The U.S. recreational boat industry has likely stopped sinking,

but it faces a slow recovery and an unpredictable future.

Sales of recreational power boats fell to a record low of

132,000 vessels last year, a 55% decline from 2006 and down 14%

from 2009. While the industry is widely seen as having bottomed out

last year, the momentum behind an upturn remains unclear. Some

projections have sales rising as much as 10% this year, but few

forecasters are willing to say when or if sales will ever return to

the 300,000 boats a year the industry averaged in the 14 years

prior to 2007.

The dynamics that sustained the industry for years changed

significantly during the economic recession. Largely gone are the

easy access to credit and the disposable income from rising real

estate values, factors that helped send first-time boat buyers to

showrooms and prompt existing boaters to move up to more expensive

models.

Rising fuel costs and elevated unemployment levels, especially

in such coastal states as California and Florida, have further

damped enthusiasm for boating among those who own boats. The

average annual number of days owners used their boats dropped by

more than a week between 2006 and 2009.

"I think we'll be a lot smaller industry, but that doesn't mean

we'll be a less profitable industry," said Phil Keeter, president

of the Marine Retailers Association of America, who expects boat

sales to eventually plateau at about 200,000 units a year. "I don't

think boating is going to go away."

Keeter's sentiments are shared by many in the boating industry

who are counting on lower overhead costs, slimmed down boat

inventories and fewer dealers and boat brands to create a healthier

industry for the survivors.

Brunswick Corp. (BC), the largest boat and engine builder in

U.S. by annual sales, closed 17 plants, furloughed 45% of its

worldwide work force and eliminated eight boat brands since 2007.

The company estimates those moves will lower expenses by $420

million a year. Brunswick's remaining brands include Bayliner,

Meridian, Sea Ray, Lund, Hatteras and Mercury engines.

"While we were going through this [downturn] we knew we had to

come out differently," Brunswick Chairman and Chief Executive

Dustan McCoy said during a presentation to investors. "We had to

have a significantly lower cost base. We had to come out of this

much more efficient."

McCoy's goal is for Brunswick to earn as much money from an

industry that sells 200,000 boats a year as it did when industry

sales were 300,000 boats a year. McCoy projects Brunswick should be

able to break even if industry sales are no better than 135,000

boats this year.

The Illinois-based company also sells bowling, billiards and

fitness equipment, but hasn't reported a profit since 2007.

However, McCoy expects the company to earn between 5 cents and 40

cents a share in 2011.

"Brunswick did a pretty good of [showing] just how lean they

could become," said James Hardiman, an analyst for Longbow

Research. "If they hadn't, they would not be in business right

now."

The number of U.S. boat dealers has fallen by more than 40% in

recent years to 3,100. Boats from those shuttered dealerships

flooded onto the used-boat market at rock-bottom prices. That

depressed demand for new boats, which accounted for just 15% of all

boats sold last year.

"Our biggest competitors became our own boats that were being

repossessed," said Irwin Jacobs, cofounder of boat maker J&D

Holdings LLC in Minnesota.

Jacobs previously presided over Genmar Holdings Inc., the

second-largest U.S. boat builder behind Brunswick. But the

privately held company's debt problems forced it into bankruptcy in

2009. Genmar, which had annual sales of $1 billion before the

downturn, was sold last year to California private equity firm

Platinum Equity for about $70 million. Jacobs managed to buy back

six of Genmar's boat brands, including Carver, Marquis and Larson,

and three of its factories. Jacobs sees J&D's sales reaching

about $200 million this year.

"For the first time in two years, I have some sincere optimism,"

he said.

The glut of boats on the market from failed dealerships has

eased in recent months, forcing more boat buyers to consider new

models at full price. Sales from regional boat shows this winter

have been running ahead of last year, with demand strongest for

smaller, lower-priced motor boats and pontoon boats.

Kurt and Robin Anstaett were among those looking at pontoon

boats at last month's Chicago Boat, RV & Outdoors Show. The

suburban Chicago couple are building a waterfront home in

Michigan.

"We'll buy a boat, but not sure what kind of boat," said Kurt

Anstaett. "People are definitely buying boats. The dealers aren't

giving them away."

But loans for boats from banks, credit unions or finance

companies remain tight and consumers are cautious about taking on

additional debt, dealers say. Unlike auto companies, boat

manufacturers don't operate finance companies for their retail

customers.

"People are still scared" of buying, said Warren Moulis, owner

of a Brunswick dealership in Fox Lake, Ill. "If [Brunswick] could

do the retail side financing, our industry would be back on its

feet in no time. People are sick of sitting around. They want to

get out on the water."

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

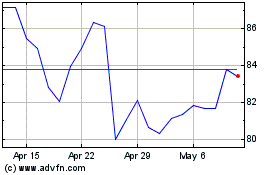

Brunswick (NYSE:BC)

Historical Stock Chart

From May 2024 to Jun 2024

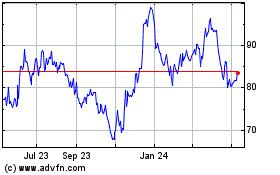

Brunswick (NYSE:BC)

Historical Stock Chart

From Jun 2023 to Jun 2024