SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of

Foreign Private Issuer

Pursuant

to Rule 13a-16 Or 15d-16 Of The

Securities

Exchange Act of 1934

Long

form

of Press Release

BANCO

LATINOAMERICANO DE EXPORTACIONES, S.A.

(Exact

name of Registrant as specified in its Charter)

LATIN

AMERICAN EXPORT BANK

(Translation

of Registrant’s name into English)

Calle

50

y Aquilino de la Guardia

P.O.

Box

0819-08730

El

Dorado, Panama City

Republic

of Panama

(Address

of Registrant’s Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under

cover of Form 20-F or Form 40-F.)

Form

20-F

x

Form

40-F

o

(Indicate

by check mark whether the registrant by furnishing the information contained

in

this Form is also thereby furnishing information to the Commission pursuant

to

Rule 12g-3-2(b) under the Securities Exchange Act of 1934.)

Yes

o

No

x

(If

“Yes”

is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b). 82__.)

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned, thereto

duly authorized.

|

February 19, 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco

Latinoamericano de Exportaciones, S.A.

|

|

|

|

|

|

By:

|

/s/

Pedro Toll

|

|

|

Name:

Pedro Toll

Title:

Deputy Manager

|

FOR

IMMEDIATE RELEASE

Bladex

Reports

Full

Year 2007 Net Income of $72.2 million, up 25% from 2006 and

Fourth

Quarter Net Income of $15.5 million, up 5% from prior quarter;

Asset

quality remains strong; liquidity strengthens.

Financial

Highlights

Full

Year 2007 vs. Full Year 2006:

|

|

·

|

Net

income amounted to $72.2 million, an increase of

25%.

|

|

|

·

|

Operating

income

(1)

amounted to $71.2 million, an increase of

81%.

|

|

|

·

|

The

Commercial Division’s operating income increased 25%, to $42.3 million,

driven by increased net interest income.

|

|

|

·

|

The

Treasury Division’s operating income increased 84%, driven by higher net

gains on the sale of securities available for sale.

|

|

|

·

|

Bladex

Asset Management’s (“BAM”) operating income increased $18.6 million,

driven by trading gains.

|

|

|

·

|

The

Bank’s efficiency ratio improved from 42% to 34%.

|

Fourth

Quarter 2007 vs. Third Quarter 2007:

|

|

·

|

Net

income stood at $15.5 million, increasing 5%. Operating income amounted

to

$15.8 million, increasing 4%, driven by 9% in higher net interest

income.

|

|

|

·

|

The

average commercial portfolio rose 6% to $4.2 billion.

|

|

|

·

|

The

Bank’s liquidity ratio (liquid assets / total assets) strengthened from

7.3% to 8.4%; deposits rose 1% to $1.5 billion.

|

|

|

·

|

As

of December 31, 2007, the Bank had zero credits in non-accruing or

past

due status.

|

Fourth

Quarter 2007 vs. Fourth Quarter 2006:

|

|

·

|

Operating

income increased 12%, driven primarily by increased net interest

income

and non-interest operating income, which offset higher operating

expenses.

|

|

|

·

|

Net

income declined 26%, because of the impact of a one-time $5.6 million

recovery on impaired assets that took place in the fourth quarter

2006.

|

|

|

·

|

The loan portfolio grew 25% to $

3.7

billion.

|

(1)

Operating income refers to net income, excluding reversals (provisions) for

credit losses, and recoveries (impairment), on assets.

Panama

City, Republic of Panama, February 19, 2008

-

Banco

Latinoamericano de Exportaciones, S.A. (NYSE: BLX) (“Bladex” or the “Bank”)

announced today its results for the fourth quarter ended December 31, 2007.

The

table

below depicts selected key financial figures and ratios for the periods

indicated (the Bank’s financial statements are prepared in accordance with U.S.

GAAP, and all figures are stated in U.S. dollars):

Key

Financial Figures

|

(US$

million, except percentages and per share amounts)

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Net

interest income

|

|

$

|

58.8

|

|

$

|

70.6

|

|

$

|

16.7

|

|

$

|

17.6

|

|

$

|

19.1

|

|

|

Operating

income by business segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

Division

|

|

$

|

33.7

|

|

$

|

42.3

|

|

$

|

8.6

|

|

$

|

10.8

|

|

$

|

11.4

|

|

|

Treasury

Division

|

|

$

|

5.6

|

|

$

|

10.3

|

|

$

|

0.6

|

|

$

|

0.8

|

|

$

|

2.8

|

|

|

Bladex

Asset Management

|

|

$

|

0.0

|

|

$

|

18.6

|

|

$

|

4.9

|

|

$

|

3.7

|

|

$

|

1.5

|

|

|

Operating

income

|

|

$

|

39.3

|

|

$

|

71.2

|

|

$

|

14.1

|

|

$

|

15.2

|

|

$

|

15.8

|

|

|

Net

income

|

|

$

|

57.9

|

|

$

|

72.2

|

|

$

|

21.1

|

|

$

|

14.8

|

|

$

|

15.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS

(1)

|

|

$

|

1.56

|

|

$

|

1.99

|

|

$

|

0.58

|

|

$

|

0.41

|

|

$

|

0.43

|

|

|

Book

value per common share

|

|

$

|

16.07

|

|

$

|

16.83

|

|

$

|

16.07

|

|

$

|

16.89

|

|

$

|

16.83

|

|

|

Return

on average equity (“ROE”) p.a.

|

|

|

10.0

|

%

|

|

11.9

|

%

|

|

14.5

|

%

|

|

9.6

|

%

|

|

9.9

|

%

|

|

Tier

1 capital ratio

|

|

|

24.4

|

%

|

|

20.9

|

%

|

|

24.4

|

%

|

|

21.6

|

%

|

|

20.9

|

%

|

|

Net

interest margin

|

|

|

1.76

|

%

|

|

1.71

|

%

|

|

1.76

|

%

|

|

1.65

|

%

|

|

1.69

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liquid

Assets

(2)

