Brookfield Infrastructure (NYSE: BIP; TSX: BIP.UN) today announced

its results for the fourth quarter ended December 31, 2020.

“2020 provided a unique backdrop to showcase the

resilience and strength of our business,” said Sam Pollock, Chief

Executive Officer of Brookfield Infrastructure. “We were also able

to invest in high quality assets that were immediately accretive to

our results. We are beginning 2021 with a robust liquidity position

which will allow us to pursue attractive opportunities and convert

them into meaningful investments.”

| |

For the three months endedDecember 31, |

|

For the year endedDecember 31, |

| US$

millions (except per unit amounts), unaudited1 |

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Net income2 |

$ |

331 |

|

$ |

23 |

|

|

$ |

394 |

|

$ |

233 |

|

|

– per unit3,4 |

$ |

0.58 |

|

$ |

(0.06 |

) |

|

$ |

0.35 |

|

$ |

0.06 |

|

| FFO5 |

$ |

398 |

|

$ |

358 |

|

|

$ |

1,454 |

|

$ |

1,384 |

|

|

– per unit (split-adjusted)6 |

$ |

0.86 |

|

$ |

0.77 |

|

|

$ |

3.13 |

|

$ |

3.06 |

|

Brookfield reported net income for the year of

$394 million ($0.35 per unit) compared to $233 million ($0.06 per

unit) in the prior year. Net income for the year benefited from

organic growth across our regulated and contracted operations,

contributions from recently completed acquisitions and a gain

associated with the partial disposition of our Australian export

terminal. These increases were partially offset by the impact of

foreign exchange and higher depreciation associated with our annual

revaluation process and new investments.

Funds from Operations (or FFO) for 2020 totaled

$1.45 billion, compared to $1.38 billion in the prior year. This 5%

increase reflects the highly regulated and contracted nature of our

cash flows and embedded organic growth within the company. Results

benefited from capital deployed across our segments and organic

growth within our utilities, midstream and data segments. The

single largest adverse impact on results was the depreciation of

the Brazilian real, which reduced FFO by approximately $100 million

relative to 2019.

Segment Performance

Our utilities segment generated FFO of $659

million in 2020, an annual increase of 6% after adjusting for the

impact of a weaker Brazilian real. Our utility businesses performed

well overall, reflecting the regulated and contractual frameworks

under which we operate. Results benefited from inflation-indexation

and $340 million of capital commissioned into rate base during

the last 12 months. These contributions were partially offset by

delays in the recognition of certain connections revenue at our

U.K. regulated distribution business.

FFO from our transport segment was $590 million,

which was relatively consistent with the prior year despite a

challenging environment and disruptions in global trade. The

segment benefited from the initial contribution of our North

American rail operation and LNG export terminal, solid volumes

across our rail networks and favorable rent settlements at our U.K.

port operation. These contributions were offset by lower volumes at

our toll roads and container ports.

FFO from our midstream segment totaled $289

million, an increase of 18% compared to the prior year. Performance

this year was excellent, with organic growth contributing 13%

despite challenges in global energy markets. Our highly contracted

cash flows were uninterrupted by the economic shutdowns and we

benefited from robust transportation volumes and the commissioning

of several new capital expenditure projects.

Our data segment delivered FFO of $196 million,

an increase of almost 50% compared to the prior year. This

step-change increase is the result of organic growth and

approximately $1 billion of capital deployed into various

strategic growth initiatives over the last 24 months. With respect

to our ongoing growth capital projects, we have commissioned 22 MW

of capacity at our South American data center operation and

constructed approximately 150,000 fiber plugs at our French telecom

operation in the last year. Combined, these two projects will

contribute additional annual EBITDA of $50 million (BIP’s

share - approximately $10 million).

The following table presents FFO by segment:

| |

For the three months endedDecember 31, |

|

For the year endedDecember 31, |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

FFO by segment |

|

|

|

|

|

|

|

|

Utilities |

$ |

168 |

|

|

$ |

178 |

|

|

$ |

659 |

|

|

$ |

672 |

|

|

Transport |

170 |

|

|

147 |

|

|

590 |

|

|

603 |

|

|

Midstream |

86 |

|

|

64 |

|

|

289 |

|

|

244 |

|

|

Data |

61 |

|

|

42 |

|

|

196 |

|

|

136 |

|

|

Corporate |

(87 |

) |

|

(73 |

) |

|

(280 |

) |

|

(271 |

) |

|

FFO |

$ |

398 |

|

|

$ |

358 |

|

|

$ |

1,454 |

|

|

$ |

1,384 |

|

Update on Strategic

Initiatives

We completed several important initiatives in

2020:

- Deployed $2.5 billion in

new investments and organic capital projects - Expanded

our presence in India’s rapidly expanding data infrastructure

sector with the acquisition of a large-scale portfolio of telecom

towers and made an investment in a world class LNG export terminal

that is contributing to global decarbonization efforts.

- Generated over $700 million

through capital recycling – Completed four sale processes

and several asset-level financings that produced over $700 million

of proceeds, resulting in an average after-tax IRR of approximately

20% and approximately three times multiple of capital.

In addition, we recently reached an agreement to

sell our North American district energy business in two separate

transactions for total consideration of $4.1 billion on an

enterprise value basis. Net proceeds to BIP are expected to be

approximately $950 million. We will earn an IRR of over 30% on our

investment and a multiple of invested capital of over six

times.

