0000067215false00000672152023-08-232023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 23, 2023

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Florida | | 001-10613 | | 59-1277135 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. employer identification no.) |

| | | | | | |

| | 11780 U.S. Highway One, Suite 600 | | |

| | Palm Beach Gardens, | FL | 33408 | | |

| | (Address of principal executive offices) (Zip Code) | | |

Registrant’s telephone number, including area code: (561) 627-7171

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.33 1/3 per share | | DY | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On August 23, 2023, Dycom Industries, Inc. (the “Company”) held a webcast and conference call to review its fiscal 2024 second quarter results and provide forward guidance. A copy of the transcript is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The transcript contains the financial measures of Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted Net Income (Loss), Non-GAAP Adjusted Diluted Earnings (Loss) per Common Share and certain amounts relating to organic contract revenue, which are Non-GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. Non-GAAP Adjusted EBITDA, defined by the Company as earnings before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items, is not a recognized term under GAAP and does not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Non-GAAP Adjusted Net Income (Loss) is not a recognized term under GAAP and does not purport to be an alternative to GAAP net income (loss). Non-GAAP Adjusted Diluted Earnings (Loss) per Common Share is not a recognized term under GAAP and does not purport to be an alternative to GAAP diluted earnings (loss) per common share. Organic contract revenue is not a recognized term under GAAP and does not purport to be an alternative to GAAP contract revenue. Because all companies do not use identical calculations, the presentation of these Non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. The Company believes these Non-GAAP financial measures provide information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. A reconciliation of these Non-GAAP financial measures to the most directly comparable GAAP measures is provided in the conference call materials referred to on the webcast and conference call, a copy of which has been furnished as Exhibit 99.1 to the Company’s Form 8-K previously filed with the Securities and Exchange Commission on August 23, 2023.

The information in the preceding paragraphs, as well as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. It may only be incorporated by reference into another filing under the Exchange Act or the Securities Act if such subsequent filing specifically references this Current Report on Form 8-K.

Forward Looking Statements

The transcript of Dycom Industries, Inc.’s webcast and conference call held on August 23, 2023 (the “Transcript”) included in this Current Report on Form 8-K contains forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act. These statements are subject to change. Forward-looking statements are based on management’s current expectations, estimates and projections. These statements are subject to risks and uncertainties that may cause actual results for completed periods and periods in the future to differ materially from the results projected or implied in any forward-looking statements contained in this press release. The most significant of these risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include future economic conditions and trends including the potential impacts of an inflationary economic environment, changes to customer capital budgets and spending priorities, the availability and cost of materials, equipment and labor necessary to perform our work, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the impact to the Company’s backlog from project cancellations or postponements, the impacts of pandemics and public health emergencies, the impact of varying climate and weather conditions, the anticipated outcome of other contingent events, including litigation or regulatory actions involving the Company, the adequacy of our liquidity, the availability of financing to address our financials needs, the Company’s ability to generate sufficient cash to service its indebtedness, the impact of restrictions imposed by the Company’s credit agreement, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These filings are available on a web site maintained by the Securities and Exchange Commission at http://www.sec.gov. The Company does not undertake any obligation to update forward-looking statements.

Item 9.01 Financial Statement and Exhibits.

| | | | | |

| (d) | Exhibits |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: August 23, 2023

| | | | | |

DYCOM INDUSTRIES, INC.

(Registrant) |

| By: | /s/ Ryan F. Urness |

| Name: | Ryan F. Urness |

| Title: | Vice President, General Counsel and Corporate Secretary |

Dycom Industries, Inc. (NYSE: DY) Q2 2024 Results Conference Call August 23, 2023 9:00 AM ET

CORPORATE PARTICIPANTS

Steven E. Nielsen, President, Chief Executive Officer & Director, Dycom Industries, Inc.

Ryan F. Urness, Vice President, General Counsel & Corporate Secretary, Dycom Industries, Inc.

H. Andrew DeFerrari, Senior Vice President & Chief Financial Officer, Dycom Industries, Inc.

OTHER PARTICIPANTS

Adam Thalhimer, Analyst, Thompson, Davis & Company, Inc.

