As filed with the Securities and Exchange Commission on July 27, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CANADIAN NATURAL RESOURCES LIMITED

(Exact name of Registrant as specified in its charter)

| |

Alberta

|

|

|

1311

|

|

|

Not Applicable

|

|

| |

(Province or other jurisdiction of

incorporation or organization)

|

|

|

(Primary Standard Industrial

Classification Code Number (if applicable))

|

|

|

(I.R.S. Employer

Identification Number (if applicable))

|

|

Suite 2100, 855-2nd Street, S.W., Calgary, Alberta, Canada, T2P 4J8

(403) 517-6700

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System, 28 Liberty Street, New York, New York 10005

(212) 894-8940

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

| |

Brent W. Kraus

Bennett Jones LLP

4500 Bankers Hall East

855 2nd Street, S.W.

(403) 298-3100

|

|

|

Christopher J. Cummings

Paul, Weiss, Rifkind, Wharton &

Garrison LLP

1285 Avenue of the Americas

New York, NY 10019-6064

(212) 373-3000

|

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement.

Province of Alberta, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

A.

|

☐

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

B.

|

☒

|

at some future date (check appropriate box below)

|

1.

|

☐

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing).

|

2.

|

☐

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ).

|

3.

|

☒

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

4.

|

☐

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. ☒

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registration statement shall become effective as provided in Rule 467 under the Securities Act of 1933, as amended, or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

Pursuant to Rule 429 under the Securities Act, the prospectus contained in this Registration Statement relates to Registration Statement 333-258127.

PART I

INFORMATION REQUIRED TO BE

DELIVERED TO OFFEREES OR PURCHASERS

SHORT FORM BASE SHELF PROSPECTUS

New IssueJuly 27, 2023

CANADIAN NATURAL RESOURCES LIMITED

US$3,000,000,000

Debt Securities

Canadian Natural Resources Limited may offer for sale from time to time debt securities in the aggregate principal amount of up to US$3,000,000,000 (or the equivalent thereof in other currencies or currency units based on the applicable exchange rate at the time of the distribution) during the 25 month period that this prospectus (including any amendments hereto) remains valid. The debt securities may be offered separately or together, in one or more series, in amounts, at prices and on other terms to be determined based on market conditions at the time of issuance and set forth in an accompanying prospectus supplement.

We will provide the specific terms of the debt securities and all information omitted from this prospectus in supplements to this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest.

We are permitted, under the multijurisdictional disclosure system adopted by the United States and the provinces of Canada, to prepare this prospectus and any applicable prospectus supplement in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. We prepare our financial statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), and they are subject to the standards of the Public Company Accounting Oversight Board (U.S.). As a result, the financial statements included or incorporated by reference in this prospectus and any applicable prospectus supplement may not be comparable to financial statements of United States companies.

As of the date hereof, Canadian Natural has determined that it qualifies as a “well-known seasoned issuer” under the WKSI Blanket Order (as defined herein). See “Reliance on Exemptions For Well-Known Seasoned Issuers”.

Certain data on oil and gas reserves included or incorporated by reference in this prospectus and any applicable prospectus supplement has been prepared in accordance with Canadian disclosure standards, which are not comparable in all respects to United States disclosure standards. See “Note Regarding Reserves Disclosure”.

Prospective investors should be aware that the acquisition of the debt securities may have tax consequences both in the United States and Canada. Such consequences for investors who are residents in, or citizens of, the United States may not be described fully in this prospectus or any applicable prospectus supplement. You should read the tax discussion in any applicable prospectus supplement and consult with your tax adviser. See “Certain Income Tax Considerations”.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that we are incorporated in Alberta, that most of our officers and directors are Canadian residents, that some of the experts named in the registration statement may be residents of Canada, and that most of our assets and all or most of the assets of our officers and directors and the experts are located outside the United States. See “Enforceability of Civil Liabilities”.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) NOR HAS THE SEC OR ANY STATE OR PROVINCIAL SECURITIES COMMISSION OR SIMILAR AUTHORITY PASSED UPON

THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The debt securities have not been qualified for sale under the securities laws of any province or territory of Canada and are not being and may not be offered or sold, directly or indirectly, in Canada or to any resident of Canada in contravention of the securities laws of any province or territory of Canada.

All shelf information permitted under applicable law to be omitted from this prospectus will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus. Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the debt securities to which the prospectus supplement pertains.

Unless otherwise specified in the applicable prospectus supplement, the debt securities will not be listed on any securities or stock exchange. There is no market through which the debt securities may be sold and purchasers may not be able to resell the debt securities purchased under any prospectus supplement. This may affect the pricing of the debt securities in the secondary market, the transparency and availability of trading prices, the liquidity of the debt securities and the extent of issuer regulation. See “Risk Factors”.

Our head, principal and registered office is located at 2100, 855 — 2nd Street S.W., Calgary, Alberta, Canada, T2P 4J8.

ABOUT THIS PROSPECTUS

In this prospectus and any applicable prospectus supplement, all capitalized terms and acronyms used and not otherwise defined have the meanings provided in the prospectus and any applicable prospectus supplement. Unless otherwise specified or the context otherwise requires, all references in this prospectus to “Canadian Natural”, the “Company”, “we”, “us”, and “our” mean Canadian Natural Resources Limited and its subsidiaries, partnerships and, where applicable, interests in other entities. In the section entitled “Description of Debt Securities” in this prospectus, “Canadian Natural”, “we”, “us” and “our” refers only to Canadian Natural Resources Limited, without its subsidiaries or interests in partnerships and other entities.

Unless otherwise specified or the context otherwise requires, in this prospectus, in any applicable prospectus supplement and in documents incorporated by reference in this prospectus and any applicable prospectus supplement, all dollar amounts are expressed in Canadian dollars, and references to “dollars”, “Cdn$” or “$” are to Canadian dollars and all references to “US$” are to United States dollars.

Our financial statements incorporated by reference in this prospectus and any applicable prospectus supplement are prepared in accordance with IFRS, as issued by the IASB, and they are subject to the standards of the Public Company Accounting Oversight Board (U.S.).

This prospectus replaces our base shelf prospectus for debt securities dated July 30, 2021.

Canadian Natural has filed with the SEC under the United States Securities Act of 1933, as amended (the “1933 Act”) a registration statement on Form F-10 relating to the offering of the debt securities, of which this prospectus forms part. This prospectus does not contain all of the information set forth in such registration statement, certain items of which are contained in the exhibits to the registration statement as permitted or required by the rules and regulations of the SEC. Items of information omitted from this prospectus but contained in the registration statement will be available on the SEC’s website at www.sec.gov. You may refer to the registration statement and the exhibits to the registration statement for further information with respect to us and the debt securities.

