Additional Proxy Soliciting Materials (definitive) (defa14a)

April 03 2020 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION

14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (Amendment No. )

|

☑

|

Filed by the Registrant

|

☐

|

Filed by a Party other than the Registrant

|

|

|

CHECK THE APPROPRIATE BOX:

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

☑

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Under Rule 14a-12

|

CVS HEALTH CORPORATION

(Name of Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

|

|

☑

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

1) Title of each class of securities to which transaction applies:

|

|

|

|

|

2) Aggregate number of securities to which transaction applies:

|

|

|

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

4) Proposed maximum aggregate value of transaction:

|

|

|

|

|

5) Total fee paid:

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

1) Amount previously paid:

|

|

|

|

|

2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

3) Filing Party:

|

|

|

|

|

4) Date Filed:

|

CVS Health Executive Compensation Overview

Compensation Program Core Principles

Five core principles drive our executive compensation philosophy

and promote company growth:

Compensation Program Reflects Stockholder

Feedback

The Management Planning

and Development (MP&D) Committee of the CVS Health Board annually reviews the results of the stockholder advisory vote on executive compensation (“say

on pay”)

|

|

•

|

Approximately

91% of votes were cast in favor of our say on pay proposals in the last two years

|

The MP&D

Committee also considers feedback received through our direct engagement with stockholders

|

|

•

|

In

the latter part of 2019 and early 2020, we reached out to stockholders representing approximately

52% of our outstanding shares and held calls with holders of nearly 22% of our outstanding

shares

|

We have made numerous enhancements

to our executive compensation program to incorporate stockholder input

Recent Enhancements

to Compensation Program

|

Simplification

of Performance Stock Unit (PSU) structure: single PSU in place of the two forms of PSUs awarded in 2018

|

|

Alignment

of PSU metrics to shift in business strategy and enhanced transparency in metric selection and target setting process

|

|

Committed to disclose

methodology for calculation of any Non-GAAP financial measures in pay program

|

|

Enhanced

disclosure of Recoupment Policy and amended to include commitment to transparency

|

|

Enhanced

disclosure on the selection of comparator companies in peer groups that reflect evolving business

|

|

1

|

|

|

Compensation Program Aligns to Company

Performance

|

|

•

|

Our

pay-for-performance philosophy places a majority of an executive officer’s compensation

at risk and emphasizes long-term incentives tied to defined individual and Company performance

goals and continued service

|

|

|

•

|

More than 70% of executive officer target total compensation is provided through equity,

including PSUs and stock options

|

2019 Compensation Program –

Performance Metrics that Support Strategy and

Growth

|

|

Performance

Metric

|

Weighting

|

Metric

Rationale

|

|

Annual Cash Incentive

|

MIP Adjusted Operating Income

|

80%

|

·

|

Key measure of profitability followed closely by investors

|

|

Retail Customer Service, PBM Client Satisfaction and Health Care Benefits Member Satisfaction Result

|

20%

|

·

·

|

Important drivers of recurring revenue and the achievement

of long-term strategic and operational goals

Emphasize and reinforce the business objectives of

the Enterprise

|

|

Individual Performance Goals

|

Modifier 0-120%

|

·

·

|

Position-specific performance goals that are established early in the fiscal year

MP&D Committee has

sole authority to determine the amount, if any, of each annual cash incentive award

|

|

PSUs

|

2021 Adjusted EPS

|

100%

|

·

|

Measures profitability and performance during the final year of the 3-year performance period

|

|

Leverage Ratio

|

Modifier

+/- 25%

|

·

·

|

Measures achievement of our goal of debt reduction

over the 3-year performance period

Also measures ability to maintain a strong capital

structure which enables the resumption of normal capital deployment

|

|

Relative Total Shareholder Return

|

Modifier

+/- 25%

|

·

|

Considers the Company’s TSR performance relative to the broad market of companies with which we compete for talent and capital over the 3-year performance period

|

|

2

|

|

|

CEO Compensation Determinations

|

•

|

The excerpt from the

Summary Compensation Table (SCT) below reflects disclosures as required by SEC rules.

To the right of the SCT, we show the MP&D Committee’s CEO compensation determination for 2019 which we believe is a more representative presentation

since it removes Mr. Merlo’s August 2019 PSUs and the LTIP related double reporting.

|

|

2019 Summary Compensation Table

|

2019 MP&D

Committee

Compensation

Determination

Total

($)

|

|

|

Salary

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive Plan

Compensation

($)

|

All Other

Compensation

($)

|

Total

($)

|

|

Larry J. Merlo

President and

Chief Executive

Officer

|

1,630,000

|

20,249,968

1

1

|

3,374,998

|

10,625,000

2

2

|

571,783

|

36,451,749

|

19,576,764

|

|

•

|

The 2019 Summary Compensation Table includes equity grants for multiple years. In addition to the 2019 PSUs with a grant date value of $10.1 million for the 2019 – 2021 performance cycle, it includes:

|

|

$10.1 million for 2020 PSUs which were granted early in place of a 2020 annual award (see below), and

|

|

$6.75 million representing 100% of the value earned for the LTIP granted in 2017 and earned for the 2017-2019 performance cycle

|

|

•

|

Our

CEO’s 2019 total compensation value is $19.6 million excluding the $16.85 million in equity not reflective of annual

compensation for fiscal year 2019

|

|

•

|

Reflecting

feedback from stockholders, we have adjusted our equity grant denomination practices to better align to SEC reporting

requirements, which will eliminate the double reporting of historical and go-forward awards effective in 2020 and will be

reported in the 2021 Proxy Statement

|

2020 PSU Award for our CEO Granted in August

2019

In

August 2019, the MP&D Committee approved accelerating the grant date of our CEO’s 2020 annual PSU award.

|

3

|

|

|

Leading Practices In Compensation Programs

Our pay

practices align with and support our core compensation principles

|

|

ü

|

Performance measures aligned with strategy

|

|

|

ü

|

Majority of total compensation opportunity is performance-based

|

|

|

ü

|

No excise tax gross-ups

|

|

|

ü

|

No option repricing

|

|

|

ü

|

No recycling of shares

|

|

|

ü

|

Robust recoupment policy and disclosure commitment

|

|

|

ü

|

Broad anti-pledging and anti-hedging policy

|

|

|

ü

|

Policy to limit executive severance

|

|

|

ü

|

Limited perquisites and personal benefits

|

|

|

ü

|

SERP closed to new participants

|

|

|

ü

|

Double trigger vesting of equity awards

|

|

|

ü

|

Robust stock ownership guidelines

|

|

|

ü

|

Two-year post vesting holding period on PSU shares earned

|

|

|

ü

|

No dividend equivalents on unvested awards

|

|

|

ü

|

Cap on annual cash incentive awards

|

|

|

ü

|

Relative TSR modifier incorporated into long-term program

|

MIP

Adjusted Operating Income is a non-GAAP measure used in our compensation program. The definition of MIP Adjusted Operating Income

and a reconciliation of 2019 operating income to MIP Adjusted Operating Income can be found in Annex A of the Company’s

2020 Proxy Statement.

|

4

|

|

|

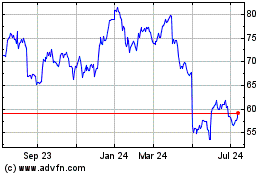

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

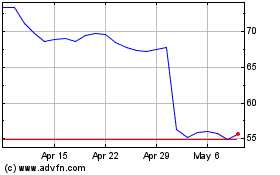

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024