2nd UPDATE:Bunge 4Q Profit Surges On Strong Agribusiness Results

February 10 2011 - 2:21PM

Dow Jones News

Bunge Ltd.'s (BG) fourth-quarter earnings surged as the

grain-processing company saw strong profit at its agribusiness

division, while the fertilizer unit swung to a modest profit.

The results beat analysts' expectations, as the company became

the latest grain merchandiser to show it is positioned to take

advantage of tightening global crop supplies.

Tight grain supplies have a potential downside, as Bunge likely

will have to pay more for commodities it resells and processes. But

grain buyers are forced to turn to Bunge and other large

competitors that have storage and transportation networks that

allow them to source grain from around the world amid supply

disruptions.

"Our team managed volatile markets well and our global asset

network enabled us to be responsive to customers in the face of

supply disruptions," said Alberto Weisser, Bunge's chairman and

chief executive, during a conference call. Bunge was able to

respond to a severe drought in the Black Sea region by shipping

grain from North and South America, he added.

Agribusiness, Bunge's largest segment, reported earnings nearly

sextupled on strong performance in the grain merchandising

business, while oilseed processing weakened.

The surge in earnings echoes recent results from competitors

such as Archer Daniels Midland Co. (ADM), which last week reported

a 29% jump in earnings, led by its agricultural services segment,

in which earnings tripled. Privately held Cargill Inc. also

reported sharply higher quarterly profit in January.

Yet Bunge's shares fell Thursday, recently down 1% to $69.10.

The company, which has had trouble meeting its own guidance in

recent years, confirmed it won't issue guidance for this year after

hinting at it last fall.

While executives said the company will continue to see strong

results in its grain business due to tight global supplies, the

remarks weren't as strong as recent commentary from Archer Daniels

Midland and Cargill, Jefferies and Co. analyst Jeff Farmer

said.

"If you listen to the context, the mosaic tells you (earnings)

are going to have to come down," Farmer said.

Bunge's earnings slipped in its sugar and bioenergy unit, driven

by lower sugarcane yields in Brazil that limited its ability to

produce ethanol and because of mill start-up costs.

A drought in Brazil that decimated its sugarcane crop cost the

company about $70 million during the 2010 fiscal year, Chief

Financial Officer Drew Burke said. The lower sugarcane supplies

increased costs and diminished sugar and ethanol volumes, he

added.

The $70 million hit included losses from forward sales of sugar

early in the year. Because of the crop shortfall, Bunge was unable

to make deliveries later in the year.

Officials said the tight Brazilian sugarcane supplies will

persist in 2011. But the outlook for Bunge's sugar operations is

expected to improve, driven by Bunge's purchase of five sugar mills

from Moema during 2010.

Bunge also saw its edible oils business earnings slide 61%

absent prior-year gains from asset sales.

Its fertilizer unit swung to a profit of $1 million from a loss

of $174 million a year earlier. The company last year sold off its

fertilizer mines and is focusing more now on distribution, a move

Weisser said will give more stability to the unit's earnings.

Bunge reported a profit of $301 million, up $11 million from a

year earlier. On a per-share basis, which includes preferred

dividend impacts, earnings were $1.95 from a year-earlier loss of

21 cents. Excluding write-downs and prior-year gains from asset

sales, earnings were $1.99 a share from a loss of 55 cents. Revenue

jumped 22% to $12.73 billion.

Analysts polled by Thomson Reuters most recently forecast

earnings of $1.59 a share on revenue of $12.1 billion.

-By Ian Berry, Dow Jones Newswires; 312-750-4072;

ian.berry@dowjones.com

Order free Annual Report for Bunge Limited

Visit http://djnewswires.ar.wilink.com/?link=BG or call

1-888-301-0513

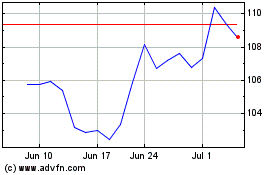

Bunge Global (NYSE:BG)

Historical Stock Chart

From May 2024 to Jun 2024

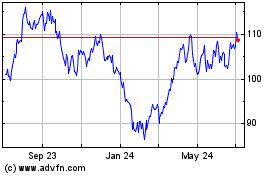

Bunge Global (NYSE:BG)

Historical Stock Chart

From Jun 2023 to Jun 2024