Information on or connected to our website, even if referred to in a document incorporated by reference herein, does not constitute part of this prospectus.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation incorporated under and governed by the Business Corporations Act (Alberta). Most of our officers and directors and some of the experts named in this prospectus are Canadian residents, and most of our assets and all or most of the assets of our officers and directors and the experts are located outside the United States. We have appointed an agent for service of process in the United States, but it may be difficult for holders of debt securities who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for holders of debt securities who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors and officers and experts under the United States federal securities laws. We have been advised by our Canadian counsel, Bennett Jones LLP, that a judgment of a United States court predicated solely upon civil liability under U.S. federal securities laws would probably be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the matter that would be recognized by a Canadian court for the same purposes. We have also been advised by Bennett Jones LLP, however, that there is a substantial doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated solely upon U.S. federal securities laws.

We filed with the SEC, concurrently with our registration statement on Form F-10 of which this prospectus forms a part, an appointment of agent for service of process and undertaking on Form F-X. Under the Form F-X, we appointed CT Corporation System as our agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC and any civil suit or action brought against or involving us in a United States court arising out of or related to or concerning the offering of debt securities under this prospectus.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus and any applicable prospectus supplement, and in the documents incorporated by reference herein and therein, may contain or incorporate by reference “forward-looking information” and “forward-looking statements” (collectively referred to herein as “forward-looking statements”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the words “believe”, “anticipate”, “expect”, “plan”, “estimate”, “target”, “continue”, “could”, “intend”, “may”, “potential”, “predict”, “should”, “will”, “objective”, “project”, “forecast”, “goal”, “guidance”, “outlook”, “effort”, “seeks”, “schedule”, “proposed”, “aspiration” or expressions of a similar nature suggesting future outcome or statements regarding an outlook.

Disclosure related to expected future commodity pricing, forecast or anticipated production volumes, royalties, production expenses, capital expenditures, income tax expenses, the use of proceeds from any sale of debt securities, credit ratings and their interpretations, and other targets provided throughout this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein or therein constitute forward-looking statements. Disclosure of plans relating to and expected results of existing and future developments, including, without limitation, those in relation to our assets at Horizon Oil Sands, the Athabasca Oil Sands Project, Primrose, Pelican Lake, Kirby, Jackfish and Pike, the operations of the North West Redwater bitumen upgrader and refinery, construction by third parties of new or expansion of existing pipeline capacity or other means of transportation of bitumen, crude oil, natural gas, natural gas liquids (“NGLs”) or synthetic crude oil that we may be reliant upon to transport our products to market, development and deployment of technology and technological innovations, the assumption of operations at processing facilities, the “2023 Activity” section of the AIF (as defined herein) with respect to budgeted capital expenditures for 2023, the “Form 51-101F1 Statement of Reserves Data and Other Information” section of the AIF, the impact of the Pathways Alliance initiative and activities including any projects pursued in connection therewith such as the carbon trunk line and storage hub, government support for Pathways Alliance and the ability to achieve net zero emissions from oil production, targeted international decommissioning activities and the timing thereof, and any targeted payouts pursuant to Canadian Natural’s free cash flow policy, also constitute forward-looking statements. These forward-looking statements are based on annual budgets and multi-year forecasts, and are reviewed and revised throughout the year as necessary in the context of targeted financial ratios, project returns, product pricing expectations and balance in project risk and time horizons. These statements are not guarantees of future performance and are subject to certain risks. The reader should not place undue reliance on these forward-looking statements as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur.

In addition, statements relating to “reserves” are deemed to be forward-looking statements as they involve the implied assessment based on certain estimates and assumptions that the reserves described can be profitably produced in the future. There are numerous uncertainties inherent in estimating quantities of proved and proved plus probable crude oil, natural gas and NGLs reserves and in projecting future rates of production and the timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserves and production estimates.

The forward-looking statements are based on current expectations, estimates and projections about us and the industry in which we operate, which speak only as of the earlier of the date such statements were made or as of the date of the report or document in which they are contained, and are subject to known and unknown risks and uncertainties that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, among others: general economic and business conditions (including as a result of the lingering effects of the novel coronavirus (“COVID-19”) pandemic, the actions of the Organization of the Petroleum Exporting Countries Plus (“OPEC+”) and inflation) which may impact, among other things, demand and supply for and market prices of our products, and the availability and cost of resources required by our operations; volatility of and assumptions regarding crude oil, natural gas and NGLs prices including due to actions of OPEC+ taken in response to COVID-19 or otherwise; fluctuations in currency and interest rates; assumptions on which our current targets are based; economic conditions in the countries and regions in which we conduct business; political uncertainty, including actions of or against terrorists, insurgent groups or other conflict including conflict between states (including

the Russian invasion of Ukraine); industry capacity; our ability to implement our business strategy, including exploration and development activities; impact of competition; our defense of lawsuits; availability and cost of seismic, drilling and other equipment; our ability and the ability of our subsidiaries to complete capital programs; our ability and our subsidiaries’ ability to secure adequate transportation for our products; unexpected disruptions or delays in the mining, extracting or upgrading of our bitumen products; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; our ability to attract the necessary labour required to build, maintain, and operate our thermal and oil sands mining projects; operating hazards and other difficulties inherent in the exploration for and production and sale of crude oil and natural gas and in mining, extracting or upgrading our bitumen products; availability and cost of financing; our success and our subsidiaries’ success of exploration and development activities and our ability to replace and expand crude oil and natural gas reserves; the timing and success of integrating the business and operations of acquired companies and assets; production levels; imprecision of reserves estimates and estimates of recoverable quantities of crude oil, natural gas and NGLs not currently classified as proved; actions by governmental authorities (including government mandated production curtailments); government regulations and the expenditures required to comply with them (especially safety and environmental laws and regulations and the impact of climate change initiatives on capital expenditures and production expenses); asset retirement obligations; the adequacy of our provision for taxes; changes in credit ratings; and other circumstances affecting revenues and expenses.

Our operations have been, and in the future may be, affected by political developments and by national, federal, provincial and local laws and regulations such as restrictions on production, changes in taxes, royalties and other amounts payable to governments or governmental agencies, price or gathering rate controls and environmental protection regulations. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are dependent upon other factors, and our course of action would depend upon our assessment of the future considering all information then available.

We caution that the foregoing list of factors is not exhaustive. Unpredictable or unknown factors not discussed in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein or therein, could also have adverse effects on forward-looking statements. Although we believe that the expectations conveyed by the forward-looking statements are reasonable based on information available to us on the date such forward-looking statements are made, no assurances can be given as to future results, levels of activity and achievements. All subsequent forward-looking statements, whether written or oral, attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements.

