Amended Current Report Filing (8-k/a)

March 06 2020 - 5:01PM

Edgar (US Regulatory)

Interim President & CEO compensation arrangementstrue000113031000000487320001042773TexasTexasDelawareCommon Stock, $0.01 par valueCNP

0001130310

cnp:NewYorkStockExchangeMember

cnp:CenterPointEnergyHoustonElectricLLCMember

cnp:A9.15FirstMortgageBondsdue2021Member

2020-02-19

2020-02-19

0001130310

cnp:NewYorkStockExchangeMember

cnp:CenterPointEnergyHoustonElectricLLCMember

cnp:A6.95GeneralMortgageBondsdue2033Member

2020-02-19

2020-02-19

0001130310

cnp:NewYorkStockExchangeMember

us-gaap:CommonStockMember

2020-02-19

2020-02-19

0001130310

cnp:NewYorkStockExchangeMember

cnp:CenterPointEnergyResourcesCorp.Member

cnp:A6.625SeniorNotesdue2037Member

2020-02-19

2020-02-19

0001130310

cnp:NewYorkStockExchangeMember

cnp:DepositarysharesMember

2020-02-19

2020-02-19

0001130310

cnp:ChicagoStockExchangeMember

us-gaap:CommonStockMember

2020-02-19

2020-02-19

0001130310

cnp:CenterPointEnergyHoustonElectricLLCMember

2020-02-19

2020-02-19

0001130310

cnp:CenterPointEnergyResourcesCorp.Member

2020-02-19

2020-02-19

0001130310

2020-02-19

2020-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2020 (February 19, 2020)

|

|

|

|

|

|

|

|

|

|

Registrant, State or Other Jurisdiction

of Incorporation or Organization

|

|

|

Commission file number

|

Address of Principal Executive Offices, Zip Code

and Telephone Number

|

I.R.S. Employer Identification No.

|

|

|

|

|

|

|

|

1-31447

|

CenterPoint Energy, Inc.

|

74-0694415

|

|

|

(a Texas corporation)

|

|

|

|

1111 Louisiana

|

|

|

|

Houston

|

Texas

|

77002

|

|

|

|

(713)

|

207-1111

|

|

|

|

|

|

|

|

|

|

1-3187

|

CenterPoint Energy Houston Electric, LLC

|

22-3865106

|

|

|

(a Texas limited liability company)

|

|

|

|

1111 Louisiana

|

|

|

|

Houston

|

Texas

|

77002

|

|

|

|

(713)

|

207-1111

|

|

|

|

|

|

|

|

|

|

1-13265

|

CenterPoint Energy Resources Corp.

|

76-0511406

|

|

|

(a Delaware corporation)

|

|

|

|

1111 Louisiana

|

|

|

|

Houston

|

Texas

|

77002

|

|

|

|

(713)

|

207-1111

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

CNP

|

The New York Stock Exchange

|

|

Chicago Stock Exchange, Inc.

|

|

Depositary Shares for 1/20 of 7.00% Series B Mandatory Convertible Preferred Stock, $0.01 par value

|

CNP/PB

|

The New York Stock Exchange

|

|

9.15% First Mortgage Bonds due 2021

|

n/a

|

The New York Stock Exchange

|

|

6.95% General Mortgage Bonds due 2033

|

n/a

|

The New York Stock Exchange

|

|

6.625% Senior Notes due 2037

|

n/a

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

This Form 8-K/A amends our Form 8-K filed on February 19, 2020.

As previously disclosed on February 19, 2020, CenterPoint Energy, Inc. (the “Company”) announced that on February 19, 2020, John W. Somerhalder II was appointed Interim President and Chief Executive Officer of the Company. On March 4, 2020, the Compensation Committee of the Board of Directors of the Company approved the following compensation arrangements for Mr. Somerhalder: (i) an annualized base salary of $1,000,000; (ii) an annualized target cash incentive of $1,000,000, payable pro-rata at the end of his term as Interim President and Chief Executive Officer, the payout of which is subject to the Compensation Committee’s discretion; and (iii) a fully-vested restricted stock unit (“RSU”) award of up to four quarterly grants with a value at each grant date equal to $1,375,000 beginning on March 1, 2020 until the end of his term as Interim President and Chief Executive Officer, with the underlying shares to be paid ratably over three years; provided, however, if Mr. Somerhalder earlier separates from the Company such that he is neither an employee nor director, any remaining unpaid shares under the award will be payable upon his separation. Further, Mr. Somerhalder is not eligible to participate in the CenterPoint Energy, Inc. Change in Control Plan, as amended and restated effective May 1, 2017. Unless otherwise specified, these compensation arrangements were made retroactive to February 19, 2020, the effective date of Mr. Somerhalder’s appointment as Interim President and Chief Executive Officer of the Company.

In connection with the foregoing, the Compensation Committee also approved a new form of award agreement for RSU awards applicable for certain grants under the Company’s Long Term Incentive Plan (“LTIP”) that provides RSU awards that are fully vested on the grant date, with distribution of underlying shares to be made upon scheduled payment dates or upon the employee’s termination date, if earlier. Among other things, the newly approved form of award agreement also provides for distribution of underlying shares upon a change in control of the Company, as defined in the LTIP, if the RSU award is not assumed, continued, or substituted with a substantially equivalent award by the surviving or successor entity. The description of the form of award agreement is qualified in its entirety by reference to the full text of the form of restricted stock unit award agreement, which is included as Exhibit 10.1 hereto and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

EXHIBIT

NUMBER

|

EXHIBIT DESCRIPTION

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

CENTERPOINT ENERGY, INC.

|

|

|

|

|

|

Date: March 6, 2020

|

By:

|

/s/ Jason M. Ryan

|

|

|

|

Jason M. Ryan

|

|

|

|

Senior Vice President and General Counsel

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

CENTERPOINT ENERGY HOUSTON ELECTRIC, LLC

|

|

|

|

|

|

Date: March 6, 2020

|

By:

|

/s/ Jason M. Ryan

|

|

|

|

Jason M. Ryan

|

|

|

|

Senior Vice President and General Counsel

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

CENTERPOINT ENERGY RESOURCES CORP.

|

|

|

|

|

|

Date: March 6, 2020

|

By:

|

/s/ Jason M. Ryan

|

|

|

|

Jason M. Ryan

|

|

|

|

Senior Vice President and General Counsel

|

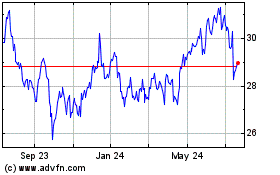

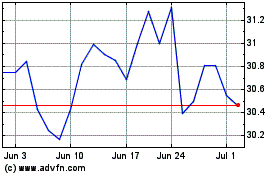

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Apr 2023 to Apr 2024