Crane Co. (NYSE: CR), a diversified manufacturer of highly

engineered industrial products, reported that first quarter 2011

earnings per diluted share increased 45% to $0.81 compared to $0.56

in the first quarter of 2010.

First quarter 2011 sales of $611 million increased $81 million,

or 15%, compared to the first quarter of 2010, resulting from a

core sales increase of $58 million (11%), an increase in sales from

acquisitions, net of divestitures, of $16 million (3%), and

favorable foreign currency translation of $7 million (1%).

First quarter 2011 operating profit increased 37% to $72.9

million, compared to $53.3 million in the first quarter of 2010,

and operating profit margin increased to 11.9%, compared to 10.0%

in the first quarter of 2010.

During the quarter, the Company sold a building and divested a

small product line. The associated gain of $4.3 million ($0.05 per

share) is included in Miscellaneous–Net on the accompanying Income

Statement.

“I am pleased with our first quarter results as strong core

revenue growth of 11% and solid execution produced a quarter that

was considerably better than we anticipated. The significant

sequential improvement in our monthly sales and earnings during the

quarter gives us increasing confidence about the year,” said Crane

Co. president and chief executive officer Eric C. Fast. “With our

late-cycle Aerospace and Fluid Handling businesses clearly gaining

momentum, we are raising our full year sales, EPS and cash flow

guidance.”

Increased Full Year 2011 Guidance

Sales for 2011 are now expected to increase approximately 10% -

12%, compared to our prior guidance of 7% - 9%, driven by strong

core sales growth. Our 2011 earnings guidance is now a range of

$3.05 - $3.25 per diluted share, compared to our previous guidance

of $2.80 - $3.00 per diluted share, reflecting strengthening

revenue and profit growth across all of our segments. Free cash

flow (cash provided by operating activities less capital spending)

is now expected to be in a range of $130 - $150 million, compared

to our previous estimate of $130 million. (Please see the Condensed

Statement of Cash Flows and Non-GAAP table.)

Cash Flow and Financial Position

Cash used for operating activities in the first quarter of 2011

was $16.2 million, which included higher working capital needs to

support improving sales trends, compared to cash provided by

operating activities of $16.8 million in the first quarter of 2010

(which included $19 million of cash received in connection with the

Boeing agreement). During the first quarter of 2011, the Company

repurchased 634,900 shares of its common stock for approximately

$30 million. The Company’s cash position at March 31, 2011 was $233

million, as compared to $273 million at December 31, 2010.

Segment Results

All comparisons detailed in this section refer to the first

quarter 2011 versus the first quarter 2010.

Aerospace & Electronics

First Quarter Change (dollars in millions) 2011

2010 Sales $ 161.9 $ 133.6 $ 28.3 21 %

Operating Profit $ 34.0 $ 24.5 $ 9.6 39 % Profit Margin 21.0

% 18.3 %

First quarter 2011 sales increased $28.3 million, or 21%,

reflecting a $19.8 million (25%) improvement in Aerospace Group

sales and an increase of $8.5 million (16%) in Electronics Group

revenue. The Aerospace Group sales increase reflected higher OEM

and aftermarket shipments while Electronics Group sales growth was

primarily driven by strength in Power Solutions. Segment operating

profit of $34.0 million increased by $9.6 million, or 39%,

reflecting strong sales growth and margin improvement in both

Aerospace and Electronics.

Aerospace & Electronics order backlog strengthened to $455

million at March 31, 2011, as compared to $431 million at December

31, 2010 and $388 million at March 31, 2010.

Engineered Materials

First Quarter Change (dollars in millions) 2011

2010 Sales $ 61.8 $ 53.8 $ 8.1 15 %

Operating Profit $ 10.1 $ 8.5 $ 1.6 19 % Profit Margin 16.4

% 15.9 %

Segment sales of $61.8 million increased 15% compared to the

first quarter of 2010, as a result of significantly higher demand

from transportation customers, as well as higher revenues across

recreational vehicle and building products end markets. Operating

profit grew 19%, and margins improved 50 basis points as higher

sales more than offset the impact of increased raw material costs.