Additional factors are described in our AIF which is filed with the securities commissions or similar authorities in the provinces of Canada and incorporated by reference in this prospectus and any applicable prospectus supplement. Prospective investors should also carefully consider the matters discussed under “Risk Factors” in this prospectus and any applicable prospectus supplement.

Except as required by applicable law, we assume no obligation to update forward-looking statements, whether as a result of new information, future events or other factors, or the foregoing factors affecting this information, should circumstances or the Company’s estimates or opinions change.

NOTE REGARDING RESERVES DISCLOSURE

The securities regulatory authorities in Canada have adopted National Instrument 51-101 — Standards of Disclosure for Oil and Gas Activities (“NI 51-101”), which imposes oil and gas disclosure standards for Canadian public issuers engaged in oil and gas activities. NI 51-101 permits oil and gas issuers, in their filings with Canadian securities regulatory authorities, to disclose proved and proved plus probable reserves, to disclose resources, and to disclose reserves and production before deducting royalties. Probable reserves are of a higher uncertainty and are less likely to be accurately estimated or recovered than proved reserves.

We are required to disclose reserves in accordance with Canadian securities law requirements and the disclosure of proved and probable reserves in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein and therein is in accordance with NI 51-101. The SEC definitions

of proved and probable reserves are different from the definitions contained in NI 51-101; therefore, proved and probable reserves disclosed in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein and therein in compliance with NI 51-101 may not be comparable to United States standards. The SEC requires United States oil and gas reporting companies, in their filings with the SEC, to disclose only proved reserves after the deduction of royalties and production due to others but permits the optional disclosure of probable and possible reserves.

In addition, as permitted by NI 51-101, we have determined and disclosed the net present value of future net revenue from our reserves in our NI 51-101 compliant reserves disclosure using forecast prices and costs. The SEC requires that reserves and related future net revenue be estimated based on historical 12-month average prices and current costs, but permits the optional disclosure of revenue estimates based on different price and cost criteria.

This prospectus, any applicable prospectus supplement and the documents incorporated by reference herein and therein contain disclosure respecting oil and gas production expressed as “cubic feet of natural gas equivalent” and “barrels of oil equivalent” or “BOE”. All equivalency volumes have been derived using the ratio of six thousand cubic feet of natural gas to one barrel of oil. Equivalency measures may be misleading, particularly if used in isolation. A conversion ratio of six thousand cubic feet of natural gas to one barrel of oil is based on an energy equivalence conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In comparing the value ratio using current crude oil prices relative to natural gas prices, the six thousand cubic feet of natural gas to one barrel of oil conversion ratio may be misleading as an indication of value.

For additional information regarding the presentation of our reserves and other oil and gas information, see the sections entitled “Special Note Regarding Currency, Financial Information, Production and Reserves” and “Form 51-101F1 Statement of Reserves Data and Other Information” in our AIF, which is incorporated by reference in this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Canadian Natural Resources Limited at 2100, 855 – 2nd Street S.W., Calgary, Alberta, T2P 4J8, Telephone (403) 517-6700. These documents are also available through the internet via the System for Electronic Document Analysis and Retrieval Plus (SEDAR+), which can be accessed at www.sedarplus.ca.

We file with the securities commission or similar authorities in each of the provinces of Canada, annual and quarterly reports, material change reports and other information. We are subject to the reporting requirements of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance with the Exchange Act, we also file reports with and furnish other information to the SEC. Under the multijurisdictional disclosure system adopted by the United States and the provinces of Canada, these reports and other information (including financial information) may be prepared, in part, in accordance with the disclosure requirements of Canada, which differ from those in the United States. You may read any document we file with or furnish to the SEC on the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system, which can be accessed at www.sec.gov, as well as from commercial document retrieval services.

Under the multijurisdictional disclosure system adopted by the United States and the provinces of Canada, the Canadian securities commissions and the SEC allow us to “incorporate by reference” certain information we file with them, which means that we can disclose important information to you by referring you to those documents. Information that is incorporated by reference is an important part of this prospectus. We incorporate by reference the documents listed below, which were filed with certain Canadian securities regulatory authorities under Canadian securities legislation and filed with or furnished to the SEC under the Exchange Act:

•

•

•

•

•

•

•

Any documents of the type required by National Instrument 44-101 — Short Form Prospectus Distributions to be incorporated by reference in a short form prospectus including, without limitation, any material change reports (excluding confidential material change reports), comparative annual financial statements and the auditors’ report thereon, comparative interim financial statements, management’s discussion and analysis of financial condition and results of operations, information circulars, annual information forms, business acquisition reports and any press release containing financial information for periods more recent than the most recent annual or interim financial statements filed by us with the securities commissions or similar authorities in the provinces of Canada subsequent to the date of this prospectus and prior to 25 months from the date hereof are deemed to be incorporated by reference in this prospectus.

Any report that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act after the date of this prospectus shall be deemed to be incorporated by reference into this prospectus and the registration statement of which it forms a part (in the case of any Report on Form 6-K, if and to the extent provided in such report). Our U.S. filings are electronically available on the SEC’s EDGAR system, which may be accessed at www.sec.gov.

To the extent that any document or information incorporated by reference into this prospectus is included in a report filed or furnished on Form 40-F, 20-F, 10-K, 10-Q, 8-K, 6-K or any respective successor form, such document or information shall also be deemed to be incorporated by reference as an exhibit to the registration statement relating to the debt securities of which this prospectus forms a part.

Upon a new annual information form and corresponding audited annual financial statements and management’s discussion and analysis being filed with, and where required, accepted by, the applicable securities commission or similar authority in Canada during the currency of this prospectus, the previous annual information form, the previous audited annual financial statements and related management’s discussion and analysis, all unaudited interim financial statements and related management’s discussion and analysis and material change reports filed prior to the commencement of the current financial year in which the new annual information form and corresponding audited annual financial statements and management’s discussion and analysis are filed, and business acquisition reports filed prior to the commencement of the fiscal year in respect of which the new annual information is filed, shall be deemed no longer to be incorporated into this prospectus for purposes of future distributions of debt securities under this prospectus. Upon new interim financial statements and related management’s discussion and analysis being filed with the applicable securities commission or similar authority in Canada during the currency of this prospectus, all interim financial statements and related management’s discussion and analysis filed prior to the new interim consolidated financial statements and related management’s discussion and analysis shall be deemed no longer to be incorporated into this prospectus for purposes of future distributions of debt securities under this prospectus. Upon a new information circular relating to an annual general meeting of our shareholders being filed by us with the securities commission or similar authority in Canada during the currency of this prospectus, the information circular for the preceding annual general meeting of our shareholders shall be deemed no longer to be incorporated into this prospectus for purposes of future distributions of debt securities under this prospectus.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that was required to be stated or that was necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

In addition, certain marketing materials (as that term is defined in applicable securities legislation) may be used in connection with a distribution of debt securities under this prospectus and any applicable prospectus supplement(s). Any template version of marketing materials (as those terms are defined in applicable securities legislation) pertaining to a distribution of debt securities, and filed by us after the date of the applicable prospectus supplement and before termination of the distribution of such debt securities, will be deemed to be incorporated by reference in that prospectus supplement for the purposes of the distribution of debt securities to which that prospectus supplement pertains.

