FALSE000181949300018194932023-11-162023-11-160001819493us-gaap:CommonStockMember2023-11-162023-11-160001819493us-gaap:WarrantMember2023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2023

XOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39598 | | 98-1550505 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

3550 Tyburn Street

Los Angeles, California | | 90065 |

| (Address of principal executive offices) | | (Zip Code) |

(818) 316-1890

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | XOS | | Nasdaq Capital Market |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | XOSWW | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Director

On November 16, 2023, Anousheh Ansari informed Xos, Inc. (the "Company") of her resignation as a member of the board of directors of the Company (the "Board"), effective immediately. Ms. Ansari’s resignation was not the result of any disagreements with the Company on any matter regarding the Company’s operations, policies or practices. Ms. Ansari served as a member of the Nominating & Governance Committee and the Compensation Committee of the Board.

Liana Pogosyan Amended Employment Letter

On November 21, 2023, the Company and Liana Pogosyan, the Company’s Vice President of Finance and Acting Chief Financial Officer, entered into an amendment (the "Offer Letter Amendment") to the offer letter dated January 5, 2022.

The Offer Letter Amendment provides certain payments and benefits upon termination of employment without cause or upon resignation for good reason during the period commencing one year prior to a change of control and ending two years following such change of control (i.e., a double trigger). These payments and benefits include (i) a cash payment of one-half of Ms. Pogosyan's annual base salary, (ii) a cash payment of Ms. Pogosyan's target yearly cash bonus and (iii) immediate vesting of Ms. Pogosyan's unvested equity awards.

The foregoing description of the Offer Letter Amendment is qualified in its entirety by reference to the full text of such document, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

Exhibit No. | | Description |

10.1 | | |

| 104 | | iXBRL language is updated in the Exhibit Index |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 22, 2023

| | | | | | | | |

| XOS, INC. |

| | |

| By: | /s/ Liana Pogosyan |

| | Liana Pogosyan |

| | Acting Chief Financial Officer |

November 21, 2023

To: Liana Pogosyan

Subject: Notice of Amendment to Offer Letter

Dear Liana,

Thank you for your continued contributions to Xos, Inc. (the “Company”). This notice of amendment to the offer letter (the “Notice of Amendment to Offer Letter”) between you and the Company, dated January 5, 2022 (the “Offer Letter”) sets forth details of the amendment to the Offer Letter. The Offer Letter shall be amended to include the language set forth in Exhibit A hereto.

No Right to Continued Employment: Nothing in this Notice of Amendment to Offer Letter shall be interpreted or construed to confer upon the employee any right with respect to continuance of employment by the Company, or a subsidiary of the Company, nor shall this Notice of Amendment to Offer Letter interfere in any way with the right of the Company, or a subsidiary of the Company, to terminate your employment at any time.

Reservation of Rights. The foregoing is subject to the approval of the Board of Directors of the Company or its designee.

Please sign below and return a copy to your dedicated HR Business Partner for record keeping and processing.

All the best,

/s/ Leslie Granados

Leslie Granados

Sr. Technical Recruiter & HR Business Partner Xos, Inc.

ACCEPTED:

/s/ Liana Pogosyan 11/21/2023

Liana Pogosyan Today's Date

EXHIBIT A

ADDENDUM A

OFFER LETTER DOUBLE TRIGGER PROVISIONS

1.TERMINATION UPON CHANGE OF CONTROL.

1.1Severance Payment. In the event of your Termination Upon Change of Control, you shall be entitled to receive, within thirty (30) days following the Termination Date, a lump sum payment equal to the sum of (i) one-half your annual base salary in effect immediately prior to the termination and (ii) the target Cash Bonus then in effect for you for the performance year in which such termination occurs; provided, however, if no such target Cash Bonus has been set for the then current year, such target amount for purposes of this Section 1 shall be no less than the target Cash Bonus for the prior year.

1.2Equity Compensation Acceleration. Upon your Termination Upon Change of Control, (a) the vesting and exercisability of all then outstanding stock options, restricted stock, restricted stock units and other equity and equity-based awards that are subject to time-based vesting and granted to you under any plan of the Company or any of its affiliates shall be immediately accelerated in full, and (b) any outstanding equity awards that vest based on the attainment of performance goals shall vest for the then-current calendar year on a prorated basis based on the then level of attainment of the performance metrics determined in good faith by the Compensation Committee.

1.3Indemnification. In the event of your Termination Upon Change of Control, (a) the Company shall continue to indemnify you against all claims related to actions arising prior to the termination of your employment to the fullest extent permitted by law, and (b) your coverage by the D&O Insurance Policy in effect immediately before the Change in Control shall be continued by the Company under a D&O Insurance Policy with substantially the same terms for not less than 24 months following your Termination Upon Change in Control.

1.4No Mitigation; No Offset. In the event of your Termination Upon Change of Control, you shall be under no obligation to seek other employment or otherwise mitigate the obligations of the Company under this Agreement, and there shall be no offset against amounts due to you under this Agreement on account of any remuneration or other benefit earned or received by you after such termination.

2Capitalized Terms Defined. Capitalized terms used in this Agreement shall have the meanings set forth in this Section 8, unless the context clearly requires a different meaning.