/

Total Assets

|

|

|

10.0

|

%

|

|

8.4

|

%

|

|

10.0

|

%

|

|

7.3

|

%

|

|

8.4

|

%

|

|

Liquid

Assets

(2)

/

Total Deposits

|

|

|

37.7

|

%

|

|

27.4

|

%

|

|

37.7

|

%

|

|

22.3

|

%

|

|

27.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

assets

|

|

$

|

3,978

|

|

$

|

4,791

|

|

$

|

3,978

|

|

$

|

4,454

|

|

$

|

4,791

|

|

|

Total

stockholders’ equity

|

|

$

|

584

|

|

$

|

612

|

|

$

|

584

|

|

$

|

614

|

|

$

|

612

|

|

|

|

(1)

|

Earnings

per share calculations are based on the average number of shares

outstanding during each period.

|

|

|

(2)

|

Excludes

cash balances in the proprietary asset management portfolio.

|

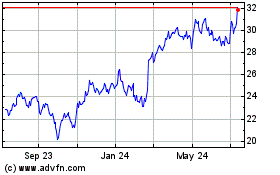

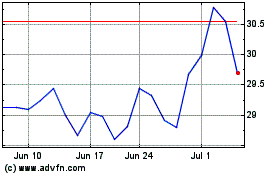

The

following graphs illustrate Operating Income and the Return on Average

Stockholders’ Equity trends from 2005 through 2007:

Comments

from the Chief Executive Officer

Jaime

Rivera, Bladex’s Chief Executive Officer, stated the following regarding the

quarterly and year end results:

“The

Bank’s performance during the fourth quarter, and during 2007 as a whole, was a

proxy for the steady, quality growth pattern established by Bladex during the

last four years.

During

2007, we achieved steady growth and solid returns across all of our business

lines. The operating contribution of the Commercial Division increased 25%,

the

second consecutive year of double digit growth rates. The Commercial Division

remains at the heart of the Bank’s business, responsible for 59% of the year’s

operating results.

Our

Treasury Division had a successful year as well, contributing 15% of operating

income. In addition, we were able to strengthen liquidity and improve the

diversification and relative cost of our funding.

Bladex’s

proprietary asset management operations had what, in our opinion, can be

objectively described as a banner year, with returns over NAV amounting to

23.34%.

These

results prove that our business model combines the strength and stability of

our

credit risk-driven core business with higher-return, market-risk oriented

activities.

After

a

four year period of ample liquidity and lax credit standards in the markets

(to

which Bladex never subscribed, as evidenced by our pristine portfolio), we

are

experiencing a steady improvement in our intermediation margins. In addition,

current circumstances in the markets, while increasing the levels of volatility,

provide Bladex with attractive opportunities.

Events

in

the financial markets during the last few months compel me to state

unequivocally that Bladex is not afflicted with any of the types problems

impacting some segments of the international financial industry. The Bank’s

accounting records and information are simple, clear, transparent, and

reflective of the entirety of our business.

Regarding

our plans moving forward, further, steady improvement in ROE, while continuing

to strengthen the Bank’s growing core business, will remain the driving force

behind the management of the company. We will continue optimizing our business,

convinced that our valuation will reflect the unique value of our franchise,“

Mr. Rivera concluded.

CONSOLIDATED

RESULTS OF OPERATIONS

Net

Income

Yearly

Variation

For

2007,

net income amounted to $72.2 million, up $14.3 million, or 25% from the $57.9

million reported in 2006. This result reflects a $31.9 million, or 81%, increase

in operating income, which was mainly driven by the combination of a $11.7

million, or 20%, increase in net interest income (mostly from the Commercial

Division), $23.0 million in higher gains at Bladex Asset Management (“BAM”), and

$6.6 million on gains on sales in the available for sale investment

portfolio.

The

following graphs illustrate the percentage distribution of the Bank’s net

income:

Net

Income Distribution

The

following graphs illustrate the percentage distribution of the Bank’s operating

revenues:

Operating

Revenues

(1)

Distribution

|

|

(1)

|

Operating

revenues refers to net income excluding operating expenses, reversals

(provisions) for credit losses, and recoveries (impairment), on

assets.

|

Quarterly

Variation

Net

income for the fourth quarter 2007 amounted to $15.5 million, an increase of

$0.7 million, or 5%, from the third quarter 2007, and 26% below the level of

the

fourth quarter 2006. The increased net income figure in the fourth quarter

with

respect to the third quarter was mostly attributed to an increase in the

Commercial Division’s net interest income, in addition to the Treasury

Division’s higher net gains on the sale of securities available for sale. These

results were partially offset by an increase in operating expenses, and smaller

trading gains in Bladex Asset Management (“BAM”) operations.

The

26%

decrease in net income in the fourth quarter 2007 compared to the fourth quarter

2006 mostly reflects a one-time recovery on impaired assets that took place

in

2006, as well as higher generic provisions for credit losses, both of which

offset the 12% increase in operating income.

The

following graphs illustrate the percentage distribution of the Bank’s net

income:

Net

Income Distribution

NET

INTEREST INCOME AND MARGINS

The

table

below shows the Bank’s net interest income and net interest margin for the

periods indicated:

|

(In

US$ million, except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Net

Interest Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

Division

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accruing

portfolio

|

|

$

|

49.0

|

|

$

|

64.1

|

|

$

|

14.3

|

|

$

|

16.2

|

|

$

|

17.7

|

|

|

Non-accruing

portfolio

|

|

|

2.0

|

|

|

0.0

|

|

|

0.0

|

|

|

0.0

|

|

|

0.0

|

|

|

Commercial

Division

|

|

$

|

50.9

|

|

$

|

64.1

|

|

$

|

14.3

|

|

$

|

16.2

|

|

$

|

17.7

|

|

|

Treasury

Division

|

|

|

6.9

|

|

|

6.2

|

|

|

1.6

|

|

|

1.7

|

|

|

2.1

|

|

|

Bladex

Asset Management

|

|

|

1.0

|

|

|

0.2

|

|

|

0.8

|

|

|

(0.3

|

)

|

|

(0.7

|

)

|

|

Consolidated

|

|

$

|

58.8

|

|

$

|

70.6

|

|

$

|

16.7

|

|

$

|

17.6

|

|

$

|

19.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Interest Margin

(1)

|

|

|

1.76

|

%

|

|

1.71

|

%

|

|

1.76

|

%

|

|

1.65

|

%

|

|

1.69

|

%

|

(1)

Net interest income divided by average balance of interest-earning assets.

