted under the 2020 LTIP after the Company’s annual meeting of shareholders in

2030. It is not possible to determine specific amounts and types of awards that may be granted to eligible participants under

the 2020 LTIP subsequent to the Annual Meeting because the grant and payment of such awards is subject to the discretion of

the Management Development and Compensation Committee (the “Compensation Committee”) of the

Company’s Board of Directors (the “Board”). The summary of the 2020 LTIP is qualified in its entirety by

reference to the full text of the 2020 LTIP, which is filed as Exhibit 99.1 to the registration statement on Form S-8 filed by the Company with the Securities and Exchange Commission on May 1, 2020 and incorporated herein by reference.

EQT Corporation 2020 Short-Term Incentive Plan

On April 30, 2020, the Compensation Committee

approved the EQT Corporation 2020 Short-Term Incentive Plan (the “2020 STIP”), to provide the terms of annual bonus

opportunities to be granted to the Company’s executive officers and other participating employees. The purposes of the 2020

STIP are to maintain a competitive level of total cash compensation and to align the interests of the Company’s executives

and other employees with those of the Company’s shareholders and with the strategic objectives of the Company.

The 2020 STIP provides the Company’s

executive officers and other participating employees with an opportunity to earn cash incentive compensation based upon the achievement

of performance goals over a specified performance period. All of the Company’s executive officers and certain other employees

designated as eligible employees from time to time are eligible to participate in the 2020 STIP. The factors on which awards under

the 2020 STIP will be granted for service in calendar year 2020, payable in 2021, include: (i) adjusted well cost per foot;

(ii) adjusted free cash flow; (iii) adjusted gross selling, general and administrative operating expenses; (iv) operating expenses

and development costs; and (v) total recordable injury rate. Payment of incentive awards under the 2020 STIP is dependent upon

achievement of the performance goals, however the Compensation Committee retains the discretion to increase, reduce or eliminate

any incentive award that becomes payable under the 2020 STIP.

Incentive

awards under the 2020 STIP are paid in cash within two and one half months following the end of calendar year 2020 and after the

Compensation Committee has determined and certified the level of performance achieved and the incentive awards earned. The Compensation

Committee may, in its discretion, determine to satisfy an obligation for all or any part of an incentive award by issuing shares

of the Company’s common stock equal in value to the cash payment otherwise due. Such shares, if any, would be issued under

the 2020 LTIP or other source as determined by the Compensation Committee, in its discretion, or any successor plan.

In the event of a change of control of the

Company, as defined under the 2020 LTIP or its successor, the period for which performance is measured will automatically end on

the date of the change of control and the performance goals will be deemed to have been achieved for the pro-rata portion of the

performance period that elapsed through the date of the change of control at target levels. In such event, incentive awards are

paid to participants on a pro-rata basis within the time period specified above, subject to the Compensation Committee’s

overall discretion.

The foregoing description of the 2020

STIP does not purport to be complete and is qualified in its entirety by reference to the form of EQT Corporation short-term

incentive plan, which is filed as Exhibit 10.1 to this Form 8-K.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws;

Change in Fiscal Year

|

At the Annual Meeting, the

Company’s shareholders voted on and approved amendments to the Company’s Restated Articles of Incorporation (the

“Articles”) to (i) eliminate the current 80% supermajority voting requirements for shareholders to approve

certain amendments to the Articles and to the Company’s Amended and Restated Bylaws (the “Bylaws”) and to

remove directors outside of the annual meeting process and (ii) provide that shareholders holding at least 25% of the

Company’s outstanding voting stock may call special meetings of shareholders (collectively, the “Articles

Amendment”), as further described in the Company’s definitive proxy statement filed with the Securities and

Exchange Commission on March 10, 2020 (the “Proxy Statement”). The Articles Amendment was filed with the

Department of State of the Commonwealth of Pennsylvania on, and specified an effective date of, May 1, 2020. The complete

text of the Articles Amendment, as filed with the Department of State of the Commonwealth of Pennsylvania, as well as a

marked copy illustrating the changes made to those sections of the Articles that were amended pursuant to the Articles

Amendment, are attached hereto as Exhibits 3.1 and 3.2, respectively, to this Form 8-K.

In connection with the Articles Amendment,

the Board approved conforming amendments to the Bylaws to (i) eliminate the 80% supermajority voting requirements for shareholders

to approve certain amendments to the Bylaws and (ii) provide that shareholders holding at least 25% of the Company’s outstanding

voting stock may call special meetings of shareholders and establish clear procedures to be followed in the calling of special

shareholder meetings. Additionally, the Bylaws were amended to remove the specified minimum number of regular annual Board meetings.

A marked copy illustrating the changes made to those sections of the Bylaws that were amended pursuant to these Bylaw amendments

and a fully restated version of the Company’s Amended and Restated Bylaws, as amended through May 1, 2020, are attached hereto

as Exhibits 3.3 and 3.4, respectively, to this Form 8-K.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

At the Annual Meeting, the Company’s

shareholders considered the following six proposals, each of which is described in more detail in the Company’s Proxy Statement.

