0001866368false777 W. Main StreetSuite 900BoiseIdaho00018663682024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________________

FORM 8-K

_____________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

_____________________________________________________

Clearwater Analytics Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

_____________________________________________________

| | | | | | | | |

| Delaware | 001-40838 | 87-1043711 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

777 W. Main Street Suite 900 Boise, Idaho | | 83702 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 208 433-1200

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.001 per share | | CWAN | | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, Clearwater Analytics Holdings, Inc. (“Clearwater” or the “Company”) issued a press release announcing its results for the fourth quarter and full year 2023. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information in this current report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly provided by specific reference in such a filing.

Clearwater is making reference to non-GAAP financial information in both the press release and its earnings call. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is contained in the attached press release.

Item 9.01 Financial Statements and Exhibits.

(d):The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| Clearwater Analytics Holdings, Inc. |

|

| Date: | February 28, 2024 | By: | /s/ Jim Cox |

| Jim Cox, Chief Financial Officer |

Exhibit 99.1

Clearwater Analytics Announces Fourth Quarter and Full Year 2023 Financial Results

Q4 2023 Revenue of $99.0 million, up 20% year-over-year

Full Year 2023 Revenue of $368.2 million, up 21% year-over-year

Q4 2023 Adjusted EBITDA margin of 30.3%; Q4 2023 Free Cash Flows of $22.5 million

Q4 2023 Gross Revenue Retention Rate of 98%; Net Revenue Retention Rate of 107%

BOISE, Idaho — February 28, 2024 — Clearwater Analytics Holdings, Inc. (NYSE: CWAN) (“Clearwater Analytics” or the “Company”), a leading provider of SaaS-based investment management, accounting, reporting, and analytics solutions, today announced its financial results for the quarter ended December 31, 2023.

| | | | | | | | | | | |

| Fourth Quarter 2023 | | Full Year 2023 |

| Revenue | $99.0 million | | $368.2 million |

| Year-over-Year Revenue Growth % | 19.8% | | 21.3% |

Annualized Recurring Revenue (ARR)1 | | | $379.1 million |

| Year-over-Year ARR Growth % | | | 17.2% |

| Net Loss | $(3.4) million | | $(23.1) million |

| Net Loss Margin % | (3.5)% | | (6.3)% |

| Adjusted EBITDA | $30.0 million | | $105.9 million |

| Adjusted EBITDA Margin % | 30.3% | | 28.8% |

1ARR is a point in time metric, therefore fourth quarter 2023 and full year 2023 results are the same.

“We had a strong 2023, and the durability of our business was on full display as we delivered a full year revenue growth of 21%, while meaningfully improving both gross margin and Adjusted EBITDA. The number of $1 million-plus clients grew by 28% over the last year, which is a testament to the advanced capabilities of our platform, now fully transitioned to the public cloud. With this transition complete, we are very excited to allocate more than 60% of R&D capacity to fueling growth,” said Sandeep Sahai, Chief Executive Officer. “Thanks to the continuing advances in using machine learning and artificial intelligence for operational efficiency and the increasing network effect, the operations team was actually smaller at the end of 2023 than it was at the beginning of the year, demonstrating the disruptive nature of a single instance, multi-tenant business model. We recorded our best-ever customer satisfaction and NPS scores and more than 150 programs went live on our platform this past year. Finally, we are thrilled to welcome three new senior executives to the Company, bolstering our presence in Europe and Asia. Throughout our journey, we remain dedicated to fulfilling the long-term needs of our clients and relentlessly pushing the boundaries of innovation across the investment lifecycle.”

Fourth Quarter 2023 Financial Results Summary

•Revenue: Total revenue for the fourth quarter of 2023 was $99.0 million, an increase of 19.8%, from $82.7 million in the fourth quarter of 2022.

•Gross Profit: Gross profit for the fourth quarter of 2023 increased to $70.7 million, compared with $59.7 million in the fourth quarter of 2022. Non-GAAP gross profit for the fourth quarter of 2023 was $76.2 million, which equates to a 77.0% non-GAAP gross margin and an increase of 120 basis points over the fourth quarter of 2022.

•Net Income/(Loss): Net loss for the fourth quarter of 2023 was $3.4 million compared with net loss of $2.0 million in the fourth quarter of 2022. Net loss for the fourth quarter included total equity-based compensation expense and related payroll taxes of $23.7 million, which decreased compared to the third quarter as the full year revenue growth of JUMP products did not meet the performance vesting for threshold RSUs related to the JUMP

acquisition, resulting in a reversal of $6.9 million of expense previously recognized in the year. Non-GAAP net income for the fourth quarter of 2023 increased to $24.1 million from $17.2 million in the fourth quarter of 2022.

•Adjusted EBITDA: Adjusted EBITDA for the fourth quarter of 2023 was $30.0 million, up from $24.3 million in the fourth quarter of 2022. Adjusted EBITDA margin for the fourth quarter of 2023 was 30.3%, an increase of 80 basis points over the fourth quarter of 2022.

•Cash Flows: Operating cash flows for the fourth quarter of 2023 were $24.1 million. Free cash flows for the fourth quarter of 2023 increased to $22.5 million from $16.6 million in the fourth quarter of 2022. For the full year 2023, free cash flow was $79.0 million, an increase of 57.2% over the full year 2022.