2007

vs. 2006

Net

interest income for 2007 totaled $70.6 million, up $11.7 million, or 20%, from

2006. The increase in net interest income was the result of higher average

balances in the loan portfolio (24%), and increased weighted average lending

spreads over Libor.

4Q07

vs. 3Q07

Net

interest income for the fourth quarter 2007 reached $19.1 million, an increase

of 9%, driven by higher average balances in the loan portfolio, and by increased

weighted average lending spreads over Libor, which led to an increase in the

net

interest margin (“NIM”).

FEES

AND COMMISSIONS

The

following table provides a breakdown of fees and commissions for the periods

indicated:

(In

US$

thousands)

|

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Letters

of credit

|

|

$

|

4,121

|

|

$

|

2,842

|

|

$

|

1,208

|

|

$

|

625

|

|

$

|

895

|

|

|

Guarantees

|

|

|

1,419

|

|

|

1,088

|

|

|

245

|

|

|

268

|

|

|

322

|

|

|

Loans

|

|

|

556

|

|

|

836

|

|

|

167

|

|

|

187

|

|

|

194

|

|

|

Other

(1)

|

|

|

297

|

|

|

789

|

|

|

101

|

|

|

93

|

|

|

171

|

|

|

Fees

and commissions, net

|

|

$

|

6,393

|

|

$

|

5,555

|

|

$

|

1,722

|

|

$

|

1,173

|

|

$

|

1,582

|

|

(1)

Net

of

commission expenses.

For

2007,

fees and commissions decreased 13%, or $838 thousand, mostly due to lower letter

of credit and guarantees activity during the first part of the year.

Fees

and

commissions for the fourth quarter 2007 increased 35%, or $409 thousand,

compared to the third quarter 2007, mostly due to the increased commission

income from increased letter of credit and guarantees activity during the latter

part of the year.

PORTFOLIO

QUALITY AND PROVISION FOR CREDIT LOSSES

As

of

December 31, 2007, the Bank had zero credits in non-accruing or past-due status.

The Bank has no exposure to the sub-prime or mortgage segments in any market,

nor does it carry any mono-line insurance risk. In addition, contingent

liabilities consist mainly of letters of credit, country risk guarantees and

loan commitments pertaining to the Bank’s traditional intermediation activities.

As

of

December 31, 2007, the allowance for credit losses amounted $83.4 million,

an

increase of $0.3 million from September 30, 2007, reflecting a $3.0 million

decrease in the generic allowance for loan losses, and a $3.2 million increase

in the generic reserve for off-balance sheet credits.

The

$3.0

million decrease in the allowance for loan losses was the result of both changes

in the trade mix of the loan portfolio and in the overall country risk profile.

The $3.2 million increase in the reserve for losses on off-balance credits

mostly reflects increased letter of credit exposure in higher risk markets.

As

of

December 31, 2007, the ratio of the allowance for credit losses to the

commercial portfolio was 1.9%, compared to 2.1% from September 30, 2007, and

2.2% as of December 31, 2006.

The

following table depicts information regarding the allowance for credit losses,

for the dates indicated:

(In

US$

million)

|

|

|

31DEC06

|

|

31MAR07

|

|

30JUN07

|

|

30SEP07

|

|

31DEC07

|

|

|

Allowance

for loan losses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At

beginning of period

|

|

$

|

49.8

|

|

$

|

51.3

|

|

$

|

56.6

|

|

$

|

69.0

|

|

$

|

72.6

|

|

|

Provisions

|

|

|

1.5

|

|

|

5.4

|

|

|

6.2

|

|

|

3.4

|

|

|

(3.0

|

)

|

|

Recoveries

|

|

|

0.0

|

|

|

0.0

|

|

|

6.2

|

|

|

0.3

|

|

|

0.0

|

|

|

End

of period balance

|

|

$

|

51.3

|

|

$

|

56.6

|

|

$

|

69.0

|

|

$

|

72.6

|

|

$

|

69.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserve

for losses on off-balance sheet credit risk:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

at beginning of the period

|

|

$

|

30.1

|

|

$

|

27.2

|

|

$

|

21.0

|

|

$

|

13.5

|

|

|

10.5

|

|

|

Provisions

(reversals)

|

|

|

(2.9

|

)

|

|

(6.2

|

)

|

|

(7.6

|

)

|

|

(3.0

|

)

|

|

3.2

|

|

|

End

of period balance

|

|

$

|

27.2

|

|

$

|

21.0

|

|

$

|

13.5

|

|

$

|

10.5

|

|

$

|

13.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

allowance for credit losses

|

|

$

|

78.5

|

|

$

|

77.6

|

|

$

|

82.4

|

|

$

|

83.1

|

|

$

|

83.4

|

|

OPERATING

EXPENSES AND EFFICIENCY LEVEL

The

following table shows a breakdown of the operating expenses’ components for the

periods indicated:

|

(In US$

thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Salaries

and other employee expenses

|

|

$

|

16,826

|

|

$

|

22,049

|

|

$

|

5,806

|

|

$

|

4,865

|

|

$

|

6,687

|

|

|

Depreciation

and amortization

|

|

|

1,406

|

|

|

2,556

|

|

|

547

|

|

|

621

|

|

|

668

|

|

|

Professional

services

|

|

|

2,671

|

|

|

3,562

|

|

|

699

|

|

|

593

|

|

|

1,006

|

|

|

Maintenance

and repairs

|

|

|

1,000

|

|

|

1,188

|

|

|

175

|

|

|

249

|

|

|

370

|

|

|

Other

operating expenses

|

|

|

7,026

|

|

|

7,673

|

|

|

2,034

|

|

|

2,326

|

|

|

1,796

|

|

|

Total

Operating Expenses

|

|

$

|

28,929

|

|

$

|

37,027

|

|

$

|

9,261

|

|

$

|

8,652

|

|

$

|

10,527

|

|

2007

vs. 2006

Operating

expenses increased by $8.1 million, or 28%, principally due to:

|

|

1.