Distribution and Dividend

Increase

The Board of Directors has declared a quarterly

distribution in the amount of $0.51 per unit, payable on March 31,

2021 to unitholders of record as at the close of business on

February 26, 2021. This distribution represents a 5% increase

compared to the prior year. The regular quarterly dividends on the

Cumulative Class A Preferred Limited Partnership Units, Series 1,

Series 3, Series 5, Series 7, Series 9, Series 11, Series 13 and

Series 14 have also been declared, as well as the dividend for BIP

Investment Corporation Senior Preferred Shares, Series 1. In

conjunction with the Partnership’s distribution declaration, the

Board of Directors of BIPC has declared an equivalent quarterly

dividend of $0.51 per share, also payable on March 31, 2021 to

shareholders of record as at the close of business on February 26,

2021.

Additional Information

The Board has reviewed and approved this news

release, including the summarized unaudited financial information

contained herein.

Brookfield Infrastructure’s Letter to

Unitholders and Supplemental Information are available at

www.brookfield.com/infrastructure.

Brookfield Infrastructure is a

leading global infrastructure company that owns and operates

high-quality, long-life assets in the utilities, transport,

midstream and data sectors across North and South America, Asia

Pacific and Europe. We are focused on assets that generate stable

cash flows and require minimal maintenance capital expenditures.

Investors can access its portfolio either through Brookfield

Infrastructure Partners L.P. (NYSE: BIP; TSX: BIP.UN), a

Bermuda-based limited partnership, or Brookfield Infrastructure

Corporation (NYSE, TSX: BIPC), a Canadian corporation. Further

information is available at www.brookfield.com/infrastructure.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with approximately $600 billion of

assets under management. For more information, go to

www.brookfield.com.

Please note that Brookfield Infrastructure

Partners’ previous audited annual and unaudited quarterly reports

have been filed on SEDAR and Edgar, and can also be found in the

shareholders section of its website at

www.brookfield.com/infrastructure. Hard copies of the annual and

quarterly reports can be obtained free of charge upon request.

For more information, please contact:

|

Media: |

Investors: |

| Claire Holland |

Kate White |

| Senior Vice President,

Communications |

Manager, Investor

Relations |

| Tel: (416) 369-8236 |

Tel: (416) 956-5183 |

| Email:

claire.holland@brookfield.com |

Email:

kate.white@brookfield.com |

| |

|

Conference Call and Quarterly Earnings

Details

Investors, analysts and other interested parties

can access Brookfield Infrastructure’s 2020 Year-End Results as

well as the Letter to Unitholders and Supplemental Information on

Brookfield Infrastructure’s website under the Investor Relations

section at www.brookfield.com/infrastructure.

The conference call can be accessed via webcast

on February 3, 2021 at 9:00 a.m. Eastern Time at

https://edge.media-server.com/mmc/p.63nh6f4w or via teleconference

at 1-866-688-9459 toll free in North America. For overseas calls

please dial +1-409-216-0834, at approximately 8:50 a.m. Eastern

Time. A recording of the teleconference can be accessed at

1-855-859-2056 or +1-404-357-3406 (Conference ID: 4178742).

Note: This news release may contain

forward-looking information within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, Section 21E of the U.S. Securities Exchange Act of 1934,

as amended, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations. The words “will”, “target”,

“future”, “growth”, “expect”, “believe”, “may”, derivatives thereof

and other expressions which are predictions of or indicate future

events, trends or prospects and which do not relate to historical

matters, identify the above mentioned and other forward-looking

statements. Forward-looking statements in this news release may

include statements regarding expansion of Brookfield

Infrastructure’s business, the likelihood and timing of

successfully completing the transactions referred to in this news

release, statements with respect to our assets tending to

appreciate in value over time, the future performance of acquired

businesses and growth initiatives, the commissioning of our capital

backlog, the pursuit of projects in our pipeline, the level of

distribution growth over the next several years and our

expectations regarding returns to our unitholders as a result of

such growth. Although Brookfield Infrastructure believes that these

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject

to a number of known and unknown risks and uncertainties. Factors

that could cause actual results of Brookfield Infrastructure to

differ materially from those contemplated or implied by the

statements in this news release include general economic conditions

in the jurisdictions in which we operate and elsewhere which may

impact the markets for our products and services, the ability to

achieve growth within Brookfield Infrastructure’s businesses and in

particular completion on time and on budget of various large

capital projects, which themselves depend on access to capital and

continuing favourable commodity prices, and our ability to achieve

the milestones necessary to deliver the targeted returns to our

unitholders, the impact of market conditions on our businesses, the

fact that success of Brookfield Infrastructure is dependent on

market demand for an infrastructure company, which is unknown, the

availability of equity and debt financing for Brookfield

Infrastructure, the impact of health pandemics such as the COVID-19

on our business and operations, the ability to effectively complete

transactions in the competitive infrastructure space (including the

ability to complete announced and potential transactions that may

be subject to conditions precedent, and the inability to reach

final agreement with counterparties to transactions referred to in

this press release as being currently pursued, given that there can

be no assurance that any such transaction will be agreed to or

completed) and to integrate acquisitions into existing operations,

the future performance of these acquisitions, changes in technology

which have the potential to disrupt the business and industries in

which we invest, the market conditions of key commodities, the

price, supply or demand for which can have a significant impact

upon the financial and operating performance of our business and

other risks and factors described in the documents filed by

Brookfield Infrastructure with the securities regulators in Canada

and the United States including under “Risk Factors” in Brookfield

Infrastructure’s most recent Annual Report on Form 20-F and other

risks and factors that are described therein. Except as required by

law, Brookfield Infrastructure undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether as a result of new information, future events or

otherwise.