•Net Loss Per Share and Non-GAAP Net Income Per Share attributable to Clearwater Analytics Holdings, Inc.: Net loss per basic and diluted share was $0.02 in the fourth quarter of 2023. For the full year of 2023, net loss per basic and diluted share was $0.11. For the fourth quarter of 2023, non-GAAP net income per basic share was $0.12, and non-GAAP net income per diluted share was $0.10.

•Cash, cash equivalents, and investments were $317.7 million as of December 31, 2023, compared to $255.6 million as of December 31, 2022. Total debt, net of debt issuance cost, was $48.0 million as of December 31, 2023.

Fourth Quarter 2023 Key Metrics Summary

•Annualized Recurring Revenue: As of December 31, 2023, annualized recurring revenue (“ARR”) reached $379.1 million, an increase of 17.2% from $323.5 million as of December 31, 2022.

ARR is calculated at the end of a period by dividing the recurring revenue in the last month of such period by the number of days in the month and multiplying by 365.

•Gross Revenue Retention Rate: As of December 31, 2023, the gross revenue retention rate was 98%, consistent with the Company’s gross revenue retention rate as of December 31, 2022. The Company has reported a gross revenue retention rate of 98% for nineteen out of the twenty prior quarters.

Gross revenue retention rate represents annual contract value (“ACV”) at the beginning of the 12-month period ended on the reporting date less client attrition over the prior 12-month period, divided by ACV at the beginning of the 12-month period, expressed as a percentage. ACV is comprised of annualized recurring revenue plus contracted-not-billed revenue, which represents the estimated annual contracted revenue for new and existing client opportunities prior to revenue recognition.

•Net Revenue Retention Rate: As of December 31, 2023, the net revenue retention rate was 107%, compared to

106% as of December 31, 2022.

Net revenue retention rate is the percentage of recurring revenue from clients on the platform for 12 months and includes changes from the addition, removal, or value of assets on our platform, contractual changes that have an impact to annualized recurring revenues and lost revenue from client attrition.

•Clients: As of December 31, 2023, the Company had 1,349 clients, and 86 clients that contributed at least $1.0 million in ARR, an increase of 28.4% from 67 clients that contributed at least $1.0 million in ARR as of December 31, 2022.

•Assets Under Management (AUM): As of December 31, 2023, the platform processes and reports on $7.3 trillion assets daily, compared to $6.4 trillion assets daily as of December 31, 2022.

Recent Business Highlights

•Notably, while AUM on the Clearwater platform grew to $7.3 trillion, the Company ended 2023 at essentially the same headcount as the end of 2022.

•After completing its transition to the cloud, Clearwater Analytics now devotes more than 60% of its R&D resources to fostering innovation across our comprehensive suite of product offerings. R&D is focused on:

◦Investment Data Consolidation: Enhancing our products, like Clearwater Prism and Clearwater for IBOR, to provide a full 360-degree look at investment data for analytics and reporting, while bringing agility to investment managers and buy-side investors so they can improve efficiencies and increase AUM.

◦Asset Class and Funds Expansion: Delivery of more comprehensive solutions such as Clearwater LPx, Clearwater MLx, Clearwater LPx Clarity, Clearwater for Stable Value Funds and more, to provide the deep details required for compliance and risk across varying asset and fund classes.

◦Front and Middle Office Solutions: Expansion into new buyers across the investment lifecycle.

◦with products like Clearwater Risk & Analytics, Clearwater Performance & Attribution, Clearwater JUMP and Clearwater JUMP Start.

◦Platform Innovations: Applying innovations, such as Premium Close Package and Clearwater Tri-Partite Transactions, to our accounting and reporting platform for our existing clientele.

◦New Frontiers: Using the latest technologies, such as Clearwater’s CWIC apps and Clearwater Insights, to drive innovation across the investment lifecycle.

•Clearwater Analytics expanded its footprint within existing clients and added marquee clients such as AppsFlyer, Assured Life Association, Caisse Centrale de Réassurance, Carpenters’ Combined Funds Pension, Colcom Foundation, Cross River Bank, Equinix, Evergreen Annuity & Life Co, Federal Life Insurance Company, Globe Life, IQUW Administration Services Limited, Metropolitan Police Friendly Society Ltd., Millers Mutual Insurance Group, Openly Holdings Corp, Pro-Demnity Insurance Company, Ronald McDonald House Charities of Southern California, Salud Integral en la Montana, United Casualty and Surety Insurance Company, USA Underwriters, and Vermont Community Foundation.

•Clearwater Analytics successfully drove cross-sell and upsell motions in the fourth quarter. Highlights include:

◦A growing roster of clients, including Globe Life, that use both Clearwater’s JUMP solution for OMS/PMS and Clearwater’s accounting and reconciliation solution.

◦Noteworthy new Clearwater Prism clients who have chosen our market-leading next-gen investment data management hub for enhanced client portal and reporting.

◦The Clearwater for Stable Value solution was chosen by T. Rowe Price to support their growing stable value business.

