Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 07 2024 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Javier Leonardo Cardenas |

|

| |

|

Name: |

Javier Leonardo Cardenas |

|

| |

|

Title: |

Chief

Financial Officer (acting) |

|

Date: August 6,

2024

Ecopetrol S.A. announces partial redemption of U.S.$250

million of its Notes due 2026

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) announces

that, as part of its comprehensive debt management strategy, it will redeem U.S.$250 million of its 5.375% Notes due 2026 (the “Notes”)

(CUSIP: 279158 AL3 / ISIN: US279158AL39). The outstanding balance of the Notes is U.S.$1.5 billion as of the date hereof.

The redemption date of the bonds will take place

on September 5, 2024 (the “Redemption Date”) at a redemption price equal to, approximately, U.S.$1,014.95 per U.S.$1,000.00

principal amount outstanding (approximately U.S.$253,737,148.23 for U.S.$250,000,000.00 aggregate principal amount of the Notes outstanding),

plus accrued and unpaid interest to the Redemption Date equal to U.S.$10.30 per U.S.$1,000 principal amount outstanding (approximately

U.S.$2,575,520.83 for U.S.$250,000,000.00 aggregate principal amount of the Notes outstanding), amounting to, approximately, U.S.$1,025.25

per U.S.$1,000 principal amount outstanding (approximately U.S.$256,312,669.06 for U.S.$250,000,000.00 aggregate principal amount of the

Notes outstanding), to be finally calculated three business days prior to the Redemption Date.

The redemption is in line with the objectives

of the financial plan and confirms Ecopetrol S.A.'s commitment to proactively manage the refinancing of maturities in 2026.

For more information, please refer to the Securities

and Exchange Commission's official Securities and Exchange Commission press release at the following link: Ecopetrol - Notice of Redemption

to Holders - 2026 Notes.pdf.

Bogota D.C., August 6, 2024

-----------------------------------------

Ecopetrol is the largest

company in Colombia and one of the main integrated energy companies in the American continent, with more than 19,000 employees. In Colombia,

it is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems,

and it holds leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares,

the company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway

concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration

operations in the United States (Permian basin and the Gulf of Mexico), Brazil, and, through ISA and its subsidiaries, Ecopetrol holds

leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications

sector.

For more information, please contact:

Head of Capital Markets (a)

Lina María Contreras Mora

Email: investors@ecopetrol.com.co

Head of Corporate Communications

Marcela Ulloa

Email: marcela.ulloa@ecopetrol.com.co

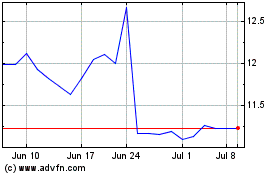

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Oct 2024 to Nov 2024

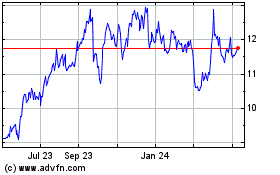

Ecopetrol (NYSE:EC)

Historical Stock Chart

From Nov 2023 to Nov 2024