Brent Thielman, Analyst, D.A. Davidson & Co.

Sean Eastman, Analyst, KeyBanc Capital Markets, Inc.

Frank Louthan, Analyst, Raymond James & Associates, Inc.

Alex Rygiel, Analyst, B Riley Securities, Inc.

Eric Luebchow, Analyst, Wells Fargo Securities LLC

Alan Mitrani, Managing Partner, Sylvan Lake Asset Management LLC

MANAGEMENT DISCUSSION SECTION

Operator

Good day, and welcome to Dycom Industries, Inc. Second Quarter Results Conference Call. At this time, all participants are in a listen-only mode. After the speaker presentation, there will be a question-and-answer session. Please be advised that today's conference is being recorded. I would now like to hand the conference over to your speaker, Mr. Steven Nielsen, President and Chief Executive Officer. Please go ahead, sir.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Thank you, Operator. Good morning, everyone. Thank you for attending this conference call to review our second quarter fiscal 2024 results. Going to slide 2. During this call we will be referring to a slide presentation which can be found on our website’s investor center main page. Relevant slides will be identified by number throughout our presentation. Today we have on the call Drew DeFerrari, our Chief Financial Officer, and Ryan Urness, our General Counsel. Now I will turn the call over to Ryan Urness.

Ryan F. Urness

Vice President, General Counsel & Corporate Secretary, Dycom Industries, Inc.

Thank you, Steve. All forward-looking statements made during this conference call are provided pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all comments reflecting our expectations, assumptions or beliefs about future events or performance that do not relate to historical periods. These forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from current projections, including those risks described in our annual report on Form 10-K filed March 3, 2023, together with our other filings with the US Securities and Exchange Commission. Forward-looking statements are made solely as of the original broadcast date of this conference call, and we assume no obligation to update any forward-looking statements. Steve?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Thanks, Ryan. Now, moving to slide 4 and a review of our second quarter results. As we review our results, please note that in our comments today, and in the accompanying slides, we reference certain Non-GAAP measures. We refer you to the Quarterly Reports section of our website for a reconciliation of these Non-GAAP measures to their corresponding GAAP measures.

Now for the quarter. Revenue was $1.042 billion, an organic increase of 7.1%. As we deployed gigabit wireline networks, wireless/wireline converged networks and wireless networks, this quarter reflected an increase in demand from 4 of our top 5 customers.

Gross margin was 20.3% of revenue and increased 234 bps compared to the second quarter of fiscal year 2023. General and administrative expenses were 8.1% of revenue and all of these factors produced Adjusted EBITDA of $130.8 million, or 12.6% of revenue, and earnings per share of $2.03, compared to $1.46 in the year-ago quarter. Liquidity was strong at $685.9 million.

Last Friday we acquired Bigham Cable Construction, a provider of telecommunications construction services in the southeastern United States for a purchase price of $127 million. Bigham generated revenues of approximately $140 million over the last year and expands our ability to further address significant growth opportunities in rural broadband deployments.

And finally, as our most recent share repurchase authorization has expired, our board has newly authorized $150 million in share repurchases.

Now Going to Slide 5. Today major industry participants are constructing or upgrading significant wireline networks across broad sections of the country. These wireline networks are generally designed to provision gigabit network speeds to individual consumers and businesses either directly or wirelessly using 5G technologies.

Industry participants have stated their belief that a single high-capacity fiber network can most cost effectively deliver services to both consumers and businesses, enabling multiple revenue streams from a single investment. This view is increasing the appetite for fiber deployments, and we believe that the industry effort to deploy high-capacity fiber networks continues to meaningfully broaden the set of opportunities for our industry.

Increasing access to high-capacity telecommunications continues to be crucial to society, especially for rural America. The Infrastructure Investment and Jobs Act includes over $40 billion for the construction of rural communications networks in unserved and underserved areas across the country. This represents an unprecedented level of support. In addition, substantially all states have commenced programs that will provide funding for telecommunications networks even prior to the initiation of funding under the Infrastructure Act.