◦Clearwater also welcomed its first clients for Clearwater MLx, a new solution for mortgage loan detailed accounting. The Company continued to capitalize on the market need for detailed LP accounting with our best-ever quarterly sales of Clearwater LPx, a full-service solution for private funds, and LPx Clarity, an extension of Clearwater LPx that provides look-through insight into private assets, facilitating asset allocation and risk management decisions.

•To support the Company’s global expansion efforts and go-to market strategy, Clearwater Analytics recently announced new leadership appointments. Shane Akeroyd has been named as Chief Strategy Officer, Keith Viverito as Managing Director for EMEA, and Ann-Sophie Skjoldager Bom as Sales Director for Strategic Asset clients.

•Clearwater Analytics published several reports in the fourth quarter, including the 2023 Insurer Cash and Short-Term Investment Management Market Outlook study, the 2024 Hong Kong & Singapore Insurance Industry Outlook report, and The Digital Promise: Operational Challenges, Approaches, and Progress for European Insurers.

•Clearwater Analytics announced that it won the Chartis Research RiskTech Buyside 50 Award in the Investment Lifecycle – Insurance/Pension Funds category. The RiskTech Buyside 50 rankings honor the top financial technology vendors in the investment management industry. For the second consecutive year, Clearwater Analytics received the highest score in breadth of coverage, depth of functionality, technology and techniques, strategy and innovation, and market presence.

First Quarter and Full Year 2024 Guidance

| | | | | | | | | | | |

| First Quarter 2024 | | Full Year 2024 |

| Revenue | $100.5 million | | $431 million to $437 million |

| Year-over-Year Growth % | ~19% | | ~17% to 19% |

| Adjusted EBITDA | $28.8 million | | $135 million to $137 million |

| Adjusted EBITDA Margin % | ~29% | | ~31% |

| Total equity-based compensation expense and related payroll taxes | | | ~$106 million |

| Depreciation and Amortization | | | ~$11 million |

| Non-GAAP effective tax rate | | | 25% |

| Diluted non-GAAP share count | | | ~258 million |

Certain components of the guidance given above are provided on a non-GAAP basis only without providing a reconciliation to guidance provided on a GAAP basis. Information is presented in this manner because the preparation of such a reconciliation could not be accomplished without “unreasonable efforts.” The Company does not have access to certain information that would be necessary to provide such a reconciliation, including non-recurring items that are not indicative of the Company’s ongoing operations. The Company does not believe that this information is likely to be significant to an assessment of the Company’s ongoing operations.

Conference Call Details

Clearwater Analytics will hold a conference call and webcast on February 28, 2024, at 5:00 p.m. Eastern time to discuss fourth quarter and full year 2023 financial results, provide a general business update, and respond to analyst questions.

A live webcast of the call will also be available on the Company’s investor relations website. Please visit investors.clearwateranalytics.com at least fifteen minutes prior to the start of the event to register, download and install any necessary audio software.

If you are unable to participate live, a replay of the webcast will be available following the conference call on the Company’s investor relations website, along with the earnings press release, and related financial tables.

About Clearwater Analytics

Clearwater Analytics (NYSE: CWAN), a global, industry-leading SaaS solution, automates the entire investment lifecycle. With a single instance, multi-tenant architecture, Clearwater offers award-winning investment portfolio planning, performance reporting, data aggregation, reconciliation, accounting, compliance, risk, and order management. Each day, leading insurers, asset managers, corporations, and governments use Clearwater’s trusted data to drive efficient, scalable investing on more than $7.3 trillion in assets spanning traditional and alternative asset types. Additional information about Clearwater can be found at clearwateranalytics.com.

###

Investor Contact:

Joon Park | +1 415-906-9242 | investors@clearwateranalytics.com

Media Contact:

Claudia Cahill | +1 703-728-1221 | press@clearwateranalytics.com

Use of non-GAAP Information

This press release contains certain non-GAAP measures, including non-GAAP gross profit, non-GAAP gross margin, adjusted EBITDA, adjusted EBITDA margin, non-GAAP net income, non-GAAP net income per basic and diluted share, non-GAAP effective tax rate, diluted non-GAAP share count and free cash flow.

The non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. However, the Company believes that this non-GAAP information is useful as an additional means for investors to evaluate its operating performance, when reviewed in

conjunction with its GAAP financial statements. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP and, because these amounts are not determined in accordance with GAAP, they should not be used exclusively in evaluating the Company's business and operations. In addition, undue reliance should not be placed upon non-GAAP or operating information because this information is neither standardized across companies nor subjected to the same control activities and audit procedures that produce the Company's GAAP financial results.

The Company's non-GAAP statement of operations measures, including non-GAAP gross profit, non-GAAP gross margin, adjusted EBITDA, adjusted EBITDA margin, non-GAAP net income, non-GAAP net income per basic and diluted share, non-GAAP effective tax rate, diluted non-GAAP share count and free cash flow, are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of its ongoing operations. These adjusted measures exclude the impact of share-based compensation and eliminate potential differences in results of operations between periods caused by factors such as financing and capital structures, taxation positions or regimes, restructuring, transaction expenses, impairment and other charges. Please refer to the reconciliations of these measures below to what the Company believes are the most directly comparable measures evaluated in accordance with GAAP.