|

$5.2

million increase in salaries and other employee expenses driven mostly

by:

|

|

|

a.

|

$3.0

million increase in performance-based variable compensation for the

Bank's

proprietary asset management team;

|

|

|

b.

|

$0.7

million related to senior management’s stock compensation plan;

|

|

|

c.

|

$0.6

million associated with a one-time accrual of employee vacation provision;

and a

|

|

|

d.

|

$0.9

million increase in performance-based variable compensation provision

for

business lines other than proprietary asset management.

|

|

|

2.

|

$1.3

million increase in maintenance and depreciation expenses related

to the

new technology platform;

|

|

|

3.

|

$0.9

million increase in professional services, mostly due to legal expenses

and the renewal of the Bank’s EMTN Program; and

a

|

|

|

4.

|

$0.6

million increase in expenses related to marketing and business travel.

|

Year-over-year,

efficiency levels improved once again as revenue growth exceeded expense growth:

4Q07

vs. 3Q07

The

$1.9

million increase in operating expenses was mostly driven by higher stock option

compensation for the Bank’s senior management, a one-time accrual employee

vacation provision and higher legal expenses. These were partially offset by

a

one-time decrease in ‘other’ operating expenses.

PERFORMANCE

AND CAPITAL RATIOS

The

following table shows capital amounts and ratios at the dates indicated:

|

(US$

million, except percentages)

|

|

|

|

|

|

|

|

|

|

|

31DEC06

|

|

30SEP07

|

|

31DEC07

|

|

|

Tier

1 Capital

|

|

$

|

584

|

|

$

|

614

|

|

$

|

612

|

|

|

Total

Capital

|

|

$

|

614

|

|

$

|

650

|

|

$

|

649

|

|

|

Risk-weighted

assets

|

|

$

|

2,388

|

|

$

|

2,850

|

|

$

|

2,927

|

|

|

Tier

1 Capital Ratio

(*)

|

|

|

24.4

|

%

|

|

21.6

|

%

|

|

20.9

|

%

|

|

Total

Capital Ratio

(*)

|

|

|

25.7

|

%

|

|

22.8

|

%

|

|

22.2

|

%

|

|

Leverage

ratio (capital / total assets)

|

|

|

14.7

|

%

|

|

13.8

|

%

|

|

12.8

|

%

|

(*)

Ratios are calculated based on U.S. Federal Reserve Board and Basel I

capital adequacy guidelines.

The

following table sets forth the annualized return on average assets, operating

return on average stockholders’ equity, and return on average stockholders’

equity for the periods indicated:

|

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

ROA

(return on average assets)

|

|

|

1.7

|

%

|

|

1.7

|

%

|

|

2.2

|

%

|

|

1.4

|

%

|

|

1.3

|

%

|

|

Operating

ROE (operating return on average stockholders’ equity)

|

|

|

6.8

|

%

|

|

11.7

|

%

|

|

9.7

|

%

|

|

9.9

|

%

|

|

10.1

|

%

|

|

ROE

(return on average stockholders’ equity)

|

|

|

10.0

|

%

|

|

11.9

|

%

|

|

14.5

|

%

|

|

9.6

|

%

|

|

9.9

|

%

|

BUSINESS

SEGMENT ANALYSIS

Commercial

Division

The

Commercial Division incorporates the Bank’s financial intermediation and fee

generation activities. Operating income from the Commercial Division includes

net interest income from loans, fee income, net of allocated operating expenses.

The

following table shows the Operating income components of the Commercial Division

for the periods indicated:

|

(US$

million)

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Commercial

Division:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

$

|

50.9

|

|

$

|

64.1

|

|

$

|

14.3

|

|

$

|

16.2

|

|

$

|

17.7

|

|

|

Non-interest

operating income

|

|

|

6.4

|

|

|

5.3

|

|

|

1.7

|

|

|

1.1

|

|

|

1.5

|

|

|

Operating

revenues

|

|

$

|

57.4

|

|

$

|

69.5

|

|

$

|

16.0

|

|

$

|

17.4

|

|

$

|

19.2

|

|

|

Operating

expenses

|

|

|

(23.7

|

)

|

|

(27.2

|

)

|

|

(7.4

|

)

|

|

(6.6

|

)

|

|

(7.7

|

)

|

|

Operating

income

|

|

$

|

33.7

|

|

$

|

42.3

|

|

$

|

8.6

|

|

$

|

10.8

|

|

$

|

11.4

|

|

Yearly

Variation

For

2007,

the Commercial Division’s operating income amounted to $42.3 million, an

increase of 25% compared to 2006, reflecting a 26% increase in net interest

income, the result of a 24% increase in the average loan portfolio and higher

weighted average lending spreads over Libor. Excluding the impact of 2006

net

revenues from the impaired portfolio, operating income increased 35%. The

Bank

no longer carries any impaired credits on its books, and thus, did not

recognized revenues from such assets in 2007.

