By Alexander Osipovich

Investors won't necessarily benefit when the New York Stock

Exchange and other market operators welcome traders back to their

closed floors, new research suggests.

An academic study released Thursday found that NYSE's crucial 4

p.m. auctions, which determine end-of-day prices for thousands of

stocks, ran more smoothly after the Big Board closed its floor to

curtail the spread of the coronavirus. NYSE has questioned the

study's conclusions.

The floor closure, which began March 23 and ends next week, is

the first time in NYSE's 228-year history that it has operated in

all-electronic mode. It has prevented floor brokers from executing

trades in the auctions, one of the few times of the day when humans

on NYSE's floor still play a significant role.

Meanwhile, brokerages such as Charles Schwab Corp. say

individual investors have gotten better prices on trades in a

popular options contract since Cboe Global Markets Inc. shut its

Chicago trading floor on March 16 to combat the pandemic.

The new data casts fresh doubt on the value of old-fashioned

trading floors, just as exchanges are moving to reopen them. NYSE

plans to reopen its floor Tuesday, while Cboe says it could reopen

its floor as soon as June 1.

Only a few exchanges still have floors, including Cboe, the

Chicago Mercantile Exchange, the Intercontinental Exchange

Inc.-owned NYSE and the London Metal Exchange. Almost all trading

-- from stocks to Treasury bonds to cattle futures -- can be done

electronically, with computers lining up buyers and sellers. But

proponents of trading floors say they provide a valuable service,

by funneling trades into one place and allowing traders to exercise

human judgment about how to execute them. That can be especially

useful for larger and more complex transactions, floor traders

say.

Open-outcry trading floors emerged centuries ago as places where

traders could haggle over securities and commodities.

Traditionally, floor traders enjoyed perks unavailable to those

elsewhere, such as quicker access to information and the ability to

collect fees from firms sending orders to the exchange.

The rise of electronic trading put many floor traders out of

business. Advocates of electronic exchanges say they are fairer

than the floors they replaced.

For ordinary investors, the closure of NYSE's floor was a

nonevent. But it changed the way big traders participate in the

exchange's closing auctions, which have grown in importance in

recent years as Wall Street has increasingly used them to execute

big trades. Nearly 7% of equities-trading volume this year has

occurred in closing auctions at NYSE, Nasdaq Inc. and elsewhere,

according to brokerage Rosenblatt Securities.

When NYSE closed its floor, firms could no longer use "D

orders," a popular way for traders to buy or sell large quantities

of NYSE-listed stocks in the closing auctions. Under NYSE rules,

such orders must be routed through a floor broker, and they can be

entered throughout the day, until 10 seconds before 4 p.m. That

gives traders greater flexibility than they have at Nasdaq, which

imposes stricter limits on closing-auction trades after 3:55 p.m.,

but it can fuel price swings in NYSE stocks during the final

minutes.

In Thursday's study, researchers at New York University and the

University of Illinois at Chicago found that closing the floor made

the process more orderly. NYSE's "indicative" auction prices, which

are meant to give investors a sense of closing prices for stocks,

grew more accurate: The gap between 3:55 p.m. indicative prices and

actual closing prices narrowed by about 1%, the study found.

Traders also tended to join the auctions earlier, potentially

damping big moves at the end of the day. Before the floor closed,

only 46% of NYSE closing-auction volume was matched -- or paired

off between buyers and sellers -- by 3:55 p.m. That jumped to 74%

after the closure, the study found.

"These improvements in closing auction market quality on NYSE

are especially notable given the widespread market turmoil during

the Covid-19 pandemic," the researchers wrote.

NYSE says the study missed the point and didn't look at better

ways to measure the quality of its auctions.

"This flawed study ignores real-world investor outcomes," NYSE

Chief Operating Officer Michael Blaugrund said. "The only credible

conclusion from analyses evaluating the best outcomes for investors

is that the NYSE closing auction, in conjunction with its trading

floor, leads to the fairest prices for investors."

Meanwhile, Cboe's floor closure saved money for investors in

S&P 500 options, according to brokers and data from Citadel

Securities, one of the biggest electronic trading firms in options

markets. S&P 500 options pay off if the index rises above or

below certain levels, allowing investors to bet on or hedge against

market swings. They gained popularity during this year's elevated

volatility.

In the first half of March, investors trading 100 or fewer

S&P 500 options -- a size often associated with individual

investors -- traded at prices slightly worse than those publicly

posted by options exchanges, costing them an average $1.46 per

order, according to Citadel Securities data. In the second half of

March, with the floor closed, that flipped into a savings of $98.54

per order, the data shows.

The reason for the striking difference: When it closed its

floor, Cboe activated a mechanism that lets investors get better

prices for S&P 500 options than those publicly posted, by

routing their orders to auctions where electronic trading firms

compete to execute them at better prices.

Brokerages that cater to individual investors welcomed the

change.

"We've seen a meaningful improvement in execution quality for

retail-sized [S&P 500] options contracts since Cboe has gone

all-electronic," said Jeffrey Starr, a senior vice president at

Charles Schwab. "It is certainly something that we'll be monitoring

closely going forward."

Cboe says it is looking at making the change permanent when it

reopens its floor. "That's been a great outcome for retail," Bryan

Harkins, co-head of Cboe's markets division, said in an interview

this week. "We're going to preserve the experience that they've

come to enjoy."

--To receive our Markets newsletter every morning in your

inbox,

click here

.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

May 21, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

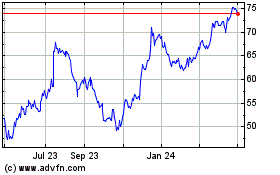

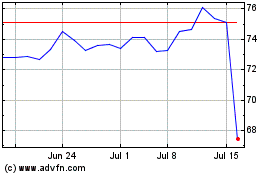

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024