Use of Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include information concerning the Company's possible or assumed future results of operations, business strategies, technology developments, financing and investment plans, dividend policy, competitive position, industry, economic and regulatory environment, potential growth opportunities and the effects of competition. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “aim,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms, but are not the exclusive means of identifying such statements.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors, many of which are beyond Clearwater Analytics’ control, that may cause the Company's actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks and uncertainties may cause actual results to differ materially from Clearwater Analytics’ current expectations and include, but are not limited to, the Company's ability to keep pace with rapid technological change and market developments, including artificial intelligence, competitors in its industry, the possibility that market volatility, a downturn in economic conditions or other factors may cause negative trends or fluctuations in the value of the assets on the Company’s platform, the Company's ability to manage growth, the Company's ability to attract and retain skilled employees, the possibility that the Company's solutions fail to perform properly, disruptions and failures in the Company's and third parties’ computer equipment, cloud-based services, electronic delivery systems, networks and telecommunications systems and infrastructure, the failure to protect the Company, its customers’ and/or its vendors’ confidential information and/or intellectual property, claims of infringement of others’ intellectual property, factors related to the Company's ownership structure and status as a “controlled company” as well as other risks and uncertainties detailed in Clearwater Analytics’ periodic public filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to those discussed under “Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 3, 2023, those discussed under “Risk Factors” in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 that will be filed following this earnings release, and in other periodic reports filed by Clearwater Analytics with the SEC. These filings are available at www.sec.gov and on Clearwater Analytics’ website.

Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent management’s beliefs and assumptions only as of the date of this press release and should not be relied upon as representing Clearwater Analytics’ expectations or beliefs as of any date subsequent to the time they are made. Clearwater Analytics does not undertake to and specifically declines any obligation to update any forward-looking statements that may be made from time to time by or on behalf of Clearwater Analytics.

###

Clearwater Analytics Holdings, Inc.

Consolidated Balance Sheets

(In thousands, except share amounts and per share amounts, unaudited)

| | | | | | | | | | | |

| December 31, | | December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 221,765 | | | $ | 250,724 | |

| Short-term investments | 74,457 | | | 4,890 | |

| Accounts receivable, net | 92,091 | | | 72,575 | |

| Prepaid expenses and other current assets | 27,683 | | | 28,157 | |

| Total current assets | 415,996 | | | 356,346 | |

| Property and equipment, net | 15,349 | | | 15,064 | |

| Operating lease right-of-use assets, net | 22,554 | | | 24,114 | |

| Deferred contract costs, non-current | 6,439 | | | 6,563 | |

| Debt issuance costs - line of credit | 533 | | | 728 | |

| Other non-current assets | 4,907 | | | 5,880 | |

| Intangible assets, net | 26,132 | | | 29,456 | |

| Goodwill | 45,338 | | | 43,791 | |

| Long-term investments | 21,495 | | | — | |

| Total assets | $ | 558,743 | | | $ | 481,942 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 3,062 | | | $ | 3,092 | |

| Accrued expenses and other current liabilities | 49,535 | | | 42,119 | |

| Notes payable, current portion | 2,750 | | | 2,750 | |

| Operating lease liability, current portion | 6,551 | | | 5,851 | |

| Tax receivable agreement liability | 18,894 | | | 12,200 | |

| Total current liabilities | 80,792 | | | 66,012 | |

| Notes payable, less current maturities and unamortized debt issuance costs | 45,828 | | | 48,492 | |

| Operating lease liability, less current portion | 16,948 | | | 19,505 | |

| Other long-term liabilities | 5,518 | | | 9,547 | |

| Total liabilities | 149,086 | | | 143,556 | |

| | | |

| Stockholders' Equity | | | |

| Class A common stock, par value $0.001 per share; 1,500,000,000 shares authorized, 127,604,185 shares issued and outstanding as of December 31, 2023, 61,148,890 shares issued and outstanding as of December 31, 2022 | 128 | | | 61 | |

| Class B common stock, par value $0.001 per share; 500,000,000 shares authorized, 111,191 shares issued and outstanding as of December 31, 2023, 1,439,251 shares issued and outstanding as of December 31, 2022 | — | | | 1 | |

| Class C common stock, par value $0.001 per share; 500,000,000 shares authorized, 32,684,156 shares issued and outstanding as of December 31, 2023, 47,377,587 shares issued and outstanding as of December 31, 2022 | 33 | | | 47 | |

| Class D common stock, par value $0.001 per share; 500,000,000 shares authorized, 82,955,977 shares issued and outstanding as of December 31, 2023, 130,083,755 shares issued and outstanding as of December 31, 2022 | 83 | | | 130 | |

| Additional paid-in-capital | 532,507 | | | 455,320 | |

| Accumulated other comprehensive income | 2,909 | | | 609 | |

| Accumulated deficit | (181,331) | | | (186,647) | |

| Total stockholders' equity attributable to Clearwater Analytics Holdings, Inc. | 354,329 | | | 269,521 | |

| Non-controlling interests | 55,328 | | | 68,865 | |

| Total stockholders' equity | 409,657 | | | 338,386 | |

| Total liabilities and stockholders' equity | $ | 558,743 | | | $ | 481,942 | |

Clearwater Analytics Holdings, Inc.

