N&B Announcement - Core Slides

December 16, 2019 FILED BY DUPONT DE NEMOURS, INC. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: DUPONT DE NEMOURS, INC. COMMISSION

FILE NO. 001-38196

2005 2012 2017 2018 2011 2019 Pharma &

Food Microbial Control N&H + IB Nutrition & Biosciences N&B is the result of all of your hard work and continued effort through multiple integrations and business accelerations Core Value Contact: Thank You for Creating N&B Note:

Divestments: Diagnostics business (2016), hDuPont Alginates business (2018), Natural Colors business (2019)

DuPont Nutrition & Biosciences and IFF

to Merge New company will be a global leader in high-value ingredients and solutions for global Food & Beverage, Home & Personal Care and Health & Wellness Transaction close expected in Q1, 2021* *Subject to regulatory and shareholder

approvals, as well as other closing conditions

Redefining the value-add ingredients

industry A Powerful combination Leading value-added ingredients and solutions provider #1 or 2 positions in cultures, enzymes and probiotics Customer led science and R&D focused organization Deep customer relationships across food, nutrition,

pharma and HPC customers Extensive global sales & applications capability Deep commitment to sustainability and product stewardship A global leader in taste and scent Leading Natural capabilities Creative and R&D led organization Broadest

customer base with 60% of sales to local & regional customers (45% in Emerging Markets) Well positioned in fast-growing adjacencies (i.e., Food Protection, Inclusions, Health ingredients, Cosmetic Actives) Deep commitment to sustainability

DuPont N&B IFF Combined Company Broader Set of Ingredients and Solutions Deeper Innovation and R&D Platform Shared Focus on Consumer-oriented End Markets >$11B Pro Forma 2019 Revenue $2.6B Pro Forma 2019 EBITDA $562m 2018 Pro Forma

R&D Spend

Differentiating product portfolio and

balanced geographic footprint A new global leader PRO FORMA GEOGRAPHIC SPLIT – 2018A SALES PRO FORMA PORTFOLIO – 2018A SALES Pro Forma EMEA Latin America Greater Asia North America Food & Beverage Pharma Solutions Health &

Bioscience 2018 Sales Source: Company information IFF 2018 sales are pro forma for the acquisition of Frutarom, PF revenue split by region calculated by applying 2017 IFF geographical sales split to IFF 2018 standalone revenue figures and 2018PF

Frutarom geographical split to Frutarom standalone 2018 figures Taste Scent Nutrition

Redefining the industry Together A clear

leader in the categories where we compete Shared focus on consumer-oriented end-markets Compelling proposition to customers in line with consumer demand Powerful R&D platform with clear path to deliver differentiated offering Strength in shared

cultures led by science and creativity Leading positions in Food & Beverage, Home & Personal Care, Health & Wellness

Breadth of capability & exposure

establishes strong competitive position leader across attractive markets IFF + DuPont N&B Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Functional Solutions(1) ✔ ✔ Emulsifiers & Lecithin ✔ Sweeteners (2) ✔ Plant

Protein (2) ✔ Health & Bioscience Cultures ✔ Probiotics ✔ ✔ Enzymes ✔ ✔ ✔ Animal Nutrition(1) ✔ ✔ ✔ ✔ Pharma Excipients ✔ Nutraceuticals(1) ✔ ✔

✔ ✔ Flavor & Fragrance Flavors ✔ ✔ Fragrances ✔ Cosmetic Ingredients(1) ✔ ✔ ✔ ✔ ✔ Participates in the category Category Leader Position Food & Beverage Source: Company

information Functional solutions, Animal Nutrition, Nutraceuticals and Cosmetic Ingredients are widely defined categories with limited traditional “leadership” In relevant segments Evolving Customer Base Demands More Integrations

Solutions from Their Suppliers

Competitive and thorough process leading

to the selection of IFF Significant value creation opportunities Compelling growth profile benefitting stakeholders and attractive value creation for shareholders over the short, medium and long term Will deliver ~$300 million in run-rate cost

synergies and >$400 million in run-rate growth synergies* Creates the industry’s broadest technology portfolio Strong Corporate Governance Andreas Fibig to serve as Chairman & CEO Balanced board with equal composition from IFF and

