false000182139300018213932023-09-132023-09-13

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 13, 2023 (September 8, 2023)

| | | | | |

THE AARON'S COMPANY, INC. |

(Exact name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Georgia | | 1-39681 | | 85-2483376 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 400 Galleria Parkway SE | Suite 300 | Atlanta | Georgia | | 30339-3194 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (678) 402-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.50 Par Value | AAN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of New Directors

On September 8, 2023, the Board of Directors (the “Board”) of The Aaron’s Company, Inc. (the “Company”) elected Ms. Kristine K. Malkoski and Mr.Wali Bacdayan to serve as independent directors of the Company, effective as of October 1, 2023, upon the recommendation of the Nominating and Corporate Governance Committee. Each new director has a term of office expiring at the 2024 annual meeting of shareholders.

Ms. Malkoski will also serve on the Audit Committee and Compensation Committee. Mr. Bacdayan will also serve on the Nominating and Corporate Governance Committee and Compensation Committee.

Ms. Malkoski and Mr. Bacdayan have no arrangements or understandings pursuant to which they were elected as directors and do not have any transactions reportable under Item 404(a) of Regulation S-K.

Ms. Malkoski and Mr. Bacdayan receive the standard compensation paid by the Company to non-employee directors for their service on the Board consisting of a $80,000 cash retainer and grant of $135,000 of restricted stock on the date of the Company's annual meeting of shareholders, vesting one-year following the date of the grant. Ms. Malkoski will receive additional cash retainers of $15,000 for her service on the Audit Committee and $10,000 for her service on the Compensation Committee. Mr. Bacdayan will receive additional cash retainers of $7,500 for his service on the Nominating and Corporate Governance Committee and $10,000 for his service on the Compensation Committee. The cash retainers are paid quarterly and new directors will receive a pro-rated amount for the quarter in which they become directors. Upon joining the Board, each of the new directors will also receive a one-time grant under the Company’s 2020 Equity and Incentive Plan of $135,000 of restricted stock units, vesting one-year following the date of grant. Ms. Malkoski and Mr. Bacdayan will also enter into an Indemnification Agreement with the Company, a form of which is filed as Exhibit 10.31 to the Company’s Annual Report on Form 10-K filed on March 1, 2023, and the terms of which are incorporated herein by reference.

The September 13, 2023 press release announcing the election of Ms. Malkoski and Mr. Bacdayan to the Company’s Board is attached hereto as Exhibit 99.1 and incorporated by reference.

Appointment of New Officer

Additionally, on September 8, 2023, the Board appointed Russell Falkenstein as Executive Vice President, Chief Operating Officer, Lease-to-Own of the Company, effective immediately.

Mr. Falkenstein, age 35, has served as Senior Vice President, Chief Strategy, Analytics and Development Officer at Aaron’s, LLC, a subsidiary of the Company, since 2021. He joined Aaron’s LLC in 2016 as Vice President, Corporate Initiatives and was promoted to Vice President, Financial Planning & Strategic Analytics and then to Senior Vice President, Finance & Accounting before taking on his previous role in 2021. Prior to joining Aaron’s LLC, Mr. Falkenstein was a Senior Associate in Alvarez & Marsal’s Turnaround and Restructuring Group. Mr. Falkenstein has a BBA from The George Washington University and an MBA from Northwestern University – Kellogg School of Management.

In connection with his appointment as Executive Vice President, Chief Operating Officer, Lease-to-Own, Mr. Falkenstein’s annual base salary will be increased to $500,000 as of the effective date and his target cash bonus for 2023 under the Company’s annual cash incentive program will be increased to $297,770. Beginning in 2024 he will be eligible for a target cash bonus of $350,000 under the Company’s annual cash incentive program and a target long term incentive award with a value of $650,000. Any performance-based incentive compensation will be subject to the Company’s Incentive-Based Compensation Recoupment Policy. Mr. Falkenstein will be entitled to severance

in accordance with the Company’s Executive Severance Pay Plan. Mr. Falkenstein also receives medical and other benefits consistent with the Company’s standard policies and is eligible to participate in other Company plans, as applicable.

Additionally, there are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Falkenstein and any of the Company’s executive officers or directors or any person nominated or chosen by the Company to become a director or executive officer. There is no arrangement or understanding between Mr. Falkenstein and any other person pursuant to which Mr. Falkenstein was appointed as Executive Vice President, Chief Operating Officer, Lease-to-Own of the Company. There are no transactions in which Mr. Falkenstein has an interest requiring disclosure under Item 404(a) of Regulation S-K.

