Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

July 19 2021 - 4:58PM

Edgar (US Regulatory)

Filed by: Brookfield Infrastructure

Corporation

(Commission File No. 001-39250)

and

Brookfield

Infrastructure Partners L.P.

(Commission File No. 001-33632)

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Inter Pipeline Ltd.

Tender to Brookfield Infrastructure’s Superior Offer

Vote AGAINST the Alternative

Transaction

July 19, 2021

Dear fellow IPL

shareholders:

Brookfield Infrastructure Partners L.P., together with its institutional partners (collectively, “Brookfield

Infrastructure”), is pleased to present you with an increased offer (the “Offer”) to acquire all of the outstanding common shares of Inter Pipeline Ltd. (TSX:IPL) (“IPL”). In order to receive the compelling consideration

under the Offer, IPL shareholders are urged to vote AGAINST IPL’s proposed transaction (the “Alternative Transaction”) with Pembina Pipeline Corporation (“Pembina”).

Details of the Offer

Each IPL

shareholder will have the ability to elect to receive, per IPL share:

|

|

●

|

|

Up to 100% cash consideration totalling C$20.00 per share of IPL without being subject to proration; or

|

|

|

●

|

|

0.250 of a Brookfield Infrastructure Corporation (NYSE: BIPC; TSX: BIPC) class A exchangeable subordinated voting share

(“BIPC Share”) subject to proration, valued at C$23.85 per IPL share as of market close on July 14, 2021.

|

IPL

Shareholders do not have to elect all cash or all shares and can instead, elect the consideration split which best suits their objectives (subject to the BIPC Share proration). For further details, IPL shareholders are encouraged to read the

enclosed fourth notice of variation and change (the “Fourth Notice of Variation”).

Reasons to Accept the Offer

|

|

✓

|

Superior Value. Brookfield Infrastructure’s Offer to purchase IPL for C$21.23 per IPL common share1, on a prorated basis, represents a premium of C$1.53 or 8% to the Alternative Transaction2.

|

|

|

✓

|

Value Certainty and Flexibility of Consideration. IPL shareholders have the ability to elect the form of

consideration according to their individual preferences.

|

|

1

|

Based on assumed proration of 32% BIPC Shares and 68% cash and based on the closing price of the BIPC Shares on the TSX

on July 14, 2021.

|

|

2

|

Based on the closing price of the Pembina common shares on the TSX on July 14, 2021.

|

|

|

✓

|

Speed to Close and Immediate Liquidity. Brookfield Infrastructure has received all key regulatory approvals and

can take up and pay for tendered shares within three business days after the Offer expiry time.

|

|

|

✓

|

Tax Deferred Consideration. Eligible shareholders can elect a tax deferred rollover into BIPC Shares through

the Offer.

|

|

|

✓

|

Superior Share Consideration. Brookfield Infrastructure share consideration provides a more attractive total

return opportunity for IPL shareholders. We are proud of our average annual total return of 19% over a 10-year period, which has significantly outperformed Pembina’s total return of 10% over the same

period. Additionally, since 2009, Brookfield Infrastructure has delivered superior dividend growth to its shareholders with an annual growth rate of 10%, compared to Pembina’s growth rate of 4% over the same period.

|

|

|

✓

|

Best-in-class Infrastructure

Portfolio. Our platform offers the unique advantage of being able to invest across four key infrastructure sectors, at all points within economic cycles, and across multiple geographies to secure the best risk adjusted returns for our investors.

|

|

|

✓

|

Stable and Growing Cash Flows. 95% of Brookfield Infrastructure’s revenue is underpinned by regulated and

contractual frameworks driving predictable and growing cash flows.

|

|

|

✓

|

Strong Growth Pipeline. We have a strong growth outlook through a combination of organic revenue growth and new

investment activity.

|

Reasons to Vote Against the Alternative Transaction

|

|

×

|

The Alternative Transaction Represents Lower Value for Shareholders. Based on the current and historical market

prices, the Alternative Transaction delivers inferior value to IPL shareholders when compared to Brookfield Infrastructure’s superior Offer.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brookfield Infrastructure Offer1

|

|

Alternative Transaction2

|

|

Brookfield Offer Premium to

Alternative Transaction

|

|

|

|

|

|

|

|

July 14, 2021

|

|

$21.23

|

|

$19.70

|

|

$1.53

|

|

7.8%

|

|

|

|

|

|

|

|

30-Day VWAP

|

|

$20.82

|

|

$19.84

|

|

$0.98

|

|

4.9%

|

|

|

|

|

|

|

|

60-Day VWAP

|

|

$20.70

|

|

$19.51

|

|

$1.19

|

|

6.1%

|

|

|

|

|

|

|

|

90-Day VWAP

|

|

$20.78

|

|

$19.11

|

|

$1.67

|

|

8.7%

|

|

|

|

(1) Assumes that IPL shareholders select the higher value BIPC Shares resulting in 68% cash and 32% share proration and

based on the closing price of the BIPC Shares on the TSX on July 14, 2021.

|

|

(2) Based on the closing price of the Pembina common shares on the TSX on July 14, 2021

|

|

|

×

|

Zero Cash Consideration: The Alternative Transaction offers zero cash consideration and therefore no access to

immediate liquidity or value certainty for those who would otherwise seek an exit.

