Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-258741

PROSPECTUS

3,341,900 Common Shares Issuable

upon

Exercise of Warrants

XORTX Therapeutics Inc.

We are offering 3,341,900

common shares issuable upon exercise of 3,341,900 common share purchase warrants (the “Warrants”) pursuant to this

prospectus. The Warrants were offered and sold by us pursuant to a prospectus dated October 15, 2021 as part of a public offering

of common shares and Warrants. The common shares and Warrants were sold in units, with each common share unit consisting of one common

share and one Warrant to purchase one common share. The common shares and Warrants were immediately separable upon issuance. Each unit

was sold at a price of $4.13 per common share unit. Each Warrant was originally exercisable to purchase one common share at an exercise

price of $4.77 and expired five years from the original date of issuance (October 15, 2026). In connection with an October 7, 2022,

letter agreement between us and Armistice Capital Master Fund Ltd. (the “Letter Agreement”), we revised the exercise

price of 910,000 of the Warrants from $4.77 per common share to $1.17 per common share (the “Amended

IPO Common Share Purchase Warrants”). The October 15, 2021 prospectus also covered the offer and sale by

us of the common shares underlying the Warrants. No securities are being offered pursuant to this prospectus other than the common shares

that will be issued upon the exercise of the Warrants.

In order to obtain the common shares

offered hereby, holders of Warrants must pay the applicable exercise price per Warrant. We will receive proceeds from the exercises of

the Warrants for cash, if any, but not from the sale of the underlying common shares.

There is no established

public trading market for the Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing

of the Warrants on any national securities exchange. Without an active trading market, the liquidity of the Warrants will be limited.

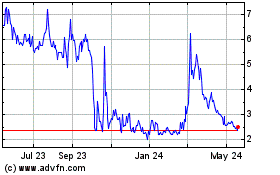

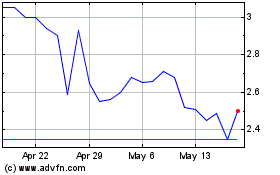

Our common shares are currently traded under

the symbol “XRTX” on the TSX Venture Exchange (the “TSXV”) and on the Nasdaq Capital Market (“Nasdaq”).

We are an “emerging

growth company” as defined by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such,

we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. However,

we have elected not to take advantage of the extended transition period allowed for emerging growth companies for complying with new or

revised accounting guidance as allowed by Section 107 of the JOBS Act and Section 7(a)(2)(B) of the Securities Act of 1933,

as amended, (the “Securities Act”).

Investing in our securities involves

a high degree of risk. See “Risk Factors” beginning on page 10.

We are a “foreign private issuer”

as defined under the federal securities laws and, as such, are subject to reduced public company reporting requirements. See “Prospectus

Summary – Implications of Being a Foreign Private Issuer.”

Neither the Securities

and Exchange Commission, Canadian securities commission nor any domestic or international securities body has approved or disapproved

of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated

August 7, 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission (“SEC”).

You

should read this prospectus and the related registration statement carefully. This prospectus and registration statement contain important

information you should consider when making your investment decision. See “Where You Can Find More Information” in

this prospectus.

We have not authorized

anyone to provide you with information other than that contained in this prospectus or in any free writing prospectus prepared by or on

behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any

other information that others may give to you. The information contained in this prospectus or any free writing prospectus is accurate

only as of the date of this prospectus or such free writing prospectus, regardless of the time of delivery of this prospectus or any free

writing prospectus.

We are offering to

sell, and seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. We have not taken any action to

permit a public offering of our securities or the possession or distribution of this prospectus in any jurisdiction where action for that

purpose is required, other than the United States. You are required to inform yourself about and to observe any restrictions relating

to this offering and the distribution of this prospectus.

We express all amounts in this

prospectus in United States dollars, except where otherwise indicated. References to “$” are to United States dollars and

references to “CAD$” are to Canadian dollars.

Except as otherwise

indicated, references in this prospectus to “XORTX,” the “Company,” “we,” “us” and “our”

refer to XORTX Therapeutics Inc. and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary

highlights certain information contained elsewhere in this prospectus. This summary does not contain all of the information that may

be important to you. You should read and carefully consider the following summary together with the entire prospectus, including all

documents incorporated by reference herein. In particular, attention should be directed to the “Risk Factors,” beginning

on page 10 of this prospectus and to the sections “Risk Factors,” “Information on the Company,”

“Operating and Financial Review and Prospects” and the financial statements and related notes thereto incorporated by

reference hereto in our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, before making an investment

decision. See also “Cautionary Note Regarding Forward-Looking Statements,” “Incorporation by Certain Information

by Reference” and “Where You Can Find Additional Information” in this prospectus.

Overview

XORTX

Therapeutics is a late-stage clinical pharmaceutical company focused on identifying, developing and potentially

commercializing therapies to treat progressive kidney disease modulated by aberrant purine and uric acid metabolism in orphan (rate)

disease indications such as autosomal dominant polycystic kidney disease (“ADPKD”)

and type 2 diabetic nephropathy (“T2DN”), as well as acute kidney injury (“AKI”) associated

with respiratory virus infection.

Our focus is on developing

three therapeutic product candidates to:

| · | slow or reverse the progression of chronic kidney disease in patients at risk of end stage kidney failure; |

| · | address the immediate need of individuals facing AKI associated with respiratory virus infection; and |

| · | Treat patients with type 2 diabetic nephropathy. |

We are also looking

to identify other opportunities where our existing and new intellectual property can be leveraged to address health issues.

We believe that our

technology is underpinned by well-established research and insights into the underlying biology of aberrant purine metabolism, its health

consequences and of oxypurinol, a uric acid lowering agent that works by effectively inhibiting xanthine oxidase. We are developing innovative

product candidates that include new or existing drugs that can be adapted to address different disease indications where aberrant purine

metabolism and/or elevated uric acid is a common denominator, including polycystic kidney disease, pre-diabetes, insulin resistance, metabolic

syndrome, diabetes, diabetic nephropathy, and infection. Oxypurinol, and our proprietary pipeline-in-a-product strategy supported by our

intellectual property, established exclusive manufacturing agreements, and proposed clinical trials with experienced clinicians, are focused

on building a pipeline of assets to address the unmet medical needs for patients with a variety of serious or life-threatening diseases:

| · | XRx-008, a program for the treatment of ADPKD; |

| |

· |

XRx-101, a program to treat AKI associated with severe respiratory infection and associated health consequences; and |

| · | XRx-225, a program for the treatment of T2DN. |

At

XORTX, we aim to redefine the treatment of kidney diseases by developing medications to improve the quality-of-life of patients with life

threatening diseases by modulating aberrant purine and uric acid metabolism, including lowering elevated uric acid as a therapy.

