Ameriprise Looks To Match 2009 Broker Recruiting Level

February 05 2010 - 1:27PM

Dow Jones News

Ameriprise Financial Inc. (AMP) is hoping history repeats itself

in 2010.

The Minneapolis financial planner's Ameriprise Advisor Group,

which includes its employee brokers, added 550 financial advisers

from competitors in 2009 and is targeting a similar recruiting

tally this year.

Ameriprise is also paring down its lower-producing brokers as it

focuses more on hiring and retaining brokers who can generate more

revenue over time.

"We saw a slowdown [in recruiting] at the end of the third

quarter, but in the fourth quarter we saw activity pick up quite a

bit," said Dave Geschke, senior vice president of Ameriprise

Advisor Group, who oversees the western half of the U.S. for the

firm.

"In January we are back to red-hot again," he told Dow Jones

Newswires, referring to advisers interested in joining Ameriprise

from its rivals.

Ameriprise has benefited from major brokerages, or wirehouses,

focusing more on top-tier advisers and cutting back on those in

lower production brackets. The average broker at Ameriprise

produces between $300,000 and $500,000 in fees and commissions. By

contrast, three of the four wirehouses reported an average of

$600,000 to $800,000 in production for their respective brokerage

forces at the end of the fourth quarter.

However, Ameriprise is taking steps to boost the overall

productivity of its roughly 12,000 member advisory force. The firm

reduced its broker headcount by 4% year-over-year, cutting back on

those who failed to meet certain production benchmarks.

During a conference call with analysts Thursday, Ameriprise

Chief Financial Officer Walter Berman said "advisers must meet

productivity requirements and the vast majority of the departing

advisors had less than $50,000 in annual production."

During the call, Chairman and Chief Executive James Cracchiolo

said that because Ameriprise is eliminating these lower-producers,

the company will begin to see a "payback" from new recruits in

"probably two to three years" rather than five to seven.

In a note to clients Thursday, Sandler O'Neill analyst Edward

Shields wrote that while Ameriprise's expenses rose due to adviser

recruitment and technology, he expects those costs to drop as the

newly hired advisers begin to produce more.

Shields estimated that the wealth segment will boost

Ameriprise's pre-tax margin to 7% by year-end 2011 from the 2.3%

reported in the fourth quarter.

Ameriprise, which acquired H&R Block Inc.'s (HRB) advisory

force in 2008, slowed its recruiting efforts late last year as it

completed that integration and rolled out a new brokerage

platform.

Following the lead of its larger peers, the firm also paused in

its hiring of novice advisers in early 2009. Major brokerages laid

off rookie brokers to cut costs during the financial crisis as a

plunging stock market made it difficult for these advisers to meet

production goals.

Patrick O'Connell, senior vice president of Ameriprise Advisor

Group, who manages the Eastern half of the U.S., told Dow Jones the

company will "do a little novice hiring again in 2010, but

Ameriprise sees a tremendous opportunity to bring experienced

advisers to the firm."

While Ameriprise doesn't recruit high producers at the same

level as the wirehouses, the productivity of new recruits is 20%

higher than two years ago, a company spokesman said.

Geschke said Ameriprise is also seeing interest from top-tier

brokers, adding "we have had some $1 million producers come in here

too."

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

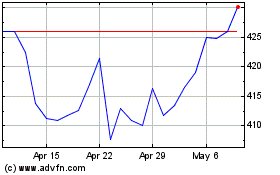

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024