UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

x ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

For the fiscal year ended December 31, 2023

OR

o TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

for the transition period from to

Commission file number 000-56607

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Bunge Retirement Savings Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Bunge Global SA

Route de Florissant 13

1206 Geneva, Switzerland

(Address of registered office and principal executive office)

1391 Timberlake Manor Parkway

Chesterfield, Missouri 63017

(Address of corporate headquarters)

| | | | | | | | |

| TABLE OF CONTENTS | | |

| | |

| | Page |

| | |

| Report of Independent Registered Public Accounting Firm | | |

| | |

| | |

| Financial Statements | | |

| | |

Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022 | | |

| | |

Statements of Changes in Net Assets Available for Benefits for the Years ended December 31, 2023 and 2022 | | |

| | |

| Notes to Financial Statements | | |

| | |

| Supplemental Schedules | | |

| | |

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions for the Year ended December 31, 2023 | | |

| | |

Schedule H, Line 4i - Schedule of Assets (held at End of Year) as of December 31, 2023 | | |

| | |

| Exhibits | |

| | |

| Signature | | |

| | |

| Exhibit 23.1 Consent of Independent Registered Public Accounting Firm | | |

| | |

Report of Independent Registered Public Accounting Firm

To the Bunge U.S. Retirement Plans Committee

and the Plan Administrator of the Bunge

Retirement Savings Plan

Chesterfield, Missouri

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Bunge Retirement Savings Plan (the "Plan") as of December 31, 2023 and 2022, and the related statements of changes in net assets available for benefits for the years then ended, including the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits for the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information contained in Schedule H, Line 4a – Schedule of Delinquent Participant Contributions for the year ended December 31, 2023, and Schedule H, Line 4j – Schedule of Assets (held at End of Year) as of December 31, 2023 have been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

We have served as the Plan’s auditor since 2011.

/s/Armanino LLP

St. Louis, Missouri

June 18, 2024

| | | | | | | | | | | |

| BUNGE RETIREMENT SAVINGS PLAN | | | |

| | | |

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS | | | |

AS OF DECEMBER 31, 2023 AND 2022 | | | |

| | | |

| | | |

| 2023 | | 2022 |

| | | |

| INVESTMENTS, at fair value: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Plan interest in Bunge Defined Contribution Master Trust (Note 8) | $ | 451,325,822 | | | $ | 367,267,811 | |

| | | |

| RECEIVABLES: | | | |

| Notes receivable from participants (Note 4) | 4,701,346 | | | 4,057,715 | |

| Employer contributions | 1,613,915 | | | 1,411,190 | |

| | | |

| Total receivables | 6,315,261 | | | 5,468,905 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 457,641,083 | | | $ | 372,736,716 | |

| | | |

| | | |

The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | | | |

BUNGE RETIREMENT SAVINGS PLAN | | | |

| | | |

| STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 | | |

| | | |

| 2023 | | 2022 |

| | | |

| ADDITIONS AND INVESTMENT INCOME (LOSS): | | | |

| Participants’ contributions | $ | 20,168,659 | | | $ | 17,361,673 | |

| Employer contributions | 24,319,916 | | | 13,347,500 | |

| Rollover contributions | 7,048,594 | | | 4,186,777 | |

| Interest income on notes receivable from participants | 240,678 | | | 144,473 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Change in Plan Interest in Bunge Defined Contribution Master Trust | 69,052,891 | | | (78,462,287) | |

| | | |

| Total Additions to Net Assets, Including Total Investment Income (Loss) | 120,830,738 | | | (43,421,864) | |

| | | |

| DEDUCTIONS: | | | |

| Benefits paid to participants | 35,827,767 | | | 39,116,041 | |

| Administrative expenses | 98,604 | | | 87,996 | |

| | | |

| Total Deductions from Net Assets | 35,926,371 | | | 39,204,037 | |

| | | |

| INCREASE (DECREASE) IN NET ASSETS | 84,904,367 | | | (82,625,901) | |

| | | |

| | | |

| | | | |

| NET ASSETS AVAILABLE FOR BENEFITS — Beginning of year | 372,736,716 | | | 455,362,617 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS — End of year | $ | 457,641,083 | | | $ | 372,736,716 | |

| | | |

| | | |

The accompanying notes are an integral part of these financial statements. |

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

1.BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The Bunge Retirement Savings Plan (the “Plan”) was established on January 1, 1971. On January 1, 2004, the Plan was amended to include participants from the Bunge Management Services Inc. Savings Plan, the Central Soya and Affiliates Thrift Savings Plan, and the non-union participants from the Bunge North America, Inc. Savings Plan.