References to Brookfield Infrastructure are to

the Partnership together with its subsidiaries and operating

entities. Brookfield Infrastructure’s results include limited

partnership units held by public unitholders, redeemable

partnership units, general partnership units, Exchange LP units,

and class A shares of BIPC.

References to the Partnership are to Brookfield

Infrastructure Partners L.P.

- Please refer to page 12 for results

of Brookfield Infrastructure Corporation.

- Includes net income attributable to

limited partners, the general partner, and non-controlling

interests ‒ Redeemable Partnership Units held by Brookfield,

Exchange LP Units, and class A shares of BIPC.

- Average number of limited

partnership units outstanding on a time weighted average basis for

the three and twelve-month period ended December 31, 2020 were

295.4 million and 294.7 million, respectively (2019 – 293.5 million

and 285.6 million). Earnings per limited partnership unit have been

adjusted to reflect the dilutive impact of the special

distribution.

- Results in a loss on a per unit

basis for the three-month period ended December 31, 2019 as

allocation of net income is reduced by preferred unit and incentive

distributions.

- FFO is defined as net income

excluding the impact of depreciation and amortization, deferred

income taxes, breakage and transaction costs, and non-cash

valuation gains or losses. A reconciliation of net income to FFO is

available on page 9 of this press release.

- Average number of partnership units

outstanding on a fully diluted time weighted average basis,

assuming the exchange of redeemable partnership units held by

Brookfield, Exchange LP units, and class A shares of BIPC for

limited partnership units, as if the special distribution had been

completed prior to the periods presented, for the three and

twelve-month periods ended December 31, 2020 were

465.0 million and 464.9 million, respectively (2019 –

464.8 million and 452.9 million). Average number of units

outstanding on a fully diluted time weighted average basis,

excluding the impact of the special distribution, for the three and

twelve-month periods ended December 31, 2020 were

418.5 million and 418.4 million, respectively (2019 –

418.3 million and 407.6 million).

Brookfield Infrastructure Partners

L.P. Consolidated Statements of Financial

Position

| |

As of |

| US$

millions, unaudited |

Dec 31, 2020 |

|

|

Dec 31, 2019 |

|

|

|

|

|

|

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

867 |

|

|

$ |

827 |

|

| Corporate financial

assets |

425 |

|

|

149 |

|

| Property, plant and equipment

and investment properties |

32,102 |

|

|

23,429 |

|

| Intangible assets and

goodwill |

18,401 |

|

|

20,939 |

|

| Investments in associates and

joint ventures |

5,528 |

|

|

4,967 |

|

|

Deferred income taxes and other |

4,008 |

|

|

5,997 |

|

|

Total assets |

$ |

61,331 |

|

|

$ |

56,308 |

|

|

|

|

|

|

| Liabilities and

partnership capital |

|

|

|

| Corporate borrowings |

$ |

3,158 |

|

|

$ |

2,475 |

|

| Non-recourse borrowings |

20,020 |

|

|

18,544 |

|

| Financial liabilities |

3,374 |

|

|

2,173 |

|

| Deferred income taxes and

other |

13,106 |

|

|

10,939 |

|

| |

|

|

|

| Partnership

capital |

|

|

|

| Limited partners |

4,233 |

|

|

5,048 |

|

| General partner |

19 |

|

|

24 |

|

| Non-controlling interest

attributable to: |

|

|

|

|

Redeemable partnership units held by Brookfield |

1,687 |

|

|

2,039 |

|

|

Class A shares of BIPC and Exchange LP units |

650 |

|

|

18 |

|

|

Interest of others in operating subsidiaries |

13,954 |

|

|

14,113 |

|

|

Preferred unitholders |

1,130 |

|

|

935 |

|

|

Total partnership capital |

21,673 |

|

|

22,177 |

|

|

Total liabilities and partnership capital |

$ |

61,331 |

|

|

$ |

56,308 |

|

Brookfield Infrastructure Partners

L.P.Consolidated Statements of Operating

Results

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, except per unit information, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

