Ecolab Files Registration Statement to Enable Henkel to Sell Its Entire 72.7 Million Ecolab Share Position

November 10 2008 - 6:15AM

Business Wire

Ecolab Inc. announced that, at the request of stockholder Henkel AG

& Co. KGaA, Ecolab has filed a registration statement with the

Securities and Exchange Commission to enable Henkel to sell all of

the 72.7 million Ecolab shares it holds. Ecolab and Henkel have

also agreed to amend the Stockholder�s Agreement between the

parties to facilitate the offering. The offering will begin today,

and Ecolab�s senior management team will meet with potential

investors in connection with the offering. Ecolab further announced

that it has agreed to purchase $300 million of its shares directly

from Henkel in conjunction with Henkel�s sale of Ecolab shares.

Ecolab will utilize existing cash balances, commercial paper and

committed bank lines to fund the purchase. The purchase is expected

to be accretive to Ecolab�s 2009 earnings per share. Henkel has

held an investment in Ecolab since 1989. The investment originated

as part of a transaction in which Ecolab and Henkel formed a joint

venture in Europe, combining each company�s European commercial

cleaning and sanitizing operations. Also at that time, Henkel sold

its remaining worldwide commercial cleaning and sanitizing

businesses to Ecolab. In 2001 Ecolab purchased Henkel�s interest in

the joint venture for cash. In August 2007 Henkel announced its

intention to acquire the adhesives and electronic materials

businesses of National Starch. In February 2008 Henkel announced

its intention to sell some or all of its Ecolab shares. Henkel

closed on the acquisition of National Starch in April 2008. Douglas

M. Baker, Jr., Ecolab�s Chairman, President and Chief Executive

Officer, commented on the action, saying, �We have had a productive

relationship with Henkel. Through it, we expanded our global

business reach and developed new and better opportunities to serve

our customers. Henkel has been a strong and supportive shareholder,

and we wish them well in the future.� Baker continued, �We are

excited by the opportunity this transaction represents to further

diversify our shareholder base and increase our float. We are also

excited by the opportunity to purchase our shares. We believe our

$300 million purchase is a sound and timely investment for Ecolab

and its shareholders. It balances a unique opportunity to invest in

a strong and growing asset � Ecolab shares � while allowing us to

retain appropriate flexibility in our balance sheet to fund new

business opportunities that should help keep us a strong and

attractive growth company for years to come.� Baker concluded by

saying, �We look forward to our upcoming meetings with investors,

and as always, remain fully focused on driving our business,

building our future and continuing to deliver superior shareholder

value.� With sales of $5.5 billion and more than 26,000 associates,

Ecolab Inc. (NYSE:ECL) is the global leader in cleaning,

sanitizing, food safety and infection prevention products and

services. Ecolab delivers comprehensive programs and services to

foodservice, food and beverage processing, healthcare, and

hospitality markets in more than 160 countries. This news release

does not constitute an offer to sell, or a solicitation of an offer

to buy, any of the common stock or any other security of Ecolab.

Any such offers, or solicitations to buy, will be made solely by

means of a prospectus and related prospectus supplements filed with

the Securities and Exchange Commission. This news release contains

various �Forward-Looking Statements� within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements,

including the potential impact of the company�s stock repurchase on

earnings per share in 2009, represent Ecolab�s expectations or

beliefs concerning various future events, and are based on current

expectations that involve a number of risks and uncertainties that

could cause actual results to differ materially from those of such

Forward-Looking Statements. We caution that undue reliance should

not be placed on Forward-Looking Statements, which speak only as of

the date made. Risks and uncertainties that may affect operating

results and business performance are set forth under Item 1A of our

most recent Form 10-K and Item 1A of Part II of our subsequent

reports on Form 10-Q and include the vitality of the markets we

serve; the impact of economic factors, such as the worldwide

economy, interest rates and foreign currency exposure; our ability

to develop competitive advantages through innovation; fluctuations

in raw material costs; restraints on pricing flexibility due to

contractual obligations; pressure on operations from consolidation

of customers, vendors or competitors; the impact of acquisitions,

divestitures and investments to develop business systems or to

optimize our business structure; changes in regulations or

accounting standards; the costs and effects of complying with laws

and regulations relating to the environment and to the manufacture,

storage, distribution, sale and use of our products; the occurrence

of litigation or claims, acts of war, terrorism, severe weather or

public health epidemics; the loss or insolvency of a major

customer, supplier or distributor; our ability to attract and

retain high caliber management talent; and other uncertainties or

risks reported from time to time in our reports to the Securities

and Exchange Commission. Except as may be required under applicable

law, we undertake no duty to update our Forward-Looking Statements.

Ecolab has filed a registration statement (including a prospectus)

with the SEC for the offering to which this communication relates.

Before you invest, you should read the prospectus in that

registration statement and other documents the issuer has filed

with the SEC for more complete information about the issuer and

this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the

issuer, any underwriter or any dealer participating in the offering

will arrange to send you the prospectus if you request it by

calling toll-free 1-800-221-1037, 1-866-471-2526 or 1-866-500-5408.

(ECL-C)

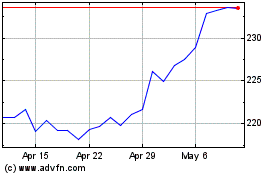

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2024 to Nov 2024

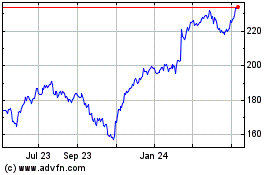

Ecolab (NYSE:ECL)

Historical Stock Chart

From Nov 2023 to Nov 2024