On November 1, 2023, Bunge Global SA completed the change of jurisdiction of incorporation of its group holding company from Bermuda to Switzerland (the "Redomestication"). The Redomestication, as approved by Bunge shareholders, was effected pursuant to a scheme of arrangement under Bermuda law. Each common share of Bunge Limited, par value $0.01 per share, was cancelled in exchange for an equal number of registered shares of Bunge Global SA, par value $0.01 per share (the "registered shares"). The registered shares began trading on the New York Stock Exchange (the "NYSE") under the symbol "BG" on November 1, 2023, which is the same symbol under which the Bunge Limited shares were previously traded. References in this Report on Form 11-K to "shares" refer to Bunge Limited common shares prior to the Redomestication and to Bunge Global SA registered shares after the Redomestication, unless otherwise specified. The Redomestication did not have an impact on the Plan or the accompanying financial statements of the Plan.

Significant accounting policies followed by the Plan are as follows.

Basis of Accounting — The accompanying financial statements of the Plan have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investment Valuation and Income Recognition — The Plan’s investment in the Bunge Defined Contribution Master Trust (the “Trust”) is presented at fair value, which has been determined based on the fair value of the underlying investments of the Trust. The Trust’s investments primarily include mutual funds, Bunge Global SA's shares, and self-directed brokerage accounts, whereby a participant may elect to invest the participant's transferable account balance in a variety of options including mutual funds, other common stock, and interest-bearing cash and cash equivalents that are stated at estimated fair value based on quoted market prices. Other investments are valued using pricing models maximizing the use of observable inputs for similar securities.

The collective trust funds consist of certain trust funds that are valued at the net asset value per share as determined by the issuer based on the underlying fair value of its net assets and of a stable value fund that is composed primarily of fully benefit-responsive investment contracts that are valued at the net asset value of units of the bank collective trust.

One of the investment options offered by the Plan, the MIP II Fund, is a collective trust that is fully invested in contracts deemed to be fully benefit-responsive. The Plan reports its investment in the MIP II Fund at fair value using the net asset value of the units held by the fund at year-end as a practical expedient. See Note 11 - Investments Measured Using The Net Asset Value Per Share Practical Expedient, for investments held by the Trust for which fair value is measured using the net asset value per share practical expedient.

Sales and purchases of investments are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Earnings on investments are allocated to participants based on daily account balances. See Note 9 - Fair Value Measurements for discussion of fair value measurements.

Payment of Benefits — Benefit payments are recorded when paid.

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

Administrative Expenses — Administrative expenses of the Plan are paid by the participants as provided in the Plan document. Certain expenses of maintaining the Plan are paid directly by Bunge North America, Inc. (the "Company") and are excluded from these financial statements.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires the Plan's management to make estimates and assumptions that affect the reported amounts of assets, liabilities, accompanying notes of the Plan financial statements, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties — The Plan invests in the Trust, which holds various securities, primarily including mutual funds, Bunge Global SA's shares, collective trust funds, other common stock, and interest-bearing cash and cash equivalents that are stated at estimated fair valued based on quoted market prices. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities may occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Voluntary Compliance Resolution — The Company had late participant contributions for the Plan years ended December 31, 2023 and 2022. The Company utilized the Department of Labor Voluntary Fiduciary Correction Program calculator to determine the lost earnings in the amount of $946 and $4,141, respectively, and corrected the delinquent contributions in 2023.

Reclassifications — Certain amounts in the 2022 financial statements have been reclassified to conform with the 2023 presentation. The reclassifications included the categorization of the self-directed brokerage accounts in Note 9 - Fair Value Measurements. These reclassifications do not affect the financial statements for any period.

Subsequent Events — The Plan has evaluated subsequent events through June 18, 2024, the date the financial statements were available to be issued.