We are providing program management, planning, engineering and design, aerial, underground, and wireless construction, and fulfillment services for gigabit deployments. These services are being provided across the country in numerous geographic areas to multiple customers.

These deployments include networks consisting entirely of wired network elements and converged wireless/wireline multi-use networks. Fiber network deployment opportunities are increasing in rural America as new industry participants respond to emerging societal initiatives.

We continue to provide integrated planning, engineering and design, procurement and construction and maintenance services to several industry participants.

Macro-economic conditions, including those impacting the cost of capital may influence the execution of some industry plans. In addition, the market for labor remains tight in many regions around the country. Automotive and equipment supply chains remain challenged, particularly for the large truck chassis required for specialty equipment. Prices for capital equipment continue to increase. It remains to be seen how long these conditions may persist.

We expect demand to continue to fluctuate amongst customers. For several customers, deployments are increasing into next year. For others, capital expenditures have been more heavily weighted toward the first half of this year and, accordingly, they appear to be managing budgets closely through the end of this year.

We are encouraged by recent longer-term industry financings. These financings have expanded the pool of capital available to fund future industry growth. Within this context, we remain confident that our scale and financial strength position us well to deliver valuable services to our customers.

Moving to Slide 6. During the quarter revenue increased 7.1%. Our top 5 customers combined produced 59.2% of revenue, decreasing 2.3% organically. Demand increased from 4 of our top 5 customers. All other customers increased 24.6% organically.

AT&T was our largest customer at 16.7% of total revenue, or $174.3 million. Lumen was our second largest customer at 15.6% of revenue, or $162.5 million. Lumen grew organically 56.5%, excluding operations sold to Brightspeed from the year ago period. This was our sixth consecutive quarter of organic growth with Lumen. Revenue from Comcast was $119.5 million, or 11.5% of revenue. Comcast was Dycom’s third largest customer and grew organically 6.9%. Verizon was our fourth largest customer at $104.9 million, or 10.1% of revenue. Verizon grew 29.8% organically. And finally, a customer who has requested their name not be disclosed, was our fifth largest customer at $55.3 million, or 5.3% of revenue. This customer grew 68.6% organically.

This is the eighteenth consecutive quarter where all of our other customers in aggregate, excluding the top five customers, have grown organically. It is the first quarter since our October 2014 quarter where our top 5 customers have represented less than

60% of total revenue, an encouraging sign of increasing customer breadth and opportunity. Of note, fiber construction revenue from electric utilities was $82.7 million in the quarter and grew organically 3.6%.

We have extended our geographic reach and expanded our program management and network planning services. In fact, over the last several years we believe we have meaningfully increased the long-term value of our maintenance and operations business, a trend which we believe will parallel our deployment of gigabit wireline direct and wireless/wireline converged networks as those deployments dramatically increase the amount of outside plant network that must be extended and maintained.

Now going to Slide 7. Backlog at the end of the second quarter was $6.207 billion vs. $6.316 billion at the end of the April 2023 quarter, a decrease of $109 million. Of this backlog, approximately $3.523 billion is expected to be completed in the next 12 months. Backlog activity during the second quarter reflects solid performance as we booked new work and renewed existing work. We continue to anticipate substantial future opportunities across a broad array of our customers.

During the quarter we received, from Frontier, a fiber construction agreement for California, Texas, Illinois, Michigan, Indiana, Ohio, New York, Connecticut, Pennsylvania, and Florida. For Brightspeed, a fiber construction agreement for Pennsylvania, New Jersey, Virginia, and North Carolina. From Charter, rural fiber construction agreements in Missouri and Florida. For Windstream, fiber construction agreements in Georgia and from AT&T, a utility line locating agreement for Arkansas. Headcount was 15,147.

Now I will turn the call over to Drew for his financial review and outlook.

H. Andrew DeFerrari

Senior Vice President & Chief Financial Officer, Dycom Industries, Inc.