2,534 |

|

|

$ |

1,655 |

|

|

$ |

8,885 |

|

|

$ |

6,597 |

|

| Direct operating costs |

(1,356 |

) |

|

(907 |

) |

|

(4,843 |

) |

|

(3,395 |

) |

| General and administrative

expense |

(93 |

) |

|

(79 |

) |

|

(312 |

) |

|

(279 |

) |

|

Depreciation and amortization expense |

(519 |

) |

|

(282 |

) |

|

(1,705 |

) |

|

(1,214 |

) |

|

|

566 |

|

|

387 |

|

|

2,025 |

|

|

1,709 |

|

| Interest expense |

(372 |

) |

|

(222 |

) |

|

(1,179 |

) |

|

(904 |

) |

| Share of earnings from

associates and joint ventures |

55 |

|

|

136 |

|

|

131 |

|

|

224 |

|

| Mark-to-market on hedging

items |

(73 |

) |

|

(47 |

) |

|

(16 |

) |

|

57 |

|

| Other

income (expense) |

452 |

|

|

(144 |

) |

|

234 |

|

|

(158 |

) |

|

Income before income tax |

628 |

|

|

110 |

|

|

1,195 |

|

|

928 |

|

| Income tax expense |

|

|

|

|

|

|

|

|

Current |

(54 |

) |

|

(70 |

) |

|

(237 |

) |

|

(250 |

) |

|

Deferred |

— |

|

|

(14 |

) |

|

(54 |

) |

|

(28 |

) |

|

Net income |

574 |

|

|

26 |

|

|

904 |

|

|

650 |

|

|

Non-controlling interest of others in operating subsidiaries |

(243 |

) |

|

(3 |

) |

|

(510 |

) |

|

(417 |

) |

|

Net income attributable to partnership |

$ |

331 |

|

|

$ |

23 |

|

|

$ |

394 |

|

|

$ |

233 |

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

Limited partners |

$ |

182 |

|

|

$ |

(13 |

) |

|

$ |

141 |

|

|

$ |

52 |

|

|

General partner |

46 |

|

|

41 |

|

|

183 |

|

|

159 |

|

|

Non-controlling interest – redeemable partnership units held by

Brookfield |

74 |

|

|

(5 |

) |

|

55 |

|

|

22 |

|

|

Non-controlling interest – class A shares of Brookfield

Infrastructure Corporation |

28 |

|

|

— |

|

|

14 |

|

|

— |

|

|

Non-controlling interest – exchange LP units |

1 |

|

|

— |

|

|

1 |

|

|

— |

|

|

Basic and diluted earnings per unit attributable to: |

|

|

|

|

|

|

|

|

Limited partners1 |

$ |

0.58 |

|

|

$ |

(0.06 |

) |

|

$ |

0.35 |

|

|

$ |

0.06 |

|

- Average number of limited

partnership units outstanding on a time weighted average basis for

the three and twelve-month period ended December 31, 2020 were

295.4 million and 294.7 million, respectively (2019 –

293.5 million and 285.6 million). Earnings per limited

partnership unit have been adjusted to reflect the dilutive impact

of the special distribution.