In addition, you may obtain a copy of the AIF and other information mentioned above by writing or calling us at the following address and telephone number:

Canadian Natural Resources Limited

2100, 855 – 2nd Street S.W.

Calgary, Alberta, Canada, T2P 4J8

(403) 517-6700

Attention: Corporate Secretary

You should rely only on the information contained in: (a) this prospectus and any applicable prospectus supplement; and (b) any documents incorporated by reference in this prospectus or in any applicable prospectus supplement. We have not authorized anyone to provide you with different or additional information. If anyone provides you with any different or inconsistent information, you should not rely on it. You should bear in mind that although the information contained in, or incorporated by reference in, this prospectus is accurate as of the date hereof or the date of such documents incorporated by reference, respectively, such information may also be amended, supplemented or updated, as may be required by applicable securities laws, by the subsequent filing of additional documents deemed by applicable securities laws to be, or otherwise incorporated by reference into this prospectus, any prospectus supplement and by any subsequently filed prospectus amendments, if any. This prospectus constitutes a public offering of debt securities only in those jurisdictions where they may be lawfully distributed and therein only by persons permitted to distribute such debt securities. We are not making any offer of debt securities in any jurisdiction where the offer is not permitted by law.

CANADIAN NATURAL RESOURCES LIMITED

We are a Canadian based senior independent energy company engaged in the acquisition, exploration, development, production, marketing and sale of crude oil, natural gas and NGLs. Our principal core regions of operations are western Canada, the United Kingdom sector of the North Sea and Offshore Africa. Our head and principal office is located at 2100, 855 – 2nd Street S.W., Calgary, Alberta, Canada, T2P 4J8.

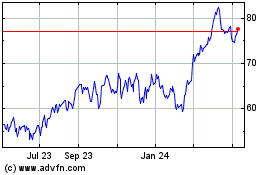

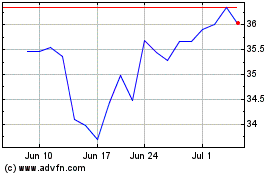

Our common shares are listed for trading on the Toronto Stock Exchange and on the New York Stock Exchange under the trading symbol “CNQ”.

USE OF PROCEEDS

Unless otherwise indicated in an applicable prospectus supplement relating to a series of debt securities, we will use the net proceeds we receive from the sale of the debt securities for general corporate purposes relating to our principal core regions of operations in western Canada, the United Kingdom sector of the North Sea and Offshore Africa, which may include financing our capital expenditure program and working

capital requirements in those regions. We may also use the net proceeds for the repayment of indebtedness. Pending such use of any proceeds, we may invest funds in short-term marketable securities. We may, from time to time, issue securities (including debt securities) other than pursuant to this prospectus.

EARNINGS COVERAGE

The following earnings coverage ratios have been prepared in accordance with Canadian securities law requirements and are included in this prospectus in accordance with Canadian disclosure requirements.

The coverage ratios are calculated on a consolidated basis for the twelve month periods ended March 31, 2023 and December 31, 2022 and are based on information contained within our financial statements for the related periods which were prepared in accordance with IFRS.

The coverage ratios do not give effect to any debt securities offered by this prospectus since the aggregate amount of debt securities that will be issued hereunder, if any, and terms of issue are not presently known. The coverage ratios set forth below do not purport to be indicative of coverage ratios for any future periods.

| |

|

|

March 31, 2023

(unaudited)

|

|

|

December 31, 2022

(unaudited)

|

|

|

Earnings coverage(1)

|

|

|

|

|

23.1x |

|

|

|

|

|

26.0x |

|

|

Note:

(1)

Earnings coverage is equal to Canadian Natural’s net earnings (loss) plus income taxes and interest expense excluding other taxes; divided by the sum of interest expense and capitalized interest.

Our borrowing cost requirements amounted to $549 million for the twelve months ended December 31, 2022. Our earnings before borrowing costs and income tax for the twelve months then ended was $14,253 million which is 26.0 times our borrowing cost requirements for this period. Our borrowing cost requirements amounted to $540 million for the twelve months ended March 31, 2023. Our earnings before borrowing costs and income tax for the twelve months then ended was $12,455 million which is 23.1 times our borrowing cost requirements for this period.

DESCRIPTION OF DEBT SECURITIES

In this section, “we”, “us”, “our” or “Canadian Natural” refers only to Canadian Natural Resources Limited without its subsidiaries or interest in partnerships and other entities. The following describes certain general terms and provisions of the debt securities. The particular terms and provisions of the series of debt securities offered by any prospectus supplement, and the extent to which the general terms and provisions described below may apply to them, will be described in the applicable prospectus supplement. Canadian Natural reserves the right to set forth in a prospectus supplement specific terms of the debt securities that are not within the options or parameters set forth in this prospectus. Accordingly, for a description of the terms of a particular series of debt securities, reference must be made to both the applicable prospectus supplement relating to them and the description of the debt securities set forth in this prospectus. You should rely on information in the applicable prospectus supplement if it is different from the description set forth in this prospectus.

The debt securities will be issued under a trust indenture dated July 24, 2001 originally made between us and The Bank of Nova Scotia Trust Company of New York, as trustee (the “Initial Trustee”), as amended by a supplemental indenture dated October 28, 2011 (the “First Supplemental Indenture”) entered into between us and the Initial Trustee and having effect only with respect to debt securities issued after the date of the First Supplemental Indenture, as amended by a second supplemental indenture (the “Second Supplemental Indenture”) dated as of August 30, 2013 among us, the Initial Trustee and Wells Fargo Bank, National Association (the “Trustee”), as the successor trustee on the resignation of the Initial Trustee (the trust indenture dated July 24, 2001 as amended by the First Supplemental Indenture and the Second Supplemental Indenture referred to herein as the “Indenture”). Pursuant to the terms of the Second Supplemental Indenture, the Trustee has accepted its appointment as successor Trustee, Security Registrar and Paying Agent under the Indenture. The Indenture is subject to and governed by the United States Trust Indenture Act of 1939, as

amended. A copy of the Indenture has been filed with the SEC as an exhibit to the registration statement of which this prospectus is a part.