2. PLAN DESCRIPTION

The Plan is a defined contribution plan designed to qualify under Section 401(k) of the Internal Revenue Code (“IRC”). The Bunge U.S. Retirement Plans Committee is responsible for administering the Plan in accordance with the Employee Retirement Income Securities Act of 1974 and Plan documents. The Investment Committee is charged with plan governance and responsible for monitoring Plan assets. The Company has appointed Fidelity Management Trust Company (“Fidelity”) to serve as record keeper, administrator, and trustee of both the Plan and the Trust. The descriptions of Plan terms in the following notes to financial statements are provided for general information purposes only and are qualified in their entirety by reference to the Plan document. Participants should refer to the Plan document for a more complete description of the applicable provisions of the Plan. All non-union employees (except seasonal and temporary employees) employed by Bunge North America, Inc., EGT, LLC, Bunge SCF Grain, LLC, Loders Croklaan USA, LLC (as of May 2023, the legal entity name was updated to Bunge Loders Croklaan USA, LLC), and subsidiaries and affiliates of these entities which have adopted the Plan (collectively the "Employer Group") are immediately eligible to participate in the Plan. Individual accounts are maintained for each Plan participant. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

3. CONTRIBUTIONS AND WITHDRAWALS

Contributions

Participants may contribute up to 50% of their eligible compensation as defined by the Plan document during the plan year on a pre-tax or Roth after-tax basis. As determined by the IRC’s qualified retirement plan limits, the total amount which a participant could elect to contribute to the Plan on a pre-tax or Roth after-tax basis could not exceed $22,500 in 2023 and $20,500 in 2022. However, if a participant reached age 50 by December 31, they are able to contribute an additional $7,500 in 2023 and $6,500 in 2022 in “catch up” contributions to the Plan on a pre-tax or Roth after-tax basis. Participants could also contribute regular after-tax contributions, up to an aggregate when combined with pre-tax and Roth after-tax contribution of 100% of compensation.

Each pay period, matching contributions are made in cash by the Employer Group. Participant contributions are matched at the rate of 100% of the first 3% and 50% of the next 2% of participant pre-tax or Roth after-tax contributions. Furthermore, as of January 1, 2023, as a result of an amendment to the Plan, all employees, regardless of hire or rehire date, are eligible to receive an additional contribution to the Plan from the Employer Group on behalf of the participant for an amount equal to 5% of the participant's compensation; provided that, in no event shall a participant be eligible to receive an allocation during any plan year in which the participant accrues a benefit under the Bunge U.S. Pension Plan. Prior to January 1, 2023, only participants hired or rehired on or after January 1, 2018 were eligible for this additional employer contribution.

Plan participants may select from a number of investment alternatives for their contributions. Investment choices include various mutual funds, self-directed brokerage accounts, whereby a participant may elect to invest in a variety of investment options, and the Bunge Common Stock Fund (subject to certain limits) (the “Bunge Fund”). The Bunge Fund pools a participant’s money with that of other employees to buy shares of Bunge Global SA as well as short-term investments designed to allow participants to buy or sell without the usual trade settlement period for individual stock transactions. The value of the participant investment in the Bunge Fund will vary depending on the performance of Bunge Global SA, the overall stock market, and the performance and amount of short-term investments held by the Bunge Fund, less any expenses accrued against the Bunge Fund. All dividends and interest earned in the Bunge Fund are reinvested in the Bunge Fund. A participant’s ownership in the Bunge Fund is measured in units of the Bunge Fund instead of shares.

Employer Group matching and fixed contributions are allocated to participants based upon the current contribution allocation among investment alternatives elected by the individual participant. Thereafter, employee and employer contributions may be reallocated by the participant among all investment alternatives. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

The Plan allows participants the option of making qualified (as defined by the Plan document and the IRC) rollover contributions into the Plan.

Vesting

Participants are vested immediately in their contributions and the Employer Group's matching contributions plus actual earnings thereon. Vesting in the Employer Group's 5% fixed contribution portion of their account is based on years of continuous services and participants are 100% vested after two years of credited service.

Nonvested forfeited accounts can be used to reduce future employer contributions or pay plan expenses. During the years ended December 31, 2023 and 2022, employer contributions were reduced by $211,626

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

and $138,915, respectively, and nonvested forfeited accounts remaining in Net Assets Available for Benefits as of December 31, 2023 and 2022 were $10,856 and $53,193, respectively.

Withdrawals

A participant may withdraw all or any portion of their after-tax contribution account or rollover contribution account, including earnings, at any time and, in certain circumstances, vested pre-January 1, 2004 Employer Group contributions plus earnings. Vested Employer Group contributions plus earnings may only be withdrawn after all participant after-tax contributions plus earnings have been withdrawn. Participants may not withdraw pre-tax and Roth after-tax contributions except as provided for hardship withdrawals or age 59½ withdrawals permitted by the Plan. Following normal retirement or termination of employment, participants may withdraw their entire account balances in a lump sum or any other form of payment allowed by the Plan prior to April 1 following the calendar year in which the participant attains age 73. Participants with account balances less than or equal to $5,000 upon retirement or termination must withdraw their entire account balances in a lump sum or any other form of payment allowed by the Plan on the date the participant terminates employment. Withdrawals by participants are recorded upon distribution.