Brookfield Infrastructure Partners

L.P.Consolidated Statements of Cash

Flows

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

| Operating

Activities |

|

|

|

|

|

|

|

|

Net income |

$ |

574 |

|

|

$ |

26 |

|

|

$ |

904 |

|

|

$ |

650 |

|

| Adjusted for the following

items: |

|

|

|

|

|

|

|

|

Earnings from investments in associates and joint ventures, net of

distributions received |

(39 |

) |

|

(48 |

) |

|

36 |

|

|

30 |

|

|

Depreciation and amortization expense |

519 |

|

|

282 |

|

|

1,705 |

|

|

1,214 |

|

|

Mark-to-market on hedging items, provisions and other |

(344 |

) |

|

147 |

|

|

51 |

|

|

153 |

|

|

Deferred income tax expense |

— |

|

|

14 |

|

|

54 |

|

|

28 |

|

| Change

in non-cash working capital, net |

(293 |

) |

|

(8 |

) |

|

(220 |

) |

|

68 |

|

|

Cash from operating activities |

417 |

|

|

413 |

|

|

2,530 |

|

|

2,143 |

|

|

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

| Net investments in: |

|

|

|

|

|

|

|

|

Operating and held for sale assets |

(37 |

) |

|

(7,787 |

) |

|

(2,660 |

) |

|

(9,999 |

) |

|

Associates |

— |

|

|

(115 |

) |

|

(369 |

) |

|

(404 |

) |

|

Long-lived assets |

(456 |

) |

|

(329 |

) |

|

(1,426 |

) |

|

(1,144 |

) |

|

Financial assets |

71 |

|

|

231 |

|

|

(237 |

) |

|

102 |

|

| Net

settlements of foreign exchange contracts |

— |

|

|

14 |

|

|

83 |

|

|

73 |

|

|

Cash used by investing activities |

(422 |

) |

|

(7,986 |

) |

|

(4,609 |

) |

|

(11,372 |

) |

|

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

| Distributions to limited and

general partners |

(286 |

) |

|

(263 |

) |

|

(1,134 |

) |

|

(1,027 |

) |

| Net borrowings: |

|

|

|

|

|

|

|

|

Corporate |

185 |

|

|

330 |

|

|

629 |

|

|

398 |

|

|

Subsidiary |

736 |

|

|

2,615 |

|

|

1,119 |

|

|

3,573 |

|

| Deposit received from

parent |

— |

|

|

— |

|

|

545 |

|

|

— |

|

| Net preferred units and

preferred shares issued |

— |

|

|

— |

|

|

195 |

|

|

72 |

|

| Net partnership units

issued |

2 |

|

|

2 |

|

|

9 |

|

|

781 |

|

| Net

capital provided by non-controlling interest and other |

(824 |

) |

|

5,019 |

|

|

763 |

|

|

5,745 |

|

|

Cash (used by) from financing activities |

(187 |

) |

|

7,703 |

|

|

2,126 |

|

|

9,542 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

|

Change during the period |

$ |

(192 |

) |

|

$ |

130 |

|

|

$ |

47 |

|

|

$ |

313 |

|

|

Cash reclassified as held for sale |

— |

|

|

3 |

|

|

— |

|

|

(13 |

) |

|

Impact of foreign exchange on cash |

47 |

|

|

17 |

|

|

(7 |

) |

|

(13 |

) |

|

Balance, beginning of period |

1,012 |

|

|

677 |

|

|

827 |

|

|

540 |

|

|

Balance, end of period |

$ |

867 |

|

|

$ |

827 |

|

|

$ |

867 |

|

|

$ |

827 |

|

Brookfield Infrastructure Partners

L.P.Statements of Funds from

Operations

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

Utilities |

$ |

218 |

|

|

$ |

223 |

|

|

$ |

854 |

|

|

$ |

850 |

|

|

Transport |

237 |

|

|

202 |

|

|

806 |

|

|

833 |

|

|

Midstream |

110 |

|

|

86 |

|

|

379 |

|

|

320 |

|

|

Data |

92 |

|

|

54 |

|

|

266 |

|

|

175 |

|

|

Corporate |

(93 |

) |

|

(79 |

) |

|

(312 |

) |

|

(279 |

) |

|

Total |

564 |

|

|

486 |

|

|

1,993 |

|

|

1,899 |

|

| |

|

|

|

|

|

|

|

| Financing costs |

(188 |

) |

|

(146 |

) |

|

(623 |

) |

|

(585 |

) |

| Other

income |

22 |

|

|

18 |

|

|

84 |

|

|

70 |

|

|

Funds from operations (FFO) |

398 |

|

|

358 |

|

|

1,454 |

|

|

1,384 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

(326 |

) |

|

(222 |

) |

|

(1,034 |

) |

|

(895 |

) |

|

Deferred taxes and other items |

259 |

|

|

(113 |

) |

|

(26 |

) |

|

(256 |

) |

|

Net income attributable to the partnership |

$ |

331 |

|

|

$ |

23 |

|

|

$ |

394 |

|

|

$ |

233 |

|

Notes:Funds from operations in

this statement is on a segmented basis and represents the

operations of Brookfield Infrastructure net of charges associated

with related liabilities and non-controlling interests. Adjusted

EBITDA is defined as FFO excluding the impact of interest expense

and other income or expenses. Net income attributable to the

partnership includes net income attributable to limited partners,

the general partner, and non-controlling interests – redeemable

partnership units held by Brookfield, Exchange LP Units and class A

shares of BIPC.

The Statements of Funds from Operations above

are prepared on a basis that is consistent with the Partnership’s

Supplemental Information and differs from net income as presented

in Brookfield Infrastructure’s Consolidated Statements of Operating

Results on page 7 of this release, which is prepared in accordance

with IFRS. Management uses funds from operations (FFO) as a key

measure to evaluate operating performance. Readers are encouraged

to consider both measures in assessing Brookfield Infrastructure’s

results.

Brookfield Infrastructure Partners

L.P.Statements of Funds from Operations per

Unit

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$,

unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per limited partnership unit1 |

$ |

0.58 |

|

|

$ |

(0.06 |

) |

|

$ |

0.35 |

|

|

$ |

0.06 |

|

| Add back or deduct the

following: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

0.70 |

|

|

0.48 |

|

|

2.22 |

|

|

1.98 |

|

|

Deferred taxes and other items |

(0.42 |

) |

|

0.35 |

|

|

0.56 |

|

|

1.02 |

|

|

FFO per unit2 |

$ |

0.86 |

|

|

$ |

0.77 |

|

|

$ |

3.13 |

|

|

$ |

3.06 |

|

- Average number of limited

partnership units outstanding on a time weighted average basis for

the three and twelve-month periods ended December 31, 2020

were 295.4 million and 294.7 million, respectively (2019

– 293.5 million and 285.6 million). Earnings per limited

partnership unit have been adjusted to reflect the dilutive impact

of the special distribution.

- Average number of partnership units

outstanding on a fully diluted time weighted average basis,

assuming the exchange of redeemable partnership units held by

Brookfield, Exchange LP units, and class A shares of BIPC for

limited partnership units, as if the special distribution had been

completed prior to the periods presented, for the three and

twelve-month periods ended December 31, 2020 were 465.0

million and 464.9 million, respectively (2019 – 464.8 million and

452.9 million). Average number of units outstanding on a fully

diluted time weighted average basis, excluding the impact of the

special distribution, for the three and twelve-month periods ended

December 31, 2020 were 418.5 million and 418.4 million,

respectively (2019 – 418.3 million and 407.6 million).

Notes:The Statements of Funds

from Operations per unit above are prepared on a basis that is

consistent with the Partnership’s Supplemental Information and

differs from net income per limited partnership unit as presented

in Brookfield Infrastructure’s Consolidated Statements of Operating

Results on page 7 of this release, which is prepared in accordance

with IFRS. Management uses funds from operations per unit (FFO per

unit) as a key measure to evaluate operating performance. Readers

are encouraged to consider both measures in assessing Brookfield

Infrastructure’s results.