DuPont; Breen as Lead Independent Director Experienced senior leadership team with representation from both companies Advances DuPont strategy of active portfolio management to unlock shareholder value Transaction benefits all stakeholders *Expect

to achieve run rates year 3 after close

Integration team established Separation

team established Prepare for N&B separation Key Milestones Towards Expected Transaction Close DuPont/N&B Separation Teams prepare N&B spin from DuPont N&B/IFF Integration Office works on intended new company set-up N&B spins out

from DuPont, immediately combines with IFF Q1 2020 Q1 2021

Team Dialogues Team and site meetings

to follow where you can ask questions Always reach out to your manager or local HR if you have questions or concerns Employee Guidance Business as Usual For the time being, it is business as usual N&B and IFF remain independent entities until

transaction close Our goals, priorities and tasks remain the same Let’s keep focus on running the business and staying safe Integration Updates As soon as new information becomes available you will be informed Ongoing integration updates will

start in January Stay updated on The Bridge Contact us on: NB_Internal_Communications@dupont.com Leadership Roadshows Senior leaders will visit key sites in coming months and engage with employees

Legal Disclaimer Forward-Looking

Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and

variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the proposed transaction, the expected timetable for completing the proposed

transaction, the benefits and synergies of the proposed transaction, future opportunities for the combined company and products and any other statements regarding DuPont’s, IFF’s and N&Bco’s future operations, financial or

operating results, capital allocation, dividend policy, debt ratio, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets for future

periods. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, (i) the parties’ ability to meet

expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; changes in relevant tax and other laws, (ii) failure to obtain necessary regulatory approvals, approval, if required, of IFF’s

shareholders, anticipated tax treatment or any required financing or to satisfy any of the other conditions to the proposed transaction, (iii) the possibility that unforeseen liabilities, future capital expenditures, revenues, expenses, earnings,

synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies that could impact the value, timing or pursuit of the proposed transaction, (iv) risks and costs and pursuit and/or

implementation of the separation of the N&B Business, including timing anticipated to complete the separation, any changes to the configuration of businesses included in the separation if implemented, (v) risks related to indemnification of

certain legacy liabilities of E. I. du Pont de Nemours and Company (“Historical EID”) in connection with the distribution of Corteva Inc. on June 1, 2019 (the “Corteva Distribution”); (vi) potential liability arising from

fraudulent conveyance and similar laws in connection with the distribution of Dow Inc. on April 1, 2019 and/or the Corteva Distributions (the “Previous Distributions”); (vii) failure to effectively manage acquisitions, divestitures,

alliances, joint ventures and other portfolio changes, including meeting conditions under the Letter Agreement entered in connection with the Corteva Distribution, related to the transfer of certain levels of assets and businesses; (viii)

uncertainty as to the long-term value of DuPont common stock; (ix) potential inability or reduced access to the capital markets or increased cost of borrowings, including as a result of a credit rating downgrade, (x) inherent uncertainties involved

in the estimates and judgments used in the preparation of financial statements and the providing of estimates of financial measures, in accordance with the accounting principles generally accepted in the United States of America and related

standards, or on an adjusted basis, (xi) the integration of IFF and N&Bco being more difficult, time consuming or costly than expected; (xii) IFF’s and N&Bco’s failure to achieve expected or targeted future financial and

operating performance and results; (xiii) the possibility that the combined company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the proposed transaction within the expected time frames or at

all or to successfully integrate IFF and N&Bco; (xiv) customer loss and business disruption being greater than expected following the proposed transaction; (xv) the impact of divestitures required as a condition to consummation of the proposed

transaction as well as other conditional commitments; (xvi) legislative, regulatory and economic developments; (xvii) an increase or decrease in the anticipated transaction taxes (including due to any changes to tax legislation and its impact

on tax rates (and the timing of the effectiveness of any such changes)), (xviii) potential litigation relating to the proposed transaction that could be instituted against DuPont, IFF or their respective directors, (xix) risks associated

with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (xx) negative effects of the announcement or the consummation of the transaction on the market price of DuPont’s