The following is, unless otherwise indicated, a summary of certain provisions of the Indenture and the debt securities issuable thereunder and is not meant to be complete and is subject to and qualified in its entirety by the detailed provisions of the Indenture. For more information, you should refer to the full text of the Indenture and the debt securities, including the definitions of certain terms not defined in this prospectus, and the applicable prospectus supplement. References in parentheses are to section numbers in the Indenture.

General

The Indenture does not limit the aggregate principal amount of debt securities (which may include debentures, notes and other unsecured evidences of indebtedness) that may be issued under the Indenture, and provides that debt securities may be issued from time to time in one or more series and may be denominated and payable in foreign currencies. The debt securities offered pursuant to this prospectus will be issued in an amount up to US$3,000,000,000 (or the equivalent thereof in other currencies or currency units based on the applicable exchange rate at the time of the distribution). The Indenture also permits us to increase the principal amount of any series of debt securities previously issued and to issue that increased principal amount.

The applicable prospectus supplement will contain a description of the following terms relating to the debt securities being offered:

(a)

the title of the debt securities of such series;

(b)

any limit on the aggregate principal amount of the debt securities of such series;

(c)

the date or dates, if any, on which the principal (and premium, if any) of the debt securities of such series will mature and the portion (if less than all of the principal amount) of the debt securities of such series to be payable upon declaration of acceleration of maturity and/or the method by which such date or dates shall be determined;

(d)

the rate or rates (which may be fixed or variable) at which the debt securities of such series will bear interest, if any, the date or dates from which that interest will accrue and on which that interest will be payable and the Regular Record Dates for any interest payable on the debt securities of such series which are Registered Securities and/or the method by which such date or dates shall be determined;

(e)

if applicable, any mandatory or optional redemption or sinking fund provisions, including the period or periods within which, the price or prices at which and the terms and conditions upon which the debt securities of such series may be redeemed or purchased at the option of Canadian Natural or otherwise;

(f)

if applicable, whether the debt securities of such series will be issuable in registered form or bearer form or both, and, if issuable in bearer form, the restrictions as to the offer, sale and delivery of the debt securities of such series in bearer form and as to exchanges between registered and bearer form;

(g)

whether the debt securities of such series will be issuable in the form of one or more Registered Global Securities and, if so, the identity of the Depository for those Registered Global Securities;

(h)

the denominations in which any of the debt securities of such series which are in registered form will be issuable, if other than denominations of US$1,000 and any multiple thereof, and the denominations in which any of the debt securities of such series which are in bearer form will be issuable, if other than the denomination of US$1,000;

(i)

each office or agency where the principal of and any premium and interest on the debt securities of such series will be payable, and each office or agency where the debt securities of such series may be presented for registration of transfer or exchange;

(j)

if other than United States dollars, the foreign currency or the units based on or relating to foreign

currencies in which the debt securities of such series are denominated and/or in which the payment of the principal of and any premium and interest on the debt securities of such series will or may be payable;

(k)

any index pursuant to which the amount of payments of principal of and any premium and interest on the debt securities of such series will or may be determined;

(l)

any applicable Canadian and U.S. federal income tax consequences;

(m)

whether and under what circumstances we will pay Additional Amounts on the debt securities of such series in respect of certain taxes (and the terms of any such payment) and, if so, whether we will have the option to redeem the debt securities of such series rather than pay the Additional Amounts (and the terms of any such option);

(n)

any deletions from, modifications of or additions to the Events of Default or covenants of Canadian Natural with respect to such debt securities, whether or not such Events of Default or covenants are consistent with the Events of Default or covenants set forth herein; and

(o)

any other terms of the debt securities of such series.

Unless otherwise indicated in the applicable prospectus supplement, the Indenture does not afford the Holders the right to tender debt securities to us for repurchase, or provide for any increase in the rate or rates of interest per annum at which the debt securities will bear interest, in the event we become involved in a highly leveraged transaction or in the event that we undergo a change in control.

Debt securities may be issued under the Indenture bearing no interest or interest at a rate below the prevailing market rate at the time of issuance and may be offered and sold at a discount below their stated principal amount. The Canadian and U.S. federal income tax consequences and other special considerations applicable to those discounted debt securities or other debt securities offered and sold at par which are treated as having been issued at a discount for Canadian and/or U.S. federal income tax purposes will be described in the prospectus supplement relating to the debt securities.

Ranking and Other Indebtedness

The debt securities will be unsecured obligations of ours and, unless otherwise provided in the prospectus supplement relating to such debt securities, will rank pari passu with all our other unsecured and unsubordinated debt from time to time outstanding and pari passu with other debt securities issued under the Indenture. The debt securities will be structurally subordinated to all existing and future liabilities of any of our corporate or partnership subsidiaries, including trade payables and other indebtedness.

Registered Global Securities

Unless otherwise indicated in a prospectus supplement, a series of debt securities will be issued in the form of one or more Registered Global Securities which will be registered in the name of and be deposited with a Depository, or its nominee, each of which will be identified in the prospectus supplement relating to that series. Unless and until exchanged, in whole or in part, for debt securities in definitive registered form, a Registered Global Security may not be transferred except as a whole by the Depository for a Registered Global Security to a nominee of that Depository, by a nominee of that Depository to that Depository or another nominee of that Depository or by that Depository or any nominee of that Depository to a successor of that Depository or a nominee of a successor of that Depository.

The specific terms of the depository arrangement with respect to any portion of a particular series of debt securities to be represented by a Registered Global Security will be described in the prospectus supplement relating to that series. Canadian Natural anticipates that the following provisions will apply to all depository arrangements.

Upon the issuance of a Registered Global Security, the Depository or its nominee will credit, on its book entry and registration system, the respective principal amounts of the debt securities represented by that Registered Global Security to the accounts of those persons having accounts with that Depository or its nominee (“participants”) as shall be designated by the underwriters, investment dealers or agents participating

in the distribution of those debt securities or by us if those debt securities are offered and sold directly by us. Ownership of beneficial interests in a Registered Global Security will be limited to participants or persons that may hold beneficial interests through participants. Ownership of beneficial interests in a Registered Global Security will be shown on, and the transfer of the ownership of those beneficial interests will be effected only through, records maintained by the Depository therefor or its nominee (with respect to beneficial interests of participants) or by participants or persons that hold through participants (with respect to interests of persons other than participants).

The laws of some states in the United States require certain purchasers of securities to take physical delivery of the debt securities in definitive form. These depository arrangements and these laws may impair the ability to transfer beneficial interests in a Registered Global Security.