The Company issued a press release on September 13, 2023, announcing the appointment of Mr. Falkenstein as the Company’s Executive Vice President, Chief Operating Officer, Lease-to-Own, a copy of which is attached to this Form 8-K as Exhibit 99.2.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

| | | | | |

Exhibit No. | Description |

| |

| |

| |

| |

Exhibit 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE AARON'S COMPANY, INC. |

| | By: | /s/ C. Kelly Wall |

Date: | September 13, 2023 | | C. Kelly Wall Chief Financial Officer |

AARON’S NAMES TWO NEW INDEPENDENT BOARD MEMBERS

ATLANTA (September 13, 2023) – The Aaron's Company, Inc. (NYSE: AAN), a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions, today announced the appointment of Wangdali (Wali) Bacdayan and Kristine (Kris) K. Malkoski to its Board of Directors effective on October 1, 2023.

"On behalf of the entire Board of Directors, I would like to welcome Wali and Kris as the newest members of the Aaron’s board,” said John Robinson, chair of The Aaron’s Company Board of Directors. “We believe their strong backgrounds and independence make them excellent additions to the board as it carries out its oversight responsibilities, and we look forward to their guidance as we continue to move Aaron's forward and deliver on our mission of enhancing people's lives by providing easy access to high-quality products through affordable lease and retail purchase options."

Wangdali (Wali) Bacdayan

Mr. Bacdayan is a private investor and entrepreneur. He also currently serves as a Venture Partner for Delta-v Capital, a technology-focused growth capital investment firm. In addition, he is the principal investor and co-founder of Millie’s Homemade Ice Cream and Southern Steer Franchising. Previously, Mr. Bacdayan was a co-founding managing principal of Incline Equity Partners. Before that, he was a partner at PNC Equity Partners and a financial analyst in the Mergers and Acquisitions Group of Dean Witter Reynolds Inc.

Mr. Bacdayan has served as a board director and investor for numerous privately held companies, serving currently as a director of Diamond Kinetics, Envirovac Holdings LLC, and WBX Commerce. He is currently a Trustee of Washington and Lee University and also serves as a board member of several non-profit and charitable organizations. Mr. Bacdayan holds a bachelor’s degree in economics and mathematics from Washington and Lee University, as well as an MBA from the Kellogg School of Management at Northwestern University.

Mr. Bacdayan will join the Compensation Committee and the Nominating and Corporate Governance Committee.

Kristine (Kris) K. Malkoski

Ms. Malkoski currently serves as Segment CEO, Learning & Development at Newell Brands, where she manages global brands including Graco, Sharpie, Paper Mate, Expo, Nuk, and Elmer’s. Ms. Malkoski also oversees Newell’s go-to-market actions in EMEA and Asian emerging markets and serves as a member of the Newell Executive Committee. Previously, Ms. Malkoski served as CEO, Americas for Arc International, a privately held company active in the food service, retail, and business-to-business industry segments. Prior to that, she was President and Chief Commercial Officer for World Kitchen, a private equity-owned company that made and distributed kitchenware products. Before that, she held senior positions at Sears Holdings Corporation, Ubiquity Brands, and Pharmaceutical Corporation of America. Ms. Malkoski began her career at Procter & Gamble, where she held a number of management and leadership roles.

Ms. Malkoski previously served on the boards of Fluidmaster, Trustmark Mutual Insurance Company, and Banfi Vineyards. She has also been active in non-profit organizations, previously serving as President of the Hinsdale Center for the Arts and President of the University of Cincinnati College Conservatory of Music and as a board member for the Cincinnati Ballet and CARE Women’s Advisory Committee. She currently serves on the board of the

University of Nebraska Foundation. Ms. Malkoski holds a bachelor's degree in journalism from the University of Nebraska.

Ms. Malkoski will join the Audit Committee and the Compensation Committee.

About The Aaron's Company, Inc.

Headquartered in Atlanta, The Aaron's Company, Inc. (NYSE: AAN) is a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions of appliances, electronics, furniture, and other home goods across its brands: Aaron's, BrandsMart U.S.A., BrandsMart Leasing, and Woodhaven. Aaron's offers a direct-to-consumer lease-to-own solution through its approximately 1,260 Company-operated and franchised stores in 47 states and Canada, as well as its e-commerce platform. BrandsMart U.S.A. is one of the leading appliance retailers in the country with ten retail stores in Florida and Georgia, as well as its e-commerce platform. BrandsMart Leasing offers lease-to-own solutions to customers of BrandsMart U.S.A. Woodhaven is the Company's furniture manufacturing division. For more information, visit investor.aarons.com, aarons.com, and brandsmartusa.com.