Thanks Steve and good morning, everyone. Going to slide 8. Contract revenues were $1.042 billion and organic revenue increased 7.1%. Adjusted EBITDA was $130.8 million, or 12.6% of revenue, compared to $104.7 million, or 10.8% of revenue. The Adjusted EBITDA percentage increased 179 bps compared to Q2 2023 from improved operating performance on the higher level of revenue in the quarter. Gross margin was 20.3% of revenue compared to 17.9% in Q2 2023. G&A expense was 8.1% of revenue compared to 7.5% in Q2 2023.

Net income was $2.03 per share compared to $1.46 per share in Q2 last year. The increase in earnings reflects higher Adjusted EBITDA, lower amortization, and higher gains on asset sales, partially offset by higher depreciation, stock-based compensation, interest expense and taxes.

Going to slide 9. Our financial position and balance sheet remains strong. We ended Q2 with $500.0 million of senior notes, $323.75 million of Term Loan, and no revolver borrowings. Cash and equivalents were $83.4 million and liquidity was strong at $685.9 million. Our capital allocation prioritizes organic growth, followed by M&A and opportunistic share repurchases, within the context of our historical range of net leverage.

Last Friday, we acquired Bigham Cable Construction for a purchase price of $127 million, and this week our board of directors approved a new $150 million authorization for share repurchases through February 2025. This authorization replaces the remaining amount from our prior authorization.

Going to slide 10. Cash flows provided by operating activities were $56.3 million in Q2. Capital expenditures were $40.0 million, net of disposal proceeds, and gross CapEx was $51.0 million. The combined DSO’s of accounts receivable and net contract assets was 111 days, an increase of 5 days sequentially.

Going to slide 11. As we look ahead to the quarter ending October 28, 2023, we expect organic contract revenues to be in-line with Q3 of last year. In addition, we expect approximately $30 million of acquired revenues from Bigham Cable Construction in Q3 2024. We also expect Non-GAAP Adjusted EBITDA percentage of contract revenues to increase 50 to 100 bps as compared to Q3 2023

Additionally, we expect $6.1 million of total amortization expense, $13.3 million of net interest expense, a 26.0% effective income tax rate, and 29.7 million diluted shares.

Now, I will turn the call back to Steve.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Thanks Drew. Moving to slide 12. This quarter we experienced solid activity and capitalized on our significant strengths. First and foremost, we maintained significant customer presence throughout our markets. We are encouraged by the breadth in our business. Our extensive market presence has allowed us to be at the forefront of evolving industry opportunities.

Telephone companies are deploying fiber-to-the-home to enable gigabit high speed connections. Rural electric utilities are doing the same. Dramatically increased speeds for consumers are being provisioned and consumer data usage is growing, particularly upstream.

Wireless construction activity in support of newly available spectrum bands continues this year.

Federal and state support for rural deployments of communications networks is dramatically increasing in scale and duration.

Cable operators are increasing fiber deployments in rural America. Capacity expansion projects are underway.

Customers are consolidating supply chains creating opportunities for market share growth and increasing the long-term value of our maintenance and operations business.

As our nation and industry navigate economic uncertainty, we remain encouraged that a substantial number of our customers are committed to multi-year capital spending initiatives. We are confident in our strategies, the prospects for our company, the capabilities of our dedicated employees, and the experience of our management team.

Before we take questions, I want to welcome our new employees at Bigham Cable Construction. We look forward to growing together.

Now, Operator, we will open the call for questions.

QUESTION AND ANSWER SECTION

Operator

[Operator Instructions] And that will come from the line of Adam Thalhimer with Thompson & Davis.

Adam Thalhimer

Analyst, Thompson, Davis & Company, Inc.

Hey, good morning, guys. Congrats on the good quarter and the acquisition.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Thanks, Adam

Adam Thalhimer

Analyst, Thompson, Davis & Company, Inc.

Steve or Drew - for the customers that are going to be a touch weaker in the back half of this year, when do you think activity picks back up? Is it possible in your fiscal Q4?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, Adam, I think we've seen other environments where people that had strong first halves, they closely manage their budget going into the end of the year and then as they look forward to more normalized activity in the following year, there's certainly a possibility that that activity could pick up. We've seen that before.

