ADM Teams with Prairie Pride - Analyst Blog

April 05 2011 - 2:09PM

Zacks

Archer Daniels Midland Company (ADM) announced

that it is acquiring the soybean facility from Prairie Pride, Inc.

The company also announced its intention to form a partnership deal

with the company for its biodiesel business. Both the acquisition

and the partnership deal will augment the growth strategy of Archer

Daniels and go well with the integrated business model of the

company.

Prairie Pride, Inc. is a new-generation producer cooperative

formed to convert soybeans into biodiesel fuel and soy meal. The

facility began producing biodiesel in late 2007 and processing

soybeans in August 2008.

Archer Daniels is one of the leading players in the global food

processing industry and commands a massive network of more than 560

processing and sourcing facilities and 27,000 vehicles operating

across the Americas, Europe and Asia for transportation of

agricultural commodities. This provides a strong competitive

advantage to the company and strengthens its well-established

position in the market.

Archer Daniels is in the midst of a brisk expansion strategy,

which includes expanding crushing capacities in North America, and

fertilizer blending and biodiesel capacities in South America.

Moreover, in Europe, the company has acquired processing facilities

in The Czech Republic and Germany. These initiatives offer a strong

upside potential to the company.

However, the agricultural commodity-based business is

capital-intensive and hence requires sufficient liquidity and

financial flexibility to fund the operating and capital

requirements. For this, Archer relies on cash generated from its

operations and external financing. Limitations on access to

external financing could negatively affect the company’s operating

results.

Additionally, the company faces intense competition from its

rivals such as privately held Cargill Inc., and Bunge

Ltd. (BG) and Corn Products International

Inc. (CPO). Furthermore, Archer Daniels also encounters

competition from local and regional players in the countries where

it operates.

Archer Daniel holds a Zacks #3 Rank, which translates into a

short-term Hold recommendation.

ARCHER DANIELS (ADM): Free Stock Analysis Report

BUNGE LTD (BG): Free Stock Analysis Report

CORN PROD INTL (CPO): Free Stock Analysis Report

Zacks Investment Research

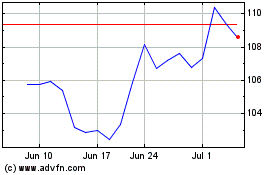

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

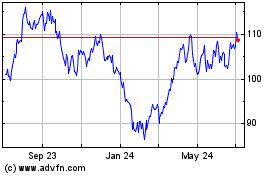

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024