Brookfield Infrastructure Partners

L.P. Statements of Partnership

Capital

| |

As of |

| US$

millions, unaudited |

Dec 31, 2020 |

|

|

Dec 31, 2019 |

|

|

|

|

|

|

| Assets |

|

|

|

| Operating groups |

|

|

|

|

Utilities |

$ |

2,896 |

|

|

$ |

3,112 |

|

|

Transport |

4,209 |

|

|

4,058 |

|

|

Midstream |

2,245 |

|

|

2,127 |

|

|

Data |

1,995 |

|

|

1,318 |

|

|

Corporate cash and cash equivalents |

464 |

|

|

273 |

|

|

|

$ |

11,809 |

|

|

$ |

10,888 |

|

|

|

|

|

|

|

Liabilities |

|

|

|

| Corporate borrowings |

$ |

3,158 |

|

|

$ |

2,475 |

|

| Other

liabilities |

2,062 |

|

|

1,284 |

|

|

|

5,220 |

|

|

3,759 |

|

|

Capitalization |

|

|

|

|

Partnership capital |

6,589 |

|

|

7,129 |

|

|

|

$ |

11,809 |

|

|

$ |

10,888 |

|

Notes:Partnership capital in

these statements represents Brookfield Infrastructure’s investments

in its operations on a segmented basis, net of underlying

liabilities and non-controlling interests, and includes partnership

capital attributable to limited partners, the general partner and

non-controlling interests – redeemable partnership units held by

Brookfield, Exchange LP Units, and class A shares of BIPC.

The Statements of Partnership Capital above are

prepared on a basis that is consistent with the Partnership’s

Supplemental Information and differs from the Brookfield

Infrastructure’s Consolidated Statements of Financial Position on

page 6 of this release, which is prepared in accordance with IFRS.

Readers are encouraged to consider both bases of presentation in

assessing Brookfield Infrastructure's financial position.

Brookfield Infrastructure Corporation

ReportsFourth Quarter 2020 Results

The Board of Directors of Brookfield

Infrastructure Corporation (“BIPC” or our “company”) (NYSE, TSX:

BIPC) today has declared a quarterly dividend in the amount of

$0.51 per class A exchangeable subordinate voting share of BIPC (a

“Share”), payable on March 31, 2021 to shareholders of record as at

the close of business on February 26, 2021. This dividend is

identical in amount per Share and has identical record and payment

dates to the quarterly distribution announced today by BIP on BIP’s

units.

The Shares of BIPC are structured with the

intention of being economically equivalent to the non-voting

limited partnership units of Brookfield Infrastructure Partnership

L.P. (“BIP” or the “Partnership”) (NYSE: BIP; TSX: BIP.UN). We

believe economic equivalence is achieved through identical

dividends and distributions on the Shares and BIP’s units and each

Share being exchangeable at the option of the holder for one BIP

unit at any time. Given the economic equivalence, we expect that

the market price of the Shares will be significantly impacted by

the market price of BIP’s units and the combined business

performance of our company and BIP as a whole. In addition to

carefully considering the disclosure made in this news release in

its entirety, shareholders are strongly encouraged to carefully

review BIP’s letter to unitholders, supplemental information and

its other continuous disclosure filings. BIP’s letter to

unitholders and supplemental information are available at

www.brookfield.com/infrastructure. Copies of the

Partnership’s continuous disclosure filings are available

electronically on EDGAR on the SEC’s website at

www.sec.gov or on SEDAR at

www.sedar.com.

Results

The net income and Funds from Operations (FFO)

of BIPC is fully attributed to the Partnership and the earnings of

BIPC are fully captured in the Partnership’s financial statements

and results.

| |

For the three months endedDecember 31, |

|

For the year endedDecember 31, |

| US$

millions, unaudited1 |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

Net (loss) income attributable to the Partnership |

$ |

(102 |

) |

|

$ |

51 |

|

|

$ |

(552 |

) |

|

$ |

197 |

|

|

FFO2 |

$ |

105 |

|

|

$ |

110 |

|

|

$ |

401 |

|

|

$ |

432 |

|

BIPC reported a net loss for the year of $552

million compared to net income of $197 million in the prior year.

Earnings for the current year benefited from capital commissioned

into rate base at our U.K. regulated distribution business and

inflation-indexation at our Brazilian regulated gas transmission

business. These positive impacts were more than offset by

revaluation losses recognized on our Shares that are classified as

liabilities under IFRS, and the impact of foreign exchange.

Our business generated FFO of $401 million for

the year, representing a 4% increase over the prior year after

adjusting for a weaker Brazilian real. Results benefited from

inflationary-indexation and additions to rate base, however these

positive factors were more than offset by the impacts of foreign

exchange and lower connections activity at our U.K. regulated

distribution business.

Note: This news release may contain

forward-looking information within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, Section 21E of the U.S. Securities Exchange Act of 1934,

as amended, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations. The words “believe”, “expect”,