4. NOTES RECEIVABLE FROM PARTICIPANTS

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum of the lesser of $50,000 or 50% of their vested account balance. Loan terms range from one to five years with the exception of loans for the purchase of a primary residence which may have a longer term and participants can have no more than one loan outstanding at any given time. The loans are secured by the balance in the participant’s account and bear interest at rates commensurate with the prevailing interest rate charged on similar commercial loans by lending institutions as determined by the plan administrator. Loan payments, including interest due, are paid ratably through payroll deductions. As of December 31, 2023, participant loans bear interest rates of 3.75% to 9.00% and mature through September 2052. No allowance for credit losses has been recorded as of December 31, 2023 or 2022. Delinquent loans are recorded as distributions based on the terms of the Plan document. Notes receivable from participants are measured at their unpaid principal balance plus any accrued, but unpaid interest. Fees related to the administration of notes receivable from participants are charged directly to the participant's account and are included in administrative expenses.

5. PLAN TERMINATION

Although it has not expressed any intention to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions set forth in ERISA. In the event the Plan is terminated, participants will become 100% vested in their employer contributions.

6. FEDERAL INCOME TAX STATUS

The Plan obtained its latest determination letter from the Internal Revenue Service on August 15, 2022, stating that the Plan and related trust were designed and in compliance with the applicable sections of the IRC. Although the Plan has been amended since receiving the determination letter, the plan administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC and the Plan and related trust continue to be tax exempt. Accordingly, no provision for income taxes has been recorded in the Plan’s financial statements.

GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the state and federal taxing authorities. The plan administrator has analyzed the tax positions

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

taken by the Plan, and has concluded that as of December 31, 2023, there were no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

7. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

Certain of the Trust’s investments are in shares of funds offered by Fidelity. Therefore, these transactions qualify as exempt party-in-interest transactions under ERISA. Fees paid by the Plan were $98,604 and $87,996 for the years ended December 31, 2023 and 2022, respectively.

Personnel and facilities of the Company have been used by the Plan for its accounting and other activities at no charge to the Plan.

The Plan allows for participants to invest in the Bunge Fund (subject to certain limits) which holds Bunge Global SA registered shares and short-term investments. Bunge Global SA is the parent company of the sponsoring Company. The Bunge Fund held 122,572 and 128,712 shares of Bunge Global SA at December 31, 2023 and 2022, respectively, of which 114,184 and 119,538 shares were allocated to the Plan at December 31, 2023 and 2022, respectively. During 2023 and 2022, the Plan recorded dividend income of $298,878 and $279,679, respectively, and net appreciation in fair value of $122,777 and $832,905, respectively, from Bunge shares.

8. INTEREST IN BUNGE DEFINED CONTRIBUTION MASTER TRUST

The Plan’s investment assets are held in the Trust which was established for the investment of the combined assets of the Plan and other defined contribution plans sponsored by the Company. The assets of the Trust are held, managed, and administered by Fidelity pursuant to the terms of the Bunge Defined Contribution Master Trust. Investment income and administrative expenses relating to the Trust are allocated to the individual participants in the plans based upon individual participant activity. Each participating retirement plan has a divided interest in the Trust.

The Trust is required to maintain separate accounts reflecting the equitable share of each participating plan in the Trust. The Plan’s equitable share of the Trust cannot be used for the payments of expenses or benefits allocable to any other participating plan.

At December 31, 2023 and 2022, the Plan's interest in the net assets of the Trust was approximately 93.5% and 93.3%, respectively.

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

The investments of the Trust at December 31, 2023 and 2022 are summarized as follows:

| | | | | | | | | | | | | | | | | |

| 2023 | | 2022 |

| Bunge Defined Contribution Master Trust | Plan's Interest in Master Trust | | Bunge Defined Contribution Master Trust | Plan's Interest in Master Trust |

| | | | | |

| Investments – at fair value: | | | | | |

| Mutual funds | $ | 246,347,249 | | $ | 233,608,536 | | | $ | 211,760,812 | | $ | 200,791,492 | |

| Bunge shares | 12,373,643 | 11,526,914 | | 12,841,596 | 11,926,265 |

| Collective trust funds | 203,335,451 | 186,983,328 | | 155,116,396 | 141,274,331 |

| Self-Directed Brokerage Accounts | 20,355,857 | 19,207,044 | | 13,924,728 | 13,275,723 |

| | | | | |

| Total investments, at fair value | $ | 482,412,200 | | $ | 451,325,822 | | | $ | 393,643,532 | | $ | 367,267,811 | |