|

|

|

×

|

Long and Uncertain Timeline to Closing. The Alternative Transaction requires shareholders and regulatory

approvals that are yet to be received, exposing IPL shareholders to uncertainty in respect of potential customer complaints and consequently possible anti-trust approvals that are delayed or denied entirely. Pursuant to the Alternative

Transaction’s “hell or high water”

|

|

|

provisions, the risk of any punitive regulatory or anti-competition rulings or outcomes will be borne by IPL

shareholders due to the proposed all-share consideration.

|

|

|

×

|

Potential for Overhang and Downward Price Pressure on the Share-Based Consideration: IPL shareholders may

experience prolonged downward pressure on Pembina’s share price as short-term shareholders seek to monetize their shareholding via selling shares in the public market.

|

|

|

×

|

IPL Employees. Pembina has publicly indicated ~$150 million of general, administrative and operational

synergies, which we fear would inevitably result in significant job losses for local IPL employees.

|

Voting AGAINST the

Alternative Transaction is reinforced by a leading independent proxy advisor, Institutional Shareholder Services (“ISS”). On July 16, 2021, ISS recommended IPL Shareholders vote AGAINST the Alternative Transaction citing:

“the combination with PPL carries execution risk and shareholders have also been offered a higher competing bid from BIP which

has financing certainty, no regulatory risk, and an all-cash option. Absent an improvement of terms from PPL, shareholders appear to be better off with the riskless option from BIP’s

deal. As such, shareholders are recommended to vote against this proposal based on the current terms” – ISS, July 16, 2021

IPL Shareholders are urged to cast their vote AGAINST well in advance of

IPL’s July 27, 2021 proxy voting deadline.

Tender to Brookfield Infrastructure’s Offer which is open for acceptance until

5:00 p.m. (Mountain Time) on Friday, August 6, 2021.

IPL shareholders who have questions or require assistance may contact Laurel Hill Advisory Group toll free at 1-877-452-7184 (416-304-0211 outside North America), or by email at

assistance@laurelhill.com.

Sincerely Yours,

Brookfield

Infrastructure

Additional Information Regarding Proxy Solicitation

Brookfield Infrastructure is soliciting proxies pursuant to an order of the Alberta Securities Commission dated June 29, 2021 allowing

Brookfield Infrastructure to solicit proxies through public broadcast without Brookfield Infrastructure filing a proxy circular. Brookfield Infrastructure is soliciting proxies in respect of IPL and the annual general and special meeting of

shareholders of IPL to be held on July 29, 2021 (the “IPL Meeting”). IPL’s head office is located at Suite 3200, 215—2nd Street SW, Calgary, Alberta, T2P 1M4.

Brookfield Infrastructure has engaged Laurel Hill Advisory Group as their strategic advisor and proxy solicitation agent to assist Brookfield

Infrastructure in the solicitation of proxies from IPL shareholders for the IPL Meeting. The total cost of these proxy solicitation services is up to approximately $100,000, plus reasonable out of-pocket

expenses. Brookfield Infrastructure will bear the costs of this solicitation.

In addition to revocation in any other manner permitted by

law, a registered IPL shareholder may revoke or change a previously made proxy vote: (a) by accessing the IPL Meeting by following the instructions under the heading “How to Participate at the IPL Shareholders’ Meeting” in the

Joint Information Circular of IPL and Pembina dated June 29, 2021 in respect of the IPL Meeting and voting their IPL shares during the designated time; (b) by an instrument in writing executed by the IPL shareholder or such IPL

shareholder’s attorney authorized in writing or, if the IPL shareholder is a corporation, under its corporate seal or by an officer or attorney thereof, duly authorized, indicating the capacity under which such officer or attorney is signing

and deposited with Computershare, the transfer agent of IPL, at the office designated in the Notice of Special Meeting of IPL Shareholders dated June 29, 2021 not later than 10:00 a.m. (Calgary time), on the business day preceding the day of

the IPL Meeting (or any adjournment or postponement thereof); or (c) by a duly executed and deposited proxy as provided herein bearing a later date or time than the date or time of the proxy being revoked. IPL shareholders who hold their shares

through a bank, broker or other intermediary are encouraged to follow the instructions provided to them from their applicable intermediary as they differ from those of registered shareholders (shareholders who hold IPL shares in their own name).

Alternatively, IPL shareholders may contact Laurel Hill for assistance.

Brookfield Infrastructure beneficially own and exercise control or

direction over 41,848,857 IPL shares. Additionally, Brookfield Infrastructure has economic exposure to an aggregate of 42,492,698 IPL shares pursuant to a cash-settled total return swap. The cash-settled total return swap affords economic exposure

to IPL shares, but does not give Brookfield Infrastructure any right to vote, or direct or influence the voting, acquisition, or disposition of any IPL shares.

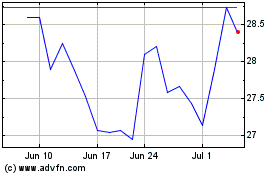

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From May 2024 to Jun 2024

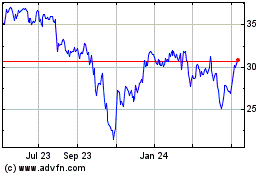

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Jun 2023 to Jun 2024