“will” derivatives thereof and other expressions which are

predictions of or indicate future events, trends or prospects and

which do not relate to historical matters, identify the above

mentioned and other forward-looking statements. Forward-looking

statements in this news release include statements regarding the

impact of the market price of BIP’s units and the combined business

performance of our company and BIP as a whole on the market price

of the Shares. Although Brookfield Infrastructure believes that

these forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject

to a number of known and unknown risks and uncertainties. Factors

that could cause actual results of Brookfield Infrastructure to

differ materially from those contemplated or implied by the

statements in this news release include general economic conditions

in the jurisdictions in which we operate and elsewhere which may

impact the markets for our products and services, the ability to

achieve growth within Brookfield Infrastructure’s businesses and in

particular completion on time and on budget of various large

capital projects, which themselves depend on access to capital and

continuing favorable commodity prices, and our ability to achieve

the milestones necessary to deliver the targeted returns to our

unitholders, the impact of market conditions on our businesses, the

fact that success of Brookfield Infrastructure is dependent on

market demand for an infrastructure company, which is unknown, the

availability of equity and debt financing for Brookfield

Infrastructure, the ability to effectively complete transactions in

the competitive infrastructure space (including the ability to

complete announced and potential transactions that may be subject

to conditions precedent, and the inability to reach final agreement

with counterparties to transactions being currently pursued, given

that there can be no assurance that any such transaction will be

agreed to or completed) and to integrate acquisitions into existing

operations, the future performance of these acquisitions, changes

in technology which have the potential to disrupt the business and

industries in which we invest, the market conditions of key

commodities, the price, supply or demand for which can have a

significant impact upon the financial and operating performance of

our business and other risks and factors described in the U.S.

registration statement on Form F-1 and Canadian prospectus filed in

connection with the distribution of the Shares on March 31, 2020

with securities regulators in Canada and the United States and the

documents incorporated by reference therein, including under “Risk

Factors” in the Partnership’s most recent Annual Report on Form

20-F and other risks and factors that are described therein and in

other documents filed by the Partnership and BIPC with the

securities regulators in Canada and the United States. Except as

required by law, Brookfield Infrastructure Corporation undertakes

no obligation to publicly update or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise.

- Brookfield Infrastructure

Corporation was established on August 30, 2019 by the Partnership.

On March 30, 2020, the Partnership contributed its regulated

utilities businesses in Brazil and the U.K. to our company. For the

periods prior to March 30, 2020, the financial statements represent

a combined carve-out of the assets, liabilities, revenues,

expenses, and cash flows of the businesses that were contributed to

our company effective March 30, 2020.

- FFO is defined as net income

excluding the impact of depreciation and amortization, deferred

income taxes, breakage and transaction costs, and non-cash

valuation gains or losses. We also exclude from FFO dividends paid

on exchangeable shares of our company that are presented as

interest expense, as well as interest expense on loans payable to

the Partnership which represent the Partnership’s investment in our

company. A reconciliation of net income to FFO is available on page

17 of this release.