The following are net appreciation (depreciation) in the fair value of investments and investment income for the Bunge Defined Contribution Master Trust for the years ended December 31, 2023 and 2022.

| | | | | | | | | | | |

| 2023 | | 2022 |

| | | |

| Net appreciation (depreciation) in fair value of investments | $ | 65,634,575 | | | $ | (94,203,052) | |

| Investment income | 8,322,830 | | | 9,571,439 | |

| Total | $ | 73,957,405 | | | $ | (84,631,613) | |

9. FAIR VALUE MEASUREMENTS

ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), established a single authoritative definition of fair value, set a framework for measuring fair value, and requires additional disclosures about fair value measurements.

The various inputs that may be used to determine the value of the Plan’s and Trust’s investments are summarized in three broad levels. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. There have been no changes in methodologies or investment levels during the years ended December 31, 2023 and 2022.

Level 1 — Quoted prices (unadjusted) in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following tables set forth by level within the fair value hierarchy a summary by category of equity securities held by the Trust measured at fair value on a recurring basis at December 31, 2023 and 2022. The tables do not include the Collective trust funds value of $203,335,451 and $155,116,396 at December 31,

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

2023 and 2022, respectively, in accordance with the disclosure requirements of ASC 820-10 for certain investments measured at net asset value per share (or its equivalent).

| | | | | | | | | | | | | | |

| Fair Value Measurements at December 31, 2023, Using |

| |

| Quoted Prices | | | |

| in Active | Significant | | |

| Markets for | Other | Significant | |

| Identical | Observable | Unobservable | |

| Assets | Inputs | Inputs | |

| (Level 1) | (Level 2) | (Level 3) | Total |

| | | | |

| Mutual funds | $ | 246,347,249 | | $ | — | | $ | — | | $ | 246,347,249 | |

| Bunge shares | 12,373,643 | | — | | — | | 12,373,643 | |

| Self-Directed Brokerage Accounts | 19,427,811 | | 928,046 | | — | | 20,355,857 | |

| | | | |

Total investments in the fair value hierarchy | 278,148,703 | | 928,046 | | — | | 279,076,749 | |

Collective trust funds measured at net asset value (1) | — | | — | | — | | 203,335,451 | |

| Total investments, at fair value | $ | 278,148,703 | | $ | 928,046 | | $ | — | | $ | 482,412,200 | |

| | | | |

| Fair Value Measurements at December 31, 2022, Using |

| |

| Quoted Prices | | | |

| in Active | Significant | | |

| Markets for | Other | Significant | |

| Identical | Observable | Unobservable | |

| Assets | Inputs | Inputs | |

| (Level 1) | (Level 2) | (Level 3) | Total |

| | | | |

| Mutual funds | $ | 211,760,812 | | $ | — | | $ | — | | $ | 211,760,812 | |

| Bunge Limited common shares | 12,841,596 | | — | | — | | 12,841,596 | |

| Self-Directed Brokerage Accounts | 13,889,810 | | 34,918 | | — | | 13,924,728 | |

| | | | |

Total investments in the fair value hierarchy | 238,492,218 | | 34,918 | | — | | 238,527,136 | |

Collective trust funds measured at net asset value (1) | — | | — | | — | | 155,116,396 | |

| Total investments, at fair value | $ | 238,492,218 | | $ | 34,918 | | $ | — | | $ | 393,643,532 | |

(1) In accordance with ASC Subtopic 820-10, certain investments that were measured at net asset value per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the line items presented in the Statements of Net Assets Available for Benefits.

10. PLAN TRANSFERS

Certain Plan participants also had accounts in another defined contribution plan sponsored by the Company or a company within the same control group. In addition, if a change in a participant’s employment classification occurs during a plan year (for example, transfer from union to non-union classification), the assets related to such participant would be transferred to the applicable plan within the control group for

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

| NOTES TO FINANCIAL STATEMENTS |

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022 |

such participant’s new employment status. Such transfer will be made within a reasonable period of time following the change in employment classification. Timing of those transfers may from time-to-time result in plan payables or receivables in the respective plans.