The Company implemented price increases during the first quarter

and continues to monitor the impact of higher input costs.

Merchandising Systems

First Quarter Change (dollars in millions) 2011

2010 Sales $ 94.9 $ 70.2 $ 24.7 35 %

Operating Profit $ 4.7 $ 5.0 ($0.3 ) (6 %) Profit Margin 4.9

% 7.1 %

Merchandising Systems sales of $94.9 million increased $24.7

million, or 35%, primarily reflecting $16.4 million of sales

associated with the December 2010 acquisition of Money Controls

(23%) and positive core sales growth in our Payment Solutions and

Vending businesses. Operating profit of $4.7 million declined

slightly from the prior year as purchase accounting charges

associated with Money Controls more than offset the impact of

higher sales.

Fluid Handling

First Quarter Change (dollars in millions) 2011

2010 Sales $ 264.1 $ 247.8 $ 16.4 7 %

Operating Profit $ 35.5 $ 28.0 $ 7.5 27 % Profit Margin 13.4

% 11.3 %

First quarter 2011 sales increased $16.4 million, or 6.6%, which

included a core sales increase of $10.9 million (4.4%), and

favorable foreign currency translation of $5.5 million (2.2%).

Orders strengthened across Fluid Handling end markets and were

particularly strong in ChemPharma and Energy. Sales, operating

profit and margin improvement was broad based across the Group. The

sales increase was effectively leveraged with operating margins

improving from 11.3% to 13.4%. Backlog increased to $305 million at

March 31, 2011, compared to $272 million at December 31, 2010 and

$254 million at March 31, 2010.

Controls

First Quarter Change (dollars in millions) 2011

2010 Sales $ 28.2 $ 24.9 $ 3.3 13 %

Operating Profit $ 3.1 $ 0.1 $ 3.0 NM Profit Margin 11.0 %

0.5 %

First quarter 2011 sales of $28.2 million increased 13%,

primarily reflecting improvement in industrial, transportation and

upstream oil and gas related demand. Operating profit of $3.1

million increased significantly over 2010, reflecting strong

leverage and the absence of the operating losses associated with

divested businesses.

Additional Information

Please see the condensed financial statements and the Non-GAAP

Financial Measures table attached to this press release for

supporting details. Additional information with respect to the

Company’s asbestos liability and related accounting provisions and

cash requirements is set forth in the Current Report on Form 8-K

filed with a copy of this press release.

Conference Call

Crane Co. has scheduled a conference call to discuss the first

quarter financial results on Tuesday, April 19, 2011 at 10:00 A.M.

(Eastern). All interested parties may listen to a live webcast of

the call at http://www.craneco.com. An

archived webcast will also be available to replay this conference

call directly from the Company’s website.

Crane Co. is a diversified manufacturer of highly engineered

industrial products. Founded in 1855, Crane provides products and

solutions to customers in the aerospace, electronics, hydrocarbon

processing, petrochemical, chemical, power generation, automated

merchandising, transportation and other markets. The Company has

five business segments: Aerospace & Electronics, Engineered

Materials, Merchandising Systems, Fluid Handling, and Controls.

Crane has approximately 11,000 employees in North America, South

America, Europe, Asia and Australia. Crane Co. is traded on the New

York Stock Exchange (NYSE:CR). For more information, visit

www.craneco.com.

This press release may contain forward-looking statements as

defined by the Private Securities Litigation Reform Act of 1995.

These statements present management’s expectations, beliefs, plans

and objectives regarding future financial performance, and

assumptions or judgments concerning such performance. Any

discussions contained in this press release, except to the extent

that they contain historical facts, are forward-looking and

accordingly involve estimates, assumptions, judgments and

uncertainties. There are a number of factors that could cause

actual results or outcomes to differ materially from those

addressed in the forward-looking statements. Such factors are

detailed in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2010 and subsequent reports filed with the

Securities and Exchange Commission.