Quarterly

Variation

Operating

income from the Commercial Division for the fourth quarter 2007 reached $11.4

million, a 6% increase compared to the third quarter 2007. This increase

was

primarily attributed to a 9% increase in net interest income, driven by a

6%

increase in the average loan portfolio and by higher weighted average lending

spreads over Libor. Compared to the fourth quarter 2006, operating income

from

the Commercial Division increased 33%, primarily due to a 24% increase in

net

interest income, driven by higher average loan balances and lending spreads.

As

of

December 31, 2007, the Bank’s commercial portfolio totaled $4.3 billion, up 6%

from September 30, 2007, and up 18% from December 31, 2006.

The

Bank’s average commercial portfolio for the fourth quarter 2007 was $4.2

billion, 6% higher than the prior quarter. The following graph shows the

average

commercial portfolio for the periods indicated:

See

Exhibit X for information related to the Bank’s commercial portfolio

distribution by country.

During

the fourth quarter 2007, the Bank disbursed $1.9 billion. Please refer to

Exhibit XII for the Bank’s distribution of credit disbursements by country.

As

of

December 31, 2007, the corporate market segment represented 49% of the Bank’s

total commercial portfolio, compared to 50% as of September 30, 2007, and

45% a

year ago. On December 31, 2007, 68% of the corporate portfolio represented

trade

financing.

The

commercial portfolio as a whole continues to be short-term and trade-related

in

nature, with 69% maturing within one year, and 63% representing trade financing

operations.

Treasury

Division

The

Treasury Division incorporates the Bank’s investment securities activity.

Operating income from the Treasury Division is presented net of allocated

operating expenses, and includes net interest income on investment securities,

gains and losses on derivatives and hedging activities, as well as the sale

of

securities and foreign currency exchange transactions.

The

following table shows the Operating income components of the Treasury Division

for the periods indicated:

|

(US$

million)

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Treasury

Division:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

$

|

6.9

|

|

$

|

6.2

|

|

$

|

1.6

|

|

$

|

1.7

|

|

$

|

2.1

|

|

|

Non-interest

operating income

|

|

|

2.1

|

|

|

8.5

|

|

|

0.0

|

|

|

0.0

|

|

|

2.2

|

|

|

Operating

revenues

|

|

$

|

9.0

|

|

$

|

14.7

|

|

$

|

1.7

|

|

$

|

1.7

|

|

$

|

4.3

|

|

|

Operating

expenses

|

|

|

(3.4

|

)

|

|

(4.3

|

)

|

|

(1.1

|

)

|

|

(0.9

|

)

|

|

(1.5

|

)

|

|

Operating

income

|

|

$

|

5.6

|

|

$

|

10.3

|

|

$

|

0.6

|

|

$

|

0.8

|

|

$

|

2.8

|

|

Yearly

Variation

For

2007,

the Treasury Division’s operating income amounted to $10.3 million, compared to

$5.6 million in 2006, driven by higher gains in the available for sale

portfolio.

Quarterly

Variation

During

the fourth quarter 2007, operating income from the Treasury Division amounted

to

$2.8 million, compared to $0.8 million in the third quarter 2007. The $2.1

million quarterly increase was mostly due to higher gains on the sale of

securities available for sale.

Compared

to the fourth quarter 2006, operating income from the Treasury Division

increased by $2.3 million, mostly due to increased net interest income and

higher gains on the sale of securities available for sale.

Bladex

Asset Management

Bladex

Asset Management (“BAM”) incorporates the Bank’s proprietary asset management

activities. Operating income from BAM is presented net of allocated operating

expenses, and includes net interest income on trading securities, as well

as

trading gains and losses.

|

(US$

million)

|

|

2006

|

|

2007

|

|

4Q06

|

|

3Q07

|

|

4Q07

|

|

|

Bladex

Asset Management:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

|

1.0

|

|

|

0.2

|

|

|

0.8

|

|

|

(0.3

|

)

|

|

(0.7

|

)

|

|

Non-interest

operating income

|

|

|

0.9

|

|

|

23.9

|

|

|

4.8

|

|

|

5.1

|

|

|

3.5

|

|

|

Operating

revenues

|

|

$

|

1.9

|

|

$

|

24.1

|

|

$

|

5.7

|

|

$

|

4.8

|

|

$

|

2.8

|

|

|

Operating

expenses

|

|

|

(1.9

|

)

|

|

(5.5

|

)

|

|

(0.8

|

)

|

|

(1.1

|

)

|

|

(1.3

|

)

|

|

Operating

income

|

|

$

|

0.0

|

|

$

|

18.6

|

|

$

|

4.9

|

|

$

|

3.7

|

|

$

|

1.5

|

|

Yearly

Variation

For

2007,

BAM’s operating income amounted to $18.6 million, reflecting higher gains from

asset management activities.

Quarterly

Variation

During

the fourth quarter 2007, operating income from BAM amounted to $1.5 million,

compared to $3.7 million in the third quarter 2007. The $2.2 million quarterly

decrease in operating income was mostly due to lower trading gains on the

Bank’s

proprietary asset management activity.

Compared

to the fourth quarter 2006, operating income from BAM decreased $3.4 million

(69%), mostly due to decreased net interest income, lower trading gains,

and

increased operating expenses mostly related to performance based variable

compensation for the asset management team.

Securities

Portfolio, Deposits and Liquidity

The

securities portfolio (including investment securities available for sale,

securities held to maturity and trading securities) totaled $521 million,

a 2%

increase from September 30, 2007. As of December 31, 2007, the securities

portfolio represented 11% of the Bank’s total credit portfolio, and consisted of

Latin American securities (please refer to Exhibit XI for a per country

distribution of the investment securities in the available for sale

portfolio).

The

available for sale portfolio includes all interest rate swaps converting

the

underlying instruments to floating rate in order to avoid interest rate risk.

Furthermore, the available for sale portfolio is mark-to-market and the impact

is reflected on the capital through the other comprehensive income account.

