false

0001843714

0001843714

2023-12-19

2023-12-19

0001843714

WNNR:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemablePublicWarrantMember

2023-12-19

2023-12-19

0001843714

WNNR:ClassOrdinaryShares0.0001ParValueMember

2023-12-19

2023-12-19

0001843714

WNNR:PublicWarrantsEachWholeWarrantExercisableForOneClassaOrdinaryShareEachAtExercisePriceOf11.50PerShareMember

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 19, 2023

Andretti Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Cayman Islands |

001-41218 |

98-1578373 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

|

7615 Zionsville Road

Indianapolis, Indiana 46268 |

| (Address of principal executive offices, including zip code) |

(317)

872-2700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Units, each consisting of one Class A ordinary share, $0.0001 par value,

and one-half of one redeemable public warrant |

|

WNNR.U |

|

New York Stock Exchange |

| Class A ordinary shares, $0.0001 par value |

|

WNNR |

|

New York Stock Exchange |

| Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

WNNR WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 | Entry into a Material Definitive Agreement. |

The Lincoln Park Transactions

As previously disclosed, on September 6, 2023, Andretti Acquisition

Corp. (“Andretti”) entered into a business combination agreement with Tigre Merger Sub, Inc., a wholly owned subsidiary of

Andretti (“Merger Sub”) and Zapata Computing, Inc. (“Zapata”), pursuant to which a business combination between

Andretti and Zapata will be effected through the merger of Merger Sub with and into Zapata, with Zapata surviving the merger as a wholly

owned subsidiary of Andretti (such transaction, the “Business Combination” and the parent company following completion of

the Business Combination, the “Surviving Company”).

On December 19, 2023, Andretti and Zapata entered into a purchase

agreement (the “Lincoln Park Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”) pursuant

to which Lincoln Park has agreed to purchase from the Surviving Company, at the option the Surviving Company, up to $75,000,000 of shares

of common stock, par value $0.0001 per share, of the Surviving Company (“New Company Common Stock”) from time to time over

a 36-month period following the closing of the Business Combination (the “Closing”) and upon the satisfaction of certain other

conditions set forth in the Lincoln Park Purchase Agreement. The Lincoln Park Purchase Agreement is subject to certain limitations including,

but not limited to, the filing and effectiveness of the registration statement covering shares of New Company Common Stock that are issuable

to Lincoln Park under the Lincoln Park Purchase Agreement (the “Lincoln Park Registration Statement”). Pursuant to the Lincoln

Park Purchase Agreement, the Surviving Company will pay Lincoln Park a commitment fee of $1,687,500 (the “Commitment Fee”)

as follows: (i) on the business day prior to the filing of the Lincoln Park Registration Statement, $562,500 in shares of New Company

Common Stock and (ii) on the business day prior to the filing of the Lincoln Park Registration Statement, the Surviving Company may elect

to pay the remaining $1,125,000 amount of the Commitment Fee in either cash or shares of New Company Common Stock. The Lincoln Park Purchase

Agreement further provides that the Surviving Company may not issue any securities pursuant to the Lincoln Park Purchase Agreement if

such issuance would reasonably be expected to result in a violation of the U.S. Securities Act of 1933, as amended (the “Securities

Act”) or a breach of the rules and regulations of the principal market on which the New Company Common Stock is traded.

In connection with the Lincoln Park Purchase Agreement, on December

19, 2023, Andretti and Zapata also entered into a Registration Rights Agreement (the “Lincoln Park Registration Rights Agreement”)

with Lincoln Park, pursuant to which the Surviving Company has agreed to file the Lincoln Park Registration Statement with the Securities

and Exchange Commission (the “SEC”) within forty-five (45) days following the Closing.

The foregoing description of the Lincoln Park Purchase Agreement

and Lincoln Park Registration Rights Agreement is a summary only, does not purport to be complete and is qualified in its entirety by

the full text of the Lincoln Park Purchase Agreement and the Lincoln Park Registration Rights Agreement, which are attached hereto as

Exhibit 10.1 and Exhibit 10.2, respectively, and are incorporated herein by reference.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

On December 20, 2023, Andretti Sponsor LLC, SOL Verano Blocker 1

LLC, Zakary C. Brown, James W. Keyes, Cassandra S. Lee, Gerald D. Putnam and John J. Romanelli, being the sole holders of Andretti’s

Class B ordinary shares, par value $0.0001 per share, acting by written consent in accordance with Andretti’s amended and restated

memorandum and articles of association, re-elected Michael M. Andretti, William J. Sandbrook, Zakary C. Brown, James W. Keyes, Cassandra

S. Lee, Gerald D. Putnam and John J. Romanelli to continue to serve as members of the board of directors of Andretti.

FORWARD-LOOKING STATEMENTS

Certain statements included in this Current Report on Form 8-K (the

“Current Report”), and certain oral statements made from time to time by representatives of Andretti or Zapata, that are not

historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate” “intend,” “expect,”

“should,” “would,” “plan,” “predict,” “potential,” “seem” “seek”

“future” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements

of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding estimates and forecasts of financial and performance metrics and projections of market opportunity. These statements

are based on various assumptions, whether or not identified in this Current Report, and on the current expectations of the management

of Zapata and Andretti, as the case may be, and are not predictions of actual performance. These forward-looking statements are provided

for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance,

a prediction or a definitive statement of fact or probability. Actual events and circumstances are beyond the control of Zapata and Andretti.