Our Proprietary

Therapeutic Programs

Our expertise and understanding

of the pathological effects of aberrant purine metabolism combined with our understanding of uric acid lowering agent structure and function,

has enabled the development of our proprietary therapeutic platforms. These are a complementary suite of therapeutic formulations designed

to provide unique solutions for acute and chronic disease. Our therapeutic platforms can be used alone, or in combination, with synergistic

activity to develop a multifunctional tailored approach to a variety of disease entities that can address disease in multiple body systems

through management of chronic or acute hyperuricemia, immune modulation, and metabolic disease. We continue to leverage these therapeutic

platforms to expand our pipeline of novel and next generation drug-based product candidates that we believe could represent significant

improvements to the standard of care in multiple acute and chronic cardiovascular diseases and specifically kidney disease.

We believe our in-house

drug design and formulation capabilities confer a competitive advantage to our therapeutic platforms and are ultimately reflected in our

programs. Some of these key advantages are:

Highly modular and

customizable

Our platforms can be

combined in multiple ways and this synergy can be applied to address acute, intermittent or chronic disease progression. For example,

our XRx-101 program for AKI is designed to produce rapid suppression of hyperuricemia then maintain purine metabolism at a low level during

viral infection and target management of acute organ injury. Our XRx-008 program is designed for longer term stable chronic oral dosing

of xanthine oxidase inhibitors. We believe the capabilities of our formulation technology allow us to manage the unique challenges of

cardiovascular and renal disease by modulating, purine metabolism, inflammatory and oxidative state.

Fit-for-purpose

Our platforms can also

be utilized to engineer new chemical entities and formulations of those agents that have enhanced properties. For example, our XRx-225

product candidate program, some of the intellectual property for which we license from third parties, represents a potential new class

of xanthine oxidase inhibitor with a targeted design to enhance anti-inflammatory activity. The capability of tailoring the potential

therapeutic benefit of this class of new agents permits us to identify targets and disease that we wish to exploit and then through formulation

design optimize those small molecules and proprietary formulations to maximize potentially clinically meaningful therapeutic effect.

Readily scalable

and transferable

Our in-house small

molecule and formulations design expertise is positioned to create a steady succession of product candidates that are scalable, efficient

to manufacture (by us or a partner or contract manufacturing organization), and produce high production and high purity active pharmaceutical

drug product. We believe this will provide a competitive advantage, new intellectual property and opportunity to provide first-in-class

products that target unmet medical needs and clinically meaningful quality of life.

Our team’s expertise in

uric acid lowering agents, specifically in the development and use of xanthine oxidase inhibitors, has enabled the development of our

therapeutic product candidates to treat the symptoms of, and potentially delay the progression of ADPKD, AKI due to respiratory virus

infection, and T2DN. There is no guarantee that the Food and Drug Administration (“FDA”) will approve our proposed

uric acid lowering agent product candidates for the treatment of kidney disease or the health consequences of diabetes.

Product Candidate

Pipeline

Our lead product candidates

are XRx-008, XRx-101, and XRx-225. XRx-008 is in preparations for a Phase 3 registration clinical trial, the last stage of clinical development

before application for FDA approval. Our XRx-101 program is advancing toward preparing for a “bridging” pharmacokinetic study

for the Company’s Phase 3 clinical trial to potentially slow or reverse acute kidney disease in hospitalized individuals with respiratory

virus infection. XRx-225 is at the non-clinical stage and advancing toward the clinical development stage.

Products

The Company’s most advanced development

program, XRx-008, sometimes referred to by its trademarked name XORLOTM, is a late clinical stage program focused on demonstrating

the potential of our novel product candidate for ADPKD. XRx-008 is the development name given to XORTX’s proprietary oral formulation

of oxypurinol, and shows increased oral bioavailability compared to oxypurinol alone. XORTX is also developing a second proprietary combination

product composed of a uric acid lowering agent administered intravenously, followed by a xanthine oxidase inhibitor - XRx-101 -, for use

in treating patients hospitalized with respiratory virus infection and accompanying hyperuricemia with associated AKI.

XORTX is currently evaluating

xanthine oxidase inhibitor candidates for the XRx-225 program to potentially treat T2DN as well as developing new chemical entities to

address the large unmet medical need.

Patents

XORTX is the exclusive

licensee of two U.S. granted patents with claims to the use of all uric acid lowering agents to treat insulin resistance or diabetic nephropathy,

and two U.S. patent applications with similar claims for the treatment of metabolic syndrome, diabetes, and fatty liver disease. Counterparts

for some of these patent applications have also been submitted in Europe. In both the US and Europe, XORTX owns composition of matter

patent applications for unique proprietary formulations of xanthine oxidase inhibitors – U.S. and European patents have been granted.

XORTX has also submitted two patent applications to cover the use of uric acid lowering agents for the treatment of the health consequences

of respiratory virus infection.

XORTX

Therapeutics Pipeline:

XORTX has held discussions

with the FDA regarding developing oxypurinol using the 505(b)(2) pathway and right of reference to the former oxypurinol New

Drug Application (“NDA”). Those discussions indicated that XORTX has the ability

to use existing clinical data to bypass conducting a number of its own Phase 1 and Phase 2 studies for XRx-008 and XRx-101 programs. However,

we may elect to conduct our own Phase 1 and Phase 2 studies as necessary or required to gain marketing approval in the aforementioned

programs.

Our Strategy

Our goal is to apply our interdisciplinary

expertise and pipeline-in-a-product strategy to further identify, develop and commercialize novel treatments in renal disease and indications

related to health consequences associated with ADPKD. To achieve this objective, we intend to pursue the following strategies:

| 1. | Subject to discussions with FDA, submit an NDA to the FDA following the successful completion of the Phase 3 clinical registration

trial of the XRx-008 product candidate program in order to establish a new standard of care for ADPKD. |

| 2. | Maximize the potential of the XRx-008 product candidate program, if approved, through independent commercialization and through opportunistic

collaborations with third parties. |

| 3. | Leverage our pipeline-in-a-product strategy, developing additional proprietary formulations leveraging our experience selecting renal

indications and complementing our developments through acquisitions or in-licensing opportunities in nephrology and diabetes when opportunities

arise. |

For the balance of 2023, XORTX

will continue its focus on advancing XORLOTM as part of the XRx-008 program for ADPKD into a Phase 3 registration clinical

trial, initiation of special protocol assessment (“SPA”) discussions with the FDA and initiation of pre-commercialization

studies to prepare for potential approval of XORLOTM as well as advancing research in other kidney disease applications.

To achieve these objectives, XORTX’s action plan includes:

| 1. | Initiate the Phase 3 clinical trial, XRX-OXY-301, to support an application

for “Accelerated Approval” of XORLOTM for individuals with ADPKD (the “XRX-OXY-301 Clinical Trial”).