So long as the Depository for a Registered Global Security or its nominee is the registered owner of the debt securities, that Depository or its nominee, as the case may be, will be considered the sole owner or Holder of the debt securities represented by that Registered Global Security for all purposes under the Indenture. Except as provided below, owners of beneficial interests in a Registered Global Security will not be entitled to have debt securities of the series represented by that Registered Global Security registered in their names, will not receive or be entitled to receive physical delivery of debt securities of that series in definitive form and will not be considered the owners or Holders of those debt securities under the Indenture.

Principal, premium, if any, and interest payments on a Registered Global Security registered in the name of a Depository or its nominee will be made to that Depository or nominee, as the case may be, as the registered owner of that Registered Global Security. Neither we, the Trustee nor any paying agent for debt securities of the series represented by that Registered Global Security will have any responsibility or liability for any aspect of the records relating to or payments made on account of beneficial interests in that Registered Global Security or for maintaining, supervising or reviewing any records relating to those beneficial interests.

We expect that the Depository for a Registered Global Security or its nominee, upon receipt of any payment of principal, premium or interest, will immediately credit participants’ accounts with payments in amounts proportionate to their respective beneficial interests in the principal amount of that Registered Global Security as shown on the records of that Depository or its nominee. We also expect that payments by participants to owners of beneficial interests in that Registered Global Security held through those participants will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of customers registered in “street name”, and will be the responsibility of those participants.

If the Depository for a Registered Global Security representing debt securities of a particular series is at any time unwilling or unable to continue as Depository, or if the Depository is no longer eligible to continue as Depository, and a successor Depository is not appointed by us within 90 days, or if an Event of Default described in clauses (a) or (b) of the first sentence under “Events of Default” below with respect to a particular series of debt securities has occurred and is continuing, we will issue Registered Securities of that series in definitive form in exchange for that Registered Global Security. In addition, we may at any time and in our sole discretion determine not to have the debt securities of a particular series represented by one or more Registered Global Securities and, in that event, will issue Registered Securities of that series in definitive form in exchange for all of the Registered Global Securities representing debt securities of that series.

Debt Securities in Definitive Form

If indicated in an applicable prospectus supplement, the debt securities may be issued in definitive form without coupons. Debt securities in definitive form may be presented for exchange and for registration of transfer in the manner, at the places and, subject to the restrictions set forth in the Indenture and in the applicable prospectus supplement, without service charge, but upon payment of any taxes or other governmental charges due in connection therewith. We have appointed the Trustee as Security Registrar. Debt securities in bearer form and the coupons appertaining thereto, if any, will be transferable by delivery.

Unless otherwise indicated in the applicable prospectus supplement, payment of the principal of and any premium and interest on debt securities in definitive form will be made at the office or agency of the Trustee except that, at our option, payment of any interest may be made (a) by check mailed to the address of the

Person entitled thereto as that Person’s address will appear in the Security Register or (b) by wire transfer to an account maintained by the Person entitled thereto as specified in the Security Register.

Negative Pledge

The Indenture includes our covenant that, so long as any of the debt securities remain outstanding, we will not, and will not permit any Subsidiary to, create, assume or otherwise have outstanding any Security Interest, except for Permitted Encumbrances, on or over its or their respective assets (present or future) securing any Indebtedness of any Person without also at the same time or prior to that time securing equally and ratably with other Indebtedness all of the debt securities then Outstanding under the Indenture.

Certain Definitions

Set forth below is a summary of certain of the defined terms used in the Indenture. Reference is made to the Indenture for the full definitions of all such terms.

The term “Capital Lease Obligation” means the obligation of a Person, as lessee, to pay rent or other amounts to the lessor under a lease of real or personal property which is required to be classified and accounted for as a capital lease on a consolidated balance sheet of such Person in accordance with GAAP.

The term “Consolidated Net Tangible Assets” means the total amount of assets of any Person on a consolidated basis (less applicable reserves and other properly deductible items) after deducting therefrom:

(a)

all current liabilities (excluding any indebtedness classified as a current liability and any current liabilities, in each case which are by their terms extendible or renewable at the option of the obligor thereon to a time more than 12 months after the time as of which the amount thereof is being computed);

(b)

all goodwill, trade names, trademarks, patents and other like intangibles; and

(c)

non-controlling interests in subsidiaries as defined under GAAP,

in each case, as shown on the most recent annual audited or quarterly unaudited consolidated balance sheet of such Person computed in accordance with GAAP.

The term “Current Assets” means current assets as determined in accordance with GAAP.

The term “Financial Instrument Obligations” means obligations arising under:

(a)

interest rate swap agreements, forward rate agreements, floor, cap or collar agreements, futures or options, insurance or other similar agreements or arrangements, or any combination thereof, entered into by a Person of which the subject matter is interest rates or pursuant to which the price, value or amount payable thereunder is dependent or based upon interest rates in effect from time to time or fluctuations in interest rates occurring from time to time;

(b)

currency swap agreements, cross-currency agreements, forward agreements, floor, cap or collar agreements, futures or options, insurance or other similar agreements or arrangements, or any combination thereof, entered into by a Person of which the subject matter is currency exchange rates or pursuant to which the price, value or amount payable thereunder is dependent or based upon currency exchange rates in effect from time to time or fluctuations in currency exchange rates occurring from time to time; and

(c)

commodity swap or hedging agreements, floor, cap or collar agreements, commodity futures or options or other similar agreements or arrangements, or any combination thereof, entered into by a Person of which the subject matter is one or more commodities or pursuant to which the price, value or amount payable thereunder is dependent or based upon the price of one or more commodities in effect from time to time or fluctuations in the price of one or more commodities occurring from time to time.

The term “GAAP” means generally accepted accounting principles which are in effect from time to time in Canada.

The term “Indebtedness” means at any time, and whether or not contingent, all items of indebtedness in respect of any amounts borrowed which, in accordance with GAAP, would be recorded as indebtedness in the consolidated financial statements of Canadian Natural as at the date as of which Indebtedness is to be determined, and in any event including, without duplication (i) any obligation for borrowed money, (ii) any obligation evidenced by bonds, debentures, notes, guarantees or other similar instruments, including, without limitation, any such obligations incurred in connection with the acquisition of property, assets or businesses, (iii) any Purchase Money Obligation, (iv) any reimbursement obligation with respect to letters of credit, bankers’ acceptances or similar facilities, (v) any obligation issued or assumed as the deferred purchase price of property or services, (vi) any Capital Lease Obligation, (vii) any obligation to pay rent or other payment amounts with respect to any Sale and Leaseback Transaction, (viii) any payment obligation under Financial Instrument Obligations at the time of determination, (ix) any indebtedness in respect of any amounts borrowed or any Purchase Money Obligation secured by any Security Interest existing on property owned subject to such Security Interest, whether or not the indebtedness or Purchase Money Obligation secured thereby shall have been assumed and (x) guarantees, indemnities, endorsements (other than endorsements for collection in the ordinary course of business) or other contingent liabilities in respect of obligations of another Person for indebtedness of that other Person in respect of any amounts borrowed by that other Person.