Adam Thalhimer

Analyst, Thompson, Davis & Company, Inc.

And then for Bigham - can you comment on do they have a specific top customer? Are there any large contracts that you're picking up? And maybe you can comment on the acquisition process.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah. They have historically had a long, successful relationship with Charter in the Southeast. They also work for a number of electric co-ops. So, we think it's a good expansion of the business that we do with Charter. We've obviously done lots of work in the Southeast. There was not a process. These are folks that we've known for a long time and respected. It just made sense for both of us to get together when we did.

Adam Thalhimer

Analyst, Thompson, Davis & Company, Inc.

Great. I'll turn it over. Thanks.

Operator

[Operator Instructions] And that will come from the line of Brent Thielman with D.A. Davidson.

Brent Thielman

Analyst, D.A. Davidson & Co.

Hey, thanks. Good morning. Great quarter. Steve, any additional color just on the strong improvement in margins, almost 200 basis points over last year? I guess just asking especially in consideration of kind of some of the slower demand you saw from a few larger customers?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, I think we are pleased with the margin performance. Over the last six consecutive quarters, both gross and EBITDA margins have increased year over year. If you look at the guidance, we expect that to continue for the October quarter. I think there are a number of things that have been helpful. I mean, clearly, we've had lots of organic growth. We've always talked about having good distribution across top customers, but we've also had great growth out of the top five. So that's been helpful. We've talked about some headwinds that have abated over the last, call it, 2 to 3 quarters. That's also been helpful. I just think that, in general, the industry is in a pretty healthy place. We could always do better. We're working hard to improve them, but we are pleased with our progress.

Brent Thielman

Analyst, D.A. Davidson & Co.

Okay. And I guess stepping back, Steve, I mean, you've been able to more than compensate for some of these customers, who’ve sort of moderated plans in the short run, with a ramp up among other customers. You've always said there will be some variations in spending patterns on kind of a short-term basis, but I guess does this environment today with sort of multiple new and legacy participants spending money, does it increase your conviction this is sort of a sustainable trend for you, especially as we see, you know, a few of your larger customers kind of take a pause here?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, I think, Brent, it's helpful to keep in mind that if you look at over the last two years, we've had just short of $1 billion of organic growth. You don't do that just on one or two customers. It's been a broad book of business that's increased. I do think that that's been helpful to the business. It's as broad a growth pattern as I think that I've ever seen, or at least maybe not since the late 1990s, long time ago. I do think that the drivers supporting that growth are really both private capital for which there's been some new capital raises, as well as public capital that's already in the industry. We expect to see a lot more in the next couple of years.

Brent Thielman

Analyst, D.A. Davidson & Co.

Okay. And just lastly on the Bigham acquisition, congrats on that. Saw the trailing twelve months revenue of $140 million, is that appropriate to consider going forward? Is there any reason to believe it'd be lower or they've had a nice period of growth?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Sure - they’ve had a nice period of growth. We expect that to continue. We're going to work hard together. We think one of the synergies of the deal is that we'll be able to help them with acquiring more capital equipment to support their growth. I think they'll grow nicely. We're not going to give you a forward forecast on one business unit, but typically we acquire things that have been growing and that we expect to continue to grow and put us in position to benefit nicely from big trends in the industry. I think Bigham helps us do that.

Brent Thielman

Analyst, D.A. Davidson & Co.

Okay, great. Thank you.

Operator

[Operator Instructions] And that will come from the line of Sean Eastman with KeyBanc Capital Markets.

Sean Eastman

Analyst, KeyBanc Capital Markets, Inc.