The XRX-OXY-301 Clinical Trial is a Phase 3, Multi-Centre, Double-Blind, Placebo Controlled, Randomized Withdrawal Design Study to Evaluate

the Efficacy and Safety of a Novel Oxypurinol Formulation in Patients with Progressing Stage 2-4 ADPKD and Coexistent Hyperuricemia. XORTX

anticipates that the XRX-OXY-301 Clinical Trial will provide data to support submission of a future NDA application for “Accelerated

Approval” to the FDA and a Marketing Authorization Application to the European Medicines Agency “EMA.” The XRX-OXY-301

Clinical Trial is planned, subject to additional financing, to start in the second half of 2023 and will enroll individuals with stage

2, 3 or 4 ADPKD accompanied by chronically high uric acid. The objective of the XRX-OXY-301 Clinical Trial is to evaluate the ability

of XORLOTM to slow the expansion of total kidney volume over a 12-month treatment period. FDA has granted Orphan Drug Designation

status for XRx-008, and confirmation that this program is eligible for Accelerated Approval when Total Kidney Volume (TKV) or estimated

glomerular filtration rate (eGFR) clinical data are produced after a 1-year treatment period. |

| 2. | Prepare and Communicate with the FDA and EMA regarding the XRX-OXY-302 Registration

trial in ADPKD (the “XRX-OXY-302 Clinical Trial”). The XRX-OXY-302 Clinical Trial is a Phase 3, Multi-Centre, Double-Blind,

Placebo Controlled, Randomized Withdrawal Design Study to Evaluate the Efficacy and Safety of a Novel Oxypurinol Formulation in Patients

with Progressing Stage 2-4 ADPKD and Coexistent Hyperuricemia with progressing stage 2, 3, or 4 kidney disease. The objective of the XRX-OXY-302

Clinical Trial is to evaluate the safety and effectiveness of XORLOTM for the XRx-008 program over a 24-month treatment period.

The aim of the XRX-OXY-302 Clinical Trial is to characterize the ability of xanthine oxidase inhibitors to potentially decrease the rate

of decline of glomerular filtration rate. An estimated 300 patients will be enrolled. The XRX-OXY-302 Clinical Trial is planned to start

in the second half of 2024, subject to Special Protocol Assessment review by FDA. |

| 3. | Ongoing Chemistry Manufacturing and Control (“CMC”) Work.

In parallel with the XRX-OXY-301 and XRX-OXY-302 Clinical Trials, XORTX will be focusing on scale-up, validation and stability testing

of clinical drug product supplies of XORLOTM under the Company’s investigational new drug application, as well as future

clinical and commercial supplies. All development will be performed according to current Good Manufacturing Practices methodology. This

work will be ongoing throughout 2023. |

| 4. | Activities Related to Potential Commercial Launch. In preparation

for a possible “Accelerated Approval” NDA filing and approval in 2025 in the US for XORLOTM XRx-008, XORTX

will conduct pre-commercialization studies to support in-depth analysis of pricing and/or reimbursement, as well as evaluate product

brand name selection, prepare related filings, and conduct other launch preparation activities. This work will be ongoing from 2023

to 2025. |

| 5. | Activities Related to European Registration. XORTX will continue

to work with and seek out guidance from the EMA to facilitate the path to potential approval of XORLOTM in the European

Union (“EU”), including required clinical studies and reimbursement conditions. This work will be ongoing from

2023 through 2026 and will include a future request for orphan drug status. XORTX intends to seek EMA Orphan Drug Designation status

in 2023 to 2024. |

To achieve the above goals, XORTX

will continue to pursue non-dilutive and dilutive funding and expand discussions to partner with pharma / biotech companies with a global

reach. XORTX will also increase financial and healthcare conference participation to further strengthen and expand its investor base.

Recent Developments

On June 29, 2023, the Company announced the appointment

of James Fairbairn as Interim Chief Financial Officer (“CFO”).

FDA has granted Orphan Drug Designation

status to XRx-008.

Risk Factors

Our

ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment

decision. These risks are described more fully in the sections entitled “Risk Factors” in this prospectus and under

“Risk Factors Summary” and “Item 3. Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein.

Our Corporate Information

We were incorporated

under the laws of Alberta, Canada on August 24, 2012, under the name ReVasCor Inc. and were continued under the Canada Business Corporations

Act on February 27, 2013, under the name of XORTX Pharma Corp. Upon completion of a reverse take-over transaction on January 10,

2018, with APAC Resources Inc., a company incorporated under the laws of British Columbia, we changed our name to “XORTX Therapeutics

Inc.” and XORTX Pharma Corp. became a wholly-owned subsidiary.

Our

registered office is located at 3710 – 33rd Street NW, Calgary, Alberta, Canada T2L 2M1 and our telephone number is (403)

455-7727. Our website address is www.xortx.com. The information contained on, or that can be accessed through, our website is not

a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Implications of Being an Emerging

Growth Company

As a company with less

than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the

JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable

generally to public companies. These provisions include:

| · | reduced executive compensation disclosure; |

| · | exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation;

and |

| · | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant

to the Sarbanes-Oxley Act of 2002. |

We may take advantage of these

provisions until we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur

of: (1) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (2) the last day

of the fiscal year in which we have total annual gross revenue of $1.235 billion or more; (3) the date on which we have issued more

than $1.0 billion in nonconvertible debt during the previous three years; or (4) the date on which we are deemed to be a large accelerated

filer under the rules of the SEC. We have elected not to take advantage of the extended transition period allowed for emerging growth

companies for complying with new or revised accounting guidance as allowed by Section 107 of the JOBS Act and Section 7(a)(2)(B) of

the Securities Act.

We report under the

Securities Exchange Act of 1934, as amended (“Exchange Act”), as a non-U.S. company with foreign private issuer status. Even

after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange

Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| · | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered

under the Exchange Act; |

| · | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability

for insiders who profit from trades made in a short period of time; and |

| · | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited

financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant

events, although we report our results of operations on a quarterly basis under the Canadian securities laws. |

Both foreign private

issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even

if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more

stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

We would cease to be

a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents, and any one of

the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents,

(ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United

States.

In this prospectus,

we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign

private issuer. Accordingly, the information contained herein may be different than the information you receive from other public companies

in which you hold equity securities.

The Offering

|

Securities offered

|

Up to 3,341,900 common shares, no par value per share (each a “common share”) are issuable upon exercise of the Warrants with 2,431,900 Warrants having an exercise price per common share of $4.77 and 910,000 Amended IPO Common Share Purchase Warrants having an exercise price of $1.17. |

| Description of Warrants |

The Warrants were issued with common shares in units, with each unit consisting of one common share and one Warrant to purchase one common share. Each common share unit was sold at a price of $4.13 per unit. The common share units were separable immediately upon issuance. Each Warrant was originally exercisable to purchase one common share at an exercise price of $4.77. In connection with the Letter Agreement, we revised the exercise price of the 910,000 Amended IPO Common Share Purchase Warrants from $4.77 per common share to $1.17 per common share. All other terms remained the same and the Amended IPO Common Share Purchase Warrants expire on October 15, 2026. |

| Limitations on beneficial ownership |

Under the Warrants, a holder (together with its affiliates) may not exercise any portion of a Warrant to the extent that the holder would own more than 4.99% of our outstanding common shares outstanding immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding common shares after exercising the holder’s Warrants up to 9.99% of the number of our common shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. |

| Common shares to be outstanding after this offering, assuming exercise of all of the Warrants |

21,331,587 shares |

| Use of proceeds |

We may receive proceeds from the exercise of the warrants if exercised

for cash, but not from the sale of the underlying common shares. We intend to use the net proceeds of the warrant exercises to fund our

ongoing research and development activities, and for working capital and general corporate purposes. See “Use of Proceeds”. |

| Nasdaq trading symbol |

“XRTX” |

| No Listing of Warrants |

We do not intend to apply for listing of the Warrants on any national securities exchange or trading system. |

| Risk Factors |

Please refer to “Risk Factors” in this prospectus and under “Risk Factors Summary” and “Item 3. Key Information—D. Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein, and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before investing in our common shares. |

The number of common shares to

be outstanding after this offering is based on 17,989,687 common shares outstanding as of March 31, 2023, and excludes:

| |

· |

1,039,335 common shares issuable upon the exercise of outstanding options to issue common shares, as of March 31, 2023, at a weighted average exercise price of CAD$2.03 per common share; and |

| |

· |

7,237,896 common shares issuable upon the exercise of outstanding common share warrants (excluding the Warrants), as of March 31, 2023, at a weighted-average exercise price of $1.86 per common share. |

Unless otherwise indicated, all information in this prospectus reflects

or assumes the Warrants have all been exercised.

