Form 8-K - Current report

August 14 2023 - 4:52PM

Edgar (US Regulatory)

false000176725800017672582023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

August 14, 2023

Date of Report (date of earliest event reported)

XPEL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 001-38858 | 20-1117381 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

| 711 Broadway St., Suite 320 | 78215 |

| San Antonio | Texas | | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (210) 678-3700

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | XPEL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

XPEL, Inc. intends to use the materials attached to this report as Exhibit 99.1 in upcoming investor presentations. The furnishing of these materials is not intended to constitute a representation that such furnishing is required by Regulation FD or other securities laws, or that the presentation materials include material investor information that is not otherwise publicly available. In addition, XPEL does not assume any obligation to update such information in the future.

The information in this Report (including Exhibit 99.1) is furnished pursuant to Item 7.01 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of the Section. The information in this Report will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| EXHIBIT NO. | | IDENTIFICATION OF EXHIBIT |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| XPEL, Inc. |

| |

| Dated: August 14, 2023 | By: /s/ Barry R. Wood |

| Barry R. Wood |

| Senior Vice President and Chief Financial Officer |

INVESTOR PRESENTATION August 2023

2 FORWARD LOOKING STATEMENT This Presentation contains certain forward-looking statements in respect of various matters including upcoming events that involve known and unknown risks and uncertainties that are beyond the control of Management. Those risks and uncertainties include, among other things, risks related to: share prices, liquidity, credit worthiness, currency, insurance, dilution, ability to access capital markets, interest rates, dependence on key personnel and environmental matters. Management believes that the expectations reflected in forward- looking statements are based upon reasonable assumptions and information currently available; however, Management can give no assurance that actual results will be consistent with these forward-looking statements. Such statements are based on our current expectations and assumptions, which are subject to known and unknown risk factors and uncertainties that could cause our actual results to be materially different from those expressed in these statements. Such factors are discussed in detail in our most recent form 10-K (included under Item 1A: Risk Factors) as filed with the SEC. XPEL undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

3 THE LEADER IN PROTECTIVE FILMS AUTOMOTIVE PAINT PROTECTION FILMS AUTOMOTIVE WINDOW TINT HOME & OFFICE WINDOW FILMS

4 A BRAND BUILT OVER 20 YEARS HEADQUARTERED IN SAN ANTONIO, TX FOUNDED IN 1997 NASDAQ: XPEL 898 FULL TIME EMPLOYEES GLOBAL OPERATIONS

5 HISTORY THAT CONTINUES TO SET THE STANDARDS

6 KEY INVESTMENTS HIGHLIGHTS Strong Recognition as Premium Brand Significant Domestic and International Market Opportunity Robust Growth, Profitability and Strong Balance Sheet High Insider Ownership

7 COMPLETE PROTECTION BUMPER HOOD HEADLIGHTS & FOG LIGHTS FENDER MIRRORS A-PILLARS & ROOFLINE DOORSILLS DOOR CUPS & DOOR EDGES ROCKER PANELS & REAR WHEEL IMPACT AREA LUGGAGE STRIP COVERAGE

8 AUTOMOTIVE PRODUCTS Invisible, Cut-To-Fit Protection Film Protects from Rock Chips, Bug Acids, and Road Debris Damage Professionally Installed New-Car Product Film for Heat Rejection, Security and Appearance 4 Core Lines of Film, Something For Everyone High-End Products for Margin, Differentiation Hydrophobic Coating Applied to PPF and Painted Surfaces Allows for Easy Finished Maintenance and Cleaning Opportunity for More Revenue Per Car

9 END CUSTOMER PPF ECONOMICS COVERAGE – FULL CAR COVERAGE – FULL FRONT COVERAGE – PARTIAL HOOD Covers entire car. $4000-$6000 Covers entire painted front bumper, hood, fenders, headlights, and backs of painted mirrors. $1800-$2500 Covers 6” - 12” of leading of hood. $100-200 FACTORS INFLUENCING PRICING Coverage Retail vs Wholesale Regional Variation

10 Cloud-Based Application Updated Daily with 80,000 Vehicle Applications Pre-Cut Film Prevents Cutting on Car Reduces Installation Time, Material Waste CERTIFIED TRAINING BRAND PRESENCE Essential to New Customer Success and Industry Growth Corporate Training Facilities in 7 Countries PPF, Automotive Window Tint, Architectural Window Films, Ceramic Coating Extensive On and Off-line Marketing and Lead Generation Sponsorships, Events and Influencer Campaigns Positions XPEL as the Premium Brand THE XPEL DIFFERENCE

11 DEALERSHIP SERVICES Unique Business Model - Serves only automotive dealership customers - Primarily window film installation today - Products are pre-loaded on vehicles prior to sale - Our labor is housed within the dealership Opportunity To Penetrate Down Market Opportunity To Introduce Paint Protection To Dealership