11. INVESTMENTS MEASURED USING THE NET ASSET VALUE PER SHARE PRACTICAL EXPEDIENT

The following table summarizes investments held by the Trust for which fair value is measured using the net asset value per share practical expedient as of December 31, 2023 and 2022. There are no participant redemption restrictions for these investments; the redemption notice period is applicable only to the Plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value at December 31, | | Unfunded Commitments at December 31, | | | |

| Investment Type | 2023 | 2022 | | 2023 | 2022 | | Redemption Frequency | Redemption Notice Period |

| Collective trust - MIPII fund | $ | 8,268,557 | | $ | 10,440,775 | | | $ | — | | $ | — | | | Daily | Daily1 |

| Collective trust funds | $ | 195,066,894 | | $ | 144,675,621 | | | $ | — | | $ | — | | | Daily | Daily |

(1) Withdrawals made on the collective trust can be initiated daily. Plan Sponsor terminations of the contracts can be initiated daily. Disbursements of the funds for Plan Sponsor terminations will be provided as soon as practicable within twelve months following written notice.

12. DIFFERENCES BETWEEN FINANCIAL STATEMENTS AND FORM 5500

The following is a reconciliation of net assets available for benefits per the financial statements to Form 5500 as of December 31, 2023 and 2022:

| | | | | | | | |

| 2023 | 2022 |

| Net assets available for benefits per the financial statements | $ | 457,641,083 | | $ | 372,736,716 | |

| Adjustment from contract value to fair value for fully benefit-responsive investment contracts | (390,911) | | (577,560) | |

| Net assets available for benefits per Form 5500 | $ | 457,250,172 | | $ | 372,159,156 | |

The following is a reconciliation of net increase (decrease) in net assets available for benefits per the financial statements to the Form 5500 for the years ended December 31, 2023 and 2022:

| | | | | | | | |

| 2023 | 2022 |

| Net increase (decrease) in net assets available for benefits per the financial statements | $ | 84,904,367 | | $ | (82,625,901) | |

| Change in adjustment from contract value to fair value for fully benefit-responsive investment contracts | 186,649 | | (621,069) | |

| Net increase (decrease) in net assets available for benefits per the Form 5500 | $ | 85,091,016 | | $ | (83,246,970) | |

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

|

|

EIN: 13-4977260 Plan Number: 334

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

Year ended December 31, 2023

| | | | | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to the Plan | Total that Constitute Nonexempt Prohibited Transactions | |

| Year | Check Here if Late Participant Loan Repayments are included: | Contributions Not Corrected | Contributions Corrected Outside VFCP | Contributions Pending Correction in VFCP | Total Fully Corrected Under VFCP |

| 2022 | ý | $ | — | | $ | — | | $ | — | | $ | 7,298,127 | |

| 2023 | ý | $ | — | | $ | — | | $ | — | | $ | 802,401 | |

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

|

|

EIN: 13-4977260 Plan Number: 334

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2023

| | | | | | | | | | | |

| (A) | (B)

Identity of issue, borrower, lessor, or similar party | (C)

Description of investment including maturity date, rate of interest, collateral, par, or maturity value | (E)

Current Value |

| * | Participant Loans | Participant Loans | $ | 4,701,346 | |

| * | Interest Held in Master Trust | Various (includes Registered Investment Companies, Self directed Brokerage, Collective Trust, etc.) | 451,325,822 | |

| | TOTAL | $ | 456,027,168 | |

*Investment with party-in-interest to the Plan

| | |

| BUNGE RETIREMENT SAVINGS PLAN |

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the plan administrator of the Bunge Retirement Savings Plan has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| Bunge Retirement Savings Plan | |

| | | | |

| | | | |

Date: June 18, 2024 | By: | /s/ Lisa Ware-Alexander | |

| | Lisa Ware-Alexander | |

| | Plan Administrator | |

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration Statement Form S-8 (No. 333-75762) of Bunge Global SA our report dated June 18, 2024, relating to the financial statements and supplemental schedules of Bunge Retirement Savings Plan which appears in this Form 11-K.

/s/ Armanino LLP

St. Louis, Missouri

June 18, 2024

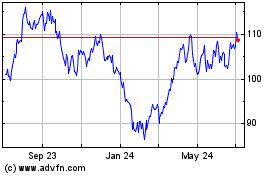

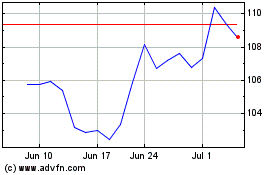

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024