The final vote results for each proposal were as follows:

Proposal 1: Election of 12 Directors

Shareholders elected the individuals set forth

below to the Board to serve a one-year term expiring at the Company’s 2021 annual meeting of shareholders:

|

|

|

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

Lydia I. Beebe

|

|

|

198,700,286

|

|

|

|

99.04%

|

|

|

|

1,922,991

|

|

|

|

0.96%

|

|

|

|

216,490

|

|

|

|

27,324,331

|

|

|

Philip G. Behrman, Ph.D.

|

|

|

199,409,287

|

|

|

|

99.40%

|

|

|

|

1,197,746

|

|

|

|

0.60%

|

|

|

|

232,734

|

|

|

|

27,324,331

|

|

|

Lee M. Canaan

|

|

|

199,430,347

|

|

|

|

99.42%

|

|

|

|

1,168,537

|

|

|

|

0.58%

|

|

|

|

240,883

|

|

|

|

27,324,331

|

|

|

Janet L. Carrig

|

|

|

199,068,577

|

|

|

|

99.23%

|

|

|

|

1,541,280

|

|

|

|

0.77%

|

|

|

|

229,910

|

|

|

|

27,324,331

|

|

|

Dr. Kathryn J. Jackson

|

|

|

198,988,536

|

|

|

|

99.22%

|

|

|

|

1,557,675

|

|

|

|

0.78%

|

|

|

|

293,556

|

|

|

|

27,324,331

|

|

|

John F. McCartney

|

|

|

198,909,951

|

|

|

|

99.15%

|

|

|

|

1,697,492

|

|

|

|

0.85%

|

|

|

|

232,324

|

|

|

|

27,324,331

|

|

|

James T. McManus II

|

|

|

199,511,193

|

|

|

|

99.46%

|

|

|

|

1,086,761

|

|

|

|

0.54%

|

|

|

|

241,813

|

|

|

|

27,324,331

|

|

|

Anita M. Powers

|

|

|

199,486,752

|

|

|

|

99.44%

|

|

|

|

1,122,940

|

|

|

|

0.56%

|

|

|

|

230,075

|

|

|

|

27,324,331

|

|

|

Daniel J. Rice IV

|

|

|

199,247,038

|

|

|

|

99.32%

|

|

|

|

1,371,088

|

|

|

|

0.68%

|

|

|

|

221,641

|

|

|

|

27,324,331

|

|

|

Toby Z. Rice

|

|

|

199,328,798

|

|

|

|

99.36%

|

|

|

|

1,289,862

|

|

|

|

0.64%

|

|

|

|

221,107

|

|

|

|

27,324,331

|

|

|

Stephen A. Thorington

|

|

|

199,495,341

|

|

|

|

99.45%

|

|

|

|

1,110,999

|

|

|

|

0.55%

|

|

|

|

233,427

|

|

|

|

27,324,331

|

|

|

Hallie A. Vanderhider

|

|

|

199,027,012

|

|

|

|

99.21%

|

|

|

|

1,577,903

|

|

|

|

0.79%

|

|

|

|

234,852

|

|

|

|

27,324,331

|

|

Proposal 2: Approval of a Non-Binding Resolution

Regarding the Compensation of the Company’s Named Executive Officers

The shareholders approved a non-binding

resolution regarding the compensation of the Company’s named executive officers for 2019, with votes as follows:

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

|

197,074,041

|

|

|

|

98.30%

|

|

|

|

3,409,459

|

|

|

|

1.70%

|

|

|

|

356,266

|

|

|

|

27,324,331

|

|

Proposal 3: Approval of Amendments to the

Articles to Remove the 80% Supermajority Voting Requirements for Shareholders to Approve Certain Amendments to the Articles and

Bylaws and to Remove Directors from Office Outside of the Annual Meeting Process

The shareholders approved the proposed amendments

to the Articles to remove the 80% supermajority voting requirements for shareholders to approve certain amendments to the Articles

and Bylaws and to remove directors from office outside of the annual meeting process, with votes as follows:

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

|

199,904,641

|

|

|

|

99.63%

|

|

|

|

743,516

|

|

|

|

0.37%

|

|

|

|

191,610

|

|

|

|

27,324,331

|

|

Proposal 4: Approval of Amendments to the

Articles to Provide that Shareholders Holding at Least 25% of the Outstanding Shares of Capital Stock of the Company Entitled to

Vote in an Annual Election of Directors May Call Special Meetings of Shareholders

The shareholders approved the proposed amendments

to the Articles to provide that shareholders holding at least 25% of the outstanding shares of capital stock of the Company entitled

to vote in an annual election of directors may call a special meeting of the shareholders, with votes as follows:

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

|

199,348,411

|

|

|

|

99.37%

|

|

|

|

1,262,772

|

|

|

|

0.63%

|

|

|

|

228,584

|

|

|

|

27,324,331

|

|

Proposal 5: Approval of the 2020 LTIP

The shareholders approved the 2020 LTIP,

with votes as follows:

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

|

194,076,148

|

|

|

|

96.76%

|

|

|

|

6,501,099

|

|

|

|

3.24%

|

|

|

|

262,520

|

|

|

|

27,324,331

|

|

Proposal 6: Ratification of the Appointment

of the Company’s Independent Registered Public Accounting Firm

The appointment of Ernst & Young LLP

as the Company’s independent registered public accounting firm for 2020 was ratified by the shareholders, with votes as follows:

Shares

For

|

|

|

% Cast

For

|

|

|

Shares

Against

|

|

|

% Cast

Against

|

|

|

Shares

Abstained

|

|

|

Broker

Non-Votes

|

|

|

|

220,798,712

|

|

|

|

96.95%

|

|

|

|

6,937,810

|

|

|

|

3.05%

|

|

|

|

427,576

|

|

|

|

N/A

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EQT CORPORATION

|

|

|

|

|

Date: May 4, 2020

|

By:

|

/s/ William E. Jordan

|

|

|

Name:

|

William E. Jordan

|

|

|

Title:

|

Executive Vice President and General Counsel

|

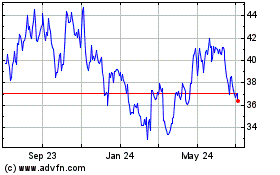

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

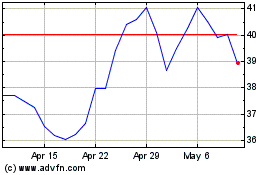

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024