12 NON-AUTOMOTIVE PRODUCTS Solar Control and Security for Commercial and Residential Applications Distinct Customer Set, But Similar Profile to Automotive Large Addressable New Market Antimicrobial Surface Protection Screens, Electronics, Consumer Surfaces Primarily B2B Sale and Available to Current Customers Sell to a Variety of Niche Non-Automotive Uses Electronics, Stainless Steel, Solid Surface Countertops and More Constantly Evaluating New Applications to Elevate Support

13 XPEL REVENUE ECOSYSTEM PRODUCT REVENUE 85% $150 - $375 / CAR $600 - $1500 / CAR $800 - $2500 / CAR DIRECT - 65% INDIRECT - 35% INTERNATIONAL DISTRIBUTORS INDEPENDENT INSTALLERS NEW CAR DEALERSHIPS END CONSUMER END CONSUMER NEW CAR DEALERSHIP PRELOAD $60 - $200 / CAR DEALERSHIP SERVICES INSTALLATION CENTER US 8 UK 1 CANADA 3 OEM INSTALLATION SERVICE REVENUE 15% MEXICO 1 ASIA 1

14 CONTINUE GLOBAL EXPANSION Operations in 10 Countries Build Out Sales Team In Under-penetrated Geographies STRATEGIC INITIATIVES DRIVE GLOBAL BRAND AWARENESS High Visibility At Premium Events Advertising Placement In Media Consumed By Car Enthusiasts EXPAND NON-AUTOMOTIVE PRODUCT PORTFOLIO Find Opportunities That Leverage The Channel and Brand Find Opportunities That Leverage Existing Products & Technology CHANNEL EXPANSION VIA ACQUISITION Acquire Select Installation Facilities in Key Markets Acquire International Partners for Global Reach

15 REVENUE TREND IN MILLIONS

16 2023 SALES MIX BY REGION CANADA 10.9% UNITED STATES 58.6% LATIN AMERICA 2.3% MIDDLE EAST/ AFRICA 4.0% ASIA PACIFIC 3.2% CHINA 7.8% UK 3.6% CONTINETAL EUROPE 9.4% OTHER 0.2%

17 GROSS MARGIN TREND IN MILLIONS

18 EBITDA PROFILE IN MILLIONS

19 NET INCOME TREND IN MILLIONS

20 STRONG FINANCIAL POSITION IN MILLIONS CASH • CASH EQUIVALENTS NET WORKING CAPITAL ACOUNTS RECEIVABLEACOUNTS EIVABLE TOTAL INVENTORY TOTAL ASSETS TOTAL DEBT (EXCLUDES LEASE OBLIGATIONS) CASH FLOW FROM OPS Q2 20232022 $8.1M $79.4M $14.7M $80.6M $193.4M $26.1M $12.1M $14.3M $90.3M $24.0M $82.7M $216.7M $13.0M $27.4M 2021 $9.6M $42.8M $13.2M $51.9M $161.0M $25.5M $18.3M

21 MACRO GROWTH OPPORTUNITIES Rock Chips Are Top Consumer Complaint Paint Protection Film Low Penetration to New Cars Sold Fragmented Market Provides Opportunity Ripe for Consolidation Dealerships Need Tangible, Profitable Products Equivalent Opportunities Domestically & Internationally Down Market Penetration Opportunity With Dealership Services Business

APPENDIX

NON - GAAP MEASURES EBITDA RECONCILIATION IN MILLIONS NET INCOME INTEREST TAXES DEPRECIATION AMORTIZATION EBITDA $31.6M $ .3M $7.9M $1.9M $2.5M $44.1M YEAR ENDED Dec 31, 2021 $41.4M $1.4M $10.6M $3.4M $4.4M $61.2M Dec 31, 2022 $27.2M $ .9M $7.1M $2.0M $2.4M $39.5M Jun 30, 2023 2023 YTD $19.7M $ .5M $5.1M $ 1.6M $2.1M $29.1M Jun 30, 2022 2022 YTD

COMPLETE PROTECTION, UNSEEN. San Antonio, TX. USA +1 210-678-3700 XPEL.COM

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

XPEL, INC.

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001767258

|

| Soliciting Material |

false

|

| City Area Code |

(210)

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

XPEL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Local Phone Number |

678-3700

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-38858

|

| Entity Tax Identification Number |

20-1117381

|

| Entity Address, Postal Zip Code |

78215

|

| Entity Address, Address Line One |

711 Broadway St., Suite 320

|

| Entity Address, State or Province |

TX

|

| Entity Address, City or Town |

San Antonio

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

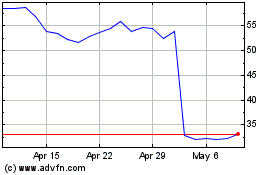

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Apr 2024 to May 2024

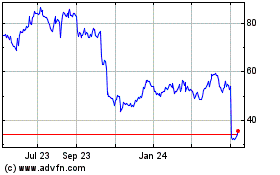

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From May 2023 to May 2024