and/or IFF’s common stock, (xxi) risks relating to the value of the IFF shares to be issued in the transaction and uncertainty as to the long-term value of IFF’s common stock, (xxii) the ability of N&Bco or IFF to retain

and hire key personnel (xxiii) the risk that N&Bco, as a newly formed entity that currently has no credit rating, will not have access to the capital markets on acceptable terms, (xxiv) the risk that N&Bco and IFF will incur

significant indebtedness in connection with the potential transaction, and the degree to which IFF will be leveraged following completion of the potential transaction may materially and adversely affect its business, financial condition and results

of operations, (xxv) the ability to obtain or consummate financing or refinancing related to the transaction upon acceptable terms or at all, and (xxvi) other risks to DuPont’s, N&Bco’s and IFF’s business, operations and

results of operations including from: failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market acceptance,

rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues;

global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including tariffs, trade disputes and

retaliatory actions; impairment of goodwill or intangible assets; the availability of and fluctuations in the cost of energy and raw materials; business or supply disruption, including in connection with the Previous Distributions; security threats,

such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for DuPont, N&Bco or IFF, adversely impact demand or production; ability to discover, develop and

protect new technologies and to protect and enforce DuPont’s, N&Bco’s or IFF’s intellectual property rights; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of

war or hostilities, as well as management’s response to any of the aforementioned factors. A further list and description of risks and uncertainties can be found in DuPont’s Form 10-Q for the period ended September 30, 2019 and in its

subsequent reports on Form 10-Q, Form 10-K and Form 8-K, the contents of which are not incorporated by reference into, nor do they form part of, this announcement. Any other risks associated with the proposed transaction will be more fully discussed

in any registration statement filed with the SEC. While the list of factors presented here is, and the list of factors that may be presented in a registration statement of IFF or N&Bco would be, considered representative, no such list should be

considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as

compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material

adverse effect on DuPont’s or N&Bco’s consolidated financial condition, results of operations, credit rating or liquidity. Neither DuPont nor N&Bco assumes any obligation to publicly provide revisions or updates to any

forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Additional Information and Where to Find It This

communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act. In connection with the proposed combination of N&Bco and IFF, which will immediately follow the proposed separation of the N&B Business from DuPont (the “proposed

transaction”), N&Bco, IFF and Merger Sub intend to file relevant materials with the SEC, including a registration statement on Form S-4 that will include a proxy statement/prospectus relating to the proposed transaction. In addition,

N&Bco expects to file a registration statement in connection with its separation from DuPont. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IFF, N&BCO, MERGER SUB AND THE PROPOSED TRANSACTION. A definitive proxy statement will be sent to shareholders of IFF seeking approval of the proposed transaction. The

documents relating to the proposed transaction (when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. Free copies of these documents, once available, and each of the companies’ other filings with

the SEC may also be obtained from the respective companies by contacting the investor relations department of DuPont or IFF at the following: DuPont Contact Information IFF Contact Information DuPont Investors:Media: Lori KochDan TurnerMichael

DeVeau Lori.d.koch@dupont.com Daniel.a.turner@dupont.com Michael.DeVeau@iff.com +1 302-999-5631+1 302-996-8372+1 212-708-1212 Participants in the Solicitation This communication is not a solicitation of a proxy from any investor or security

holder. However, DuPont, IFF and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction under the rules of the SEC. Information about

the directors and executive officers of DuPont may be found in its Annual Report on Form 10-K filed with the SEC on February 11, 2019 and its definitive proxy statement filed with the SEC on May 1, 2019. Other information regarding the participants

in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with

the SEC when they become available.

© 2019 DuPont de Nemours, Inc. All

rights reserved. DuPont™, the DuPont Oval Logo, and all products, unless otherwise noted, denoted with ™, ℠ or ® are trademarks, service marks or registered trademarks of affiliates of DuPont de Nemours, Inc.

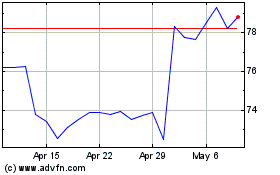

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Aug 2024 to Sep 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Sep 2023 to Sep 2024