These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business,

market, financial, political and legal conditions, the inability of Zapata or Andretti to successfully or timely consummate the Business

Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions

that could adversely affect the expected benefits of the Business Combination, the occurrence of any event, change or other circumstances

that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination;

the outcome of any legal proceedings that may be instituted against Andretti, Zapata, the Surviving Company or others following the announcement

of the Business Combination and any definitive agreements with respect thereto; the inability to complete the Business Combination due

to the failure to obtain approval of the shareholders of Andretti, the ability to meet stock exchange listing standards following the

consummation of the Business Combination; the risk that the Business Combination disrupts current plans and operations of Zapata as a

result of the announcement and consummation of the Business Combination, failure to realize the anticipated benefits of the Business Combination,

risks related to the performance of Zapata’s business and the timing of expected business or revenue milestones, and the effects

of competition on Zapata’s business. If any of these risks materialize or our assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. In addition, forward-looking statements reflect Zapata’s

expectations, plans or forecasts of future events and views as of the date of this Current Report. Zapata anticipates that subsequent

events and developments will cause Zapata’s assessments to change. Neither Andretti nor Zapata undertakes or accepts any obligation

to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change

in events, conditions or circumstances on which any such statement is based. These forward-looking statements should not be relied upon

as representing Andretti’s or Zapata’s assessments of any date subsequent to the date of this Current Report. Accordingly,

undue reliance should not be placed upon the forward-looking statements.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the contemplated transaction, Andretti intends

to file a Registration Statement, which will include a proxy statement/prospectus, with the SEC. Additionally, Andretti will file other

relevant materials with the SEC in connection with the transaction. A definitive proxy statement/final prospectus will also be sent to

the shareholders of Andretti, seeking any required shareholder approval. This Current Report is not a substitute for the Registration

Statement, the definitive proxy statement/final prospectus, or any other document that Andretti will send to its shareholders. Before

making any voting or investment decision, investors and security holders of Andretti are urged to carefully read the entire Registration

Statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC as well as any

amendments or supplements to these documents, because they will contain important information about the transaction. Shareholders will

also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov. In addition,

the documents filed by Andretti may be obtained free of charge from Andretti at andrettiacquisition.com. Alternatively, these documents,

when available, can be obtained free of charge from Andretti upon written request to Andretti Acquisition Corp., 7615 Zionsville Road,

Indianapolis, Indiana 46268, or by calling (317) 872-2700. The information contained on, or that may be accessed through, the websites

referenced in this Current Report is not incorporated by reference into, and is not a part of, this Current Report.

PARTICIPANTS IN THE SOLICITATION

Andretti, Andretti’s sponsors, Zapata and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Andretti,

in connection with the Business Combination. Information regarding Andretti’s directors and executive officers is contained in Andretti’s

Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC. Additional information regarding the interests

of those participants, the directors and executive officers of Zapata and other persons who may be deemed participants in the transaction

may be obtained by reading the Registration Statement and the proxy statement/prospectus and other relevant documents filed with the SEC

when they become available. Free copies of these documents may be obtained as described above.

NO OFFER OR SOLICITATION

This Current Report is for informational purposes only and shall

not constitute a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of

the Business Combination. This Current Report shall also not constitute an offer to sell or a solicitation of an offer to buy any securities,

nor shall there be any sale, issuance, or transfer of securities in any state or jurisdiction in which such offer, solicitation, or sale

would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit |

|

Description |

| 10.1 |

|

Purchase Agreement, dated as of December 19, 2023, among Andretti Acquisition Corp., Zapata Computing, Inc. and Lincoln Park Fund, LLC (incorporated by reference to Exhibit 10.24 filed with Andretti’s registration statement on Form S-4 filed by Andretti on December 22, 2023). |

| |

|

| 10.2 |

|

Registration Rights Agreement, dated as of December 19, 2023, among Andretti Acquisition Corp., Zapata Computing, Inc. and Lincoln Park Fund, LLC (incorporated by reference to Exhibit 10.25 filed with Andretti’s registration statement on Form S-4 filed by Andretti on December 22, 2023). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 22, 2023

| |

ANDRETTI ACQUISITION CORP. |

|

| |

|

|

|

By: |

/s/ William M. Brown |

|

| |

|

Name: |

William M. Brown |

|

| |

|

Title: |

President and Chief Financial Officer |

|

v3.23.4

Cover

|

Dec. 19, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2023

|

| Entity File Number |

001-41218

|

| Entity Registrant Name |

Andretti Acquisition Corp.

|

| Entity Central Index Key |

0001843714

|

| Entity Tax Identification Number |

98-1578373

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

7615 Zionsville Road

|

| Entity Address, City or Town |

Indianapolis

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46268

|

| City Area Code |

317

|

| Local Phone Number |

872-2700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable public warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value,

and one-half of one redeemable public warrant

|

| Trading Symbol |

WNNR.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, $0.0001 par value |

|

| Title of 12(b) Security |

Class A ordinary shares, $0.0001 par value

|

| Trading Symbol |

WNNR

|

| Security Exchange Name |

NYSE

|

| Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Public warrants, each whole warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share

|

| Trading Symbol |

WNNR WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemablePublicWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_ClassOrdinaryShares0.0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WNNR_PublicWarrantsEachWholeWarrantExercisableForOneClassaOrdinaryShareEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

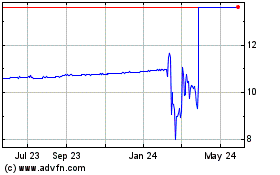

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From Apr 2024 to May 2024

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From May 2023 to May 2024