Hi team, thanks for taking my questions. Steve, I wanted to come back to your comment about the longer-term industry financings that were secured. I assume you're referring to the fiber securitization announced by one of your large customers earlier this month. But I just wanted to make sure we understand what you're communicating there, what the significance of that is. And you know, just come away with the right takeaway.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, sure. So, Sean, clearly there was one of our very significant customers that was able to go out and raise a significant amount of additional capital to fund their fiber program. They were able to do that with, you know, a couple of the tranches that were investment grade rating, but that I think it's probably bigger than that. So not only did that customer access the ABS market, but so did a number of others that we work for some that are smaller but trying to grow more rapidly. I think any time that a growth industry can gain access to investment grade capital for a portion of its future financing needs, that's a good thing for that industry. I was involved in the tower industry 20 years ago when it began to transition from high yield financing to CMBS. I think if you look back on that industry, that was a milestone that supported its hugely successful growth ever since. I think anytime that you see investment grade capital meeting a growth opportunity, as it does here with fiber infrastructure, that's a good thing.

Sean Eastman

Analyst, KeyBanc Capital Markets, Inc.

Okay, very helpful. And then coming back to the margins, the guidance for revenue implies kind of flat sequential organic revenues from 2Q to 3Q while the margin expansion guidance seems to imply, you know, a pretty meaningful sequential downtick in margins from to 2Q to 3Q. So, you know, I just want to understand why that makes sense. Is there something in the mix of business? Was there something in 2Q that perhaps wasn't sustainable? Any comment there would be helpful.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Sure. I think, Sean, what we would point you to is that clearly we've had some moderation in some customers. We're a little bit under absorbed on G&A. I think at least in our model, gross margins are in line and a little bit of pressure is on the G&A line given that it's our belief that this is a kind of a second half moderation and that things normalize going into next year. We're making some adjustments, but we're not going to do anything short term that impacts our ability to manage the business for growth long term.

Sean Eastman

Analyst, KeyBanc Capital Markets, Inc.

Okay. Again, very helpful. One last one, Steve. I mean, you know, clearly guiding to a moderation in revenue versus what we've seen over the past year or so. You know, perhaps one benefit of that would be the cash flow unwind. Is that a fair expectation that, you know, in the back half we should see, you know, good cash flowing out of the business? Any thoughts there would also be good perspective.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

I think directionally, Sean, you're there. I mean, that's what we've historically seen in our business. So, I just want to step back and provide perhaps some context on this moderation. Any time we grow, call it just less than $1 billion over a two-year period and the industry has grown with us - this isn't just us, this is lots of folks - that kind of surge in activity typically has some consolidation that comes and we've been through this before. As we consolidate, we generate cash. We invest that cash to increase our future growth when the business gets better. We’ve got a number of customers that are growing pretty substantially this year and into next year. We're going to use that cash to make the business bigger and better as this consolidation unwinds, which we don't think it's going to take very long for that to do.

Sean Eastman

Analyst, KeyBanc Capital Markets, Inc.

Really excellent responses. Thanks.

Operator

[Operator Instructions] And that will come from the line of Frank Louthan with Raymond James.

Frank Louthan

Analyst, Raymond James

Great. Thank you. Just on the Bigham deal, just curious when that closes and if you can give us an idea of the margin profile - I would assume you could improve that a little bit, but how is that relative to where you are? And then secondly, what are customers telling you about their BEAD plans? Some of the funding coming in next year – are they already lining that up? And was that some of the strategic rationale for Bigham to expand a little bit more in rural areas? Thanks.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, Frank. With respect to close, that was a sign and close deal. We closed on that last Friday - so it's done. With respect to the margins, I think they've been at our margins or a little bit better. We think on the margin line before all the purchase accounting issues that we think it's accretive to what we're doing. Once again, we're going to help invest in that business so that we can both grow at top line and bottom. On BEAD, Frank, I think that's a great question. Just with respect to Bigham, if you look at the five-state area that they focus on, those five states have received something like call it $6 billion of BEAD funding. Certainly, that's going to be helpful. We also have lots of other resources in that area, too. I think the way we're thinking about BEAD is that we're encouraged that at least some industry analysts have about 40% of the of the 12 million BSLs that are actually in ILEC footprint. I think we'll see some good opportunities with the ILECs and then with respect to others that have expressed some pretty active planning. I think there's lots of planning going on. It's kind of amazing, Frank - I looked this morning, there's 19 states that received $1 billion or more of allocation. So, lots of capital coming to the market - coming into the industry over the next couple of years.