Consolidated Statements of Operations

(In thousands, except share amounts and per share amounts, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenue | $ | 99,019 | | | $ | 82,687 | | | $ | 368,168 | | | $ | 303,426 | | | | | |

Cost of revenue(1) | 28,335 | | | 22,973 | | | 107,127 | | | 87,784 | | | | | |

| Gross profit | 70,684 | | | 59,714 | | | 261,041 | | | 215,642 | | | | | |

| Operating expenses: | | | | | | | | | | | |

Research and development(1) | 33,728 | | | 24,553 | | | 123,925 | | | 94,120 | | | | | |

Sales and marketing(1) | 16,316 | | | 14,383 | | | 60,365 | | | 52,638 | | | | | |

General and administrative(1) | 18,050 | | | 16,903 | | | 93,496 | | | 63,767 | | | | | |

| Total operating expenses | 68,094 | | | 55,839 | | | 277,786 | | | 210,525 | | | | | |

| Income (loss) from operations | 2,590 | | | 3,875 | | | (16,745) | | | 5,117 | | | | | |

| Interest income, net | (1,979) | | | (1,276) | | | (6,401) | | | (1,137) | | | | | |

| Tax receivable agreement expense | 8,284 | | | 5,939 | | | 14,396 | | | 11,639 | | | | | |

| | | | | | | | | | | |

| Other (income) expense, net | (669) | | | 778 | | | (1,874) | | | (50) | | | | | |

| Loss before income taxes | (3,046) | | | (1,566) | | | (22,866) | | | (5,335) | | | | | |

| Provision for income taxes | 401 | | | 401 | | | 217 | | | 1,360 | | | | | |

| Net loss | (3,447) | | | (1,967) | | | (23,083) | | | (6,695) | | | | | |

| Less: Net income (loss) attributable to non-controlling interests | 739 | | | 941 | | | (1,456) | | | 1,272 | | | | | |

| Net loss attributable to Clearwater Analytics Holdings, Inc. | $ | (4,186) | | | $ | (2,908) | | | $ | (21,627) | | | $ | (7,967) | | | | | |

| | | | | | | | | | | |

| Net loss per share attributable to Class A and Class D common stock: | | | | | | | | | | | |

| Basic and diluted | $ | (0.02) | | | $ | (0.02) | | | $ | (0.11) | | | $ | (0.04) | | | | | |

| | | | | | | | | | | |

Weighted average shares of Class A and Class D common stock

outstanding: | | | | | | | | | | | |

| Basic and diluted | 206,193,802 | | 190,015,070 | | 199,691,873 | | 185,560,683 | | | | |

(1)Amounts include equity-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenue | $ | 3,378 | | | $ | 1,761 | | | $ | 12,215 | | | $ | 9,043 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Research and development | 7,346 | | | 3,947 | | | 24,739 | | | 17,950 | | | | | |

| Sales and marketing | 4,622 | | | 3,259 | | | 15,843 | | | 12,711 | | | | | |

| General and administrative | 6,975 | | | 7,955 | | | 51,650 | | | 25,987 | | | | | |

| Total equity-based compensation expense | $ | 22,321 | | | $ | 16,922 | | | $ | 104,447 | | | $ | 65,691 | | | | | |

Clearwater Analytics Holdings, Inc.

Consolidated Statements of Cash Flows

(In thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| OPERATING ACTIVITIES | | | | | | | | | | | |

| Net loss | $ | (3,447) | | | $ | (1,967) | | | $ | (23,083) | | | $ | (6,695) | | | | | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | | | | |

| Depreciation and amortization | 2,593 | | | 1,640 | | | 9,929 | | | 5,139 | | | | | |

| Noncash operating lease cost | 1,952 | | | 1,600 | | | 7,619 | | | 5,950 | | | | | |

| Equity-based compensation | 22,321 | | | 16,922 | | | 104,447 | | | 65,691 | | | | | |

| | | | | | | | | | | |

| Amortization of deferred contract acquisition costs | 1,200 | | | 1,106 | | | 4,763 | | | 4,327 | | | | | |

| Amortization of debt issuance costs, included in interest expense | 71 | | | 70 | | | 280 | | | 279 | | | | | |

| Accretion of discount on investments | (573) | | | — | | | (1,474) | | | — | | | | | |

| Deferred tax benefit | (913) | | | (214) | | | (1,665) | | | (803) | | | | | |

| Realized gain on investments | — | | | — | | | (89) | | | — | | | | | |

| Changes in operating assets and liabilities, excluding the impact of business acquisitions: | | | | | | | | | | | |

| Accounts receivable, net | (434) | | | (4,444) | | | (19,298) | | | (19,098) | | | | | |

| Prepaid expenses and other assets | (3,068) | | | (6,659) | | | 1,151 | | | (4,956) | | | | | |

| Deferred contract acquisition costs | (2,405) | | | (2,253) | | | (5,067) | | | (5,845) | | | | | |

| Accounts payable | (224) | | | 1,369 | | | (115) | | | 1,609 | | | | | |

| Accrued expenses and other liabilities | 7,081 | | | 4,845 | | | 1,204 | | | 207 | | | | | |

| | | | | | | | | | | |

| Tax receivable agreement liability | (61) | | | 6,500 | | | 6,000 | | | 12,200 | | | | | |