As

of

December 31, 2007, deposit balances were $1.5 billion, a $14 million (1%)

increase over the previous quarter, and $406 million (38%) higher than on

December 31, 2006.

In

response to market conditions, the Bank strengthened its liquidity during

the

quarter, as reflected in the liquidity ratio (liquid assets / total assets),

which increased from 7.3% to 8.4% (the Bank excludes cash balances at its

proprietary asset management activity from its liquidity management and ratios).

OTHER

EVENTS

|

|

Fourth

Quarter - Common Dividend Payment:

On

January 17, 2008, the Bank paid a regular quarterly dividend of

US$0.22

per share pertaining to the fourth quarter to stockholders of record

as of

January 7, 2008.

|

|

|

Bladex’s

ratings upgraded to “Baa2” by Moody’s:

On

December 21, 2007, Moody’s Investor Services upgraded the Company’s long

term foreign currency deposit, debt and issuer ratings to Baa2

from Baa3

and raised the Bank’s financial strength ratings to C- from D+.

|

|

|

New

Chief Financial Officer Appointment:

Effective

February 22, 2008, the Bank appointed Mr. Jaime Celorio as its

Chief

Financial Officer, replacing Mr. Carlos Yap, who is retiring from

the

company after 27 years of distinguished service. Mr. Celorio will

be

responsible for the Bank’s financial management, as well as for the

interaction with rating agencies, the sell-side community, and

investors.

Mr. Celorio was previously Chief Financial Officer and Chief

Administrative Officer for Merrill Lynch Mexico S.A. de C.V.

|

Contact

Information:

Mr.

Jaime

Celorio

Chief

Financial Officer

Tel:

(507) 210-8630

Fax:

(507) 269-6333

e-mail

address: jcelorio@bladex.com

Note:

Various

numbers and percentages set forth in this press release have been rounded

and,

accordingly, may not total exactly.

SAFE

HARBOR STATEMENT

This

press release contains forward-looking statements of expected future

developments. The Bank wishes to ensure that such statements are accompanied

by

meaningful cautionary statements pursuant to the safe harbor established

by the

Private Securities Litigation Reform Act of 1995. The forward-looking statements

in this press release refer to the growth of the credit portfolio, including

the

trade portfolio, the increase in the number of the Bank’s corporate clients, the

positive trend of lending spreads, the increase in activities engaged in

by the

Bank that are derived from the Bank’s client base,

anticipated

operating income and return on equity in future periods, including income

derived from the Treasury Division,

the

improvement in the financial and performance strength of the Bank and the

progress the Bank is making. These forward-looking statements reflect the

expectations of the Bank’s management and are based on currently available data;

however, actual experience with respect to these factors is subject to future

events and uncertainties, which could materially impact the Bank’s expectations.

Among the factors that can cause actual performance and results to differ

materially are as follows:

the

anticipated growth of the Bank’s credit portfolio; the continuation of the

Bank’s preferred creditor status; the impact of increasing interest rates and

of

improving macroeconomic environment in the Region on the Bank’s financial

condition; the execution of the Bank’s strategies and initiatives, including its

revenue diversification strategy; the adequacy of the Bank’s allowance for

credit losses; the need for additional provisions for credit losses; the

Bank’s

ability to achieve future growth, to reduce its liquidity levels and increase

its leverage; the Bank’s ability to maintain its investment-grade credit

ratings; the availability and mix of future sources of funding for the Bank’s

lending operations; potential trading losses; the possibility of fraud; and

the

adequacy of the Bank’s sources of liquidity to replace large deposit

withdrawals.

About

Bladex

Bladex

is

a supranational bank originally established by the Central Banks of Latin

American and Caribbean countries to support trade finance in the Region.

Based

in Panama, its shareholders include central banks and state-owned entities

in 23

countries in the Region, as well as Latin American and international commercial

banks, along with institutional and retail investors. Through December 31,

2007,

Bladex had disbursed accumulated credits of over $152 billion.

Conference

Call Information

There

will be a conference call to discuss the Bank’s quarterly results on Wednesday,

February 20, 2008, at 11:00 a.m., New York City time (Eastern Time). For

those

interested in participating, please dial (888) 335-5539 in the United States

or,

if outside the United States, (973) 582-2857. Participants should use conference

ID# 33441861, and dial in five minutes before the call is set to begin. There

will also be a live audio webcast of the conference at

www.bladex.com

.

The

conference call will become available for review on Conference Replay one

hour

after its conclusion, and will remain available through February 27, 2008.

Please dial (800) 642-1687 or (706) 645-9291, and follow the instructions.

The

Conference ID# for the replayed call is 33441861.

For

more

information, please access

www.bladex.com

or

contact:

Mr.

Carlos Yap

Chief

Financial Officer

Bladex

Calle

50

y Aquilino de la Guardia

P.O.

Box:

0819-08730

Panama

City, Panama

Tel:

(507) 210-8563

Fax:

(507) 269-6333

e-mail

address: cyap@bladex.com

Investor

Relations Firm:

i-advize

Corporate Communications, Inc.

Mrs.