CRANE CO. Income Statement Data (in

thousands, except per share data) Three Months Ended March

31, 2011 2010

Net Sales: Aerospace & Electronics $

161,936 $ 133,645 Engineered Materials 61,832 53,755 Merchandising

Systems 94,878 70,171 Fluid Handling 264,142 247,789 Controls

28,232 24,931

Total Net Sales $ 611,020

$ 530,291

Operating Profit (Loss): Aerospace

& Electronics $ 34,042 $ 24,489 Engineered Materials 10,143

8,540 Merchandising Systems 4,673 4,969 Fluid Handling 35,453

27,989 Controls 3,111 126 Corporate (14,562 ) (12,833 )

Total

Operating Profit 72,860 53,280 Interest Income 290 225

Interest Expense (6,622 ) (6,726 ) Miscellaneous- Net 3,625

* (21 ) Income Before Income Taxes 70,153 46,758 Provision for

Income Taxes 21,775 13,574 Net income before

allocations to noncontrolling interests 48,378 33,184 Less:

Noncontrolling interest in subsidiaries' losses (89 ) (50 )

Net

income attributable to common shareholders $ 48,467 $

33,234

Share Data: Earnings per Diluted Share

$ 0.81 $ 0.56 Average Diluted Shares

Outstanding 59,552 59,570 Average Basic Shares Outstanding 58,330

58,650

Supplemental

Data:

Cost of Sales $ 397,850 $ 352,271 Selling, General &

Administrative 140,310 124,740 Depreciation and Amortization **

15,774 14,437 Stock-Based Compensation Expense 3,503 3,172 *

Primarily related to the sale of a building and the divestiture of

a small product line in the three months ended March 31, 2011.

** Amount included within cost of sales and selling, general

& administrative costs.

CRANE CO.

Condensed Balance Sheets (in thousands)

March 31, December 31, 2011 2010

ASSETS Current

Assets Cash and Cash Equivalents $ 233,162 $ 272,941 Accounts

Receivable, net 356,257 301,918 Current Insurance Receivable -

Asbestos 33,000 33,000 Inventories, net 347,813 319,077 Other

Current Assets 75,708 61,725 Total Current Assets 1,045,940 988,661

Property, Plant and Equipment, net 283,006 280,746 Long-Term

Insurance Receivable - Asbestos 174,253 180,689 Other Assets

424,481 446,316 Goodwill 822,516 810,285

Total Assets

$ 2,750,196 $ 2,706,697

LIABILITIES AND EQUITY

Current Liabilities Notes Payable and Current Maturities of

Long-Term Debt $ 916 $ 984 Accounts Payable 173,798 157,051 Current

Asbestos Liability 100,000 100,000 Accrued Liabilities 217,685

229,462 Income Taxes 13,605 11,057 Total Current Liabilities

506,004 498,554 Long-Term Debt 398,780 398,736 Long-Term

Deferred Tax Liability 49,482 48,852 Long-Term Asbestos Liability

600,506 619,666 Other Liabilities 146,964 147,859 Total

Equity 1,048,460 993,030

Total Liabilities and Equity

$ 2,750,196 $ 2,706,697

CRANE

CO. Condensed Statements of Cash Flows (in thousands)

Three Months Ended March 31, 2011 2010

Operating

Activities: Net income attributable to common shareholders $

48,467 $ 33,234 Noncontrolling interest in subsidiaries' losses

(89 ) (50 ) Net income before allocations to

noncontrolling interests 48,378 33,184 Gain on divestiture (4,258 )

- Depreciation and amortization 15,774 14,437 Stock-based

compensation expense 3,503 3,172 Defined benefit plans and

postretirement expense 2,749 2,375 Deferred income taxes 6,893

6,682 Cash used for operating working capital (67,250 ) (31,687 )

Defined benefit plans and postretirement contributions (4,779 )

(1,076 ) Environmental payments, net of reimbursements (4,593 )

(3,200 ) Other 142 4,056 Subtotal

(3,441 ) 27,943 Asbestos related payments, net of insurance

recoveries (12,725 ) (11,125 )

Total (used for)

provided from operating activities (16,166 )