MATERIAL

CHANGES

On June 29, 2023, we announced the appointment

of James Fairbairn as Interim CFO. On July 31, 2023, Amar Keshri ceased to be employed by the Company.

Pursuant to Mr. Fairbairn’s appointment

as our interim CFO, we entered into a consulting agreement with 1282803 Ontario Inc., pursuant to which we appointed Mr. Fairbairn to

act as our consultant, including in the capacity as our interim CFO (the “Fairbairn Consulting Agreement”). The terms of the

Fairbairn Consulting Agreement are effective from July 3, 2023 on a continuous basis until terminated by either party and provided for

Mr. Fairbairn’s services as an independent consultant. Under the Fairbairn Consulting Agreement, Mr. Fairbairn will act as our CFO

for a term of one-year, which shall automatically renew, but is cancellable by either party on 90 days’ notice. In return for services

as Interim CFO, we will pay a fee of CAD$205,540 annually. In addition, Mr. Fairbairn is to provide certain strategic financial guidance

for a one-year term in exchange for the grant of 30,000 stock options, which shall vest equally over 36 months. The Fairbairn Consulting

Agreement provides that Mr. Fairbairn is eligible to participate in our stock option plan and is eligible for a discretionary

bonus of up to 30% of the annual base consulting fees. Either party may terminate the Fairbairn Consulting Agreement upon not less than

30 days written notice. In the event that we were to terminate the agreement, we would be required to pay a single lump-sum termination

payment equal to one month of the base consulting fee as in effect at the time of termination.

RISK FACTORS

Any

investment in our securities involves a high degree of risk. You should carefully consider the risks described below and in “Risk

Factors Summary” and “Item 3. Key Information - D. Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein, and all of the information included or incorporated by reference

in this prospectus before deciding whether to purchase our securities. The risks and uncertainties described below are not the only risks

and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

impair our business operations. If any of the events or circumstances described in the following risk factors actually occur, our business,

financial condition and results of operations would suffer. In that event, the price of our common shares could decline, and you may lose

all or part of your investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially

from those discussed in these forward-looking statements. See “Cautionary Note Regarding

Forward-Looking Statements.”

Risks Related to this Offering

We will have broad discretion in how we use the proceeds,

and we may use the proceeds in ways in which you and other stockholders may disagree.

We intend to use the net proceeds we receive from this offering, if

any, to fund our ongoing research and development activities, and for working capital and general corporate purposes. Our management will

have broad discretion in the application of the proceeds from this offering and could spend the proceeds in ways that do not necessarily

improve our operating results or enhance the value of our common shares.

If you purchase common shares in this offering by exercising

warrants, you will suffer immediate dilution of your investment.

The public offering price of our common shares is substantially higher

than the as adjusted net tangible book value per common share. Therefore, if you purchase common shares in this offering by exercising

warrants, you will pay a price per common share that substantially exceeds our as adjusted net tangible book value per common share after

this offering. To the extent outstanding options are exercised, you will incur further dilution. Based on the exercise price per common

share of the Warrants, you will experience immediate dilution of $3.76 per common share to new investors acquiring common shares

upon the exercise of the Warrants at an exercise price per common share of $4.77 and an immediate dilution of $0.16 per common share to

new investor acquiring common shares upon the exercise of the Warrants at an exercise price per common share of $1.17, representing in

each case the difference between our as adjusted net tangible book value per common share after giving effect to this offering and the

applicable exercise price. See “Dilution.”

U.S. holders of the Company’s Amended IPO Common Share

Purchase Warrants may suffer adverse tax consequences if the Exercise Price Reduction is treated as a constructive distribution.

Pursuant to the Exercise Price Reduction (as defined in “Material

U.S. Federal Income Tax Considerations for U.S. Holders” below), the exercise price of 910,000

Amended IPO Common Share Purchase Warrants will be reduced from $4.77 per Warrant Share to $1.17 per Warrant Share. Under Section 305

of the Code, an adjustment to the exercise price of the Warrants pursuant to the Exercise Price Reduction may be treated as a constructive

distribution to a U.S. Holder of the Warrants if, and to the extent that, such adjustment has the effect of increasing such U.S. Holder’s

proportionate interest in the “earnings and profits” or the Company’s assets, depending on the circumstances of such

adjustment (for example, if such adjustment is to compensate for a distribution of cash or other property to the shareholders). Adjustments

to the exercise price of Warrants made pursuant to a bona fide reasonable adjustment formula that has the effect of preventing dilution

of the interest of the holders of the Warrants should generally not be considered to result in a constructive distribution. Depending

on the circumstances of the Exercise Price Reduction, the adjustment to the exercise price of the Warrants pursuant to the Exercise Price

Reduction may be treated as a constructive distribution to a U.S. Holder. Any such constructive distribution would be taxable whether

or not there is an actual distribution of cash or other property. See a more detailed discussion of the application of Section 305

of the Code to the Exercise Price Reduction in “Material U.S. Federal Income Tax Considerations for U.S. Holders” below.

The PFIC rules may require U.S. holders exchanging Warrants

for the Company’s Amended IPO Common Share Purchase Warrants to recognize gain that is subject to taxation under the PFIC regime.

For U.S. Holders who have not made certain tax elections with respect

to the Warrants that may mitigate possible adverse U.S. federal income tax consequences that may result from PFIC status, under proposed

U.S. Treasury Regulations and absent application of the “PFIC-for-PFIC Exception” (defined in “Material U.S. Federal

Income Tax Considerations for U.S. Holders” below), if the Company is classified as a PFIC for any tax year during which a U.S.