Melanie Carpenter / Mr. Peter Majeski

82

Wall

Street, Suite 805

New

York,

NY 10005

Tel:

(212) 406-3690

e-mail

address: bladex@i-advize.com

CONSOLIDATED

BALANCE SHEETS

|

|

|

AT

THE END OF,

|

|

|

|

|

|

|

|

|

|

|

|

|

(A)

|

|

(B)

|

|

(C)

|

|

(C)

- (B)

|

|

|

|

(C)

- (A)

|

|

|

|

|

|

|

Dec

31, 2006

|

|

Sep

30, 2007

|

|

Dec

31, 2007

|

|

CHANGE

|

|

%

|

|

CHANGE

|

|

%

|

|

|

|

|

(In

US$ million)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

and due from banks

|

|

$

|

332

|

|

$

|

441

|

|

$

|

478

|

|

$

|

37

|

|

|

8

|

%

|

$

|

145

|

|

|

44

|

%

|

|

Trading

assets

|

|

|

130

|

|

|

50

|

|

|

53

|

|

|

3

|

|

|

5

|

|

|

(77

|

)

|

|

(60

|

)

|

|

Securities

available for sale

|

|

|

346

|

|

|

469

|

|

|

468

|

|

|

(0

|

)

|

|

(0

|

)

|

|

122

|

|

|

35

|

|

|

Securities

held to maturity

|

|

|

125

|

|

|

0

|

|

|

0

|

|

|

0

|

|

|

0

|

|

|

(125

|

)

|

|

(100

|

)

|

|

Loans

|

|

|

2,981

|

|

|

3,495

|

|

|

3,732

|

|

|

237

|

|

|

7

|

|

|

751

|

|

|

25

|

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance

for loan losses

|

|

|

(51

|

)

|

|

(73

|

)

|

|

(70

|

)

|

|

3

|

|

|

(4

|

)

|

|

(18

|

)

|

|

36

|

|

|

Unearned

income and deferred loan fees

|

|

|

(4

|

)

|

|

(6

|

)

|

|

(6

|

)

|

|

(0

|

)

|

|

7

|

|

|

(2

|

)

|

|

35

|

|

|

Loans,

net

|

|

|

2,925

|

|

|

3,416

|

|

|

3,656

|

|

|

240

|

|

|

7

|

|

|

731

|

|

|

25

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customers'

liabilities under acceptances

|

|

|

46

|

|

|

4

|

|

|

9

|

|

|

5

|

|

|

136

|

|

|

(37

|

)

|

|

(80

|

)

|

|

Premises

and equipment, net

|

|

|

11

|

|

|

10

|

|

|

10

|

|

|

0

|

|

|

3

|

|

|

(1

|

)

|

|

(9

|

)

|

|

Accrued

interest receivable

|

|

|

55

|

|

|

53

|

|

|

63

|

|

|

10

|

|

|

19

|

|

|

8

|

|

|

14

|

|

|

Other

assets

|

|

|

7

|

|

|

11

|

|

|

54

|

|

|

42

|

|

|

380

|

|

|

46

|

|

|

636

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

|

$

|

3,978

|

|

$

|

4,454

|

|

$

|

4,791

|

|

$

|

337

|

|

|

8

|

%

|

$

|

812

|

|

|

20

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand

|

|

$

|

132

|

|

$

|

93

|

|

$

|

111

|

|

$

|

18

|

|

|

20

|

%

|

|

($21

|

)

|

|

(16

|

)

|

|

Time

|

|

|

924

|

|

|

1,355

|

|

|

1,351

|

|

|

(4

|

)

|

|

(0

|

)

|

|

427

|

|

|

46

|

|

|

Total

Deposits

|

|

|

1,056

|

|

|

1,448

|

|

|

1,462

|

|

|

14

|

|

|

1

|

|

|

406

|

|

|

38

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading

liabilities

|

|

|

55

|

|

|

11

|

|

|

91

|

|

|

80

|

|

|

747

|

|

|

36

|

|

|

66

|

|

|

Securities

sold under repurchase agreements

|

|

|

438

|

|

|

364

|

|

|

283

|

|

|

(81

|

)

|

|

(22

|

)

|

|

(155

|

)

|

|

(35

|

)

|

|

Short-term

borrowings

|

|

|

1,157

|

|

|

966

|

|

|

1,221

|

|

|

255

|

|

|

26

|

|

|

64

|

|

|

6

|

|

|

Long-term

debt and borrowings

|

|

|

559

|

|

|

937

|

|

|

1,010

|

|

|

74

|

|

|

8

|

|

|

451

|

|

|

81

|

|

|

Acceptances

outstanding

|

|

|

46

|

|

|

4

|

|

|

9

|

|

|

5

|

|

|

136

|

|

|

(37

|

)

|

|

(80

|

)

|

|

Accrued

interest payable

|

|

|

28

|

|

|

38

|

|

|

39

|

|

|

1

|

|

|

3

|

|

|

11

|

|

|

38

|

|

|

Reserve

for losses on off-balance sheet credit risk

|

|

|

27

|

|

|

10

|

|

|

14

|

|

|

3

|

|

|

31

|

|

|

(13

|

)

|

|

(50

|

)

|

|

Other

liabilities

|

|

|

27

|

|

|

61

|

|

|

48

|

|

|

(13

|

)

|

|

(21

|

)

|

|

21

|

|

|

76

|

|

|

TOTAL

LIABILITIES

|

|

$

|

3,394

|

|

$

|

3,839

|

|

$

|

4,178

|

|

$

|

339

|

|

|

9

|

%

|

$

|

784

|

|

|

23

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS'

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

stock, no par value, assigned value of US$6.67

|

|

|

280

|

|

|

280

|

|

|

280

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

paid-in capital in exces of assigned value

|

|

|

135

|

|

|

135

|

|

|

135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

reserves

|

|

|

95

|

|

|

95

|

|

|

95

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained

earnings

|

|

|

205

|

|

|

238

|

|

|

245

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

other comprehensive income (loss)

|

|

|

3

|

|

|

(0

|

)

|

|

(10

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasury

stock

|

|

|

(135

|

)

|

|

(134

|

)

|

|

(134

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

STOCKHOLDERS' EQUITY

|

|

$

|

584

|

|

$

|

614

|

|

$

|

612

|

|

|

($2

|

)

|

|

(0

|

)%

|

$

|

28

|

|

|

5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$

|

3,978

|

|

$

|

4,454

|

|

$

|

4,791

|

|

$

|

337

|

|

|

8

|

%

|

$

|

812

|

|

|

20

|

%

|

CONSOLIDATED

STATEMENTS OF INCOME

|

|

|

FOR

THE THREE

MONTHS

ENDED

|

|

|

|

|

|

|

|

|

|

|

|

|

(A)

|

|

(B)

|

|

(C)

|

|

(C)