| Net cash provided by operating activities | 24,093 | | | 18,515 | | | 84,602 | | | 58,005 | | | | | |

| INVESTING ACTIVITIES | | | | | | | | | | | |

| Purchases of property and equipment | (1,562) | | | (1,877) | | | (5,624) | | | (7,758) | | | | | |

| Purchase of held to maturity investments | — | | | — | | | (3,004) | | | (3,000) | | | | | |

| Purchases of available-for-sale investments | (13,160) | | | — | | | (124,178) | | | — | | | | | |

| Proceeds from sale of available-for-sale investments | — | | | — | | | 5,950 | | | — | | | | | |

| Proceeds from maturities of investments | 15,280 | | | — | | | 31,801 | | | — | | | | | |

| Acquisition of business, net of cash acquired | — | | | (65,793) | | | — | | | (65,793) | | | | | |

| Net cash provided by (used in) investing activities | 558 | | | (67,670) | | | (95,055) | | | (76,551) | | | | | |

| FINANCING ACTIVITIES | | | | | | | | | | | |

| | | | | | | | | | | |

| Proceeds from exercise of options | 274 | | | 10,358 | | | 4,738 | | | 18,284 | | | | | |

| Taxes paid related to net share settlement of equity awards | (5,895) | | | (624) | | | (20,784) | | | (3,189) | | | | | |

| | | | | | | | | | | |

| Proceeds from employee stock purchase plan | 1,994 | | | 1,814 | | | 4,588 | | | 4,215 | | | | | |

| Repayments of borrowings | (688) | | | (688) | | | (2,749) | | | (2,750) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Payment of costs associated with the IPO | — | | | — | | | — | | | (214) | | | | | |

| Payment of tax distributions | (2,149) | | | (117) | | | (2,184) | | | (117) | | | | | |

| Payment of business acquisition holdback liability | (2,900) | | | — | | | (2,900) | | | — | | | | | |

| Net cash provided by (used in) financing activities | (9,364) | | | 10,743 | | | (19,291) | | | 16,229 | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | 813 | | | 613 | | | 785 | | | (1,556) | | | | | |

| Change in cash and cash equivalents during the period | 16,100 | | | (37,799) | | | (28,959) | | | (3,873) | | | | | |

| Cash and cash equivalents, beginning of period | 205,665 | | | 288,523 | | | 250,724 | | | 254,597 | | | | | |

| Cash and cash equivalents, end of period | $ | 221,765 | | | $ | 250,724 | | | $ | 221,765 | | | $ | 250,724 | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash paid for interest | $ | 924 | | | $ | 629 | | | $ | 3,454 | | | $ | 1,395 | | | | | |

| Cash paid for income taxes | $ | 395 | | | $ | 619 | | | $ | 2,432 | | | $ | 2,044 | | | | | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES | | | | | | | | | | | |

| Purchase of property and equipment included in accounts payable and accrued expense | $ | 435 | | | $ | 350 | | | $ | 435 | | | $ | 350 | | | | | |

| Business acquisition holdback liability included in accrued expense and other long-term liabilities | $ | — | | | $ | 6,999 | | | $ | — | | | $ | 6,999 | | | | | |

| Tax distributions payable to Continuing Equity Owners included in accrued expenses | $ | 2,945 | | | $ | 3,196 | | | $ | 2,945 | | | $ | 3,196 | | | | | |

Clearwater Analytics Holdings, Inc.

Reconciliation of Net Loss to Adjusted EBITDA

(In thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| (in thousands, except percentages) |

| Net loss | $ | (3,447) | | | (3 | %) | | $ | (1,967) | | | (2 | %) |

| Adjustments: | | | | | | | |

| Interest income, net | (1,979) | | | (2 | %) | | (1,276) | | | (2 | %) |

| Depreciation and amortization | 2,593 | | | 3 | % | | 1,640 | | | 2 | % |

| Equity-based compensation expense and related payroll taxes | 27,071 | | | 27 | % | | 15,935 | | | 19 | % |

| Equity-based compensation (benefit) expense related to JUMP acquisition | (3,411) | | | (3 | %) | | 1,821 | | | 2 | % |

| Tax receivable agreement expense | 8,284 | | | 8 | % | | 5,939 | | | 7 | % |

| Transaction expenses | 441 | | | 0 | % | | 384 | | | 0 | % |

Other expenses(1) | 430 | | | 0 | % | | 1,873 | | | 2 | % |

| Adjusted EBITDA | 29,982 | | | 30 | % | | 24,349 | | | 29 | % |

| Revenue | $ | 99,019 | | | 100 | % | | $ | 82,687 | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| (in thousands, except percentages) |

| Net loss | $ | (23,083) | | | (6 | %) | | $ | (6,695) | | | (2 | %) |

| Adjustments: | | | | | | | |

| Interest income, net | (6,401) | | | (2 | %) | | (1,137) | | | 0 | % |

| Depreciation and amortization | 9,929 | | | 3 | % | | 5,139 | | | 2 | % |

| Equity-based compensation expense and related payroll taxes | 94,906 | | | 26 | % | | 64,704 | | | 21 | % |

| Equity-based compensation expense related to JUMP acquisition | 13,172 | | | 4 | % | | 1,821 | | | 1 | % |