Holder holds the Warrants, the PFIC rules may require such U.S. Holder’s to recognize gain in connection with the exchange

of Warrants for Amended IPO Common Share Purchase Warrants pursuant to the Exercise Price Reduction if the Company is not a PFIC for its

taxable year that includes the day after the Exercise Price Reduction, notwithstanding that such exchange is expected to be treated as

a “recapitalization” within the meaning of Code Section 368(a)(1)(E). See a more detailed discussion of the application

of the PFIC rules, the manner in which PFIC gains are taxed, and the PFIC-for-PFIC Exception to the Exercise Price Reduction in “Material

U.S. Federal Income Tax Considerations for U.S. Holders” below.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements contained in this Annual Report constitute forward-looking

statements. These statements relate to future events or the Company’s (as defined herein) future performance. All statements other

than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”, “propose”,

“might”, “may”, “will”, “shall”, “project”, “should”, “could”,

“would”, “believe”, “predict”, “forecast”, “pursue”, “potential”

and “capable” and similar expressions are intended to identify forward-looking statements. These statements involve known

and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated

in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking

statements included in this Annual Report should not be unduly relied upon. These statements speak only as of the date of this Annual

Report. In addition, this Annual Report may contain forward-looking statements and forward-looking information attributed to third party

industry sources.

In particular, forward-looking statements in this Annual Report include,

but are not limited to, statements about:

| · | our ability to obtain additional financing; |

| · | the accuracy of our estimates regarding expenses, future revenues and capital requirements; |

| · | the success and timing of our preclinical studies and clinical trials; |

| |

· |

our ability to obtain and maintain regulatory approval of XRx-008, also sometimes referred to by its trademarked name XORLOTM. XORTX’s proprietary formulation of oxypurinol, and any other product candidates we may develop, and the labeling under any approval we may obtain; |

| |

· |

regulatory approvals and discussions and other regulatory developments in the United States, the EU and other countries; |

| |

· |

the performance of third-party manufacturers and contract research organizations; |

| |

· |

our plans to develop and commercialize our product candidates, if approved; |

| |

· |

our plans to advance research in other kidney disease applications; |

| |

· |

our ability to obtain and maintain intellectual property protection for our product candidates; |

| |

· |

the successful development of our sales and marketing capabilities; |

| |

· |

the potential markets for our product candidates and our ability to serve those markets; |

| |

· |

the rate and degree of market acceptance of any future products; |

| |

· |

the success of competing drugs that are or become available; and |

| |

· |

the loss of key scientific or management personnel. |

All forward-looking statements, including, without limitation, our

examination of historical operating trends, are based upon our current expectations and various assumptions. Certain assumptions made

in preparing the forward-looking statements include:

| · | the availability of capital to fund planned expenditures; |

| · | prevailing regulatory, tax and environmental laws and regulations; |

| · | the ability to secure necessary personnel, equipment, supplies and services; |

| · | our ability to manage our growth effectively; |

| · | the absence of material adverse changes in our industry or the global economy; |

| · | trends in our industry and markets; |

| · | our ability to maintain good business relationships with our strategic partners; |

| · | our ability to comply with current and future regulatory standards; |

| · | our ability to protect our intellectual property rights; |

| · | our continued compliance with third-party license terms and the non-infringement of third-party intellectual property rights; |

| · | our ability to manage and integrate acquisitions; and |

| · | our ability to raise sufficient debt or equity financing to support our continued growth. |

We

believe there is a reasonable basis for our expectations and beliefs, but they are inherently uncertain. We may not realize our expectations,

and our beliefs may not prove correct. Actual results could differ materially from those described or implied by such forward-looking

statements.

EXCHANGE RATE DATA

We express all amounts in this

prospectus in United States dollars, except where otherwise indicated. References to “$” are to United States dollars and

references to “CAD$” are to Canadian dollars. The following table sets forth, for the periods indicated, average rate of exchange

for one U.S. dollar, expressed in Canadian dollars, for the years ended December 31, 2022, 2021 and 2020, as supplied by the Bank

of Canada:

| Year Ended | |

Average | |

| December 31, 2022 | |

| 1.3013 | |

| December 31, 2021 | |

| 1.2535 | |

| December 31, 2020 | |

| 1.3415 | |

On June 30, 2023, the Bank of Canada average

daily rate of exchange was $1.00 = CAD$1.3240.

MARKET, INDUSTRY AND OTHER DATA

Unless otherwise indicated, information

contained in, and incorporated into, this prospectus concerning our industry and the market in which we operate, including our market

position, market opportunity and market size, is based on information from various third-party sources not prepared at the direction of

the Company, such as industry publications, and assumptions that we have made based on such data and other similar sources and on our

knowledge of the markets for our products. These data involve a number of assumptions and limitations. We believe that this data is accurate

and that its estimates and assumptions are reasonable, but there can be no assurance as to the accuracy or completeness of this data.

We have not independently verified any of the data from third-party sources referred to in, or incorporated into, this prospectus or analyzed

or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying economic assumptions

relied upon or referred to by such sources.

In

addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate

is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section

entitled “Risk Factors” and discussed elsewhere in this prospectus, as well as in “Risk Factors Summary”

and “Item 3. Key Information - D. Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein. These and other factors could cause results to differ materially from those expressed in the estimates

made by the independent parties and by us.

USE OF PROCEEDS

To the extent that the Warrants are exercised

for cash, we will receive the gross cash proceeds from such exercise of up to a total potential of approximately $12,664,863 million,

based on the current exercise price of the Warrants. We cannot predict when or if any of the Warrants will be exercised, and it is possible

that the warrants may expire and never be exercised.

We intend to use the net proceeds from the issuance

of the securities for working capital and general corporate purposes. Such purposes may include research and development expenditures

and capital expenditures.

Our management will have broad discretion in the

application of the net proceeds of this offering, and investors will be relying on our judgment regarding the application of the net proceeds.

In addition, we might decide to postpone or not pursue certain preclinical activities or clinical trials if the net proceeds from this

offering and our other sources of cash are less than expected.

Pending their use, we plan to invest the net proceeds of any Warrant

exercises in short-and intermediate-term interest-bearing investments.

DIVIDEND POLICY

We have never paid any dividends on

our common shares or any of our other securities. We currently intend to retain any future earnings to finance the growth and development

of our business, and we do not anticipate that we will declare or pay any cash dividends in the foreseeable future. Any future determination

to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results

of operations, capital requirements, restrictions under any future indebtedness and other factors the Board of Directors deems relevant.

CAPITALIZATION

AND INDEBTEDNESS

The

following table sets forth our cash as well as capitalization as of March 31, 2023:

| · | on

an as adjusted basis to give effect to our issuance of (i) 2,431,900 common shares offered

hereby upon exercise of the Warrants at an exercise price per common share of $4.77 and (ii) 910,000

common shares offered hereby upon exercise of the Warrants at an exercise price per common

share of $1.17; |

| · | Canadian

Dollar amounts have been translated into U.S. Dollars based on the March 31, 2023, daily

rate of exchange, which was $1.00 = CAD$1.3533 or CAD$1.00 = $0.7389 as reported by the Bank

of Canada and have been provided solely for the convenience of the reader. |

You

should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

included in “Item 5. Operating and Financial Review and Prospects” and our financial

statements and related notes thereto included in “Item 18. Financial Statements” included in our Annual

Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein.