Frank Louthan

Analyst, Raymond James

All right. Great. Thank you very much.

Operator

[Operator Instructions] And that will come from the line of Alex Rygiel with B Riley Securities.

Alex Rygiel

Analyst, B Riley Securities, Inc.

Good morning, Steve and Drew.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Good morning, Alex.

Alex Rygiel

Analyst, B Riley Securities, Inc.

Steve, it looks like capital allocation priorities changed a bit as M&A as you know, this quarter appears to have moved ahead of share repurchases. Can you touch upon that a bit?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, I think, Alex, we've always had an opportunistic approach to M&A. This wasn't a deal that we found in the last three weeks and closed. We've been working on this for a while. We're always looking forward to have an opportunity to buy well-run, family businesses. This is a business that just celebrated its 46th anniversary. It fits a profile that we've been successful with in the past. I think irrespective of where we were on share repurchases or organic growth, this is a deal that when it presented itself, we were very interested in completing. I think we're going to be opportunistic on where we go with the cash flow that we have. We've always tried to increase the intrinsic capability to grow when there are periods of time where growth moderates a little bit. I think after this deal we’ll still be nicely below that leverage of 2x. We've still got plenty of room to grow given the strength of the balance sheet and the available liquidity that we have.

Alex Rygiel

Analyst, B Riley Securities, Inc.

And then specifically to Bigham - I'm assuming they are bringing in a backlog here. Any chance you could quantify that? And then as it relates to the macro M&A, can you address purchase multiples today relative to a number of years ago and how they might be might have changed?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, I think what we can say is we're working through the details. Certainly, they do have plenty of backlog. We're working through the details right now and we'll have those backlog results included in our October quarter. This deal was certainly within our historical range. Clearly, as interest rates have gone up, we factor that into our valuation, but we feel really good that this is a deal that was good for us and good for the sellers.

Alex Rygiel

Analyst, B Riley Securities, Inc.

Great. Thank you.

Operator

[Operator Instructions] And that will come from the line of Eric Luebchow with Wells Fargo.

Eric Luebchow

Analyst, Wells Fargo Securities LLC

Great. Thanks for the question, Steve. So just wondering if you could provide any more color like you did last quarter. So two of the customers you talked about, they declined pretty substantially on a sequential basis. If you stripped them out, it looks like all your other customers grew over 15% sequentially. So any kind of way to just aggregate your guide for Q3 between those two customers that are moderating spend and some of the other customers that continue to grow pretty nicely?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Yeah, I think at a high level, Eric, what we can say is that the adjustment that we saw sequentially is moderating certainly and that the growth rates as we go into October for everybody else continues but, of course, off of a bigger base. Growth at the rates that we're seeing requires hard work by everybody and we're working hard to do better if we can, but there's certainly lots of opportunity.

Eric Luebchow

Analyst, Wells Fargo Securities LLC

Okay. I appreciate that. And a couple of the equipment manufacturers recently cited some demand slowdown for wireline and wireless equipment. So maybe based on what you see, do you think this is largely just an inventory digestion issue with lead times on a lot of equipment coming down a lot versus last year? Or does it have any read that you can see in terms of demand the next few quarters in your business?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Well, certainly, and we're no expert in that business, but we've been around it. Clearly, with the benefit of hindsight, there was a lot of ordering when supply chains got challenged and they're working through that inventory. That's why we're pleased that we're in a services business where we don’t have to work through those kinds of issues. As you can tell if you look at the details - when you get time to run through the information we provided, we've got a number of customers that are still growing strongly and it's just a question of some rotation. We've seen that before, a little bit of consolidation, but we feel good about being optimistic for next year.