2.1“Cause” means:

(a)an act of fraud, embezzlement or theft in connection with your duties or in the course of your employment,

(b)you engaged in willful misconduct or gross negligence during the course of undertaking your duties as an employee that is materially detrimental to the Company; or

(c)your conviction of or plea of guilty or nolo contendere to a felony.

With respect to Causes described in Subsections (a), (b) and (c) above, no termination by reason of such Cause shall occur unless you (i) have been provided with notice of the Company’s intention to terminate you for such Cause and the Company’s reason(s) and, with respect to Causes described in Subsection (b), you were notified by the Company of such termination within thirty (30) days of knowledge of such event, and (ii) you have failed to cure or correct such failure, misconduct, incompetency or non-compliance within thirty (30) days of receiving such notice. For the avoidance of doubt, your acts or omissions shall not be considered to be willful unless you have no reasonable belief that you are acting in the best interests of the Company.

2.2“Change of Control” means:

(a)any “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) becomes the “beneficial owner” (as defined in Rule 13d-3 promulgated under the Exchange Act), directly or indirectly, of securities of the Company representing twenty percent (20%) or more of (i) the outstanding shares of common stock of the Company, or (ii) the combined voting power of the Company’s outstanding securities;

(b)the Company is party to a merger or consolidation, or series of related transactions, which results in the voting securities of the Company outstanding immediately prior thereto failing to continue to represent, directly or indirectly, twenty percent (20%) or more of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation;

(c)the sale or disposition of all or substantially all of the Company’s assets, or consummation of any transaction, or series of related transactions, having similar effect (other than to a subsidiary of the Company).

(d)Individuals who, as of the Effective Date, constitute the Board of Directors of the Company (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual was a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board;

2.3“Company” means Xos, Inc. and its affiliates and, following a Change of Control, any Successor.

2.4“Good Reason” means the occurrence of any of the following conditions, without your consent:

(a)A reduction in your compensation, or the Company fails to pay to you any compensation due to you upon five (5) days written notice from you informing the Company of such obligation.

(b)The failure of the Company (i) to continue to provide you an opportunity to participate in any benefit or compensation plans provided to employees who hold positions with the Company comparable to your position or (ii) to provide you all other fringe benefits (or the equivalent) in effect for the benefit of any employee group which includes any employee who holds a position with the Company comparable to your position, where in the event of a Change of Control, such comparison shall be made relative to the period immediately prior to the public announcement of such Change of Control.

(c)A material breach of this Agreement by the Company including, in the event of a Change of Control, the failure of any Successor to assume and agree to perform the obligations under this Agreement in the same manner and to the same extent that the Company would be required to perform such obligations if no succession had taken place, except where such assumption occurs by operation of law.

(d)A material, adverse change in your authority, duties, or responsibilities (other than temporarily while you are physically or mentally incapacitated or as required by applicable law), taking into account the Company’s size, status as a public company, and capitalization as of the Effective Date of this Agreement, other than a change to a position that is a Substantive Functional Equivalent.

(e)A change in your principal place of employment that is greater than thirty (30) miles from your principal place of employment or, if your principal place of employment shall have been changed with your express or implied consent, a change to a principal place of employment other than such consented place, other than a change directed by you.

2.5“Substantive Functional Equivalent” means that your position must:

(a)be in a substantive area of your competence (e.g., financial or executive management) and not materially different from the position occupied immediately prior;

(b)allow you to serve in a role and perform duties functionally equivalent to those performed immediately prior to the change; and

(c)not otherwise constitute a material, adverse change in your authority, title, status, responsibilities or duties Executive immediately prior to the change, causing you to be of materially lesser rank or responsibility.

2.6“Successor” means any successor in interest to, or assignee of, all or substantially all of the business and assets of the Company.

2.7“Termination Date” means the date of the termination of your employment with the Company.

2.8“Termination Upon Change of Control” means:

(a)any termination of your employment by the Company without Cause which termination of employment occurs during the period commencing one (1) year prior to a Change of Control and ending on the date that is two (2) years following the Change of Control; or

(b)any resignation by you for Good Reason where such Good Reason occurs during the period commencing one (1) year prior to a Change of Control and ending on the date that is two

(2) years following the Change of Control.

For the avoidance of doubt, the term “Termination Upon Change of Control” shall not include any termination of your employment: (1) by the Company for Cause; (2) by the Company as a result of your Permanent Disability; (3) as a result of your death; or (4) as a result of the voluntary termination of your employment for any reason other than Good Reason.

v3.23.3

Cover

|

Nov. 16, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 16, 2023

|

| Entity Registrant Name |

XOS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39598

|

| Entity Tax Identification Number |

98-1550505

|

| Entity Address, Address Line One |

3550 Tyburn Street

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90065

|

| City Area Code |

818

|

| Local Phone Number |

316-1890

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001819493

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

XOS

|

| Security Exchange Name |

NASDAQ

|

| Warrant |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

XOSWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

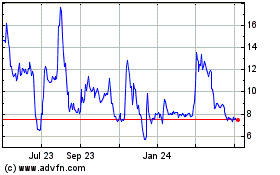

Xos (NASDAQ:XOS)

Historical Stock Chart

From Apr 2024 to May 2024

Xos (NASDAQ:XOS)

Historical Stock Chart

From May 2023 to May 2024