| | |

As

of March 31, 2023 | |

| | |

| | |

Pro forma as | |

| | |

Actual | | |

adjusted | |

| | |

(In thousands, except share data) | |

| Cash | |

$ | 7,908 | | |

$ | 20,573 | |

| Equity | |

| | | |

| | |

| Share capital | |

$ | 17,057 | | |

$ | 29,722 | |

| Common

shares, unlimited authorized shares, without par value; 17,989,687 shares issued and outstanding, actual; 21,331,587 shares issued

and outstanding, pro forma as adjusted | |

| | | |

| | |

| Share-based

payments, warrant reserve and other | |

$ | 9,559 | | |

$ | 9,559 | |

| Obligation

to Issue Shares | |

$ | 25 | | |

$ | 25 | |

| Accumulated

other comprehensive (loss) income | |

$ | (53 | ) | |

$ | (53 | ) |

| Deficit | |

$ | (17,529 | ) | |

$ | (17,529 | ) |

| Total

Equity | |

$ | 9,059 | | |

$ | 21,723 | |

| Total

Capitalization | |

$ | 9,059 | | |

$ | 21,723 | |

The

number of common shares to be outstanding after this offering is based on an aggregate of 17,989,687 shares outstanding as of March 31,

2023. The table above excludes:

| |

· |

1,039,335 common shares issuable upon the exercise of outstanding options to issue common shares, as of March 31, 2023, at a weighted-average exercise price of CAD$2.03 per share; and |

| |

· |

7,237,896 common shares issuable upon the exercise of outstanding common share purchase warrants, as of March 31, 2023, at a weighted-average exercise price of $1.86 per share. |

For

additional information regarding our share capital and the terms of the Warrants, see “Description of Share Capital” and

“Description of Warrants.”

DILUTION

If you

exercise Warrants in this offering for our common shares, your interest will be diluted to the extent of the difference between the price

per common share you will pay and the as adjusted net tangible book value per common share after the exercise.

As of March 31, 2023, we had a net tangible book

value of $8,890 million, corresponding to a net tangible book value of $0.49 per common share. Net tangible book value per share

represents the amount of our total assets less our total liabilities, excluding intangible assets, divided by 17,989,687, the total number

of our common shares outstanding as of March 31, 2023.

Assuming that we issue (i) 2,431,900 common

shares upon exercise of the Warrants at an exercise price per common share of $4.77 and (ii) 910,000 common shares upon exercise

of the Warrants at an exercise price per common share of $1.17, our as adjusted net tangible book value estimated as of March 31, 2023

would have been $21,556 million, representing $1.01 per common share. This represents an immediate increase in net tangible book value

of $0.52 per common share to existing shareholders and an immediate dilution in net tangible book value of $3.76 per common

share to new investors acquiring common shares upon the exercise of the Warrants at an exercise price per common share of $4.77 and an

immediate dilution in net tangible book value of $0.16 per common share to new investor acquiring common shares upon the exercise of

the Warrants at an exercise price per common share of $1.17. Dilution for this purpose represents the difference between the exercise

price per common share paid upon exercise of the Warrants and net tangible book value per common share immediately after the exercise.

The following

table illustrates this dilution to new investors for holders of Warrants.

| | |

Warrant holder | |

| Exercise price per common share upon exercise of the 2,431,900 Warrants | |

$ | 4.77 | |

| Exercise price per common share upon exercise of the 910,000 Warrants | |

$ | 1.17 | |

| Net tangible book value per common share as of March 31, 2023 | |

$ | 0.49 | |

| Increase in net tangible book value per common share attributable to new investors | |

$ | 0.52 | |

| As adjusted net tangible book value per common share after the exercise | |

$ | 1.01 | |

| Dilution per common share to new investors at an exercise price of $4.77 | |

$ | 3.76 | |

| Dilution per common share to new investors at an exercise price $1.17 | |

$ | 0.16 | |

| Percentage of dilution in net tangible book value per common share for new investors | |

| 78.82 | % |

| Percentage of dilution in net tangible book value per common share for new investors | |

| 13.67 | % |

The above discussion and table are based on 17,989,687

common shares outstanding as of March 31, 2023 and excludes:

| |

· |

1,039,335 common shares issuable

upon the exercise of outstanding options to issue common shares, as of March 31, 2023, at a weighted-average exercise price of CAD$2.03

per share; and |

| |

· |

7,237,896 common shares issuable

upon the exercise of outstanding common share purchase warrants, as of March 31, 2023, at a weighted-average exercise price of $1.86

per share. |

To

the extent that outstanding options or warrants are exercised, you may experience further dilution. In addition, we may choose to raise

additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or

future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the

issuance of these securities may result in further dilution to our shareholders.

Canadian Dollar amounts have

been translated into U.S. Dollars based on the March 31, 2023, daily rate of exchange, which was $1.00 = CAD$1.3533 or CAD$1.00

= $0.7389 as reported by the Bank of Canada and have been provided solely for the convenience of the reader.

LISTING

Our common shares are listed

on Nasdaq and the TSXV under the symbol “XRTX”.

TRANSFER

AGENT, REGISTRAR AND AUDITOR

The transfer

agent and registrar for our common shares is TSX Trust Company at its principal office in Toronto, Canada. Our co-transfer agent is Continental

Stock Transfer & Trust Company.

Smythe

LLP, located at 1700 — 475 Howe Street, Vancouver, British Columbia, Canada V6C 2B3 is our independent registered

public accounting firm and has been appointed as our independent auditor.

DESCRIPTION

OF SHARE CAPITAL

General

The following

is a summary of the material rights of our share capital as contained in our notice of articles and articles and any amendments thereto.

This summary is not a complete description of the share rights associated with our capital stock. For more detailed information, please

see our notice of articles and articles, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Common

Shares

Outstanding Shares

Our authorized

share capital consists of an unlimited number of common shares, each without par value.

As of March 31, 2023, we had 795,859 common shares

issuable pursuant to exercisable outstanding stock options, 243,476 common shares issuable pursuant to outstanding options that are not

currently exercisable, 10,579,796 common shares issuable upon the exercise of outstanding common share warrants, and we had approximately

15 holders of record of our common shares.

Voting Rights

Under our

articles, the holders of our common shares are entitled to one vote for each common share held on all matters submitted to a vote of

the shareholders, including the election of directors. Our notice of articles and articles do not provide for cumulative voting rights.

Because of this, the holders of a plurality of the common shares entitled to vote in any election of directors can elect all of the directors

standing for election, if they so choose.

Dividends

Subject

to priority rights that may be applicable to any then outstanding common shares, and the applicable provisions of the Business Corporation

Act British Columbia (“BCBCA”), holders of our common shares are entitled to receive dividends, as and when declared

by our Board, in their sole discretion as they see fit. For more information, see the section titled “Dividend Policy.”

Liquidation

In the

event of our liquidation, dissolution or winding up, holders of our common shares are entitled to share ratably in the net assets legally

available for distribution to shareholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation

preference granted to the holders of any then outstanding preferred shares.

Rights and Preferences

Our common

shares contain no pre-emptive or conversion rights and have no provisions for redemption or repurchase for cancellation, surrender or

sinking or purchase funds. There are no provisions in our notice of articles and articles requiring holders of common shares to contribute

additional capital. The rights, preferences and privileges of the holders of our common shares are subject to and may be adversely affected

by the rights of the holders of any series of new preferred shares that may be created, authorized, designated, and issued in the future.