| Tax receivable agreement expense | 14,396 | | | 4 | % | | 11,639 | | | 4 | % |

| Transaction expenses | 2,052 | | | 1 | % | | 1,711 | | | 1 | % |

Other expenses(1) | 934 | | | 0 | % | | 3,954 | | | 1 | % |

| Adjusted EBITDA | 105,905 | | | 29 | % | | 81,136 | | | 27 | % |

| Revenue | $ | 368,168 | | | 100 | % | | $ | 303,426 | | | 100 | % |

(1) Other expenses include management fees to our investors, provision for income taxes, foreign exchange gains and losses and other expenses that are not reflective of our core operating performance, including the costs to set up our Up-C structure and Tax Receivable Agreement.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| (in thousands) | | | | |

| Up-C structure expenses | $ | — | | | $ | — | | | $ | — | | | $ | 158 | | | | | |

| Amortization of prepaid management fees and reimbursable expenses | 698 | | | 694 | | | 2,592 | | | 2,486 | | | | | |

| Provision for income taxes | 401 | | | 401 | | | 217 | | | 1,360 | | | | | |

| Other (income) expense, net | (669) | | | 778 | | | (1,874) | | | (50) | | | | | |

| Total other expenses | $ | 430 | | | $ | 1,873 | | | $ | 934 | | | $ | 3,954 | | | | | |

Clearwater Analytics Holdings, Inc.

Reconciliation of Free Cash Flow

(In thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net cash provided by operating activities | $ | 24,093 | | | $ | 18,515 | | | $ | 84,602 | | | $ | 58,005 | | | | | |

| Less: Purchases of property and equipment | 1,562 | | | 1,877 | | | 5,624 | | | 7,758 | | | | | |

| Free Cash Flow | $ | 22,531 | | | $ | 16,638 | | | $ | 78,978 | | | $ | 50,247 | | | | | |

Clearwater Analytics Holdings, Inc.

Reconciliation of Non-GAAP Information

(In thousands, except share amounts and per share amounts, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenue | $ | 99,019 | | | $ | 82,687 | | | $ | 368,168 | | | $ | 303,426 | | | | | |

| | | | | | | | | | | |

| Gross profit | $ | 70,684 | | | $ | 59,714 | | | $ | 261,041 | | | $ | 215,642 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 3,411 | | | 1,801 | | | 12,734 | | | 9,083 | | | | | |

| Depreciation and amortization | 2,102 | | | 1,093 | | | 7,999 | | | 3,290 | | | | | |

| Gross profit, non-GAAP | $ | 76,197 | | | $ | 62,608 | | | $ | 281,774 | | | $ | 228,015 | | | | | |

| As a percentage of revenue, non-GAAP | 77 | % | | 76 | % | | 77 | % | | 75 | % | | | | |

| | | | | | | | | | | |

| Cost of Revenue | $ | 28,335 | | | $ | 22,973 | | | $ | 107,127 | | | $ | 87,784 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 3,411 | | | 1,801 | | | 12,734 | | | 9,083 | | | | | |

| Depreciation and amortization | 2,102 | | | 1,093 | | | 7,999 | | | 3,290 | | | | | |

| Cost of revenue, non-GAAP | $ | 22,822 | | | $ | 20,079 | | | $ | 86,394 | | | $ | 75,411 | | | | | |

| As a percentage of revenue, non-GAAP | 23 | % | | 24 | % | | 23 | % | | 25 | % | | | | |

| | | | | | | | | | | |

| Research and development | $ | 33,728 | | | $ | 24,553 | | | $ | 123,925 | | | $ | 94,120 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 7,035 | | | 4,013 | | | 24,221 | | | 18,016 | | | | | |

| Equity-based compensation expense related to JUMP acquisition | 359 | | | — | | | 1,406 | | | — | | | | | |

| Depreciation and amortization | 258 | | | 416 | | | 1,044 | | | 1,293 | | | | | |

| Research and development, non-GAAP | $ | 26,076 | | | $ | 20,124 | | | $ | 97,254 | | | $ | 74,811 | | | | | |

| As a percentage of revenue, non-GAAP | 26 | % | | 24 | % | | 26 | % | | 25 | % | | | | |

| | | | | | | | | | | |

| Sales and marketing | $ | 16,316 | | | $ | 14,383 | | | $ | 60,365 | | | $ | 52,638 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 4,636 | | | 3,937 | | | 16,419 | | | 13,389 | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | 148 | | | 87 | | | 589 | | | 286 | | | | | |

| Sales and marketing, non-GAAP | $ | 11,532 | | | $ | 10,359 | | | $ | 43,357 | | | $ | 38,963 | | | | | |

| As a percentage of revenue, non-GAAP | 12 | % | | 13 | % | | 12 | % | | 13 | % | | | | |

| | | | | | | | | | | |

| General and administrative | $ | 18,050 | | | $ | 16,903 | | | $ | 93,496 | | | $ | 63,767 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 11,989 | | | 6,184 | | | 41,532 | | | 24,216 | | | | | |

| Equity-based compensation (benefit) expense related to JUMP acquisition | (3,770) | | | 1,821 | | | 11,766 | | | 1,821 | | | | | |

