JANA Partners Releases Analysis of CNET Networks

April 01 2008 - 9:45AM

PR Newswire (US)

NEW YORK, April 1, 2008 /PRNewswire/ -- A group led by JANA

Partners LLC today released a detailed white paper analysis of CNET

Networks Inc. ("CNET") (NASDAQ:CNET). In this analysis, the group

argues that stopping the destruction of shareholder value at CNET

will require fundamental strategic and operational change, and that

implementing this change successfully will require the type of

experience and expertise it believes the Board nominees the group

has proposed would add to CNET's Board of Directors. The group's

analysis, entitled "CNET: Value-Unlocking Change For All

Shareholders" is available at http://www.janagroupinfo.com/. "Today

we are putting forth a detailed analysis of the fundamental change

CNET requires and shining a spotlight on the performance of the

current Board of Directors, which has presided over the loss of

more than half of CNET's market value since a majority of directors

have been in place," said JANA Managing Partner Barry Rosenstein.

"We have proposed new directors with extensive industry experience

and expertise who would pursue maximum value for all shareholders.

We believe it is now incumbent on this board, which has presided

over so much value destruction, to explain why shareholders would

not benefit from this change." CNET's shares have declined (21)%,

(52)% and (25)% in the one, two and three year periods ended March

28, 2008, respectively, compared to (1)%, 6% and 39% returns,

respectively, for its stated benchmark peer index. As described in

more detail in the group's analysis, CNET has also consistently

underperformed peers in profitability and growth. In its analysis,

the group addresses its rejection of CNET's offer of one of the

seven board seats the group is seeking, saying this would not bring

about the necessary level of change at CNET, particularly given the

magnitude of the shareholder value destruction at CNET and what the

group believes is the lack of a core nucleus of members of the

Board of Directors with the necessary sector experience and

expertise needed to address CNET's ongoing underperformance. The

group's analysis covers the following areas in detail: -- CNET's

Failure to Create Shareholder Value: Despite strong brands and

content, CNET has failed to turn these assets into shareholder

value. While CNET's current leadership has claimed it can reverse

course and begin creating shareholder value, the group believes

they have offered no evidence that they can do so. Rather than

reacting to years of underperformance and shareholder value

destruction, CNET only began examining the basics of improving core

operations after the group called for change. -- CNET's Failure to

Adapt to the Changing Industry Environment: Unlike industry peers

who have recognized and made fundamental strategic and operational

changes in response to industry changes, CNET has not undertaken

the necessary changes to protect the value of its strongest assets,

instead expanding into new verticals. -- Comprehensive Change and

the Right Board to Implement It: The group believes that CNET needs

comprehensive strategic and operational change aimed at

strengthening its core businesses and adapting to the modern

Internet, and that a lack of urgency as well as experience and

expertise at CNET is hindering this required transformation. --

Fundamental Issues to be Addressed: In the analysis, the group

highlights certain strategic and operational issues which it

believes must be successfully addressed in order to reverse CNET's

ongoing underperformance and which it has discussed with the Board

of Directors. The group believes additional issues would arise

during an internal review and in the future as the industry

continues to evolve. More important than any particular example,

however, is that each demonstrates the current leadership's failure

to effectively address issues as they arise, and the need for new

leadership with the experience and expertise to do so. The group

believes such new leadership could create significant new value for

shareholders, and its analysis details the substantial value

creation it believes would result even from just successfully

addressing the issues it has identified externally. Background JANA

has joined with Sandell Asset Management Corp. ("Sandell"), Paul

Gardi of Alex Interactive Media, Spark Capital and Velocity

Interactive Group in seeking to elect two individuals to replace

the board members who are up for re-election at CNET's 2008

stockholders meeting and to expand CNET's board by five members and

nominate individuals to fill those vacancies. Collectively these

investors hold approximately 14.9% of CNET's voting stock. JANA and

Sandell also have separate non-voting economic interests of

approximately 5% and 3%, respectively. JANA Partners LLC is a

multi-billion dollar investment management firm founded in 2001 by

Barry Rosenstein. JANA has on numerous occasions, alone or with

other shareholders, challenged management to focus on creating

shareholder value. Alex Interactive Media, LLC ("AIM") is a private

company focused on leveraging its domain expertise in digital media

and related industries. Spark Capital is a venture capital fund

focused on building businesses that transform the distribution,

management and monetization of media and content, with experience

in identifying and actively building market-leading companies in

sectors including infrastructure (Qtera, RiverDelta, Aether

Systems, Broadbus and BigBand), networks (College Sports

Television, TVONE and XCOM) and services (Akamai and the Platform).

Spark Capital has over $600 million under management, and is based

in Boston, Massachusetts. Velocity Interactive Group, LLC is an

investment firm that focuses on digital media and communications.

Velocity Interactive Group has offices in Palo Alto, Los Angeles

and New York. Sandell Asset Management Corp., is a multi-billion

dollar global investment management firm, founded by Thomas E.

Sandell, that focuses on global corporate events and restructurings

throughout North America, Continental Europe, the United Kingdom,

Latin America and the Asia-Pacific theatres. Sandell frequently

will take an "active involvement" in facilitating financial or

organization improvements accruing to the benefit of investors. ALL

STOCKHOLDERS OF CNET ARE ADVISED TO READ THE DEFINITIVE PROXY

STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF

PROXIES BY THE INVESTORS AND NOMINEES NAMED ABOVE (THE

"PARTICIPANTS") FROM THE STOCKHOLDERS OF CNET FOR USE AT THE 2008

ANNUAL MEETING OF STOCKHOLDERS OF CNET WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. WHEN COMPLETED,

THE DEFINITIVE PROXY STATEMENT AND FORM OF PROXY WILL BE MAILED TO

STOCKHOLDERS OF CNET AND WILL, ALONG WITH OTHER RELEVANT DOCUMENTS,

BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT WWW.SEC.GOV. IN

ADDITION, THE PARTICIPANTS IN THE PROXY SOLICITATION WILL PROVIDE

COPIES OF THE DEFINITIVE PROXY STATEMENT WITHOUT CHARGE UPON

REQUEST. INFORMATION RELATING TO THE PARTICIPANTS IS CONTAINED IN

EXHIBIT 2 TO THE SCHEDULE 14A FILED BY THE PARTICIPANTS WITH THE

SEC ON MARCH 13, 2008. DATASOURCE: JANA Partners LLC CONTACT:

George Sard, +1-212-687-8080, Paul Kranhold, Andrew Cole,

+1-415-618-8750, all of Sard Verbinnen & Co, for JANA Partners

LLC; Charles Penner, JANA Partners LLC, +1-212-692-7696 Web site:

http://janapartners.com/ http://www.janagroupinfo.com/

Copyright

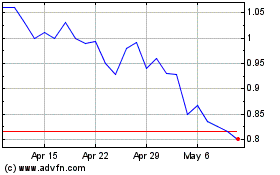

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jun 2024 to Jul 2024

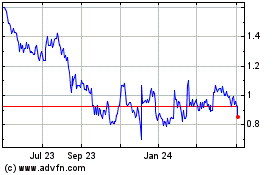

ZW Data Action Technolog... (NASDAQ:CNET)

Historical Stock Chart

From Jul 2023 to Jul 2024