Fully Paid and Non-assessable

All of

our outstanding common shares are, and the common shares to be issued pursuant to this Prospectus, when paid for, will be fully paid

and non-assessable.

Description of Warrants

The

following is a summary of certain terms and provisions of the Warrants and the Amended IPO Common Share Purchase Warrants.

This summary is not complete and is subject to, and qualified in its entirety by, the provisions of the Warrants and the Amended

IPO Common Share Purchase Warrants, the forms of which are included as exhibits 4.2 and 4.3, respectively,

to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions

of the form of Warrants for a complete description of the terms and conditions of the Warrants.

Duration

and Exercise Price

Each

Warrant included had an initial exercise price equal to $4.77 per common share. In connection with the Letter Agreement, we revised

the exercise price of 910,000 of the Warrants from $4.77 per common share to $1.17 per common share.

The Warrants were immediately

exercisable and expire on the fifth anniversary of the original issuance date (October 15, 2026). The exercise price and number of common

shares issuable upon exercise is subject to appropriate adjustment in the event of share dividends, share splits, reorganizations or

similar events affecting our common shares and the exercise price. The Warrants were sold as units consisting of one Warrant and one

common share. The Warrants were issued separately from the common shares included in such units. A Warrant to purchase one common share

was included in each common share unit purchased in this offering.

Cashless

Exercise

If, at the time a holder exercises

its Warrants, a registration statement registering the issuance of the shares of common shares underlying the under the Securities Act

is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise contemplated to

be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise

(either in whole or in part) the net number of common shares determined according to a formula set forth in the Warrants.

Exercisability

The

Warrants are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied

by payment in full for the number of common shares purchased upon such exercise (except in the case of a cashless exercise as discussed

below). A holder (together with its affiliates) may not exercise any portion of the Warrant to the extent that the holder would own more

than 4.99% of the outstanding common shares immediately after exercise, except that upon at least 61 days’ prior notice from the

holder to us, the holder may increase the amount of ownership of outstanding common shares after exercising the holder’s Warrants

up to 9.99% of the number of common shares outstanding immediately after giving effect to the exercise, as such percentage ownership

is determined in accordance with the terms of the Warrants. Purchasers of Warrants in the 2021 public offering could also elect, prior

to the issuance of the Warrants, to have the initial exercise limitation set at 9.99% of our outstanding common shares.

Fractional

Shares

No

fractional common shares will be issued upon the exercise of the Warrants. Rather, the number of common shares to be issued will be rounded

up to the nearest whole number, or the Company shall pay a cash adjustment in respect of the fractional share.

Transferability

Subject

to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent. There is currently no trading

market for the Warrants.

Exchange

Listing

There is no trading market available

for the Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the Warrants on any securities

exchange or nationally recognized trading system.

Right

as a Shareholder

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership of common shares, the holders of the Warrants do

not have the rights or privileges of holders of our common shares, including any voting rights, until they exercise their Warrants.

Fundamental

Transaction

In

the event of a fundamental transaction, as described in the Warrants and generally including any reorganization, recapitalization or

reclassification of our common shares, the sale, transfer or other disposition of all or substantially all of our properties or assets,

our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common shares, or any person

or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common shares, the holders of the Warrants

will be entitled to receive upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders

would have received had they exercised the Warrants immediately prior to such fundamental transaction.

TAXATION

Material

Canadian Federal Income Tax Considerations

The following is, as of the date of this prospectus, a general summary

of the principal Canadian federal income tax considerations under the Income Tax Act (Canada), or the Canadian Tax Act, generally applicable

to an investor who acquires common share units pursuant to this offering and who, for the purposes of the Canadian Tax Act and at all

relevant times, deals at arm’s length with the Company and the underwriters, is not affiliated with the Company or the underwriters

and who acquires and holds the common shares, or Warrants as capital property, or a Holder. Generally, the common shares and Warrants

will be considered to be capital property to a Holder thereof provided that the Holder does not use the common shares in the course of

carrying on a business of trading or dealing in securities and such Holder has not acquired them in one or more transactions considered

to be an adventure or concern in the nature of trade.

This summary does not apply to a Holder (i) that is a “financial

institution” for the purposes of the mark-to-market rules contained in the Canadian Tax Act; (ii) that is a “specified

financial institution” as defined in the Canadian Tax Act; (iii) if an interest in such a Holder is a “tax shelter”

or a “tax shelter investment,” each as defined in the Canadian Tax Act; (iv) a holder that reports its “Canadian

tax results,” as defined in the Canadian Tax Act, in a currency other than Canadian currency; or (v) that has or will enter

into a “derivative forward agreement” or a “synthetic disposition arrangement”, as those terms are defined in

the Canadian Tax Act, with respect to the common shares and Warrants. Such Holders should consult their own tax advisors with respect

to the consequences of acquiring common share units.

Additional considerations,

not discussed herein, may be applicable to a Holder that (i) is a corporation resident in Canada and (ii) is (or does not deal

at arm’s length for the purposes of the Canadian Tax Act with a corporation resident in Canada that is), or becomes as part of

a transaction or event or series of transactions or events that includes the acquisition of the common share units, controlled by a corporation

that is not resident in Canada for purposes of the “foreign affiliate dumping” rules in section 212.3 of the Canadian

Tax Act. Such Holders should consult their own tax advisors with respect to the consequences of acquiring common share units.

This summary is based upon

the current provisions of the Canadian Tax Act and the regulations thereunder, or the Regulations, in force as of the date hereof and

the Company’s understanding of the current published administrative and assessing practices of the Canada Revenue Agency, or the

CRA. This summary takes into account all specific proposals to amend the Canadian Tax Act and the Regulations publicly announced by or

on behalf of the Minister of Finance (Canada) prior to the date hereof, or the Tax Proposals, and assumes that the Tax Proposals will

be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be enacted in their current form or at

all. This summary does not otherwise take into account any changes in law or in the administrative policies or assessing practices of

the CRA, whether by legislative, governmental or judicial decision or action, nor does it take into account or consider any provincial,

territorial or foreign income tax considerations, which considerations may differ significantly from the Canadian federal income tax

considerations discussed in this summary.

This summary is of a general

nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be

construed to be, legal or tax advice to any particular Holder. This summary does not address the deductibility of interest expense incurred

or paid by a Holder that has borrowed money in connection with the acquisition of common share units pursuant to this offering. Holders

should consult their own tax advisors with respect to their particular circumstances.

All amounts in a currency other than the Canadian dollar relevant

in computing a Holder’s liability under the Canadian Tax Act with respect to the acquisition, holding or disposition of common

shares and Warrants must generally be converted into Canadian dollars using the single daily exchange rate quoted by the Bank of Canada

for the day on which the amount arose or such other rate of exchange that is acceptable to the CRA.