The term “Permitted Encumbrances” means any of the following:

(a)

any Security Interest existing as of the date of the first issuance by us of the debt securities issued pursuant to the Indenture;

(b)

any Security Interest on pipelines, pumping stations or other pipeline facilities, drilling equipment, production equipment and platforms; tank cars, tankers, barges, ships, trucks, automobiles, airplanes or other marine, automotive, aeronautical or other similar moveable facilities or equipment, computer systems and associated programs; office equipment; weather stations; townsites; housing facilities, recreation halls, stores and other related facilities; gasification or natural gas liquefying facilities and burning towers, flares or stacks; retail service stations, bulk plants, storage facilities, terminals or warehouses; or similar facilities and equipment of or associated with any of the foregoing; provided, in each case, that such Security Interest is incurred to finance the acquisition of such property or assets within 90 days after such acquisition and such Security Interest shall be limited to the specified property or assets being financed;

(c)

(i) any Security Interest on any specific properties or any interest therein, construction thereon or improvement thereto, and on any receivables, inventory, equipment, chattel paper, contract rights, intangibles and other assets, rights or collateral specifically connected with such properties, incurred (A) to secure all or any part of the financing for acquisition, surveying, exploration, drilling, extraction, development, operation, production, construction, alteration, repair or improvement of, in, under or on such properties and the plugging and abandonment of wells located thereon (it being understood that, in the case of oil and natural gas producing properties (including oil sands properties), or any interest therein, financing incurred for “development” shall include financing incurred for all facilities relating to such properties or to projects, ventures or other arrangements of which such properties form a part or which relate to such properties or interests), or (B) for acquiring ownership of any Person which owns any such property or interest therein, provided that such Security Interest is limited to such property or such interest therein owned by any such Person; and (ii) any Security Interest on an oil and/or natural gas producing property (including oil sands properties) to secure Indebtedness incurred in connection with or necessarily incidental to commitments for the purchase or sale of, or the transportation or distribution of, the products derived from such property;

(d)

any Security Interest in favor of Canadian Natural or any of its wholly-owned Subsidiaries;

(e)

any Security Interest existing on the property of any Person at the time such Person becomes a Subsidiary, or arising thereafter pursuant to contractual commitments entered into prior to and not in contemplation of such Person becoming a Subsidiary;

(f)

any Security Interest on property of a Person which Security Interest exists at the time such Person is merged into, or amalgamated or consolidated with, Canadian Natural or a Subsidiary, or such

property is otherwise acquired by Canadian Natural or a Subsidiary, provided such Security Interest does not extend to property owned by Canadian Natural or such Subsidiary immediately prior to such merger, amalgamation, consolidation or acquisition;

(g)

any Security Interest on Current Assets securing any Indebtedness to any bank or banks or other lending institution or institutions incurred in the ordinary course of business and for the purpose of carrying on the same, repayable on demand or maturing within 12 months of the date when such Indebtedness is incurred or the date of any renewal or extension thereof, provided that such security is given at the time that the Indebtedness is incurred;

(h)

any Security Interest in respect of (i) liens for taxes and assessments not at the time overdue or any liens securing workmen’s compensation assessments, unemployment insurance or other social security obligations; provided, however, that if any such liens, duties or assessments are then overdue, Canadian Natural or the Subsidiary, as the case may be, shall be prosecuting an appeal or proceedings for review with respect to which it shall have secured a stay in the enforcement of any such obligations, (ii) any liens for specified taxes and assessments which are overdue but the validity of which is being contested at the time by Canadian Natural or the Subsidiary, as the case may be, in good faith, and with respect to which Canadian Natural or the Subsidiary shall have secured a stay of enforcement thereof, if applicable, (iii) any liens or rights of distress reserved in or exercisable under any lease for rent and for compliance with the terms of such lease, (iv) any obligations or duties, affecting the property of Canadian Natural or that of a Subsidiary to any municipality or governmental, statutory or public authority, with respect to any franchise, grant, license, lease or permit and any defects in title to structures or other facilities arising solely from the fact that such structures or facilities are constructed or installed on lands held by Canadian Natural or the Subsidiary under government permits, licenses, leases or other grants, which obligations, duties and defects in the aggregate do not materially impair the use of such property, structures or facilities for the purpose for which they are held by Canadian Natural or the Subsidiary, (v) any deposits or liens in connection with contracts, bids, tenders or expropriation proceedings, surety or appeal bonds, costs of litigation when required by law, public and statutory obligations, liens or claims incidental to current construction, builders’, mechanics’, laborers’, materialmen’s, warehousemen’s, carrier’s and other similar liens, (vi) the right reserved to or vested in any municipality or governmental or other public authority by any statutory provision or by the terms of any lease, license, franchise, grant or permit, that affects any land, to terminate any such lease, license, franchise, grant or permit or to require annual or other periodic payments as a condition to the continuance thereof, (vii) any Security Interest the validity of which is being contested at the time by Canadian Natural or a Subsidiary in good faith or payment of which has been provided for by deposit with the Trustee of an amount in cash sufficient to pay the same in full, (viii) any easements, rights-of-way and servitudes (including, without in any way limiting the generality of the foregoing, easements, rights-of-way and servitudes for railways, sewers, dykes, drains, pipelines, natural gas and water mains or electric light and power or telephone conduits, poles, wires and cables) that, in the opinion of Canadian Natural, will not in the aggregate materially and adversely impair the use or value of the land concerned for the purpose for which it is held by Canadian Natural or the Subsidiary, as the case may be, (ix) any security to a public utility or any municipality or governmental or other public authority when required by such utility or other authority in connection with the operations of Canadian Natural or the Subsidiary, as the case may be, and (x) any liens and privileges arising out of judgments or awards with respect to which Canadian Natural or the Subsidiary shall be prosecuting an appeal or proceedings for review and with respect to which it shall have secured a stay of execution pending such appeal or proceedings for review;

(i)

any Security Interest arising under partnership agreements, oil and natural gas leases, overriding royalty agreements, net profits agreements, production payment agreements, royalty trust agreements, master limited partnership agreements, farm-out agreements, division orders, contracts for the sale, purchase, exchange, transportation, gathering or processing of oil, natural gas or other hydrocarbons or by-product thereof, unitizations and pooling designations, declarations, orders and agreements, development agreements, operating agreements, production sales contracts (including security in respect of take or pay or similar obligations thereunder), area of mutual interest agreements, natural gas balancing or deferred production agreements, injection, repressuring and

recycling agreements, salt water or other disposal agreements, seismic or geophysical permits or agreements, which in each of the foregoing cases is customary in the oil and natural gas business, and other agreements which are customary in the oil and natural gas business, provided in all instances that such Security Interest is limited to the assets that are the subject of the relevant agreement;