Eric Luebchow

Analyst, Wells Fargo Securities LLC

Perfect. And then just one last one for me, Steve. Few of the tower companies talked about wireless activity slowing pretty materially in the second quarter. One of your competitors did as well. I know it's a small piece of your business, but your top customer, you do a decent amount of work for - so maybe you could provide any commentary at all in terms of what you're doing on the wireless side if you did see a slowdown there consistent with what we heard from other industry participants.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Sure, Eric. You know, total wireless revenue was about 4.2 to 4.3% of total revenue. So, it certainly was off somewhat. You know, I think it's pretty generally acknowledged that the carriers have done a great job of efficiently deploying the mid-band spectrum that they have. So that's affected activity, again, in the near term. We think over the long term there are great opportunities in wireless. But again, they've done a great job of getting this out there quickly. And what's good for their business is ultimately always good for our business.

Eric Luebchow

Analyst, Wells Fargo Securities LLC

Appreciate it, Steve.

Operator

[Operator Instructions] And that will come from the line of Alan Mitrani with Sylvan Lake Asset Management.

Alan Mitrani

Managing Partner, Sylvan Lake Asset Management LLC

Hi. Thank you. Just a couple. Was Bigham a subcontractor for you guys at all or no?

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Oh, no, no. They are direct to customers.

Alan Mitrani

Managing Partner, Sylvan Lake Asset Management LLC

Okay, good. Also, normally you're guiding to, I guess, down revenues in the next quarter, excluding Bigham, if you add them in you stay flat. Normally - I just want to look ahead to your fiscal fourth quarter. I know you don't give guidance two quarters out, but normally that's the odd weather quarter or the holiday quarter and revenues are typically down around 12 to 13% depending on the year, of course. Do you think we'll normally use this base, this third quarter base, which is already against your regular seasonality given the slowdowns as that quarter to then decline from their 12 to 13%? Just give us some direction if you can looking ahead.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

I mean, Alan, we're not giving the second quarter out guidance. I think what we would say is just to reiterate what you did is it's a quarter that is always influenced by daylight hours, holidays and can be impacted by weather. We have some customers that we see some opportunities adjusting for seasonality with their activity picking up into that quarter. But it's too early for us to provide guidance at this point. In a way, Alan, I mean, thinking about it that way I know is important to the street, but when we look at over the next couple of years there's $40 billion of public capital on top of $20, $30, $40 billion of capital that's already working its way through the system. We feel pretty good at the outlook for next year.

Alan Mitrani

Managing Partner, Sylvan Lake Asset Management LLC

Okay. Thank you.

Operator

I'm showing no further questions in the queue at this time. I would now like to turn the call back over to Mr. Steven Nielsen for any closing remarks.

Steven E. Nielsen

President, Chief Executive Officer & Director, Dycom Industries, Inc.

Well, we thank everybody for their time and attention and we'll look forward to speaking to you again on our third quarter earnings call the week of Thanksgiving. Thank you.

Operator

Thank you all for participating. This concludes today's program. You may now disconnect.

v3.23.2

Document and Entity Information Document

|

Aug. 23, 2023 |

| Document and Entity Information [Abstract] |

|

| Entity Central Index Key |

0000067215

|

| Title of 12(b) Security |

Common stock, par value $0.33 1/3 per share

|

| Entity Registrant Name |

DYCOM INDUSTRIES, INC.

|

| Entity Incorporation, State or Country Code |

FL

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 23, 2023

|

| City Area Code |

561

|

| Local Phone Number |

627-7171

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Entity File Number |

001-10613

|

| Entity Tax Identification Number |

59-1277135

|

| Entity Address, Address Line One |

11780 U.S. Highway One, Suite 600

|

| Entity Address, City or Town |

Palm Beach Gardens,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33408

|

| Trading Symbol |

DY

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

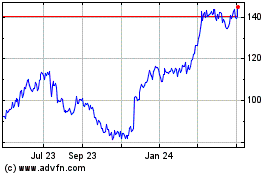

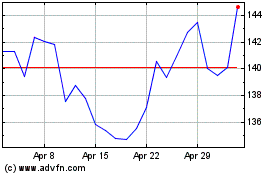

Dycom Industries (NYSE:DY)

Historical Stock Chart

From Apr 2024 to May 2024

Dycom Industries (NYSE:DY)

Historical Stock Chart

From May 2023 to May 2024