Residents

of Canada

The following section of this

summary applies to a Holder who, for the purposes of the Canadian Tax Act, is or is deemed to be resident in Canada at all relevant times,

or a Canadian Resident Holder. Certain Canadian Resident Holders whose common shares might not constitute capital property may in certain

circumstances make an irrevocable election in accordance with subsection 39(4) of the Canadian Tax Act to deem the common shares,

and every other “Canadian security” as defined in the Canadian Tax Act, held by such Canadian Resident Holder, in the taxation

year of the election and each subsequent taxation year to be capital property. Canadian Resident Holders should consult their own tax

advisors regarding this election.

Dividends

Dividends received or deemed

to be received on the common shares will be included in computing a Canadian Resident Holder’s income. In the case of an individual

(other than certain trusts), such dividends will be subject to the gross-up and dividend tax credit rules normally applicable in

respect of “taxable dividends” received from “taxable Canadian corporations” (each as defined in the Canadian

Tax Act). An enhanced dividend tax credit will be available to individuals in respect of “eligible dividends” designated

by the Company to the Canadian Resident Holder in accordance with the provisions of the Canadian Tax Act.

Dividends received or deemed

to be received by a corporation that is a Canadian Resident Holder on the common shares must be included in computing its income but

generally will be deductible in computing its taxable income. In certain circumstances, subsection 55(2) of the Canadian Tax Act

will treat a taxable dividend received by a Canadian Resident Holder that is a corporation as proceeds of disposition or a capital gain.

A Canadian Resident Holder that is a corporation should consult its own tax advisors having regard to its own circumstances. A Canadian

Resident Holder that is a “private corporation” as defined in the Canadian Tax Act and certain other corporations controlled,

by or for the benefit of an individual (other than a trust) or a related group of individuals (other than trusts) generally will be liable

to pay a 38 1/3% refundable tax under Part IV of the Canadian Tax Act on dividends received or deemed to be received on the common

shares to the extent such dividends are deductible in computing taxable income. Such refundable tax will generally be refunded to

a corporate Canadian Resident Holder at the rate of 38 1/3% of taxable dividends paid while it is a private corporation.

Expiry

of Warrants

In the event of the expiry

of an unexercised Warrant, a Canadian Resident Holder will be considered to have disposed of such Warrant for nil proceeds and will accordingly

realize a capital loss equal to the Canadian Resident Holder’s adjusted cost base of such Warrant immediately before that time.

For a description of the tax treatment of capital losses, see “Capital Gains and Losses”, below.

Exercise of Warrants

No gain or loss will be realized by a Canadian Resident Holder on

the exercise of a Warrant to acquire common shares. When a Warrant is exercised, the Canadian Resident Holder’s cost of the common

shares acquired thereby will be equal to the adjusted cost base of the Warrant to the Canadian Resident Holder, immediately before that

time, plus the amount paid on the exercise of the Warrant. For the purpose of computing the adjusted cost base of each common share acquired

on the exercise of a Warrant, the cost of such common share must be averaged with the adjusted cost base to the Canadian Resident Holder

of all other common shares held as capital property immediately before the exercise of the Warrant.

Dividends received or deemed

to be received by a corporation that is a Canadian Resident Holder on the common shares must be included in computing its income but

generally will be deductible in computing its taxable income. In certain circumstances, subsection 55(2) of the Canadian Tax Act

will treat a taxable dividend received by a Canadian Resident Holder that is a corporation as proceeds of disposition or a capital gain.

A Canadian Resident Holder that is a corporation should consult its own tax advisors having regard to its own circumstances. A Canadian

Resident Holder that is a “private corporation” as defined in the Canadian Tax Act and certain other corporations controlled,

by or for the benefit of an individual (other than a trust) or a related group of individuals (other than trusts) generally will be liable

to pay a 38 1/3% refundable tax under Part IV of the Canadian Tax Act on dividends received or deemed to be received on the common

shares to the extent such dividends are deductible in computing taxable income. Such refundable tax will generally be refunded to a corporate

Canadian Resident Holder at the rate of 38 1/3% of taxable dividends paid while it is a private corporation.

Dispositions of Common Shares or Warrants

Upon a disposition (or a deemed

disposition) of a common share, a Canadian Resident Holder generally will realize a capital gain (or a capital loss) equal to the amount

by which the proceeds of disposition of such common share, net of any reasonable costs of disposition, are greater (or are less) than

the adjusted cost base of such common share to the Canadian Resident Holder. The tax treatment of capital gains and capital losses is

discussed in greater detail below under the subheading “Capital Gains and Capital Losses.”

The adjusted cost base to a

Canadian Resident Holder of a common share acquired pursuant to this offering will be averaged with the adjusted cost base of any other

of the Company’s common shares held by such Canadian Resident Holder as capital property for the purposes of determining the Canadian

Resident Holder’s adjusted cost base of each common share.

Capital

Gains and Capital Losses

Generally, a Canadian Resident

Holder is required to include in computing its income for a taxation year one-half of the amount of any capital gain (a “taxable

capital gain”) realized in the year. Subject to and in accordance with the provisions of the Canadian Tax Act, a Canadian Resident

Holder is required to deduct one-half of the amount of any capital loss (an “allowable capital loss”) realized in a taxation

year from taxable capital gains realized in the year by such Canadian Resident Holder. Allowable capital losses in excess of taxable

capital gains may be carried back and deducted in any of the three preceding taxation years or carried forward and deducted in any following

taxation year against taxable capital gains realized in such year to the extent and under the circumstances described in the Canadian

Tax Act.

The amount of any capital loss

realized on the disposition or deemed disposition of common shares by a Canadian Resident Holder that is a corporation may be reduced

by the amount of dividends received or deemed to have been received by it on such shares or shares substituted for such shares to the

extent and in the circumstances specified by the Canadian Tax Act. Similar rules may apply where a Canadian Resident Holder that

is a corporation is a member of a partnership or beneficiary of a trust that owns such shares or that itself is a member of a partnership

of a beneficiary of a trust that owns such shares. Canadian Resident Holders to whom these rules may be relevant should consult

their own tax advisors.

A Canadian Resident Holder

that is throughout the relevant taxation year a “Canadian-controlled private corporation” as defined in the Canadian Tax

Act may also be liable to pay an additional refundable tax on its “aggregate investment income” for the year which will include

taxable capital gains. The rate of the refundable tax is 10 2/3% for taxation years beginning after 2015. Such refundable tax will generally

be refunded to a corporate Canadian Resident Holder at the rate of 38 1/3% of taxable dividends paid while it is a private corporation.

Minimum

Tax

Capital gains realized and

dividends received by a Canadian Resident Holder that is an individual or a trust, other than certain specified trusts, may give rise

to minimum tax under the Canadian Tax Act. Such Canadian Resident Holders should consult their own advisors with respect to the application

of minimum tax.

Non-Residents

of Canada

The following section of this summary is generally applicable to a

Holder who, for the purposes of the Canadian Tax Act, and at all relevant times: (i) has not been and will not be deemed to be resident

in Canada; and (ii) does not use or hold the common shares or Warrants in, or in the course of, carrying on a business, or part

of a business, in Canada, each a Non-Canadian Holder. Special rules, which are not discussed in this summary, may apply to a Non-Canadian

Holder that is an insurer carrying on business in Canada and elsewhere or that is an “authorized foreign bank” as defined