(j)

any Security Interest on cash or marketable securities of Canadian Natural or any Subsidiary granted in the ordinary course of business in connection with Financial Instrument Obligations;

(k)

any Security Interest in respect of the sale (including any forward sale) or other transfer, in the ordinary course of business, of (i) oil, natural gas, other hydrocarbons or by-product thereof, or other minerals, whether in place or when produced, for a period of time until, or in an amount such that, the purchaser will realize therefrom a specified amount of money (however determined) or a specified amount of such minerals and (ii) any other interests in property of a character commonly referred to as a “production payment”;

(l)

any extension, renewal, alteration or replacement (or successive extensions, renewals, alterations or replacements) in whole or in part, of any Security Interest referred to in the foregoing clauses (a) through (k) inclusive, provided the principal amount thereof is not increased and provided that such extension, renewal, alteration or replacement shall be limited to all or a part of the property or other assets which secured the Security Interest so extended, renewed, altered or replaced (plus improvements on such property or other assets); and

(m)

any Security Interests that would otherwise be prohibited (including any extensions, renewals, alterations or replacements thereof) provided that the aggregate Indebtedness outstanding and secured under this clause (m) does not (calculated at the time of the granting of the Security Interest) exceed an amount equal to 10 percent of Consolidated Net Tangible Assets.

The term “Person” means any individual, corporation, limited liability company, partnership, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof.

The term “Purchase Money Obligation” means any monetary obligation created or assumed as part of the purchase price of real or tangible personal property, whether or not secured, any extensions, renewals or refundings of any such obligation, provided that the principal amount of such obligation on the date of such extension, renewal or refunding is not increased and further provided that any security given in respect of such obligation shall not extend to any property other than the property acquired in connection with which such obligation was created or assumed and fixed improvements, if any, thereto or erected or constructed thereon.

The term “Sale and Leaseback Transaction” means any direct or indirect arrangement (excluding, however, any such arrangement between Canadian Natural and a Subsidiary or between one or more Subsidiaries) pursuant to which property is sold or transferred and is thereafter leased back from the purchaser or transferee thereof.

The term “Security Interest” means any security by way of an assignment, mortgage, charge, pledge, lien, encumbrance, title retention agreement or other security interest whatsoever, howsoever created or arising, whether absolute or contingent, fixed or floating, perfected or not; however, for purposes of the “Negative Pledge” covenant only, such term shall not include any encumbrance that may be deemed to arise solely as a result of entering into an agreement, not in violation of the terms of the Indenture, to sell or otherwise transfer assets or property.

The term “Shareholders’ Equity” means the aggregate amount of shareholders’ equity of a Person as shown on the most recent annual audited or unaudited interim consolidated balance sheet of such Person and computed in accordance with GAAP.

The term “Significant Subsidiary” means a Subsidiary that constitutes a “significant subsidiary” as defined in Rule 1-02 of Regulation S-X of the Exchange Act.

The term “Subsidiary” means any corporation or other Person of which there are owned, directly or indirectly, by or for Canadian Natural or by or for any corporation or other Person in like relation to Canadian Natural, Voting Shares or other interests which, in the aggregate, entitle the holders thereof to cast more than

50 percent of the votes which may be cast by the holders of all outstanding Voting Shares of such first mentioned corporation or other Person for the election of its directors or, in the case of any Person which is not a corporation, Persons having similar powers or (if there are no such persons) entitle the holders thereof to more than 50 percent of the income or capital interests (however called) thereon and includes any corporation in like relation to a Subsidiary; provided, however, that such term will not include, for purposes of the “Negative Pledge” covenant only, any Subsidiary if the assets of the Subsidiary do not at the time exceed 2 percent of Consolidated Net Tangible Assets.

The term “Voting Shares” means shares of capital stock of any class of a corporation and other interests of any other Persons having under all circumstances the right to vote for the election of the directors of such corporation or in the case of any Person which is not a corporation, Persons having similar powers or (if there are no such Persons) income or capital interests (however called), provided that, for the purpose of this definition, shares or other interests which only carry the right to vote conditionally on the happening of an event shall not be considered Voting Shares whether or not such event shall have happened.

Events of Default

The occurrence of any of the following events with respect to the debt securities of any series will constitute an “Event of Default” with respect to the debt securities of that series:

(a)

default by Canadian Natural in payment of all or any part of the principal of any of the debt securities of that series when the same becomes due under any provision of the Indenture or of those debt securities;

(b)

default by Canadian Natural in payment of any interest due on any of the debt securities of that series, or Additional Amounts on any of the debt securities of that series when they become due and payable, and continuance of that default for a period of 30 days;

(c)

default by Canadian Natural in observing or performing any of the covenants described below under “Consolidation, Merger, Amalgamation and Sale of Assets”;

(d)

default by Canadian Natural in observing or performing any other of its covenants or conditions contained in the Indenture or in the debt securities of that series and continuance of that default for a period of 60 days after written notice as provided in the Indenture;

(e)

default by Canadian Natural or any Subsidiary in payment of the principal of, premium, if any, or interest on any Indebtedness for borrowed money having an outstanding principal amount in excess of the greater of $75 million and 2 percent of the Shareholders’ Equity of Canadian Natural in the aggregate at the time of default or default in the performance of any other covenant of Canadian Natural or any Subsidiary contained in any instrument under which that indebtedness is created or issued and the holders thereof, or a trustee, if any, for those holders, declare that indebtedness to be due and payable prior to the stated maturities of that indebtedness (“accelerated indebtedness”), and such acceleration shall not be rescinded or annulled, or such default under such instrument shall not be remedied or cured, whether by payment or otherwise, or waived by the holders of such indebtedness, provided that if such accelerated indebtedness is the result of an event of default which is not related to the failure to pay principal or interest on the terms, at the times and on the conditions set forth in such instrument, it will not be considered an Event of Default under this clause (e) until 15 days after such acceleration;

(f)

certain events of bankruptcy, insolvency, winding up, liquidation or dissolution relating to Canadian Natural or any Significant Subsidiary;

(g)

the taking or entry of certain judgments or decrees against Canadian Natural or any Subsidiary for the payment of money in excess of the greater of $75 million and 2 percent of the Shareholders’ Equity of Canadian Natural in the aggregate, if Canadian Natural or such Subsidiary, as the case may be, fails to file an appeal or, if Canadian Natural or such Subsidiary, as the case may be, does file an appeal, that judgment or decree is not and does not remain vacated, discharged or stayed as provided in the Indenture; or

(h)

any other Event of Default provided with respect to debt securities of that series.