- (B)

|

|

|

|

(C)

- (A)

|

|

|

|

|

|

|

Dec

31, 2006

|

|

Sep

30, 2007

|

|

Dec

31, 2007

|

|

CHANGE

|

|

%

|

|

CHANGE

|

|

%

|

|

|

|

|

(In

US$ thousand, except per share data)

|

|

|

|

|

|

|

|

|

|

|

INCOME

STATEMENT DATA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

income

|

|

$

|

63,016

|

|

$

|

68,641

|

|

$

|

71,992

|

|

$

|

3,350

|

|

|

5

|

%

|

$

|

8,976

|

|

|

14

|

%

|

|

Interest

expense

|

|

|

(46,278

|

)

|

|

(51,020

|

)

|

|

(52,864

|

)

|

|

(1,845

|

)

|

|

4

|

|

|

(6,586

|

)

|

|

14

|

|

|

NET

INTEREST INCOME

|

|

|

16,738

|

|

|

17,622

|

|

|

19,127

|

|

|

1,506

|

|

|

9

|

|

|

2,390

|

|

|

14

|

|

|

Reversal

(provision) for loan losses

|

|

|

(1,526

|

)

|

|

(3,384

|

)

|

|

2,980

|

|

|

6,364

|

|

|

(188

|

)

|

|

4,506

|

|

|

(295

|

)

|

|

NET

INTEREST INCOME AFTER REVERSAL (PROVISION) FOR LOAN LOSSES

|

|

|

15,212

|

|

|

14,237

|

|

|

22,107

|

|

|

7,870

|

|

|

55

|

|

|

6,895

|

|

|

45

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER

INCOME (EXPENSE):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reversal

(provision) for losses on off-balance sheet credit risk

|

|

|

2,949

|

|

|

2,964

|

|

|

(3,235

|

)

|

|

(6,198

|

)

|

|

(209

|

)

|

|

(6,183

|

)

|

|

(210

|

)

|

|

Fees

and commissions, net

|

|

|

1,722

|

|

|

1,173

|

|

|

1,582

|

|

|

409

|

|

|

35

|

|

|

(140

|

)

|

|

(8

|

)

|

|

Derivatives

and hedging activities

|

|

|

115

|

|

|

(294

|

)

|

|

(212

|

)

|

|

82

|

|

|

(28

|

)

|

|

(327

|

)

|

|

(284

|

)

|

|

Recoveries

on assets

|

|

|

5,551

|

|

|

0

|

|

|

0

|

|

|

0

|

|

|

nm

|

(*)

|

|

(5,551

|

)

|

|

(100

|

)

|

|

Trading

gains

|

|

|

4,849

|

|

|

5,104

|

|

|

3,475

|

|

|

(1,628

|

)

|

|

(32

|

)

|

|

(1,373

|

)

|

|

28

|

|

|

Net

gains on sale of securities available for sale

|

|

|

0

|

|

|

288

|

|

|

2,226

|

|

|

1,937

|

|

|

672

|

|

|

2,226

|

|

|

nm

|

(*)

|

|

Gain

(loss) on foreign currency exchange

|

|

|

(67

|

)

|

|

(9

|

)

|

|

181

|

|

|

190

|

|

|

(2,006

|

)

|

|

248

|

|

|

369

|

|

|

Other

income (expense), net

|

|

|

0

|

|

|

17

|

|

|

(64

|

)

|

|

(81

|

)

|

|

(481

|

)

|

|

(64

|

)

|

|

nm

|

(*

)

|

|

NET

OTHER INCOME (EXPENSE)

|

|

|

15,118

|

|

|

9,242

|

|

|

3,954

|

|

|

(5,289

|

)

|

|

(57

|

)

|

|

(11,165

|

)

|

|

(74

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING

EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries

and other employee expenses

|

|

|

(5,806

|

)

|

|

(4,865

|

)

|

|

(6,687

|

)

|

|

(1,822

|

)

|

|

37

|

|

|

(881

|

)

|

|

15

|

|

|

Depreciation

and amortization of premises and equipment

|

|

|

(547

|

)

|

|

(621

|

)

|

|

(668

|

)

|

|

(48

|

)

|

|

8

|

|

|

(122

|

)

|

|

22

|

|

|

Professional

services

|

|

|

(699

|

)

|

|

(593

|

)

|

|

(1,006

|

)

|

|

(413

|

)

|

|

70

|

|

|

(307

|

)

|

|

44

|

|

|

Maintenance

and repairs

|

|

|

(175

|

)

|

|

(249

|

)

|

|

(370

|

)

|

|

(121

|

)

|

|

49

|

|

|

(195

|

)

|

|

111

|

|

|

Other

operating expenses

|

|

|

(2,034

|

)

|

|

(2,326

|

)

|

|

(1,796

|

)

|

|

530

|

|

|

(23

|

)

|

|

238

|

|

|

(12

|

)

|

|

TOTAL

OPERATING EXPENSES

|

|

|

(9,261

|

)

|

|

(8,652

|

)

|

|

(10,527

|

)

|

|

(1,875

|

)

|

|

22

|

|

|

(1,266

|

)

|

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

INCOME

|

|

$

|

21,070

|

|

$

|

14,827

|

|

$

|

15,534

|

|

$

|

707

|

|

|

5

|

%

|

|

($5,536

|

)

|

|

(26

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER

COMMON SHARE DATA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income per share

|

|

|

0.58

|

|

|

0.41

|

|

|

0.43

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

earnings per share

|

|

|

0.57

|

|

|

0.41

|

|

|

0.43

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

basic shares

|

|

|

36,329

|

|

|

36,363

|

|

|

36,370

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

diluted shares

|

|

|

36,853

|

|

|

36,411

|

|

|

36,367

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE

RATIOS:

|

|

|

|