| Depreciation and amortization | 85 | | | 44 | | | 297 | | | 270 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of prepaid management fees and reimbursable expenses | 698 | | | 694 | | | 2,592 | | | 2,486 | | | | | |

| Transaction expenses | 441 | | | 384 | | | 2,052 | | | 1,711 | | | | | |

| Up-C structure expenses | — | | | — | | | — | | | 158 | | | | | |

| General and administrative, non-GAAP | $ | 8,607 | | | $ | 7,776 | | | $ | 35,258 | | | $ | 33,105 | | | | | |

| As a percentage of revenue, non-GAAP | 9 | % | | 9 | % | | 10 | % | | 11 | % | | | | |

| | | | | | | | | | | |

| Income (loss) from operations | $ | 2,590 | | | $ | 3,875 | | | $ | (16,745) | | | $ | 5,117 | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 27,071 | | | 15,935 | | | 94,906 | | | 64,704 | | | | | |

| Equity-based compensation (benefit) expense related to JUMP acquisition | (3,411) | | | 1,821 | | | 13,172 | | | 1,821 | | | | | |

| Depreciation and amortization | 2,593 | | | 1,640 | | | 9,929 | | | 5,139 | | | | | |

| Amortization of prepaid management fees and reimbursable expenses | 698 | | | 694 | | | 2,592 | | | 2,486 | | | | | |

| Transaction expenses | 441 | | | 384 | | | 2,052 | | | 1,711 | | | | | |

| Up-C structure expenses | — | | | — | | | — | | | 158 | | | | | |

| Income from operations, non-GAAP | $ | 29,982 | | | $ | 24,349 | | | $ | 105,905 | | | $ | 81,136 | | | | | |

| As a percentage of revenue, non-GAAP | 30 | % | | 29 | % | | 29 | % | | 27 | % | | | | |

| | | | | | | | | | | |

| Net loss | $ | (3,447) | | | $ | (1,967) | | | $ | (23,083) | | | $ | (6,695) | | | | | |

| Adjustments: | | | | | | | | | | | |

| Equity-based compensation expense and related payroll taxes | 27,071 | | | 15,935 | | | 94,906 | | | 64,704 | | | | | |

| Equity-based compensation (benefit) expense related to JUMP acquisition | (3,411) | | | 1,821 | | | 13,172 | | | 1,821 | | | | | |

| Depreciation and amortization | 2,593 | | | 1,639 | | | 9,929 | | | 5,139 | | | | | |

| Tax receivable agreement expense | 8,284 | | | 5,939 | | | 14,396 | | | 11,639 | | | | | |

| Amortization of prepaid management fees and reimbursable expenses | 698 | | | 694 | | | 2,592 | | | 2,486 | | | | | |

| Transaction expenses | 441 | | | 384 | | | 2,052 | | | 1,711 | | | | | |

| Up-C structure expenses | — | | | — | | | — | | | 158 | | | | | |

| | | | | | | | | | | |

Tax impacts of adjustments to net loss(1) | (8,158) | | | (7,205) | | | (28,545) | | | (23,874) | | | | | |

| Net income, non-GAAP | $ | 24,071 | | | $ | 17,240 | | | $ | 85,419 | | | $ | 57,089 | | | | | |

| As a percentage of revenue, non-GAAP | 24 | % | | 21 | % | | 23 | % | | 19 | % | | | | |

| | | | | | | | | | | |

| Net income per share - basic, non-GAAP | $ | 0.12 | | | $ | 0.09 | | | $ | 0.43 | | | $ | 0.31 | | | | | |

| Net income per share - diluted, non-GAAP | $ | 0.10 | | | $ | 0.07 | | | $ | 0.33 | | | $ | 0.23 | | | | | |

| | | | | | | | | | | |

| Weighted-average common shares outstanding - basic | 206,193,802 | | 190,015,070 | | 199,691,873 | | 185,560,683 | | | | |

| Weighted-average common shares outstanding - diluted | 252,215,606 | | 252,020,192 | | 255,750,590 | | 249,664,138 | | | | |

(1)The non-GAAP effective tax rate was 25% and 29% for the three months and year ended December 31, 2023 and 2022, respectively, and has been used to adjust the provision for income taxes for non-GAAP net income and non-GAAP basic and diluted net income per share.

v3.24.0.1

Cover page

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

Clearwater Analytics Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40838

|

| Entity Tax Identification Number |

87-1043711

|

| Entity Address, Address Line One |

777 W. Main Street

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

Boise

|

| Entity Address, State or Province |

ID

|

| Entity Address, Postal Zip Code |

83702

|

| City Area Code |

208

|

| Local Phone Number |

433-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.001 per share

|

| Trading Symbol |

CWAN

|

| Security Exchange Name |

NYSE

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001866368

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

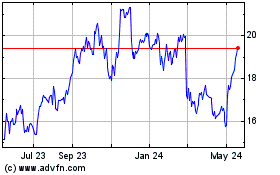

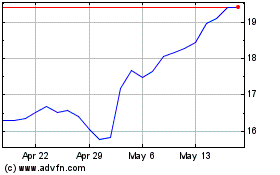

Clearwater Analytics (NYSE:CWAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clearwater Analytics (NYSE:CWAN)

Historical Stock Chart

From Apr 2023 to Apr 2024