16,818

Investing Activities: Capital

expenditures (8,138 ) (4,119 ) Proceeds from disposition of capital

assets 4,553 - Payment for acquisition, net of cash acquired -

(51,167 ) Proceeds from divestiture 1,000 -

Total used for investing activities (2,585 )

(55,286 )

Financing Activities: Dividends paid

(13,474 ) (11,743 ) Reacquisition of shares on open market (29,999

) - Stock options exercised - net of shares reacquired 12,552 4,714

Excess tax benefit from stock-based compensation 3,952 391 Change

in short-term debt (76 ) (3,046 )

Total used for

financing activities (27,045 ) (9,684 )

Effect of exchange rate on cash and cash equivalents 6,017

(4,978 ) Decrease in cash and cash equivalents

(39,779 ) (53,130 ) Cash and cash equivalents at beginning of

period 272,941 372,714 Cash and cash

equivalents at end of period $ 233,162 $ 319,584

CRANE CO. Order Backlog (in thousands)

March 31, December 31, September 30,

June 30, March 31, 2011 2010 2010 2010 2010 Aerospace &

Electronics $ 454,559 $ 431,467 $ 401,585 $ 394,554 $ 388,169

Engineered Materials 13,826 11,831 11,367 12,496 14,810

Merchandising Systems 25,008

*

30,170

*

18,044 20,346 21,947 Fluid Handling 305,255 271,825 266,578 257,840

253,946 Controls 24,015 22,354 27,575

28,711 26,910

Total Backlog $ 822,663 $ 767,647 $

725,149 $ 713,947 $ 705,782 * Includes Order

Backlog of $5.3 million in March 31, 2011 and $8.4 million in

December 2010 pertaining to the 2010 acquisition of Money Controls.

CRANE CO. Non-GAAP Financial Measures

(in thousands) Three Months Ended March

31, 2011 2010

CASH FLOW

ITEMS

Cash (Used for) Provided from Operating Activities before Asbestos

- Related Payments $ (3,441 ) $ 27,943 Asbestos Related Payments,

Net of Insurance Recoveries (12,725 ) (11,125 ) Cash

(Used for) Provided from Operating Activities (16,166 ) 16,818

Less: Capital Expenditures (8,138 ) (4,119 ) Free

Cash Flow $ (24,304 ) $ 12,699 Certain

non-GAAP measures have been provided to facilitate comparison with

the prior year. The Company reports its financial results in

accordance with U.S. generally accepted accounting principles

(GAAP). However, management believes that non-GAAP financial

measures which exclude certain non-recurring items present

additional useful comparisons between current results and results

in prior operating periods, providing investors with a clearer view

of the underlying trends of the business. Management also uses

these non-GAAP financial measures in making financial, operating,

planning and compensation decisions and in evaluating the Company's

performance. In addition, Free Cash Flow provides

supplemental information to assist management and investors in

analyzing the Company’s ability to generate liquidity from its

operating activities. The measure of Free Cash Flow does not take

into consideration certain other non-discretionary cash

requirements such as, for example, mandatory principle payments on

the Company's long-term debt. Non-GAAP financial measures, which

may be inconsistent with similarly captioned measures presented by

other companies, should be viewed in addition to, and not as a

substitute for, the Company’s reported results prepared in

accordance with GAAP. Non-GAAP financial measures, which may

be inconsistent with similarly captioned measures presented by

other companies, should be viewed in the context of the definitions

of the elements of such measures we provide and in addition to, and

not as a substitute for, the Company’s reported results prepared in

accordance with GAAP.

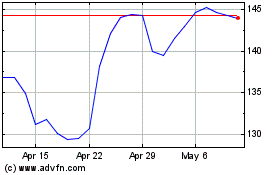

Crane (NYSE:CR)

Historical Stock Chart

From May 2024 to Jun 2024

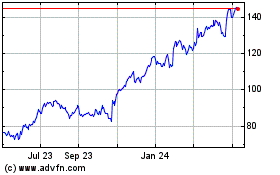

Crane (NYSE:CR)

Historical Stock Chart

From Jun 2023 to Jun 2024