Brookfield Infrastructure

Corporation Consolidated Statements of Financial

Position

| |

As of |

| US$

millions, unaudited |

Dec 31, 2020 |

|

|

Dec 31, 2019 |

|

|

|

|

|

|

| Assets |

|

|

|

|

Cash and cash equivalents |

$ |

192 |

|

|

$ |

204 |

|

| Accounts receivable and

other |

394 |

|

|

390 |

|

| Property, plant and

equipment |

5,111 |

|

|

4,497 |

|

| Intangible assets |

2,948 |

|

|

3,936 |

|

| Goodwill |

528 |

|

|

667 |

|

|

Deferred tax asset and other |

171 |

|

|

159 |

|

|

Total assets |

$ |

9,344 |

|

|

$ |

9,853 |

|

|

|

|

|

|

| Liabilities and

Equity |

|

|

|

| Accounts payable and

other |

$ |

505 |

|

|

$ |

487 |

|

| Exchangeable and class B

shares |

2,221 |

|

|

— |

|

| Non-recourse borrowings |

3,477 |

|

|

3,526 |

|

| Loans payable to Brookfield

Infrastructure |

1,143 |

|

|

— |

|

| Financial liabilities |

1,031 |

|

|

1,008 |

|

| Deferred tax liabilities and

other |

1,539 |

|

|

1,555 |

|

| |

|

|

|

| Equity |

|

|

|

| Equity in net assets

attributable to the Partnership |

(1,722 |

) |

|

1,654 |

|

|

Non-controlling interest |

1,150 |

|

|

1,623 |

|

|

Total equity |

(572 |

) |

|

3,277 |

|

|

Total liabilities and equity |

$ |

9,344 |

|

|

$ |

9,853 |

|

Brookfield Infrastructure

CorporationConsolidated Statements of Operating

Results

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

375 |

|

|

$ |

406 |

|

|

$ |

1,430 |

|

|

$ |

1,619 |

|

| Direct operating costs |

(68 |

) |

|

(67 |

) |

|

(244 |

) |

|

(244 |

) |

| General and administrative

expense |

(10 |

) |

|

(9 |

) |

|

(33 |

) |

|

(30 |

) |

|

Depreciation and amortization expense |

(71 |

) |

|

(77 |

) |

|

(283 |

) |

|

(308 |

) |

|

|

226 |

|

|

253 |

|

|

870 |

|

|

1,037 |

|

| Interest expense |

(61 |

) |

|

(36 |

) |

|

(214 |

) |

|

(156 |

) |

| Mark-to-market on hedging

items and foreign currency revaluation |

(25 |

) |

|

9 |

|

|

(61 |

) |

|

5 |

|

| Remeasurement of exchangeable

and class B shares |

(79 |

) |

|

— |

|

|

(511 |

) |

|

— |

|

| Other

expense |

(15 |

) |

|

(12 |

) |

|

(47 |

) |

|

(44 |

) |

|

Income before income tax |

46 |

|

|

214 |

|

|

37 |

|

|

842 |

|

| Income tax expense |

|

|

|

|

|

|

|

|

Current |

(44 |

) |

|

(44 |

) |

|

(167 |

) |

|

(175 |

) |

|

Deferred |

(19 |

) |

|

(25 |

) |

|

(102 |

) |

|

(97 |

) |

|

Net (loss) income |

$ |

(17 |

) |

|

$ |

145 |

|

|

$ |

(232 |

) |

|

$ |

570 |

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

Partnership |

$ |

(102 |

) |

|

$ |

51 |

|

|

$ |

(552 |

) |

|

$ |

197 |

|

|

Non-controlling interest |

85 |

|

|

94 |

|

|

320 |

|

|

373 |

|

Brookfield Infrastructure

CorporationConsolidated Statements of Cash

Flows

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

| Operating

Activities |

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(17 |

) |

|

$ |

145 |

|

|

$ |

(232 |

) |

|

$ |

570 |

|

| Adjusted for the following

items: |

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

71 |

|

|

77 |

|

|

283 |

|

|

308 |

|

|

Mark-to-market on hedging items and other |

37 |

|

|

1 |

|

|

110 |

|

|

35 |

|

|

Remeasurement of exchangeable and class B shares |

79 |

|

|

— |

|

|

511 |

|

|

— |

|

|

Deferred income tax expense |

19 |

|

|

25 |

|

|

102 |

|

|

97 |

|

| Change

in non-cash working capital, net |

(44 |

) |

|

(22 |

) |

|

(44 |

) |

|

73 |

|

|

Cash from operating activities |

145 |

|

|

226 |

|

|

730 |

|

|

1,083 |

|

|

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

|

Purchase of long-lived assets, net of disposals |

(108 |

) |

|

(133 |

) |

|

(399 |

) |

|

(441 |

) |

|

Cash used by investing activities |

(108 |

) |

|

(133 |

) |

|

(399 |

) |

|

(441 |

) |

|

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

| Distributions to

non-controlling interest |

(173 |

) |

|

(190 |

) |

|

(436 |

) |

|

(525 |

) |

| Distributions to, net of

contributions from, the Partnership |

— |

|

|

(114 |

) |

|

(33 |

) |

|

(250 |

) |

| Proceeds from borrowings |

66 |

|

|

149 |

|

|

551 |

|

|

316 |

|

|

Repayments of borrowings |

(16 |

) |

|

(14 |

) |

|

(399 |

) |

|

(55 |

) |

|

Cash used by financing activities |

(123 |

) |

|

(169 |

) |

|

(317 |

) |

|

(514 |

) |

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

|

Change during the period |

$ |

(86 |

) |

|

$ |

(76 |

) |

|

$ |

14 |

|

|

$ |

128 |

|

|

Impact of foreign exchange on cash |

28 |

|

|

(5 |

) |

|

(26 |

) |

|

(23 |

) |

|

Balance, beginning of period |

250 |

|

|

285 |

|

|

204 |

|

|

99 |

|

|

Balance, end of period |

$ |

192 |

|

|

$ |

204 |

|

|

$ |

192 |

|

|

$ |

204 |

|

Brookfield Infrastructure

CorporationStatements of Funds from

Operations

| |

For the three months |

|

For the twelve months |

| |

ended December 31 |

|

ended December 31 |

| US$

millions, unaudited |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

Utilities |

$ |

144 |

|

|

$ |

149 |

|

|

$ |

545 |

|

|

$ |

585 |

|

|

Corporate |

(10 |

) |

|

(9 |

) |

|

(33 |

) |

|

(30 |

) |

|

Total |

134 |

|

|

140 |

|

|

512 |

|

|

555 |

|

| |

|

|

|

|

|

|

|

| Financing costs |

(18 |

) |

|

(20 |

) |

|

(71 |

) |

|

(80 |

) |

| Other

income |

(11 |

) |

|

(10 |

) |

|

(40 |

) |

|

(43 |

) |

|

Funds from operations (FFO) |

105 |

|

|

110 |

|

|

401 |

|

|

432 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

(40 |

) |

|

(39 |

) |

|

(151 |

) |

|

(148 |

) |

|

Deferred taxes and other items |

(167 |

) |

|

(20 |

) |

|

(802 |

) |

|

(87 |

) |

|

Net (loss) income attributable to the Partnership |

$ |

(102 |

) |

|

$ |

51 |

|

|

$ |

(552 |

) |

|

$ |

197 |

|

Notes:

Funds from operations in this statement is on a

segmented basis and represents the operations of Brookfield

Infrastructure Corporation net of charges associated with related

liabilities and non-controlling interests. Adjusted EBITDA is

defined as FFO excluding the impact of interest expense and other

income or expenses. Net income attributable to shareholders

includes net income attributable to the Partnership prior to and

after the special distribution.

The Statements of Funds from Operations above

are prepared on a basis that differs from net income as presented

in Brookfield Infrastructure Corporation’s Consolidated Statements

of Operating Results on page 15 of this release, which is prepared

in accordance with IFRS. Management uses FFO as a key measure to

evaluate operating performance. Readers are encouraged to consider

both measures in assessing our company’s results.

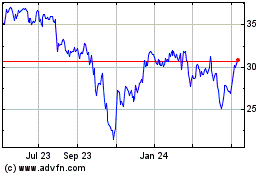

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From May 2024 to Jun 2024

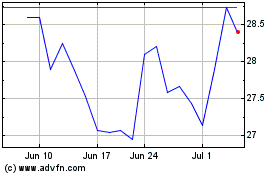

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Jun 2023 to Jun 2024