RBS To Narrow Down 5 Branch Bids In Weeks; Deal In 2nd Half-Sources

April 07 2010 - 8:09AM

Dow Jones News

Royal Bank of Scotland Group PLC (RBS) will narrow down bidders

for its 318 U.K. branches within the next few weeks, and after that

it will allow a smaller group to conduct due diligence in a deal

currently valued at up to GBP2 billion, people familiar with the

situation said Wednesday.

Five companies have put down initial bids for the branches at

Tuesday's deadline, the people said. They were Spain's Banco

Santander SA (STD) and Banco Bilbao Vizcaya Argentaria SA (BBVA),

Australia's National Australia Bank Ltd. (NAB.AU), Richard

Branson's privately held Virgin Money and private equity firm JC

Flowers.

Bids came in between GBP1.5 billion and GBP2 billion, people

added, with Santander's among the highest.

Once the due-diligence process ends, companies will go through a

second round of bidding, after which an exclusivity agreement will

be signed.

The deal is expected to close in the second half of the year,

although the actual transfer of operations probably won't take

place until 2011.

RBS, 84%-government owned, is selling branches in England and

Wales, along with NatWest branches in Scotland, and the accounts of

some SME customers across the U.K., under European Union

requirements.

Combined, the branches have GBP23.6 billion in assets and 6,000

employees.

The bank received the largest state aid in the world following

its near collapse during the financial crisis in 2008. The EU has

ordered it to cut market shares in some segments to make sure the

bank isn't at a competitive advantage to peers that stayed

independent.

The sale of the branches, however, poses a difficult separation

process for RBS, which is undergoing a wider restructuring of its

operations.

Along with the bid amounts, potential buyers are also expected

to outline integration benefits and plans for the branches'

services agreements in presentations next week.

In addition to the sale price, the winner will be required

almost immediately to inject around GBP3 billion in the business to

cover an emergency funding line from the Bank of England that will

be withdrawn.

A further GBP2 billion in capital will be needed to support

RBS's loan book.

Santander is widely considered to be in the best position to

take home the prize, since it would have the easiest time absorbing

the branches to its network of around 1,300. Because it has

infrastructure already in place, it is also likely to offer the

highest bid through the entire process.

The bank entered the U.K. market in 2004 with the acquisition of

Abbey National PLC.

Australia's NAB--which owns Clydesdale and Yorkshire banks in

the U.K.--could also be a strong competitor for the assets. The

bank entered the U.K. market in 1987, allowing it to take advantage

of two decades largely characterized by strong growth.

A bid by peer BBVA, Spain's No. 2 lender by assets, would mark a

shift in strategy for a bank that in recent years has focused on

expanding in the U.S. and Asia. It is already a big player in Latin

America, but in the U.K. it currently has only three branches.

Virgin Money, meanwhile, is seen as a strong contender,

especially for those who believe the U.K. government will have a

say in the process, potentially leading RBS to choose a fresh new

player in a sector that has become the face of the recession.

The company announced Tuesday that veteran U.S. investor Wilbur

Ross has bought a 21% stake in the company for GBP100 million to

support its bid for RBS' branches.

Virgin Money, which earlier this year entered the U.K. retail

banking market by acquiring small Church House Trust, will also get

up to GBP500 million from Ross for asset bids, according to a

person familiar with the situation.

Most of the bidders are also eyeing assets that will be put for

sale by 41%-government owned Lloyds Banking Group PLC (LYG) and

fully nationalized Northern Rock PLC.

RBS is eager to finish the EU-ordered sales fast to move on with

its wider restructuring, although it has been given four years to

do so. A successful completion of the branch sale and other

disposals is seen by analysts as a major driver for the share

price.

Shares of the bank were flat at 45 pence at 1120 GMT.

Wednesday is the deadline for a first-round of bids for another

asset being put for sale. The bank's Global Merchant Services

business, which is expected to fetch about GBP3 billion, is likely

to receive many bids from private equity firms in Europe and the

U.S., people familiar with the situation said.

-By Patricia Kowsmann and Margot Patrick, Dow Jones Newswires.

Tel +44(0)207-842-9295, patricia.kowsmann@dowjones.com

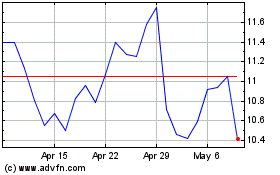

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

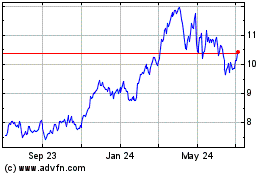

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Nov 2023 to Nov 2024