Aaron’s Contacts

Investor Relations

678-402-3590

InvestorRelations@aarons.com

Media Relations

678-402-3591

MediaRelations@aarons.com

###

AARON’S ANNOUNCES APPOINTMENT OF RUSSELL FALKENSTEIN TO EXECUTIVE VICE PRESIDENT, CHIEF OPERATING OFFICER, LEASE-TO-OWN

ATLANTA (September 13, 2023) – The Aaron's Company, Inc. (NYSE: AAN), a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions, today announced the appointment of Russell Falkenstein to the position of Executive Vice President, Chief Operating Officer, Lease-to-Own for the Company, effective immediately. In this new position, Falkenstein will oversee all lease-to-own operations at Aaron’s and BrandsMart Leasing.

"Congratulations to Russ on his well-deserved promotion,” said Douglas Lindsay, CEO of The Aaron’s Company. “Over the past several years, Russ has led a number of critical initiatives at our company, including being instrumental in transforming the Aaron’s go-to-market strategy to ensure that we provide our customers the best shopping and service experiences in the lease-to-own and retail markets that we serve. His extensive experience and exceptional leadership make him a valuable asset to our team, and we look forward to his continued success in his new role.”

Mr. Falkenstein has served as Senior Vice President, Chief Strategy, Analytics and Development Officer at Aaron’s, LLC, a subsidiary of the Company, since 2021. He joined Aaron’s, LLC in 2016 as Vice President, Corporate Initiatives and was promoted to Vice President, Financial Planning & Strategic Analytics and then to Senior Vice President, Finance & Accounting before taking on his previous role in 2021. Prior to joining Aaron’s, Mr. Falkenstein was a Senior Associate in Alvarez & Marsal’s Turnaround and Restructuring Group. Mr. Falkenstein earned his bachelor’s degree in business from The George Washington University and an MBA from the Kellogg School of Management at Northwestern University.

Mr. Falkenstein is active in the metro Atlanta community and serves on the board of directors of the Georgia Hispanic Chamber of Commerce as well as on the board of The Davis Academy. He was recently named to the Atlanta Business Chronicle’s 40 Under 40 listing for 2023, and earlier was selected to participate in Leadership Atlanta’s Class of 2024 program.

About The Aaron's Company, Inc.

Headquartered in Atlanta, The Aaron's Company, Inc. (NYSE: AAN) is a leading, technology-enabled, omnichannel provider of lease-to-own and retail purchase solutions of appliances, electronics, furniture, and other home goods across its brands: Aaron's, BrandsMart U.S.A., BrandsMart Leasing, and Woodhaven. Aaron's offers a direct-to-consumer lease-to-own solution through its approximately 1,260 Company-operated and franchised stores in 47 states and Canada, as well as its e-commerce platform. BrandsMart U.S.A. is one of the leading appliance retailers in the country with ten retail stores in Florida and Georgia, as well as its e-commerce platform. BrandsMart Leasing offers lease-to-own solutions to customers of BrandsMart U.S.A. Woodhaven is the Company's furniture manufacturing division. For more information, visit investor.aarons.com, aarons.com, and brandsmartusa.com.

Aaron’s Contacts

Investor Relations

678-402-3590

InvestorRelations@aarons.com

Media Relations

678-402-3591

MediaRelations@aarons.com

###

v3.23.2

Document and Entity Information Document

|

Sep. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 13, 2023

|

| Entity Registrant Name |

THE AARON'S COMPANY, INC.

|

| Entity Central Index Key |

0001821393

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

GA

|

| Entity File Number |

1-39681

|

| Entity Tax Identification Number |

85-2483376

|

| Entity Address, Address Line One |

400 Galleria Parkway SE

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30339-3194

|

| City Area Code |

678

|

| Local Phone Number |

402-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.50 Par Value

|

| Trading Symbol |

AAN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Address, Address Line Two |

Suite 300

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

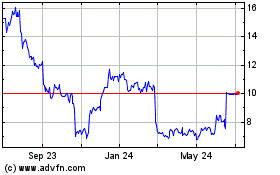

Aarons (NYSE:AAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

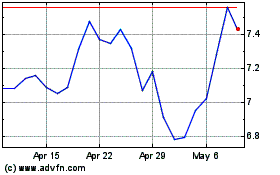

Aarons (NYSE:AAN)

Historical Stock Chart

From Apr 2023 to Apr 2024