Current Report Filing (8-k)

June 04 2020 - 4:14PM

Edgar (US Regulatory)

0001364954false00013649542020-06-042020-06-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: June 4, 2020

(Date of earliest event reported)

Chegg, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

001-36180

|

|

20-3237489

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3990 Freedom Circle

|

|

|

|

|

Santa Clara,

|

California

|

|

95054

|

|

(Address of Principal Executive Offices)

|

|

|

(Zip Code)

|

(408) 855-5700

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

CHGG

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets.

On June 4, 2020, Chegg, Inc. (“Chegg”) acquired Mathway LLC, a Delaware limited liability company (“Mathway”), an online, on-demand math problem solving resource, pursuant to an Interest Purchase Agreement, dated as of June 4, 2020 (the “Agreement”), by and among Chegg, Mathway, and the members of Mathway (such transaction, the “Acquisition”). Pursuant to the terms of the Agreement, Chegg acquired all of the outstanding membership interests of Mathway, resulting in Mathway becoming a wholly owned subsidiary of Chegg, for approximately $100.0 million in cash, subject to the terms and conditions of the Agreement and adjustment for Mathway’s net working capital, indebtedness, unpaid transaction expenses and taxes. Approximately $88.2 million was paid at the closing of the Acquisition, $0.1 million was held in escrow as security for net working capital adjustment and $7.5 million was held in escrow as security for the Mathway members’ indemnification obligations pursuant to the Agreement. Additionally, Chegg may make up to an additional $15.0 million in cash earnout payments to the Mathway members, subject to the achievement of specified performance milestones and continued service of such members with Chegg. One-third of the earnout payments may initially become payable by June 4, 2021, the first anniversary of the closing date, and the remaining amount, if earned, will be paid quarterly over a two-year period, commencing on June 4, 2021.

Item 7.01 Regulation FD Disclosure.

On June 4, 2020, Chegg issued a press release announcing its acquisition of Mathway which includes the impact on Chegg's guidance for the quarter ending June 30, 2020. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of business acquired.

As a result of acquiring Mathway and based on the criteria in Rule 3-05 of Regulation S-X, Chegg would ordinarily be required to file certain historical audited financial statements for Mathway and corresponding pro forma financial information pursuant to Rule 11-01 of Regulation S-X. However, because Chegg believed that Mathway’s financial statements would not be material to Chegg’s stockholders and would be of limited value to investors, Chegg requested relief from the Securities and Exchange Commission (the “SEC”) from the requirement to provide historical audited financial statements of Mathway otherwise required by Rule 3-05 of Regulation S-X and the corresponding pro forma financial statements set forth in Rule 11-01 of Regulation S-X. The SEC granted the relief request on April 24, 2020.

(b) Pro forma financial information.

Reference is made to the disclosure set forth in Item 9.01(a) above.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding Chegg’s potential payment of cash earnout payments to the Mathway members and the timing of such payments. We have based these forward-looking statements largely on management’s current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including the Mathway members’ ability to achieve the specified milestones and their continued service with Chegg, the potential impact on the business of Mathway due to the Acquisition, general economic conditions, including the ongoing effects of the COVID-19 pandemic, competition, integration risks, and the other factors described in Chegg’s most recent Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020 filed with the SEC on May 4, 2020 and Chegg’s other SEC filings. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events discussed herein may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. These forward-looking statements are made only as of the date hereof and Chegg undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

CHEGG, INC.

|

|

|

|

|

|

By: /s/ Andrew Brown

|

|

|

Andrew Brown

|

|

|

Chief Financial Officer

|

Date: June 4, 2020

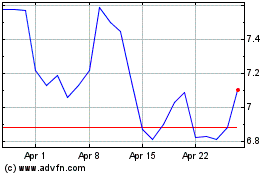

Chegg (NYSE:CHGG)

Historical Stock Chart

From Aug 2024 to Sep 2024

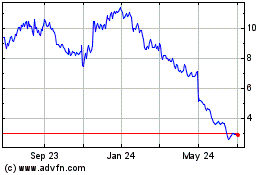

Chegg (NYSE:CHGG)

Historical Stock Chart

From Sep 2023 to Sep 2024