Yield-Starved Investors Gobble Up $11 Billion Of Corporate Bonds

March 08 2011 - 5:16PM

Dow Jones News

Companies capitalized on investors' growing dissatisfaction with

low-yielding government debt Tuesday by offering $11 billion of

high-grade corporate bonds to eager buyers.

That was the highest investment-grade volume since Feb. 14, when

$10.2 billion was sold, according to data provider Dealogic.

BP Capital Markets Plc, the funding arm of U.K. energy giant BP

PLC (BP, BP.LN), led the way by selling $3.5 billion of fixed- and

floating-rate notes and bonds. It was BP's second sale of that size

since its Gulf of Mexico oil spill disaster last April. Investors

placed nearly $5 billion of orders.

A $1.6 billion batch of five-year fixed-rate notes priced at a

slight discount to yield 3.22%, or a risk premium of 1 percentage

point over comparable government debt. Also, $1.4 billion of

10-year fixed-rate securities priced to yield 4.742%, or 1.2

percentage points over Treasurys, and $500 million of three-year

floaters sold at 0.6 percentage point over the three-month London

interbank offered rate, a benchmark.

The five-year piece was originally marketed at 0.95 of a

percentage point over Treasurys early Tuesday, said Patrick Sporl,

senior portfolio manager at American Beacon Advisors, who said that

rate was "preliminary" and was circulated before the deal had been

properly vetted by the market.

Typically, price talk on bond deals falls as investors pile into

a deal, so the spread widening was likely the result of

underwriters trying to lower BP's borrowing costs before investors

started to push back on the deal's pricing.

American Beacon sold out of BP bonds in the second quarter of

2010 following the Macondo oil spill and concern about the

company's financial stability. At the time, those bonds were

trading at around 95 cents on the dollar.

Nearly a year later, BP has a firmer financial footing and

American Beacon is looking to buy back into its bonds. The fund

manager didn't invest in BP's $3.5 billion September issue because

of lingering uncertainty over its legal liability and cleanup costs

from the spill.

"Now it appears as if microbes ate up all the oil and it appears

to be contained," said Sporl, who is looking at the five-year

fixed-rate and three-year floating-rate tranches. The fund is

already overweight 10-year bonds from industrial issuers.

Existing 3.875%, four-year BP bonds due March 2015 were trading

Tuesday with a risk premium of 0.42 percentage point over

Treasurys, according to MarketAxess data--after touching 7.79

percentage points over the risk-free rate last June and trading at

just 86 cents on the dollar. As of Tuesday, that bond was trading

at 104.6 cents.

Likewise, the cost of five-year protection on $10 million of BP

bonds using credit derivatives was quoted by data provider Markit

at $70,000 a year on Tuesday, down 86% from the highest level

recorded on June 17 last year.

A BP spokesman said the offering was "just part of [BP's]

overall group-funding requirements" and that proceeds would be used

for general corporate purposes.

Also in the market Tuesday were ING Bank NV with a $3.5 billion

deal; offshore drilling services company Ensco PLC (ESV), which

sold $2.5 billion of five- and 10-year bonds to help fund its

merger with Pride International Inc. (PDE); consumer electronics

retailer Best Buy Co. Inc. (BBY) with $1 billion--its first debt

sale since June 2008; and a unit of Bermudian food company Bunge

Ltd. (BG), with $500 million.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com.

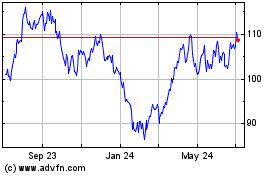

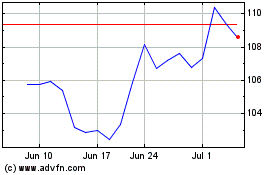

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024